Even in a "shanzhai bear market," betting on projects with outstanding fundamentals can yield alpha returns that surpass BTC and ETH.

Authors: Alex Xu, Lawrence Lee

In a previous article titled “Panning for Gold: Finding Long-Term Investment Targets Through Bull and Bear Markets (2025 Edition Part 1)”, we outlined and introduced several projects in the lending sector, including Aave, Morpho, Kamino, MakerDao, as well as staking projects like Lido and Jito. This article, as the middle part of the series, will continue to introduce projects with high-quality fundamentals that have long-term potential for attention.

PS: This article reflects the authors' thoughts as of the time of publication, which may change in the future. The views expressed are highly subjective and may contain errors in facts, data, or reasoning. All opinions in this article are not investment advice, and criticism and further discussion from peers and readers are welcome.

### 3. Trading Sector: Cow Protocol, Uniswap, Jupiter

3.1 Cow Protocol

Current Business Status

Products and Mechanisms

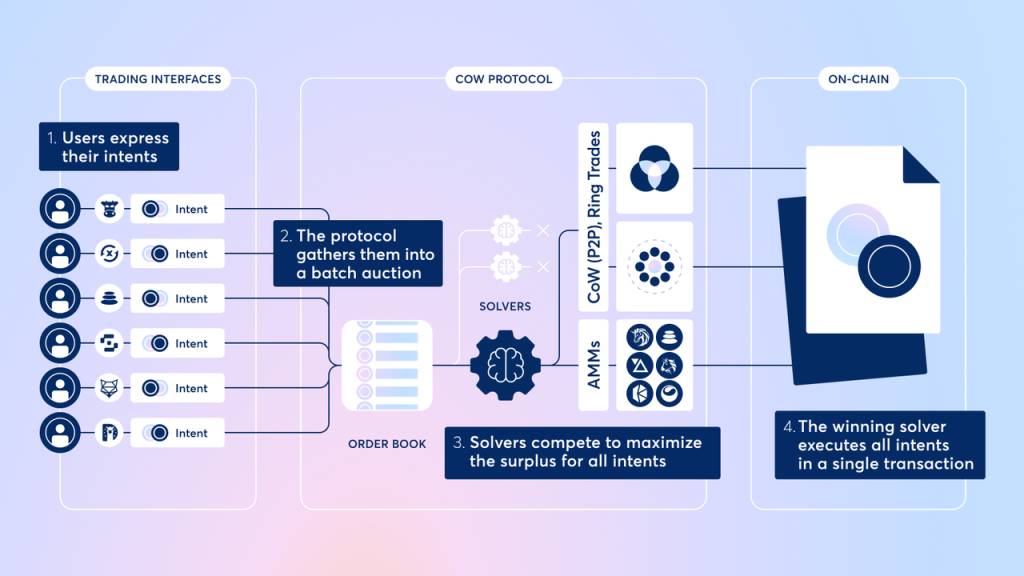

Cow Protocol is a decentralized trading aggregation protocol, with its core product being the decentralized trading aggregator CoW Swap. The "CoW" in the name stands for Coincidence of Wants, which means directly matching the demands of buyers and sellers using a matching mechanism. CoW Swap uses batch auction matching as a price discovery mechanism, aggregating users' trading intentions (order demands) and conducting unified clearing in each block.

This mechanism allows for direct matching of user orders without the need for traditional market makers or liquidity pools. When both parties want to exchange the assets they need, the transaction can be completed directly, avoiding intermediary fees. For parts that cannot be matched directly, CoW Swap routes the remaining orders to decentralized exchanges (DEX) or other aggregators to obtain liquidity. This design minimizes slippage and fees to the greatest extent and ensures that all trades executed in the same batch share the same clearing price, eliminating price unfairness caused by the order of execution.

Additionally, CoW Swap introduces a Solver bidding mechanism: multiple third-party solvers compete to provide users with the best trade execution plan. The winner gains the right to execute that batch of trades and bears the on-chain gas fees. Users only need to sign their order intentions offline, without having to pay on-chain transaction fees themselves, and no transaction costs are incurred if the order is not executed. This "intention matching + solver bidding" model enhances user experience (no need to worry about gas losses from failed transactions) and provides a certain level of MEV (Maximum Extractable Value) protection—since order matching occurs off-chain, solvers must bid to return MEV to users, making front-running and other MEV attacks difficult to execute.

CoW Swap currently provides services on Ethereum, Arbitrum, Gnosis, and Base.

In addition to CoW Swap, another product of Cow Protocol is the MEV Blocker, developed in collaboration with partners like CoW DAO, Beaver Build, and Agnostic Relay. After users switch their wallet's RPC to MEV Blocker, their transactions will go through a private searcher network (instead of entering Ethereum's public mempool, which is visible to all searchers and susceptible to MEV attacks), preventing sandwich attacks and front-running attacks from the source.

*The regular transaction process on the Ethereum network involves: after a user initiates a transaction, it first enters the public mempool; searchers monitor the mempool for MEV opportunities and bundle transactions; builders receive the bundles from searchers and construct blocks; validators receive the blocks from builders, verify them, and add them to the blockchain.

Revenue Model

Cow Protocol's revenue sources can be roughly divided into two categories:

Revenue sharing from trading surplus (Surplus) generated by CoW Swap. The so-called trading surplus refers to the money saved by CoW Swap through its bidding network, providing users with more than the initial quote. Currently, CoW Swap charges 50% of the trading surplus for most networks, but the fee does not exceed 1% of the trading volume. Additionally, for external protocols (partners) that integrate Cow Protocol, Cow Protocol takes 15% as a service fee from the trading fees generated by partners (the ratio can be customized but does not exceed 1% of the trading volume). Finally, Cow Protocol also charges a fee based on the overall trading volume of certain networks, such as Gnosis and Arbitrum, with a current fee rate of 0.1% of the trading volume (excluding special trading pairs like stablecoins).

Revenue generated from the MEV Blocker, from which Cow Protocol takes about 10% of the earnings obtained by validators through the MEV Blocker.

In the composition of the protocol's revenue, most of the income comes from the trading surplus sharing of CoW Swap, so the business data we will focus on later will primarily revolve around CoW Swap.

Business Data

We will focus on two key business data points for Cow Protocol: trading volume and protocol revenue.

Trading Volume

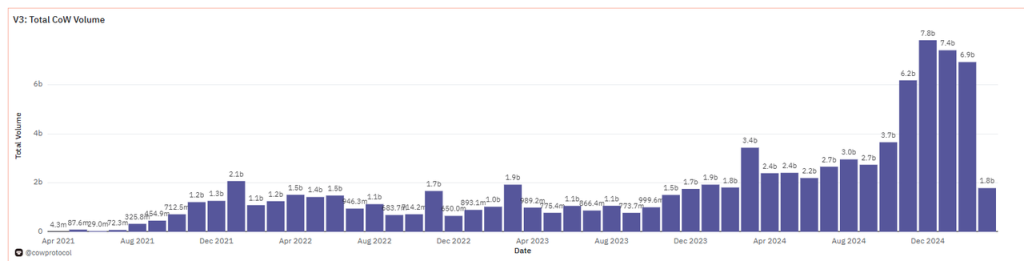

Data Source: Dune

As an emerging intention matching protocol, CoW Swap has experienced rapid development over the past three years. In 2021, the protocol was still in its infancy, with relatively low trading volumes. Entering 2022-2023, Cow Protocol saw an increase in business data as the demand for MEV protection and efficient aggregated trading in the DeFi space grew. In 2024, the protocol's trading volume surged significantly: monthly trading volume reached a new high by the end of 2024, with nearly $7.8 billion in December 2024, and still close to $6.9 billion in February 2025, far exceeding previous years' levels.

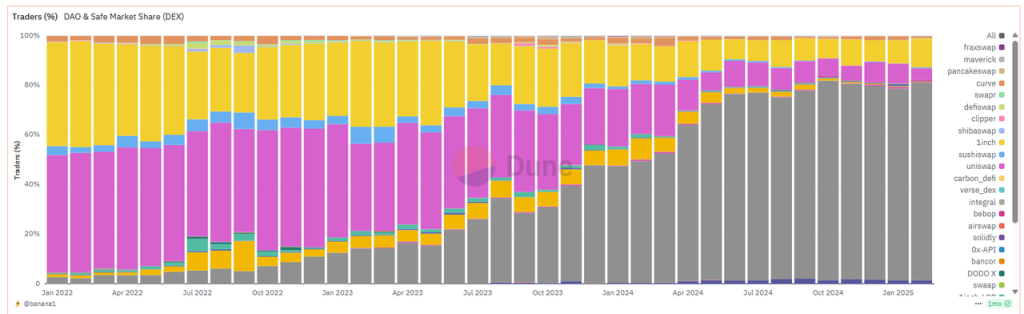

It is worth mentioning that CoW Swap has increasingly gained favor among DAO organizations and professional institutions for providing large, low-slippage trading solutions. In 2023, about one-third of the on-chain trading volume of DAOs was completed through CoW Swap, and by February of this year, this proportion had risen to 79.5%.

Data Source: Dune

Protocol Revenue

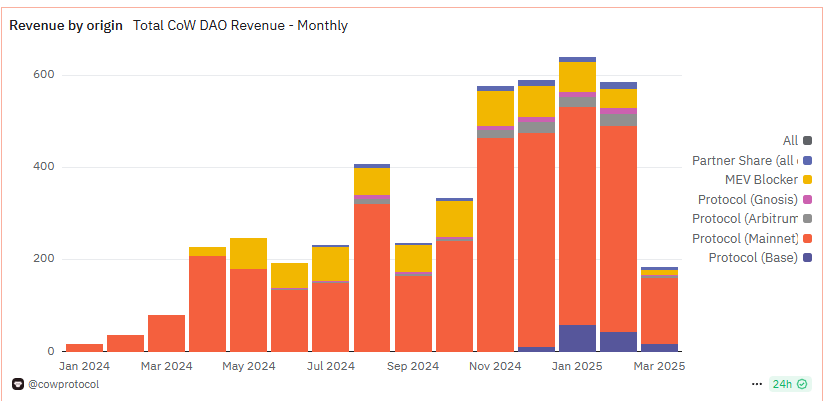

Data Source: Dune

Entering 2024, Cow Protocol began actively exploring protocol revenue generation, conducting multiple rounds of revenue tests, and revenue has shown a steady upward trend month by month. January 2025 was the highest month for revenue (calculated in ETH), with a monthly protocol revenue of 641 ETH, which, at an average ETH price of $3,328, amounts to approximately $2.13 million. In February, revenue was 586 ETH, with an average ETH price of $2,668, resulting in a protocol revenue of approximately $1.56 million.

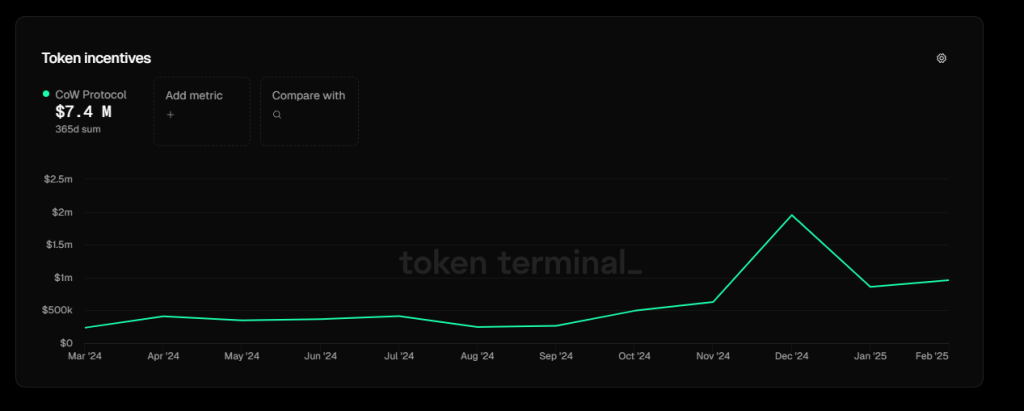

Protocol Incentives

Data Source: Tokenterminal

Currently, Cow Protocol's main expenditure is the Cow token incentives for the network solvers. Network solvers receive Cow token rewards based on the quality of the trading solutions they provide (the trading surplus offered to traders). According to Tokenterminal statistics, the expenditure on Cow token rewards over the past year was approximately $7.4 million. In January and February 2025, the protocol's token incentives were $858,000 and $961,000, respectively, which is lower than the protocol revenues of $2.13 million and $1.56 million for the same months.

According to Cow Protocol's official disclosure of the project's income and expenditure for 2024 in January this year, without considering the development costs of the protocol, the expenditure on solver token rewards for 2024 is approximately $5.2 million, while the total protocol revenue for the year is about $6 million, indicating that revenue has already exceeded token incentive expenditures.

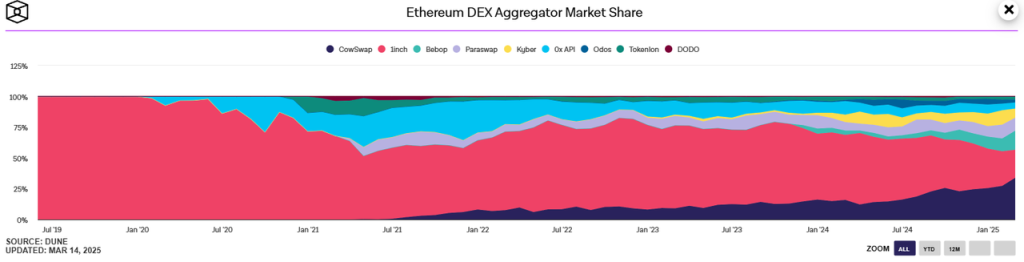

Competitive Situation

The main battleground for Cow Protocol is the decentralized trading aggregator sector. This sector was initially dominated by 1inch, but the landscape has begun to diversify in the past two years. According to the latest data from The Block in March 2025 (excluding UniswapX), 1inch's market share has dropped from the top position (on March 5, 1inch's Fusion feature was attacked, resulting in losses exceeding $5 million, exacerbating user concerns about its security) to only 22.8%, ranking second, while CoW Swap has surpassed it with 33.85%, taking the top position in monthly data for the first time.

Data Source: The Block

In addition to 1inch and CoW, the top five aggregators also include ParaSwap, 0xAPI/Matcha (the aggregation interface provided by the 0x protocol), as well as KyberSwap and Bebop. These competitors each hold around 10% or less of the market share, with ParaSwap and 0x having a long history and stable user base, while KyberSwap (which transitioned from Kyber Network to aggregation) and Bebop, launched by Wintermute, have recently gained a certain number of new users. Overall, the competitive landscape in the DEX aggregation sector remains intense, with new players continuously emerging. Although CoW Protocol has become a new leader in this field, its position is not yet firmly established.

In addition to traditional aggregation trading products, two other noteworthy competing projects are UniswapX launched by Uniswap and UniversalX, a cross-chain trading platform launched by Particle Network.

UniswapX is a cross-platform aggregation trading feature launched by the Uniswap team in the second half of 2023. Essentially, UniswapX provides users with a similar intention order + filler mechanism: users submit offline signed orders through the Uniswap frontend, and third-party "fillers" in the network (similar to the solver role in the Cow Protocol network) can take on the orders and trade on-chain for users. The process involves fillers providing quotes and enjoying exclusive matching rights for a short period; if the transaction is not completed within the specified time, it enters a Dutch auction phase where more fillers can participate in bidding. This model shares similarities with the solver bidding of CoW Swap, both being off-chain matching and on-chain settlement solutions. With Uniswap's brand and large user base, UniswapX quickly integrated into its frontend interface and launched on the ETH network. It is noteworthy that there were industry concerns that UniswapX "copied" the intention matching model of CoW Swap. Voices, including those from Curve's official team, pointed out that CoW Swap had already pioneered the solver model, and UniswapX was not the first. Despite the controversy, UniswapX has leveraged its positioning advantage within the Uniswap ecosystem to achieve considerable trading volume in a short time. By early 2024, its market share in the EVM aggregation trading market exceeded 10% (at that time, Cowswap's share was about 14%). However, its market share gradually declined afterward; according to data disclosed by Cow Protocol in March this year, UniswapX's market share in aggregation trading is about 5.5%.

UniversalX

UniversalX is another highly anticipated new project focusing on cross-chain aggregation trading. Launched by Particle Network and set to go live on the mainnet by the end of 2024, its goal is to enable trading of any on-chain asset without the need for cross-chain bridges. Its core concept is "chain abstraction": users can deposit assets from multiple chains into a unified on-chain account and trade any chain's tokens using a unified balance through the UniversalX platform, which will automatically complete cross-chain exchanges and settlements in the background. As a new entrant in the aggregator space, UniversalX targets the niche of cross-chain trading, differentiating itself from projects like Cow Protocol that primarily focus on single-chain aggregation. However, with the development of multi-chain ecosystems, UniversalX may face competition from Cow Protocol in the future if Cow Protocol expands to more chains or offers cross-chain functionality, entering UniversalX's competitive territory.

Competitive Advantages of Cow Protocol

In the face of fierce competition, Cow Protocol has been able to rise and grow steadily. Its competitive advantages can be analyzed from both product and brand perspectives:

- Product

Technical and Mechanism Advantages of Trading Products: Cow Swap is the first protocol to apply batch auction matching and solver competition to DEX aggregation, giving it a first-mover advantage. Its unique Coincidence of Wants direct matching mechanism allows transactions to be completed without traditional liquidity pools, reducing users' reliance on AMM pools and lowering slippage and fees. At the same time, the unified clearing price mechanism avoids price exploitation caused by transaction order, allowing heavy traders, especially institutional orders, to transact at fair prices. In contrast, later entrants like UniswapX and 1inch Fusion, while borrowing similar ideas, differ in specific implementations. For example, CoW Swap uses a sealed bidding process once per block, where all proposals are submitted simultaneously and executed based on quality, minimizing MEV space. This mechanism is considered more effective than UniswapX's time-limited exclusive filling and Dutch auction in preventing unfair practices like front-running.

MEV Protection and Security: The dual product structure of Cow Protocol's trading service + MEV Blocker further enhances its resistance to MEV, extracting user transactions from Ethereum's public mempool and allowing trusted solvers to batch publish them on Ethereum, effectively reducing the risk of front-running and sandwich attacks. Additionally, the protocol imposes strict limits on the slippage of quotes and execution results from solvers, mechanically compressing the space for miners and searchers to extract MEV. These measures make Cow Swap one of the most user-protective trading platforms currently available. For large transactions and DAO treasury managers, such MEV protection is highly attractive.

- Brand

- As the first trading product to launch batch auction matching and solver competition mechanisms, combined with its MEV-resistant product features, Cow Protocol's value proposition of safety and cost savings for traders has deeply resonated with users, gradually becoming the first choice for large traders, a position unlikely to change easily. This user habit is backed by the brand and reputation accumulated by Cow Protocol based on its product, which is also the source of the protocol's gradual profitability.

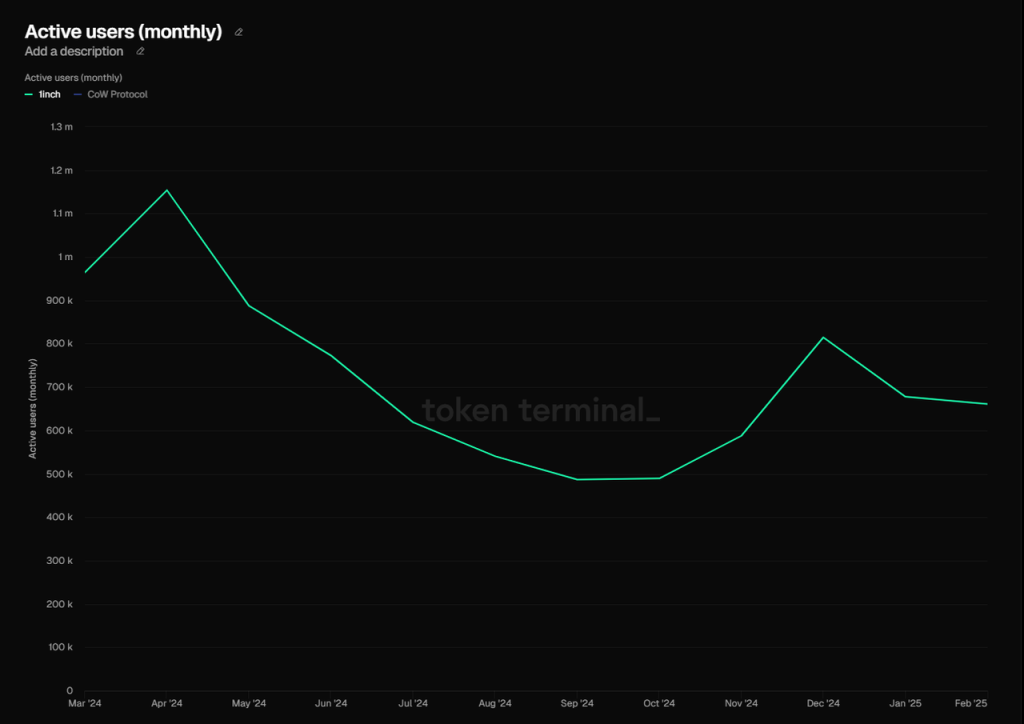

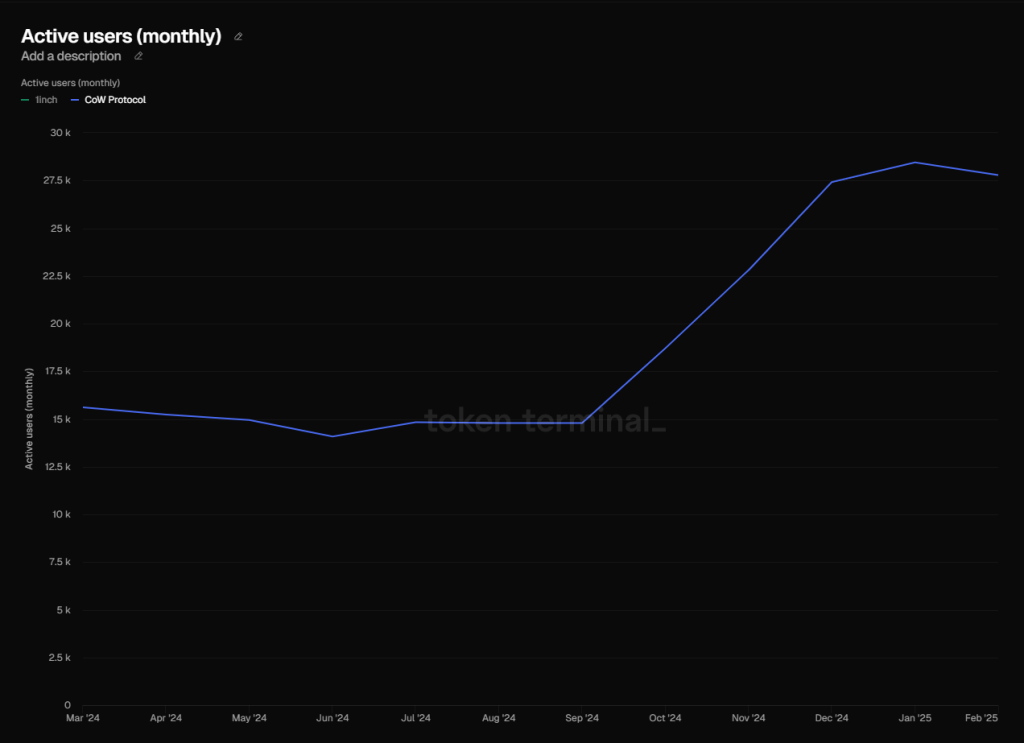

Monthly active users of 1inch over the past year, data source: Tokenterminal

Monthly active users of Cow Protocol over the past year, data source: Tokenterminal

Major Challenges and Risks

Intense Competitive Environment

The aggregation trading sector is highly competitive, with established projects like 1inch, Kyber, and DoDo, alongside new forces like Bebop, which is supported by Wintermute. Additionally, products like CEX and wallets, which are closer to users and have strong entry and frontend advantages, as well as chain abstraction concept products like UniversalX, are actively exploring innovations in trading products and striving for higher user penetration. Over the long term, their relationship with Cow Protocol is more competitive than cooperative. Therefore, even though Cow Protocol's market share has surpassed 1inch to become number one, maintaining that market share in such a high-pressure environment is not easy and will directly suppress the protocol's bargaining power with users and suppliers (solvers), creating a clear conflict between the goals of "market share" and "protocol profit."

Market Cycle

The overall downturn in the market cycle will lead to a shrinkage in total trading volume, impacting Cowswap's trading volume, which goes without saying. Other trading products are similarly affected, and this will not be elaborated further.

Binding to the EVM Ecosystem

Currently, Cow Protocol only provides services within the Ethereum ecosystem. If the Ethereum ecosystem does not develop as well as other public chains, it will naturally suppress Cow Protocol's growth potential. The same risk is faced by Uniswap, which will be mentioned later, and I will not repeat it.

Valuation Reference

COW Token

Cow currently has a total supply of 1 billion, with a circulating ratio of about 41.5% according to Coingecko data, and a projected token inflation rate of 19.61% over the next year.

Currently, the primary use case for Cow's token is governance. As protocol revenues rise in the future, there may be token buybacks, and there have been previous attempts to stake Cow to reduce transaction fees.

Valuation

From a vertical valuation perspective compared to itself, as business data continues to rise, Cow's FDV has reached a new high in this round (not considering the anomalies caused by the extremely low circulation rate in the first month after the project launched its token). The highest market cap reached a peak FDV of $990 million at the end of December last year, followed by a significant decline, currently around $280 million.

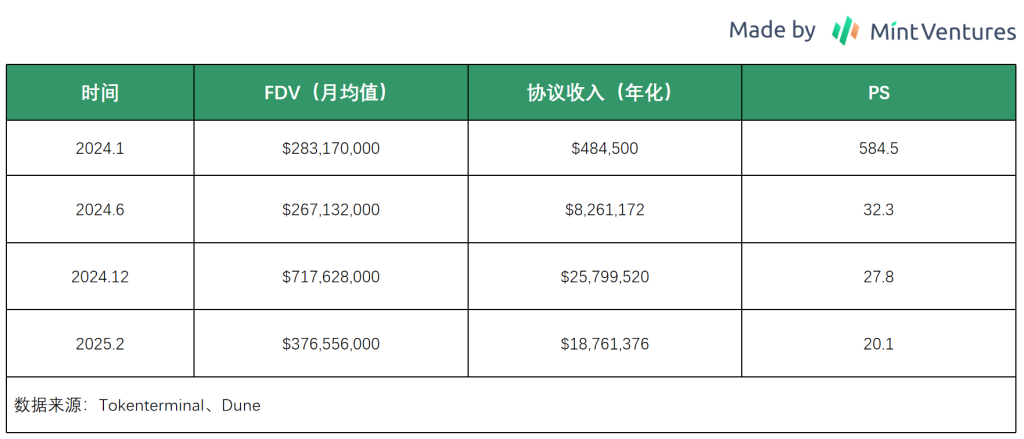

We compare Cow's PS ratio through the FDV and protocol revenue multiples:

As shown in the above chart, although Cow's FDV has shown an upward trend over the past year, its PS ratio has exhibited a significant decline as business revenue has increased, making it more cost-effective than before.

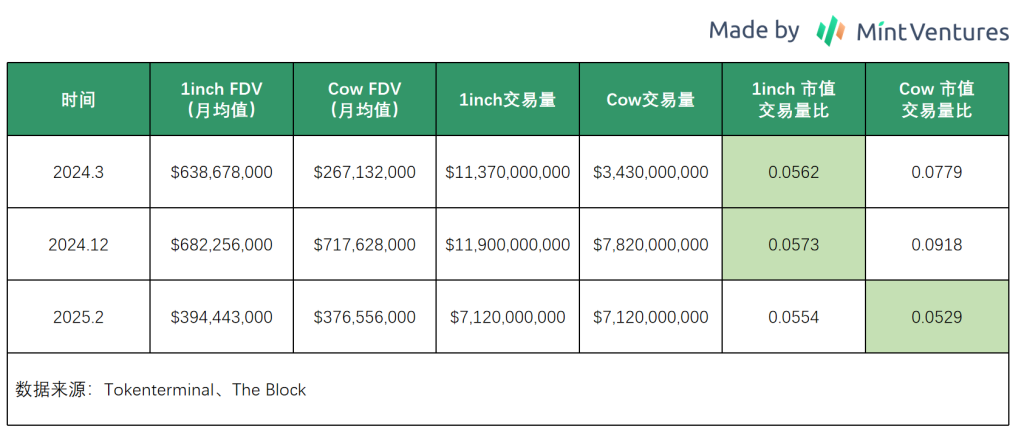

From a horizontal comparison with competitors, among comparable projects in the aggregator space, 1inch is the most direct benchmark. Considering that 1INCH currently does not have direct token value capture and the protocol does not have stable, public protocol revenue, we mainly compare the FDV to trading volume ratios of the two protocols.

As shown in the above chart, with the decline in Cow's price and the increase in business data, its market cap to trading volume ratio has fallen below that of 1inch for the first time since February 2025, offering a higher horizontal cost-effectiveness.

3.2 Uniswap

Current Business Status

Core Products

Uniswap is the largest decentralized exchange (DEX) on Ethereum, with its main products including its DEX protocol (now deployed on the Ethereum mainnet and several layer-2 chains) and the newly launched Unichain exclusive Layer 2 network.

The fee switch model of the Uniswap protocol has not yet been activated, so the protocol itself has not generated direct revenue in the past (but Uniswap Labs charges a 0.15% interface service fee on token trades on its official frontend).

However, after the official announcement of Unichain's launch in November 2024, it will subsequently distribute value directly to UNI holders through staking UNI to earn transaction sorter fee sharing, without needing to activate the fee switch.

Business Data

For Uniswap, the primary business data points are trading volume and fees; for Unichain, we mainly focus on the number of active addresses on-chain, the main ecosystem, and the scale of funds on-chain.

DEX Trading Volume and Fees

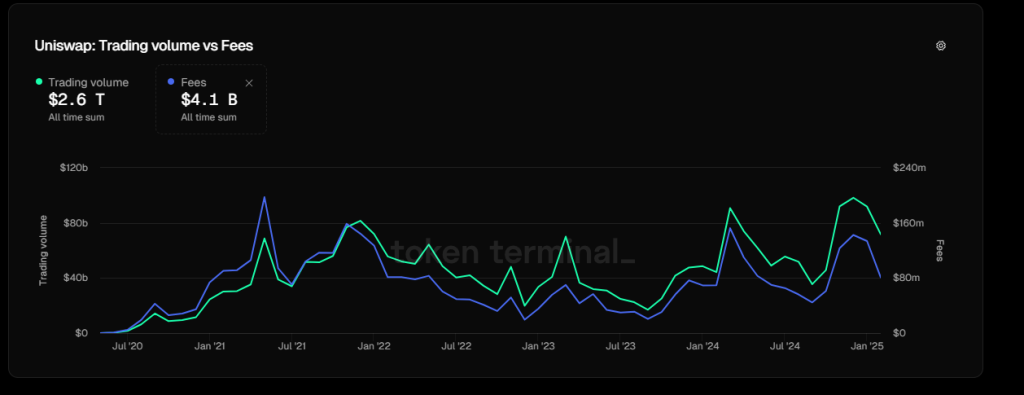

Uniswap's trading volume and fees, source: Tokenterminal

Overall, Uniswap's trading volume has continued to grow with market developments, reaching historical monthly trading volume highs in March and December of the past year. However, recently, as market conditions have cooled, trading volume has noticeably declined.

It is noteworthy that in this cycle, Uniswap's fee metrics have not surpassed the peak and secondary peak of the previous cycle, indicating that the fee ratio has been decreasing as the cycle progresses, leading to more intense competition among LPs.

Multi-Chain Data

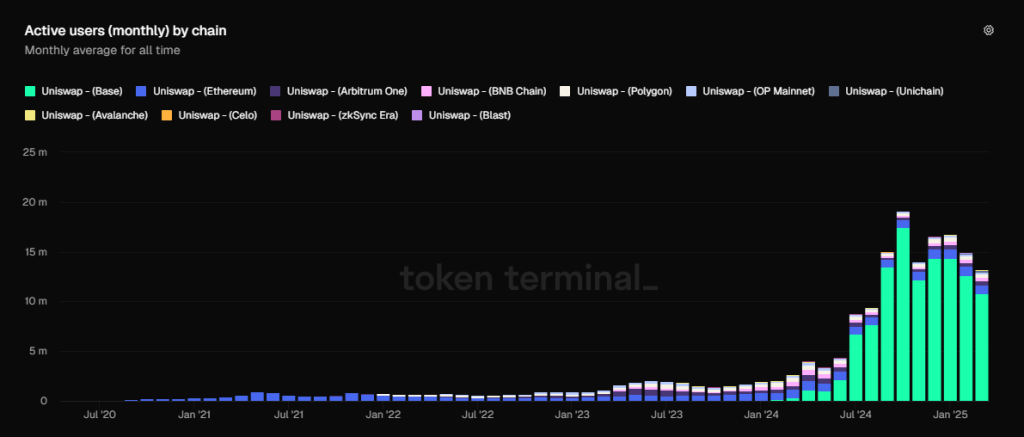

Thanks to multi-chain deployment (currently covering 11 EVM chains), especially with the launch of Base by Coinbase, Uniswap's active user count reached a new high of 19 million in October last year. The growth rate of this business data far exceeds that of trading volume, demonstrating the ability of L2 to attract new users.

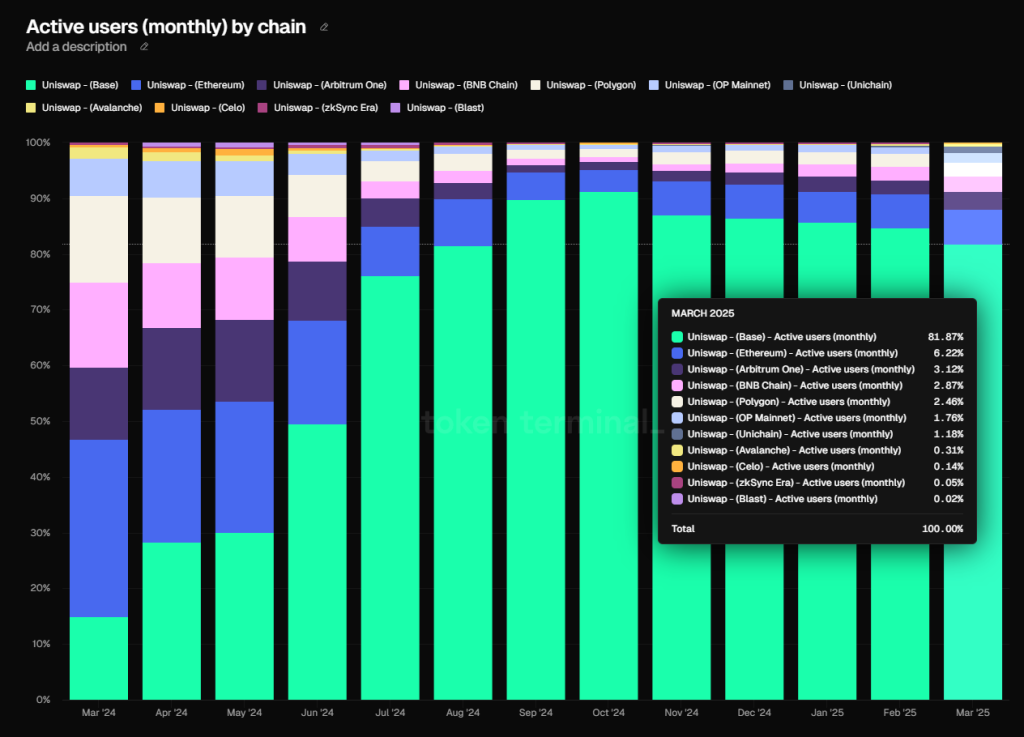

The multi-chain distribution of Uniswap's monthly active addresses, source: tokenterminal

Among them, Base is the main force of active users, accounting for 82% of Uniswap's active user count across all chains.

Source: tokenterminal

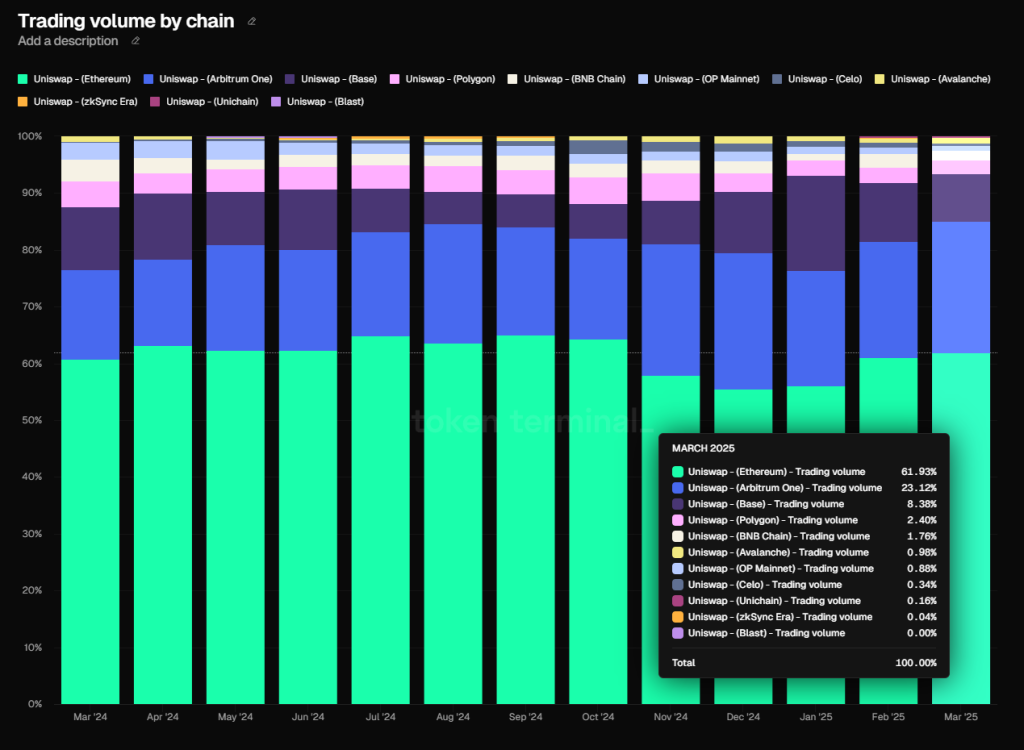

However, in terms of trading volume, Ethereum remains Uniswap's main battlefield, accounting for about 62% of the trading volume, followed by Arbitrum at 23%, and then Base at 8.4%.

Source: tokenterminal

Business Data of Unichain

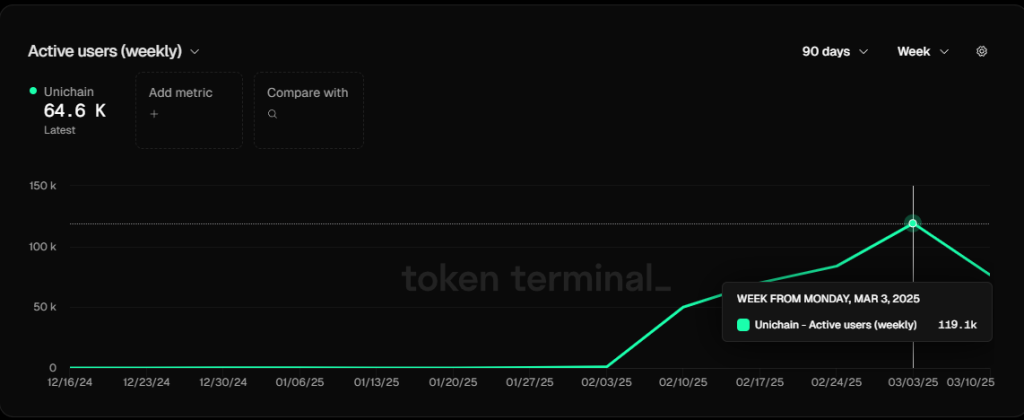

Since its official launch in early February this year, Unichain has seen rapid growth, with the number of weekly active addresses reaching nearly 120,000 by early March, ranking 7th among all L2s, surpassing well-known L2 projects like zksync, Manta, and Scroll.

Source: tokenterminal

The value of assets bridged to Unichain is still low, currently only around 14 million USD.

Source: tokenterminal

In terms of ecosystem, the Unichain official has listed over 80 ecosystem projects, although most of the actual businesses have not yet officially launched. For example, in DeFi, aside from Uniswap itself, the only well-known application currently live is Venus (with total deposits of 5.67 million USD).

Competitive Situation

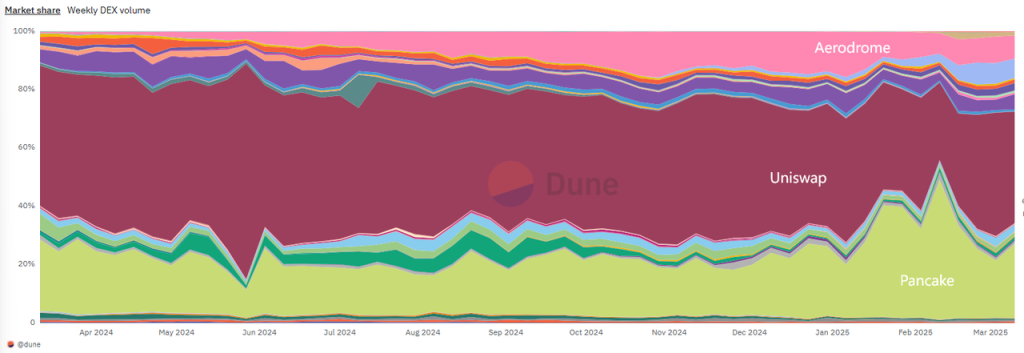

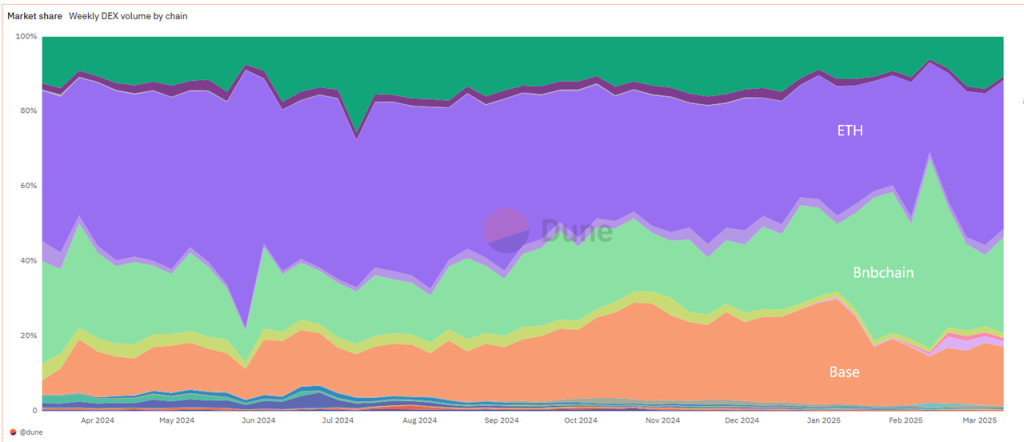

Uniswap still occupies the top position in the DEX market of the EVM ecosystem over the past year, maintaining its overall market share at the forefront, but the overall trend of market share continues to decline. The following chart shows the market share trends of all DEXs in the EVM ecosystem (including all EVM L1 and L2).

Source: Dune

The second place is Pancakeswap, and the third is Aerodrome, which are the leading DEXs on Bnbchain and Base, respectively (although Uniswap has also deployed on these two chains).

Source: Dune

ETH, Bnbchain, and Base are also the three chains with the largest trading volume in the EVM ecosystem, consistent with the market share rankings of Uniswap, Pancake, and Aerodrome.

As for Unichain, due to its short launch time, its ecosystem is still relatively weak and is in the cold start phase for applications and funds. Aside from a good growth in active user numbers, other business data still shows a significant gap compared to mainstream L2s.

Competitive Advantages of Uniswap

Uniswap's competitive advantages can be summarized as follows:

Network Effects and Liquidity Depth

The largest liquidity pools attract the most traders, and vice versa. More traders and trading volume attract more tokens to deploy liquidity here, creating a self-reinforcing cycle.

Brand and User Habit Stickiness

As the first project to promote the AMM model in the DeFi space, Uniswap has the highest brand recognition (including notoriety and legitimacy) and credibility. It holds a strong mental position in the minds of both traders and liquidity providers. Even today, with a plethora of DEXs and various aggregators, many users habitually trade on Uniswap's frontend, even if it incurs an additional trading fee. Uniswap's brand also played an important role in its L2 launch, attracting many quality projects for testing and participation right from the start, leading to rapid user growth.

Ecological Positioning through Multi-Chain Deployment

Uniswap has deployed products on most mainstream EVM chains and ranks among the top three in trading volume on most of these chains. This not only helps Uniswap maintain its foundational position in the multi-chain era but also lays the groundwork for its subsequent multi-chain aggregation trading features, making it easier to achieve interoperability of multi-chain liquidity.

Major Challenges and Risks

Intense Competitive Landscape and Impact of New Models

Although Uniswap still has a certain advantage in market share, its traditional Ethereum competitors like Curve continue to hold their ground. On the other hand, Uniswap's breakthroughs on other EVM L1 & L2 chains have not been smooth, as each chain has its own strong local competitors (such as Pancake on Bnbchain, Aerodrome on Base, and Camelot on Arbitrum). More concerning is the challenge posed by various emerging trading models: RFQ protocols (Request-For-Quote) and batch auction matching models are on the rise. Projects like CowSwap allow market makers (solvers) to quote directly, improving price efficiency for large trades and reducing AMM slippage and MEV, which are favored by professional traders and whales, significantly diverting Uniswap's trading volume. Although Uniswap later launched UniswapX with a similar mechanism, it has not been able to slow down the growth of projects like CowSwap. Additionally, products like wallets and CEXs, which have clear frontend advantages, are also intensifying their efforts in trading scenarios, attempting to penetrate upstream user behavior, leaving Uniswap in a more passive position as a "price taker" in the face of fierce pricing competition.

Inefficient Community Governance and Lack of Value Linkage for Tokens

Long-term observers of the Uniswap governance forum will find that compared to other DeFi projects with higher governance efficiency and better reputations (like Aave), Uniswap's governance efficiency is very low, reflected in slow speed, resource waste, and insufficient focus on strategic metrics. Specific examples include: 1. The community's most concerned issue regarding the fee switch has been discussed for nearly three years without resolution; 2. Various donations and budgets have been provided for studies and organizations unrelated to Uniswap's North Star metric (trading volume), but the results have been minimal in benefiting the project. The low level of community governance and the neglect and sluggishness regarding the value linkage of UNI tokens have clearly had a long-term negative impact on the price of UNI tokens.

Valuation Reference

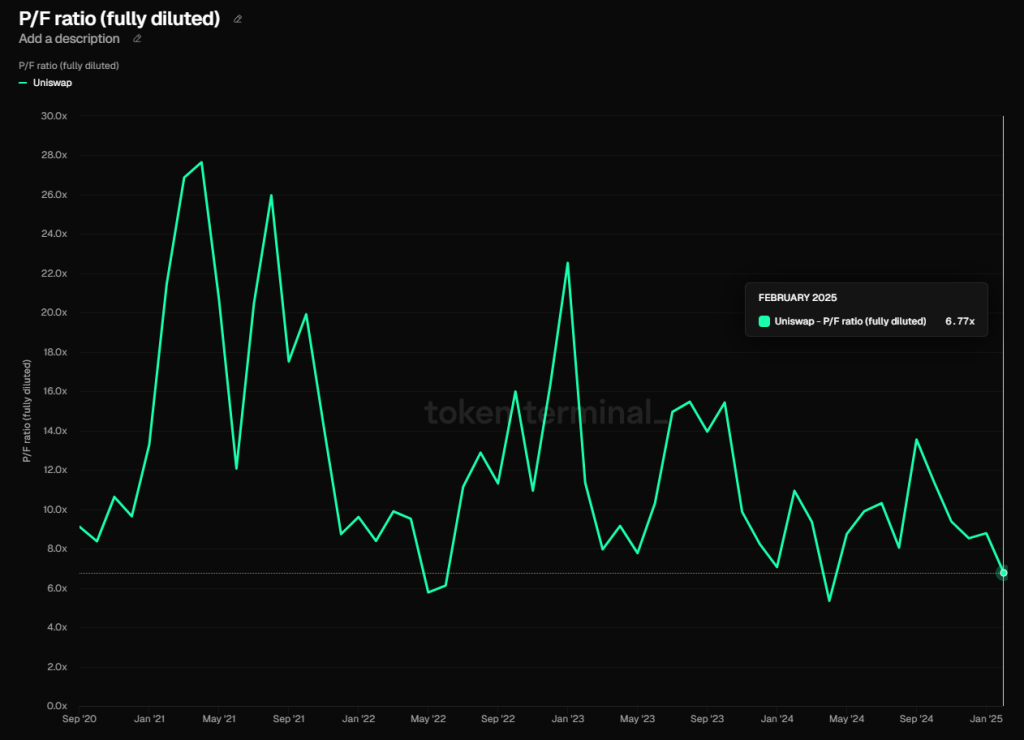

Since Uniswap has not yet generated formal protocol revenue, and Unichain's fees are negligible relative to its market cap, we use the ratio of Uniswap's market cap to its fees (PF) for both vertical and horizontal valuation comparisons.

Source: tokenterminal

In vertical comparison, Uniswap's PF in February this year was 6.77, at an absolute historical low. Since the launch of Uniswap's token, there have only been three months with a lower indicator: May-June 2022 (Three Arrows Capital collapse) and April 2024 (altcoin market correction + Uniswap receiving SEC's Wells Notice). In March, this indicator slightly rose to 7.26. From this metric, it is clear that the market is currently extremely pessimistic about the prospects of UNI tokens.

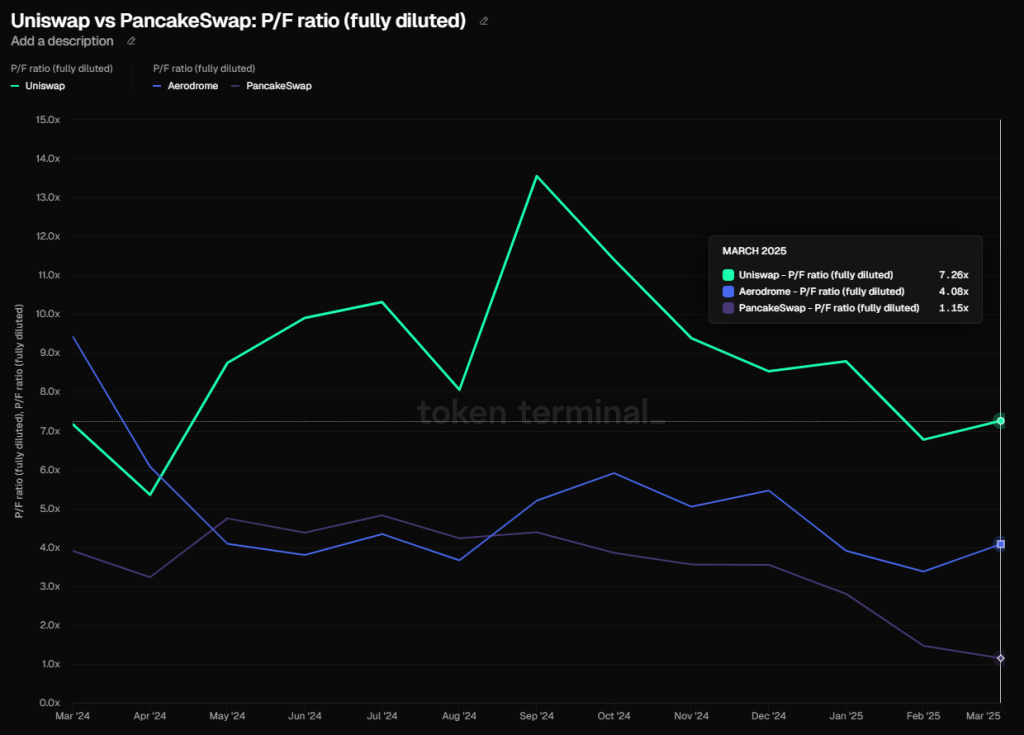

Source: tokenterminal

For horizontal comparison, I chose DEX projects that are also ranked just below Uniswap in market share, namely Pancake and Aerodrome. I did not choose Curve because, in addition to being a DEX, it currently has a main business in lending, making it less comparable to the top three.

From the PF metrics of the three, it seems that Uniswap's valuation is significantly higher than that of Pancake and Aerodrome. However, we need to consider two additional factors:

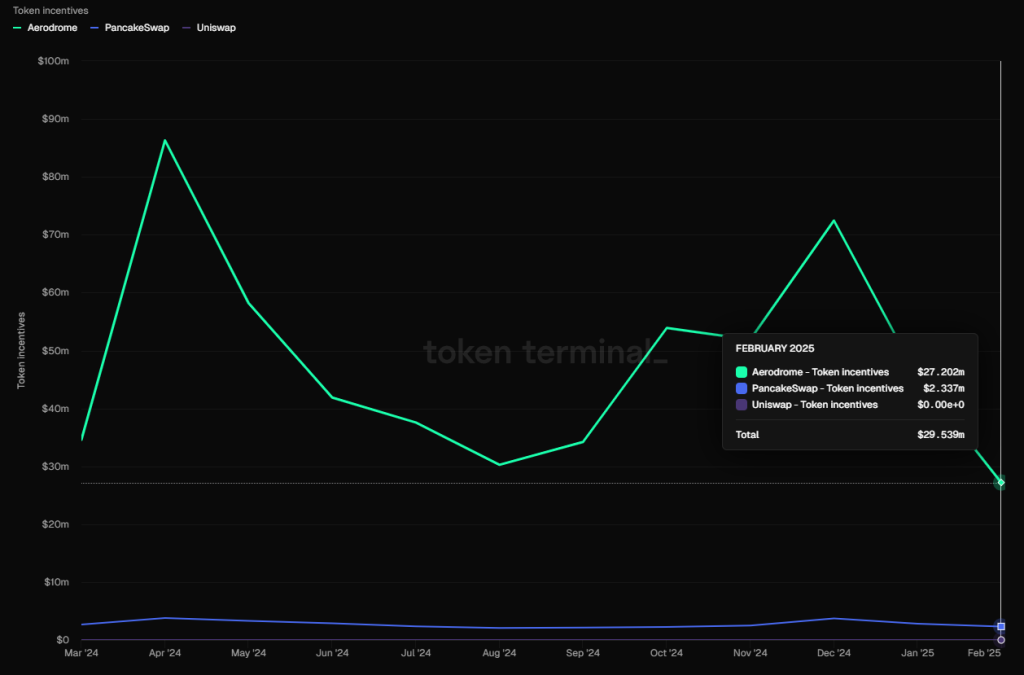

- Uniswap has not provided any token subsidies, while Pancake and Aerodrome are still offering substantial token incentives, especially Aerodrome, which had token incentives worth up to 27 million USD in February (see below).

Uniswap also has Unichain as a second growth curve.

Uniswap's multi-chain ecosystem is better developed. Although Pancake has also deployed on multiple chains, its operational situation is significantly different from Uni, while Aerodrome is a single-chain DEX.

Overall, even considering the similarities in business between Uniswap and Pancake and Aerodrome, the horizontal valuation comparison of PF is less relevant than the vertical comparison.

3.3 Jupiter

Current Business Status

Starting from aggregation trading, Jupiter has expanded its product offerings and acquisitions, forming a full-chain layout around trading on the Solana chain, and is horizontally expanding to other chains and ecosystems. The main products within the Jupiter system include:

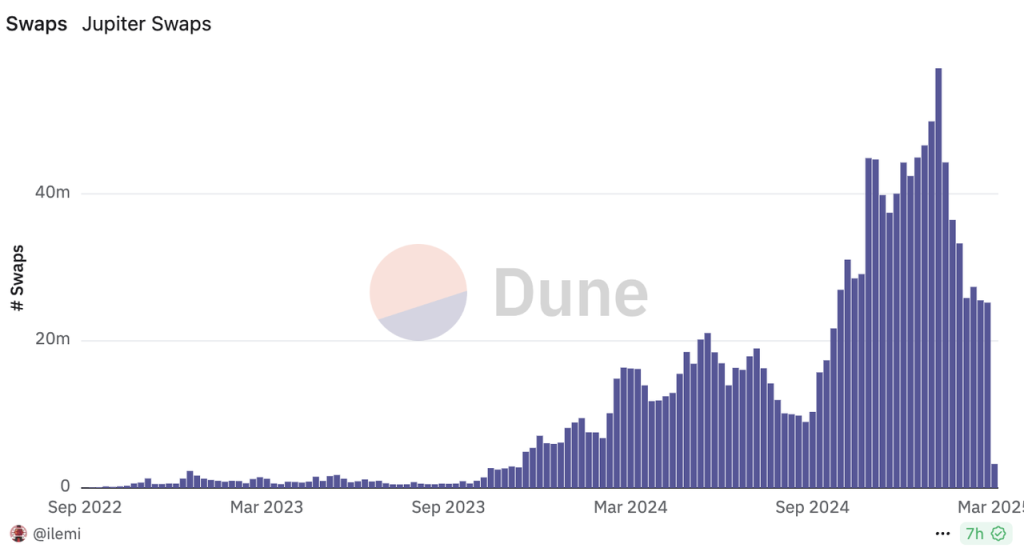

- The main site’s self-operated trading products include aggregation trading (Instant), market orders (Trigger), and conditional orders (Recurring), which are the earliest products launched by Jupiter and also the most used. The daily trading volume set a record of 57 million transactions on January 20.

Source: Dune

The Trenches product on the main site, previously known as Ape.pro, is a specific product tool for memes, consistent with typical meme trading tools like Phonton/GMGN. However, at the end of February, after ape.pro was merged into Trenches, its product form became quite similar to Jupiter's aggregation trading products.

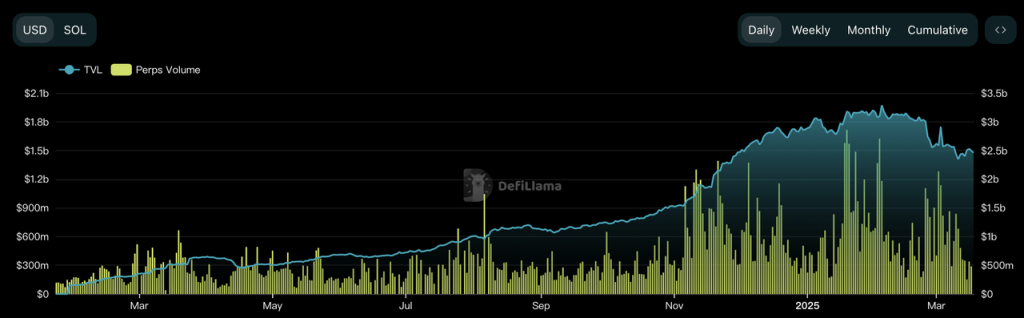

The Perps product on the main site has a core product logic similar to GMX, offering leveraged long and short positions for BTC, ETH, and SOL, as well as yield farming. This segment's TVL peaked over 2 billion USD, making it a major component of Jupiter's TVL. During peak periods, the average daily trading volume also approached 1 billion USD, serving as Jupiter's primary cash flow business.

TVL (left axis) and trading volume (right axis) data of Jupiter's derivatives exchange. Source: DeFillama

The above can be considered Jupiter's main products at present. In addition, the Jupiter ecosystem includes the following products:

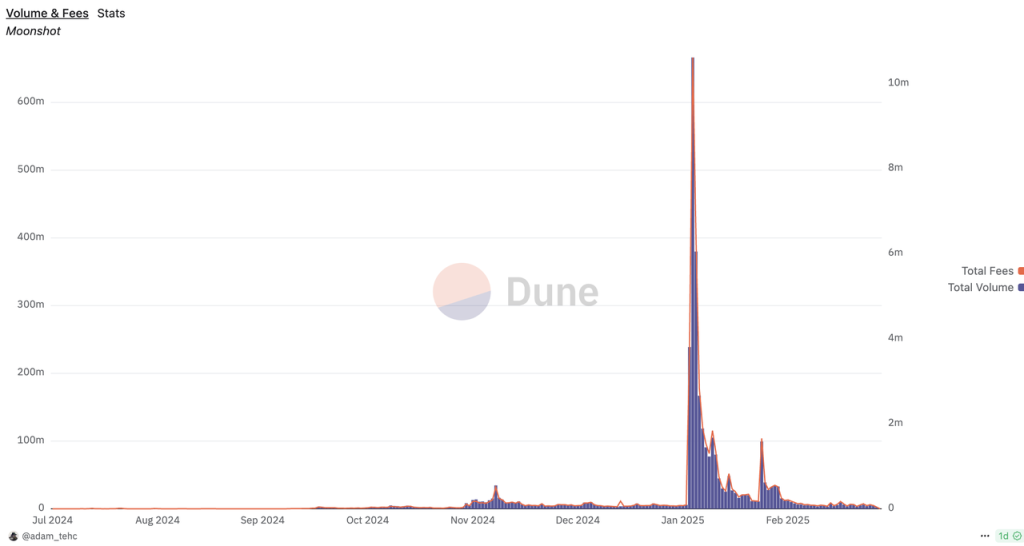

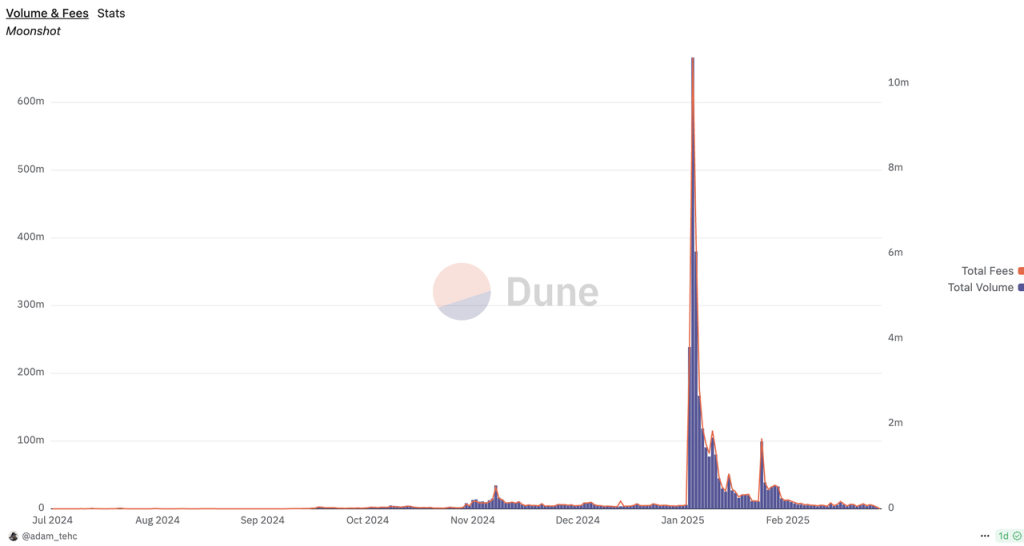

- Meme trading platform Moonshot. In January 2025, Jupiter announced the acquisition of a majority stake in the meme trading platform Moonshot. Moonshot has emerged as a rising star in the meme trading space over the past six months, attracting numerous users with its smooth fiat deposit system and simple trading process, generating a coin effect on Moonshot, especially when TRUMP was launched.

Moonshot's trading volume (left axis) and fees (right axis). Source: Dune

Liquidity platform Meteora. Meteora was founded by an early co-founder of Jupiter (Ben Chow). Although there is no explicit control relationship with Jupiter, it is also regarded as an important part of the Jupiter ecosystem. However, Meteora will issue its own token in the future. Although Meteora belongs to the Jupiter ecosystem, its relationship with the JUP token is somewhat indirect.

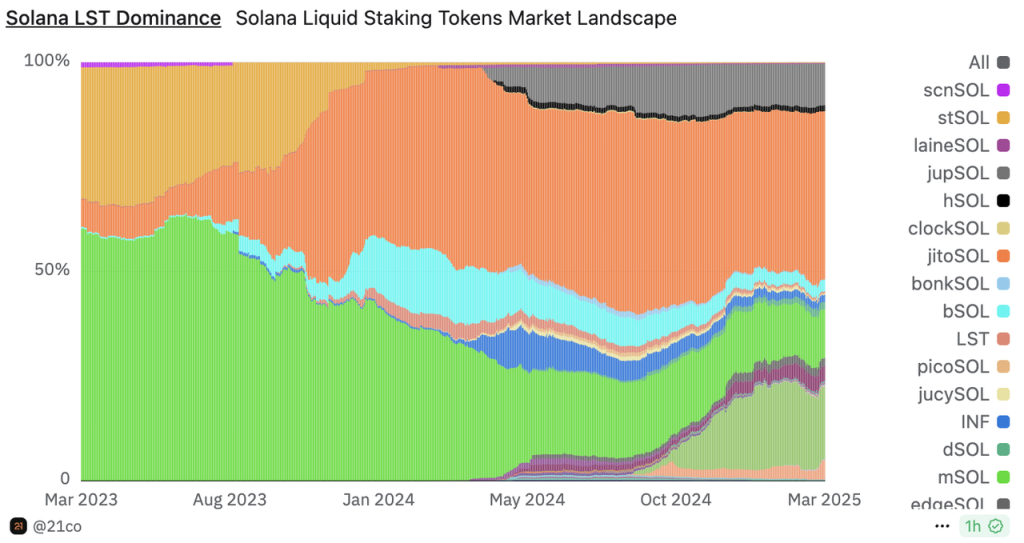

LST product jupSOL, which quickly captured a significant market share after its launch in 2024. Currently, jupSOL ranks fourth after jitoSOL, bnSOL, and mSOL.

Market share of Solana LSTs (the gray block above represents jupSOL). Source: Dune

Launchpad LFG. In addition to the JUP token itself, LFG has launched governance tokens for the cross-chain communication protocol zeus (ZEUS), the LST protocol Sanctum (CLOUD), and the cross-chain protocol debridge (DBR), as well as several other meme projects in 2024. Although the number of launched projects is small, their quality is relatively high.

Portfolio management platform Jupiter Portfolio. In January, Jupiter officially announced the acquisition of the on-chain portfolio tracker Sonarwatch and launched Jupiter Portfolio on January 30.

Mobile wallet Jupiter Mobile. After acquiring Solana's mobile wallet Ultimate Wallet, Jupiter launched its mobile wallet.

Full-chain network Jupnet, launched at the end of January this year, aims to achieve account access to all chains, all currencies, and all goods. However, there is currently no directly experienceable version targeting end users.

Trading terminal Coinhall, acquired by Jupiter in September 2024, primarily provides trading for Cosmos ecosystem tokens. By acquiring Coinhall, Jupiter gained the ability to build its own trading terminal, which is essential for the development of its Trenches product. Currently, on-chain trading of Cosmos ecosystem tokens is not frequent, with an average daily trading volume below 10 million USD.

Source: Coinhall official website

- In addition to the aforementioned products aimed at end users, Jupiter has many other initiatives, such as acquiring Solana's browser SolanaFM. They also have many products in the pipeline, such as the full-chain network Jupnet.

From the product layout perspective, Jupiter, as the largest entry point for end-user traffic on Solana, covers almost all business directions except lending. Even in the very obvious "mixed operation" situation of Solana, Jupiter's business reach remains the broadest. Moreover, in addition to self-operated products, they are also expanding their business boundaries through relatively aggressive acquisitions.

Profit Model

Currently, Jupiter's fee-based services include:

Aggregation trading services (including Trenches) charge 0.05%-0.1%, market orders and DCA charge 0.1%.

Derivatives business follows GMX's mechanism, with main fees coming from a 0.06% fee charged at the opening and closing of positions, along with borrowing fees, price impact fees, etc. However, not all fees from derivatives go to JupiterDAO; 75% of the fees are distributed to its liquidity providers (JLP), while the remaining 25% is extracted by JupiterDAO.

Other services do not charge fees.

Token Incentives

Jupiter does not have a daily token incentive program; its main incentives come from two rounds of retroactive airdrops.

Competitive Situation

Trading is the core service provided by Jupiter, and other businesses like LST, Launchpad, and wallets can be seen as a re-utilization of traffic brought by trading. Therefore, we mainly analyze Jupiter's competition in aggregation trading and derivatives trading.

Aggregation Trading

In the competition for trading entry points on Solana, Jupiter quickly surpassed Orca and Raydium in the first half of 2024, thanks to the aggregator's multi-liquidity pool routing features and excellent user experience, achieving an absolute advantage (51% of Solana's trading sources in Q2 2024, source: Messari).

However, with the rise of meme and Pump.fun, specialized meme trading tools like Photon, Trojan, Bullx, and GMGN quickly captured market share from Jupiter at the trading entry level. They emphasize faster trading speeds and more comprehensive meme trading support features, becoming more recognized in the market as "Meme trading entry points." In October last year, Jupiter launched a similar tool, ape.pro, but the market response was lukewarm, and it was eventually merged into the main site's Trenches product. This is reflected in the data, showing that Jupiter's share of Solana's trading sources dropped to 38% in Q4 2024 (source: Messari).

During the meme trading boom, meme trading accounted for 90% of Solana's network trading volume, and the division of the meme trading entry point is the biggest issue Jupiter faces in aggregation trading.

Derivatives Trading

Jupiter's derivatives exchange is currently the second-largest derivatives exchange across all chains, with trading volume only surpassed by Hyperliquid, which will be introduced in the next section. Specifically on the Solana chain, Jupiter has a clear advantage over its main competitor Drift, with its trading volume recently being approximately 5-10 times that of Drift.

7-day derivatives exchange trading volume ranking. Source: DeFillama

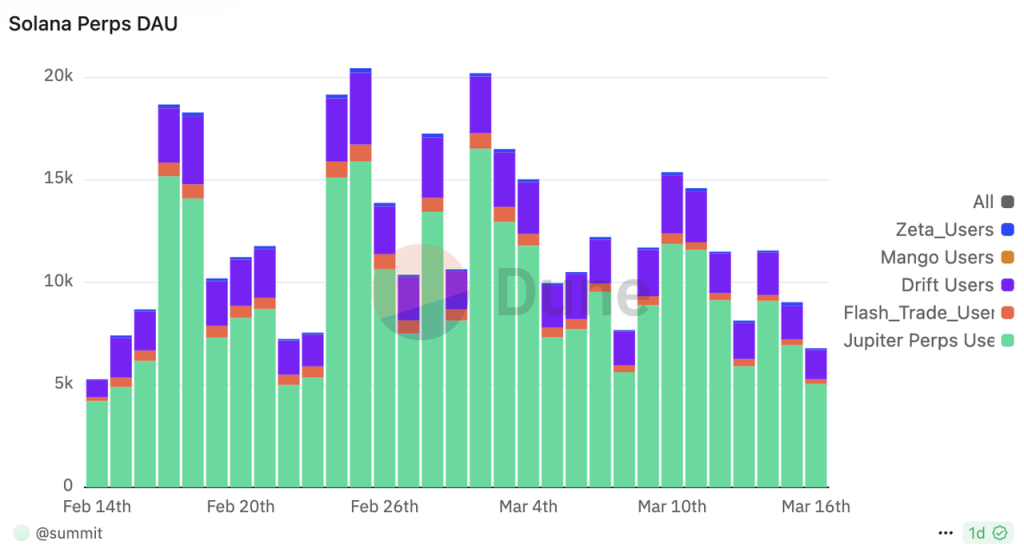

In terms of DAU, the gap between the two has also been close to an order of magnitude in the past month.

Data source: Dune

In the derivatives trading field, Jupiter's position on the Solana network is unlikely to be shaken in the short term.

Major Challenges and Risks

Despite launching Jupnet to expand its full-chain business, Jupiter's core business is still primarily on Solana. For Jupiter, the biggest uncertainty remains whether the Solana network can maintain its prosperity and keep active on-chain trading.

In addition to the aforementioned challenges of unfavorable competition in the meme trading entry point, Jupiter also faces challenges and risks including:

- Overly aggressive business expansion with questionable effectiveness.

Jupiter's business expansion is much more aggressive than that of most Web3 projects. Their business vision is grand, and over the past year, they have frequently expanded their business boundaries through acquisitions. However, many of these acquisitions have not achieved the expected results, such as the acquisitions of Moonshot and Coinhall.

Compared to the peak daily trading volume of $660 million and millions in revenue at the time of acquisition in January, Moonshot's daily trading volume has now sharply decreased to less than $5 million, with revenue not exceeding $10,000. Although Jupiter has not disclosed the acquisition price or the costs incurred, it is clear that acquiring Moonshot today would come at a much lower cost for JUP token holders.

Moonshot's trading volume (left axis) and fees (right axis). Source: Dune

The acquisition of Coinhall helped Jupiter establish its meme trading product, Trenches. However, based on the current situation, Trenches still has a significant gap in both trading volume and visibility compared to leading meme trading products like Photon, Bullx, Trojan, and GMGN.

No Self-Built Liquidity Pool

Jupiter does not have its own liquidity pool. The supported Meteora has already launched a points program and is expected to initiate an independent token issuance process, which means that JupiterDAO, or the JUP token, cannot capture the trading fees from "tokens traded in the liquidity pool." This portion of the fees supports Raydium's business revenue of over $22 million in January this year.

Untested in Bear Market

In a bear market, many of the logic that was taken for granted in a bull market will be broken. For example, currently, meme trading users on the Solana chain generally have a strong willingness to pay. They hardly react to the 0.05% fee required by Jupiter's aggregation trading, as competing meme tools charge fees of 0.5% to even 1%. However, in a bear market, as trading enthusiasm wanes, users' sensitivity to trading fees will increase, and Jupiter may find itself caught in a conflict between "market share" and "net profit."

Additionally, Jupiter's current product line includes wallets, the full-chain network Jupnet, and the portfolio management tool Jupiter Portfolio, among others, which are unlikely to generate revenue in the short term. Whether it can maintain such a large product line in a bear market is also a significant question.

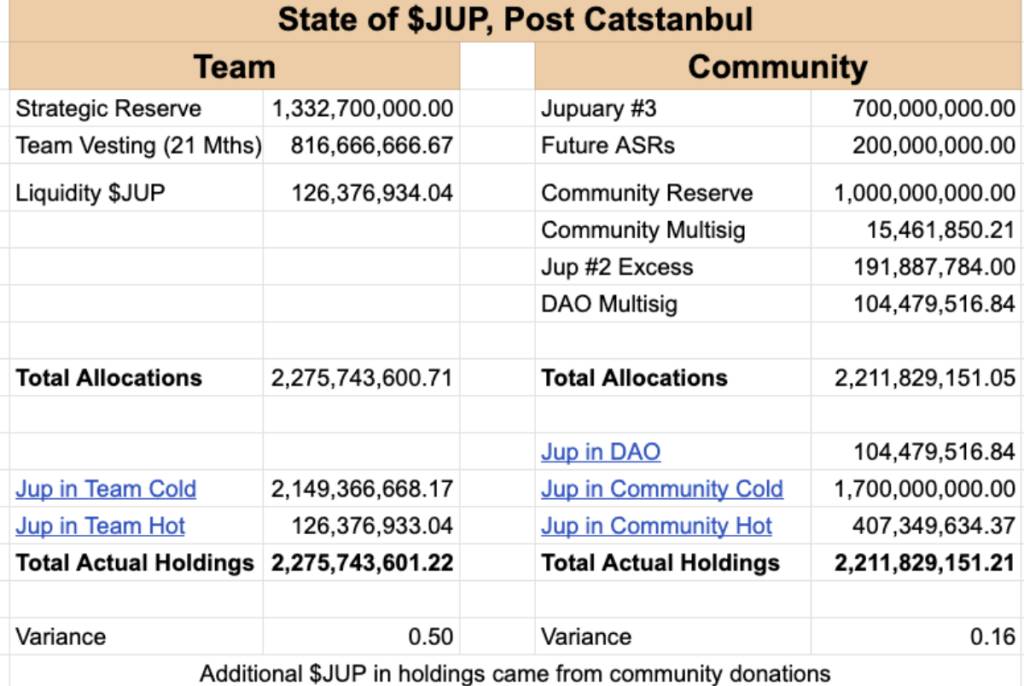

Valuation Reference

The total supply of JUP is 10 billion, and at the end of January this year, a vote was held to burn 3 billion tokens. Currently, the maximum circulating tokens are 7 billion, with an actual circulation of 2.63 billion tokens, resulting in a current circulation ratio of 38.5%. Among the currently uncirculated tokens, 810 million team tokens will be gradually unlocked over the next 21 months, and an additional 700 million tokens will be released in the Jupiter airdrop in January next year. The inflation rate for the next year exceeds 40%, and JUP still belongs to the category of low circulation and high inflation tokens.

Current distribution of JUP tokens. Source: Jupiter Governance Forum

At the end of January, Jupiter announced that 50% of protocol revenue would be used to repurchase JUP, with the repurchased JUP locked for three years.

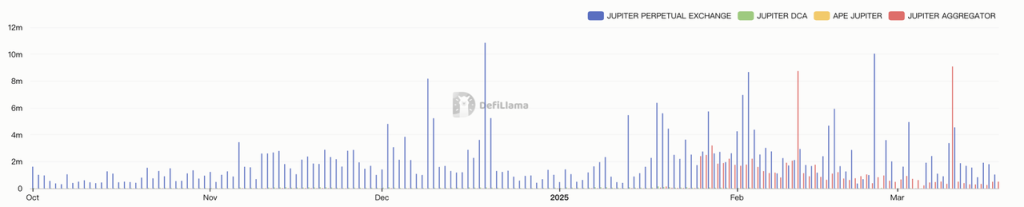

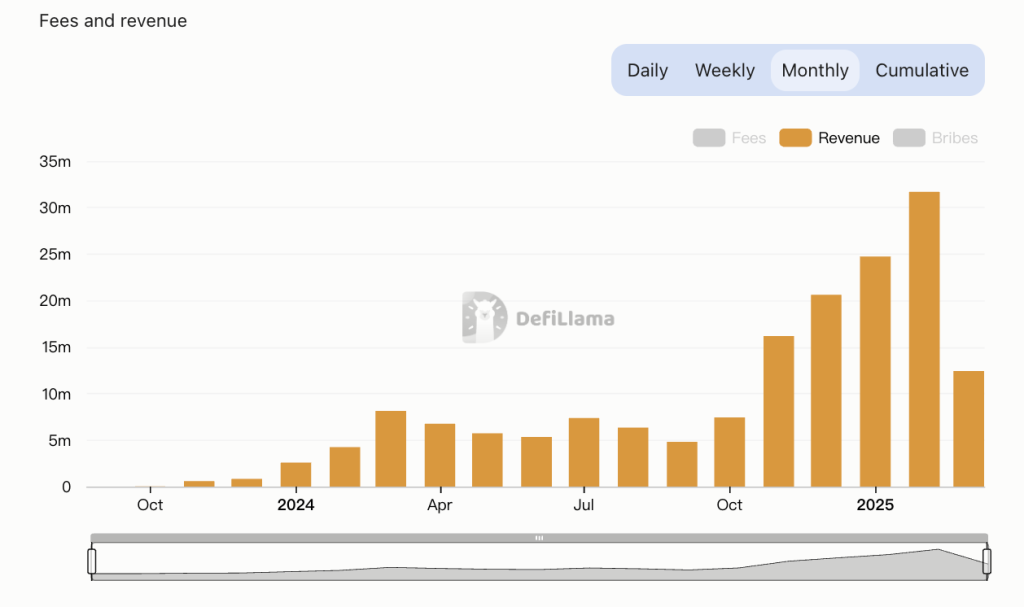

The following chart shows the revenue of the Jupiter protocol since October last year, as compiled by DeFillama (the statistics for Jupiter's aggregator revenue on February 10 and March 10 may contain anomalies, but the author has not found other data sources for Jupiter's revenue statistics). It can be seen that Jupiter's main revenue still comes from derivatives trading (blue bars), which is certainly related to the significant decline in meme trading enthusiasm when Jupiter's aggregator fees were launched.

Data source: DeFillama

Data source: DeFillama

Since Jupiter completed a significant economic model update at the end of January, charging 0.05%-0.1% for aggregation trading, the more relevant P/S data is from February and March.

According to the revenue data collected by DeFillama, Jupiter's revenue in February was $31.7 million, with an annualized revenue of $380 million, corresponding to a P/S (circulating) of only 3.65, and a P/S (fully circulating) of 9.5. By March 18, the revenue was $12.25 million, translating to an annualized revenue of $253 million, with a P/S (circulating) of 5.45 and a P/S (fully circulating) of 14.15.

Source: DeFillama

Whether compared horizontally with Cowswap mentioned earlier or vertically with Jupiter itself, JUP's current valuation appears low.

Of course, all the above data is based on the hype surrounding Solana. As the popularity of Solana further declines in the future bear market, maintaining such high revenue will be very challenging, and we have already seen this trend in the data from March compared to February.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。