If you want to become a sun, start from the dust; if you want to become a great river, start from a drop of water; if you want to become a hero that the world pays attention to, start from the most ordinary and mundane person. Gradual progress is always better than rushing for success, and the realization of every idea is achieved through accumulation.

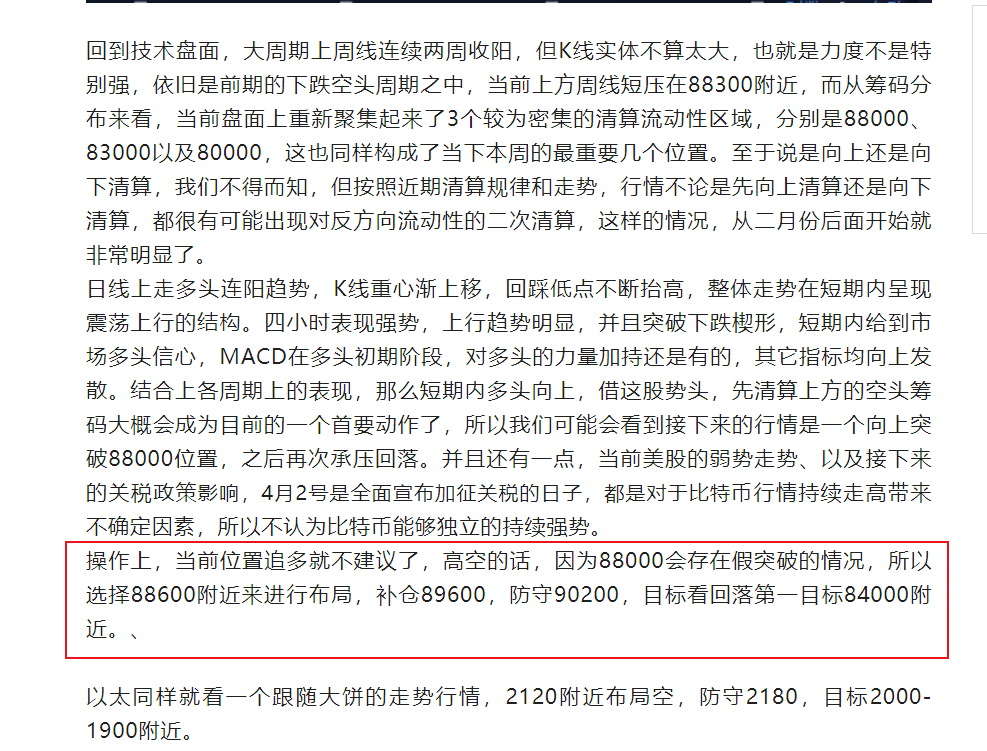

Regarding yesterday's market, I believe the analysis in yesterday's article was very detailed and accurate, and I don't want to emphasize anything. Firstly, it was emphasized yesterday that the market would rise in the short term, and breaking through 88,000 is definitely inevitable. Firstly, it is evident that most people in the market believe that 88,000 is a key resistance level, and once broken, it may rise above 91,000. This is a typical psychological consideration; from a psychological perspective, violating the outcome that most people hope for is likely to be the true outcome. Additionally, it was mentioned yesterday about the distribution of liquidity in positions; around 88,000 is a dense area of short liquidity, and when the market breaks through 88,000, it begins to liquidate this liquidity. If the market wants to continue to rise, it requires shorts to be unwilling to accept losses and continue to add positions. Do you understand this? Simply put, if shorts continue to add positions above 88,000, then bulls will definitely strengthen their upward momentum to further liquidate the shorts. Can you understand that? This is also why I chose to enter the market around 88,600; clearly, the market has identified 88,000 as the main resistance, but ultimately it formed a breakthrough and then began to pull back, which is aptly described as "going against the current," making it easier to understand.

On the chart, we don't need to analyze the larger cycle trend too much for now; we mainly look at the four-hour cycle. From a structural perspective, this is a very short-term strong structure, with each rebound high surpassing the previous one and the lows being raised, indicating an overall upward wave. Now, regarding the current pullback issue, this wave's rebound high is around 88,700, followed by a rise and then a pullback. Currently, the four-hour K-line has been closing in the red continuously. Yesterday, we mentioned that the market broke through the previous descending wedge channel, so we expected continued short-term upward movement, and the final result indeed turned out as anticipated. From the current trend, the first thing in the short term is a retest of the wedge's upper edge, which is around the 86,000 position. The MACD has started to converge on the bullish volume bars, and if the pullback strength increases, there is an expectation of a potential dead cross above zero. It is highly likely that the 86,000 position will be broken; it is just unclear whether it will break directly or have a rebound before breaking. If there is a rebound, then friends who do not have short positions can look for opportunities to enter the market again. Another support level to pay attention to is the previous round's pullback low around 83,000. Here, we consider what we mentioned yesterday about the second liquidation; first, the liquidity of the shorts above was liquidated, and the area around 83,000 is also a dense area of bullish liquidity. If the shorts come down strongly again, liquidating the bulls is also a normal trend, and from a structural perspective, if it breaks below the previous pullback low, then this upward wave structure will also be damaged.

Then, from the recent ETF data over the past few days, the recent ETFs are in a net inflow state, and MicroStrategy has also increased its Bitcoin holdings recently, which is part of the reason for the recent market rise. However, the data also shows that the recent net inflow of funds is not very large; yesterday's net inflow was 83 million dollars, which, compared to the previous large net outflows, still seems insufficient. Therefore, we have always emphasized that the market is not a trend reversal but more of a rebound behavior under capital operations.

In terms of operations, the short position at 88,600 yesterday can have its stop-loss moved down to hold, currently having a profit space of 2,000 points. Just set a stop-loss at a profitable position and continue to look at the target around 84,000. If the shorts continue, then watch for the situation of breaking 83,000. If there is a rebound to around 87,300 during the day, continue to enter the market to short.

Ethereum only rebounded to above 2,100 yesterday, not reaching our planned entry position around 2,120. Today, around 2,070 can be a point to participate in shorting, with a stop-loss at 2,140 and a target around 1,950.

As for altcoins, personally, I am not very interested in them lately; I feel a bit tired, and since it is the season of spring, there are quite a few things to do. I plan to take some time to walk around and have no time to study. In the secondary market, you can choose a few good coins and wait for pullback opportunities; when suitable, just buy some!

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article has been reviewed and published, and the market changes in real-time, so the information may be delayed, and strategies may not be timely. Specific operations should be based on real-time strategies. Feel free to contact us for market discussions.】

Scan to follow

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。