Zhou Yanling: Can Bitcoin Break Through the 90,000 Mark in This Round of Rise on March 25? Today's Latest Cryptocurrency Market Analysis and Strategy

When the market comes out of a long period of consolidation, I have high expectations for the initial momentum, which is why Yanling was bullish on 89,000 points on Monday. The market performed well, reaching a high of around 88,700, which can be considered as having arrived near 89,000 as expected. However, given Bitcoin's current pattern of rising three steps and then pulling back one, it is indeed challenging for each support level. If there is a significant rise, there won't be so many issues. At this stage, a conservative approach is the most stable psychological state because the current market is not aggressive enough; this increase is insufficient to indicate a return of the bull market, at most it can be considered a rebound. If the market continues to maintain the strong momentum from Monday and rebounds on Tuesday, then in the later stage, everyone can continue to buy on dips, as Yanling mentioned in the previous article. This week's market mainly depends on the rhythm set on Monday, so let's see Tuesday's performance.

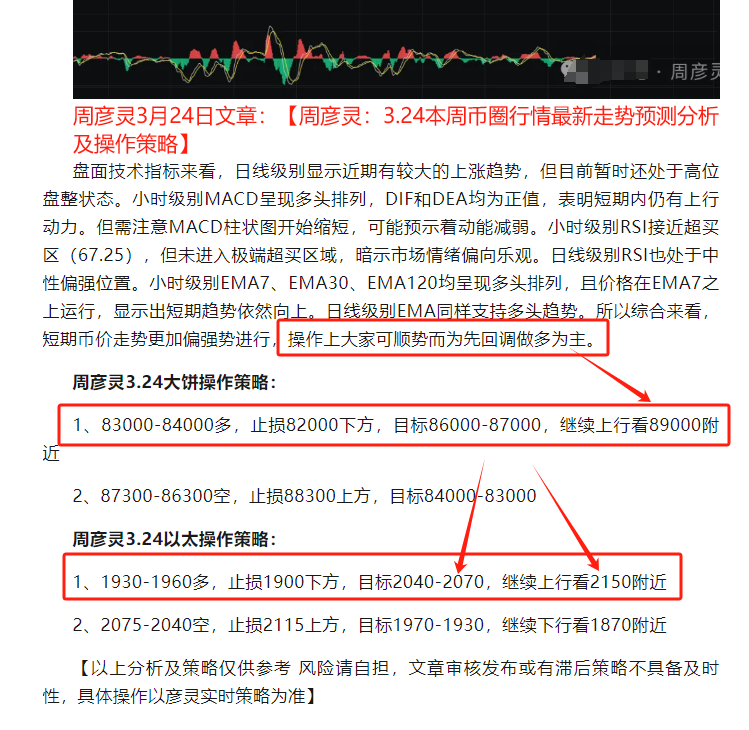

From the technical indicators on the chart, the current cryptocurrency price has formed a slight upward trend with fluctuations, and the support levels are continuously rising. The daily chart shows a strong upward trend, with a significant increase in closing prices from March 23 to March 24, forming consecutive bullish candles. The hourly MACD is in positive territory and continues to expand, indicating strong bullish momentum in the short term. The daily chart also shows a bullish trend. The hourly RSI is close to the overbought zone but has not reached extreme values, suggesting potential pullback pressure. The daily RSI is above 70, indicating a strong market. The hourly EMA7, EMA30, and EMA120 are all diverging upwards, supporting the current upward trend. The daily EMA also shows a bullish arrangement.

Zhou Yanling's March 25 Bitcoin Trading Strategy:

Buy at 86,500-87,500, stop loss below 85,500, target around 89,500, continue to look for upward movement towards 91,000.

Sell at 90,000-89,000, stop loss above 91,000, target 87,500-86,500.

Zhou Yanling's March 25 Ethereum Trading Strategy:

Buy at 2,030-2,070, stop loss below 1,990, target 2,130-2,160.

Sell at 2,150-2,120, stop loss above 2,190, target 2,080-2,040.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article review and publication may have delays, and the strategies may not be timely. Specific operations should follow Yanling's real-time strategies.】

This article is exclusively shared by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for over ten years, currently mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV, and other cryptocurrency contracts/spot operations. For more real-time community guidance, consultation on position liquidation, and learning trading skills, you can follow the teacher (WeChat public account: Zhou Yanling) to find the teacher.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。