Original|Odaily Planet Daily (@OdailyChina_)

_

Author|CryptoLeo (@LeoAndCrypto)

"Life is not easy, trading coins makes one cry." The current market is sluggish, so we can turn our attention to new projects. Odaily Planet Daily has compiled a list of recent projects worth noting, divided into two main categories: DeFi and recently announced financing projects. Friendly reminder: Participating in new projects carries certain risks, and proper risk control and review are necessary; it is not recommended to invest large amounts of money initially.

DeFi Category

Project Introduction: Stout is a native lending protocol on Sonic, currently with a TVL of $4 million. Users can borrow the protocol's stablecoin DUSX by providing wS, stS, wETH, and veSTTX. The protocol consists of four tokens:

STTX: Supports the protocol, equivalent to Stout's base token, with a token deflation and burn mechanism. It is not recommended for long-term holding; the best way is to lock it as veSTTX;

DUSX: An over-collateralized stablecoin that can be exchanged 1:1 with USDC through the protocol's PSM;

veSTTX: Governance token and collateral asset, providing a 98% loan-to-value (LTV) ratio;

stDUSX: Staking token that earns 75% of the protocol's revenue, with a staking APY of 24.47%.

When engaging in lending projects, it is essential to pay attention to the liquidation thresholds. Each collateral's maximum ratio on Stout is different, and its liquidation characteristic is: When the collateral debt position (CDP) reaches a certain collateral's liquidation threshold, users can still repay the debt to exchange for part of the collateral.

Reasons to Pay Attention: A DeFi protocol under the Sonic ecosystem; high LTV for lending (loan amount divided by collateral value); stDUSX's staking APY is 24.47%.

Project Introduction: Dexari is a self-custodial, permissionless on-chain DEX built on Hyperliquid, and has launched an iOS Testflight version App (requires an invitation code to join Early Access). It has now introduced contract markets, token charting tools, and advanced order features. The project does not require KYC, supports multi-chain with unified cross-chain balances, and spot trading, fiat deposits and withdrawals, token monitoring, and alert functions are coming soon. Additionally, Dexari will introduce staking and mining features in the future. Early users can earn points in its Dexari Points Preseason to receive rewards after Early Access ends.

Reasons to Pay Attention: Built on Hyperliquid, deep liquidity; App version DEX, potentially replacing mobile CEX; early experience version rewards available, co-founder Zac.hl is a former employee of Binance.US.

Project Introduction: flyingtulip is a one-stop DeFi platform launched by Andre Cronje, encompassing trading, liquidity pools, lending, and more, allowing users to concentrate spot, leverage, and perpetual trading within a single AMM protocol without needing to store assets across different protocols, thus solving liquidity fragmentation issues. The official claim states that this product can reduce impermanent loss by 42%, increase LP returns by 9 times, and improve capital efficiency by 85% compared to other DEX protocols. For more details, refer to “The Man Who Knows DeFi Best Brings His New Project FlyingTulip”

Reasons to Pay Attention: AC as the founder, 0.02% trading fee, 9 times LP returns, and 85% capital efficiency.

Project Introduction: Multipli.fi is a multi-chain yield generation protocol, currently with a TVL of $85.6 million, supported by Pantera Capital, Sequoia Capital, Elevation Capital, and The Spartan Group. The protocol utilizes delta-neutral arbitrage strategies in spot and futures markets to provide high yields for native tokens and RWA assets. Currently, the project supports BNB Chain and Ethereum, with deposits supporting USDT and USDC, and will support BTC, ETH, and SOL in the future. Users can deposit stablecoins to earn high yields and ORB tokens (click the invitation link to register, invitation code: 7T46G). Currently, the APY for USDC deposits is 21.19%, and for USDT is 21.21%. Deposits and ORB require a certain amount of time to complete, and bonus ORB can only be received after depositing on Multipli.fi for 30 days. The first season (50% ORB weight) deposit activity is about to end, and current deposits can participate in the second season (30% ORB weight) and third season (20% ORB weight).

Reasons to Pay Attention: High TVL, APY, and ORB token sharing, top venture capital support.

Project Introduction: A synthetic dollar stablecoin protocol launched by DWF Labs partner Andrei Grachev, currently in beta testing, requiring an application to participate (follow their X account for periodic draws for beta testing qualifications; early deposits enjoy high APY and potential airdrops). For more details, refer to “22.6% Annualized, How Falcon Finance Supported by DWF Partners Achieves High Yields”

Reasons to Pay Attention: Current TVL has surpassed $90 million ($92.1 million), and Andrei Grachev has indicated that there may be special airdrops in the future.

Recent Financing Category

- Mesh ($82 million)

Project Introduction: Mesh is a company focused on crypto payments. For more details, refer to “Total Financing of $104 million, Mesh Launches the Battle for Crypto Payment 'New Infrastructure'”

Reasons to Pay Attention: In the context of RWAfi: high financing, participation of heavyweight investment institutions, and deep cooperation with PayPal's PYUSD.

- RedotPay ($40 million)

Project Introduction: RedotPay is also a project focused on crypto payments built by a Hong Kong team, allowing users to apply for virtual and physical cards, supporting ATMs, and enabling payments via QR code, phone number, and RedotPay ID, with custodians being licensed trust and company service providers in Hong Kong.

Reasons to Pay Attention: Supported by Sequoia China and Lightspeed Venture Partners, performing well in security compliance, offering fast and seamless payments. Launched the RedotPay Alliance Program, where members can enjoy a 40% transaction commission (calculated every 30 days).

- Rain ($24.5 million, for issuing companies)

Project Introduction: Rain is a stablecoin-supported enterprise issuing institution that can provide customized debit cards, credit cards, and prepaid cards for businesses, enabling them to issue B2B and consumer cards directly linked to self-custodial wallets, custodial solutions, or traditional fiat accounts. Cardholders can make payments without converting their cryptocurrencies into government-issued currency. Rain has built a stablecoin interoperability infrastructure across fiat currency tracks, supporting local settlements on multiple blockchain networks (such as Base, Polygon, Optimism, Avalanche, Arbitrum, ZKsync, and Solana), with transactions settled in stablecoins, currently covering over 100 countries worldwide.

Reasons to Pay Attention: Led by Norwest Venture Partners, with participation from Lightspeed Venture Partners, Coinbase Ventures, etc., and is a major member sponsoring and operating card projects for Visa.

- Yeet ($7.75 million raised last year, announced this year)

Project Introduction: A crypto gambling platform led by Dragonfly, with participation from Primitive Ventures and Mirana Ventures, also supported by investors like LayerZero CEO and Fat Penguin CEO. A "crypto casino," straightforward and bold, co-founded by well-known figures in the crypto space Michael Anderson (alias Mando), anonymous trader Keyboard Monkey, and professional poker player Ben Lamb, currently in beta testing, where users can apply for a waitlist. It is known that its beta version has already launched several games, and the project has an affiliate program, where users can earn not only from direct referrals but also from second-level referrals from users who follow their referral link, with a maximum of three levels of referral rewards.

Reasons to Pay Attention: Dragonfly leads the investment, the founders' professional backgrounds, and considerable three-level referral rewards.

- Opinion Labs ($5 million)

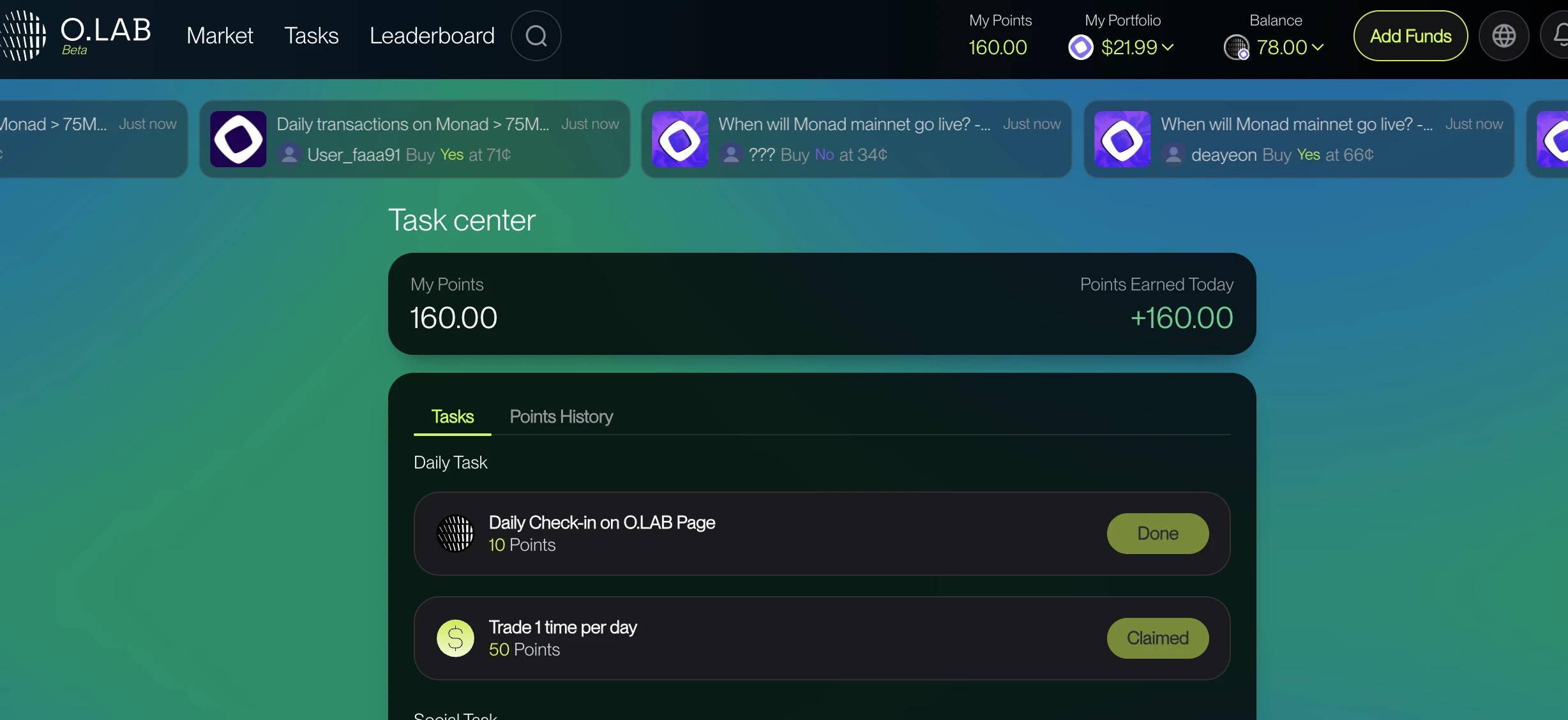

Project Introduction: Opinion Labs is a prediction market platform, led by YZi Labs, and is one of the top four performing projects in its MVB program. It has launched a Beta version, supporting the Monad testnet and Base network, where users can register an account to receive USDO test tokens for trading operations, complete social tasks, or invite friends to earn points. Here’s a recommended registration invitation code: dfRAhCsx.

Reasons to Pay Attention: Led by YZi Labs, simple operations on the Monad testnet, the points system may have airdrop expectations, and it can serve as an interaction project for zero-cost participation.

The above are the new projects recommended this time. If interested, you can take some time to keep an eye on them or apply for early qualifications. Before the market warms up, I will continue to recommend new projects, hoping to achieve good additional returns in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。