Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

Recently, community member "INVESTYOFFICIAL" tweeted that the DeFi project WLFI, supported by the Trump family, has allegedly issued the stablecoin USD1 on Ethereum and BNB Chain, and is currently undergoing multiple functional tests. The well-known market maker Wintermute is also suspected to be involved. As of now, WLFI has not officially confirmed this news.

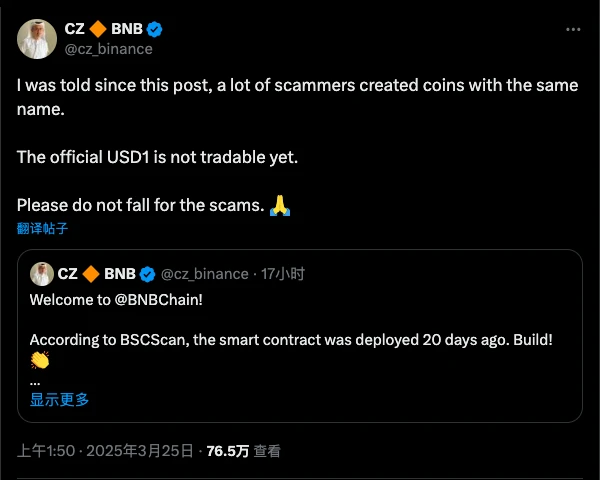

Binance founder CZ retweeted the post and stated that the USD1 smart contract was deployed on BNB Chain 20 days ago. CZ also reminded, "Many fake tokens named USD1 have already been created. The official USD1 launched by WLFI is not yet tradable, please do not be deceived."

CZ's tweet

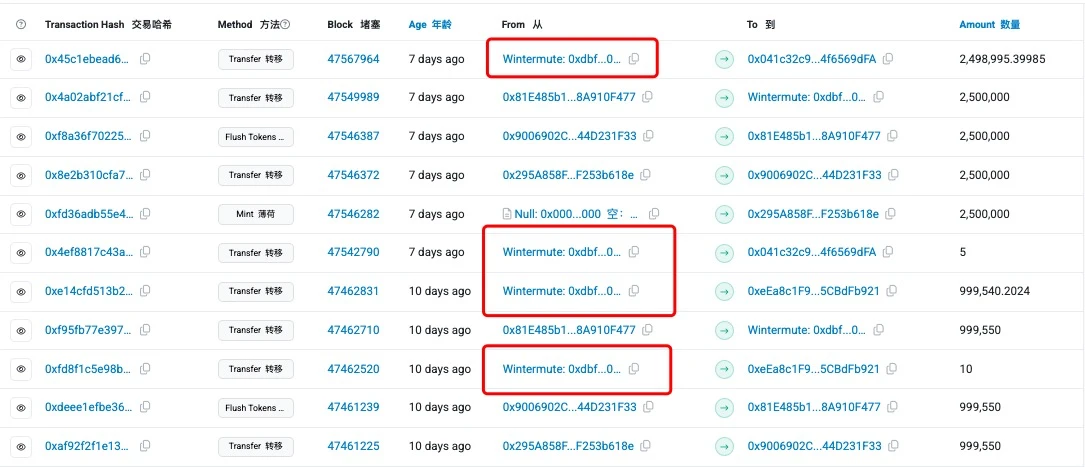

On-chain data from Bscscan shows that the current test version of USD1 has a circulation of 3.5 million tokens, with a total of 6 holders, one of which is Wintermute; Wintermute has also participated in transfer tests multiple times in the past 20 days. On-chain addresses:

https://bscscan.com/token/0x8d0d000ee44948fc98c9b98a4fa4921476f08b0d

https://etherscan.io/token/0x8d0d000ee44948fc98c9b98a4fa4921476f08b0d

Multiple Motivations: WLFI's Entry into the Stablecoin Market

Overall, WLFI's entry into the stablecoin market may be driven by the following four considerations.

1. Strengthening the dominance of the US dollar. WLFI has explicitly stated that one of its missions is to promote the widespread adoption of dollar-pegged stablecoins, thereby maintaining the United States' dominant position in the global financial system. By issuing USD1, WLFI aims to solidify the dollar's position in the DeFi space and create differentiated competition with rivals like Tether and USDC.

Additionally, the policy environment's openness towards stablecoins has paved the way for WLFI's entry into the market. At the White House crypto summit on March 8, Trump emphasized the desire to promote stablecoin legislation, with plans to complete it before Congress adjourns in August. US Treasury Secretary Scott Bessent stated at the summit, "We will deeply consider the stablecoin system. As President Trump has indicated, the US will maintain its position as the global dominant reserve currency and use stablecoins to achieve this goal."

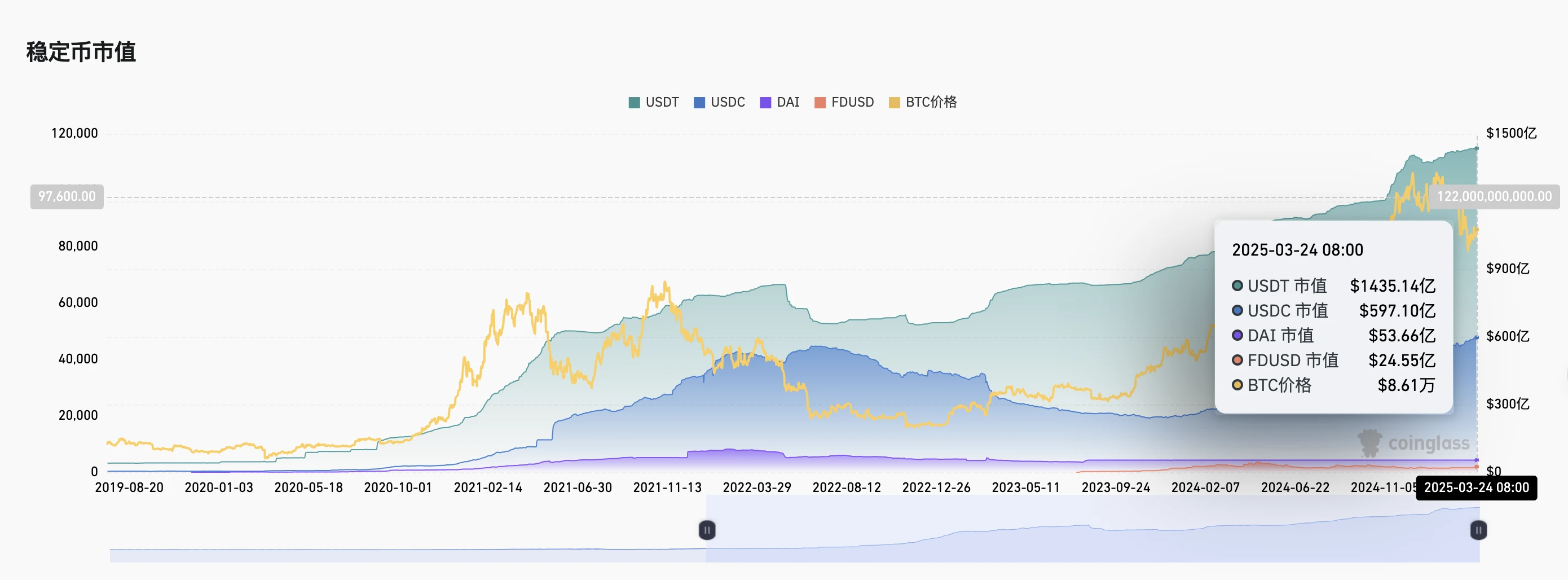

2. Seizing growth opportunities in the stablecoin market. With the market capitalization of stablecoins rapidly surpassing $200 billion in recent years and expected to double to over $400 billion by 2025, the market prospects are very enticing. Tether disclosed in its Q4 2024 report that its annual net profit reached $13 billion, reflecting the profit potential of stablecoins holding government bonds and other assets.

Data from coinglass

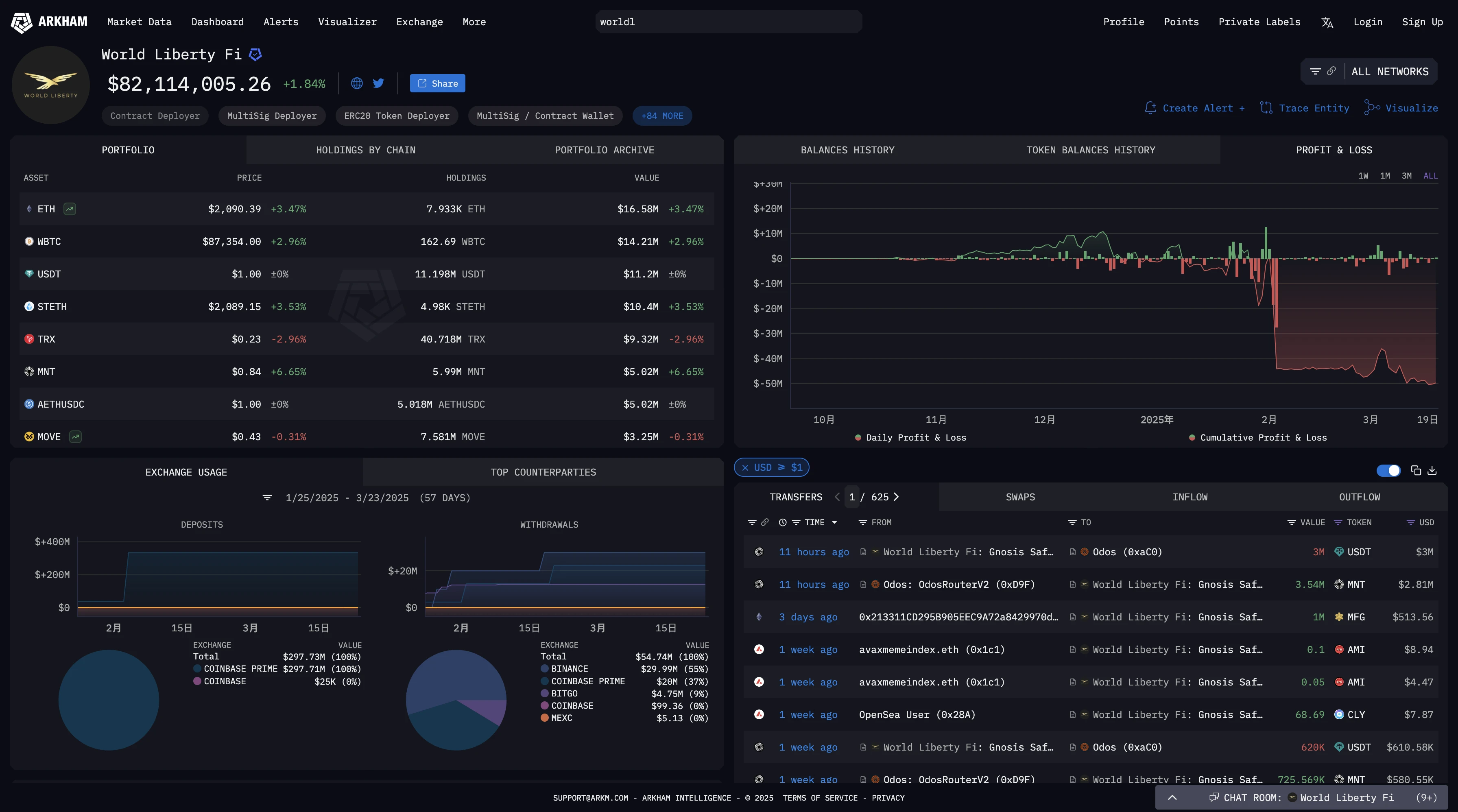

On the other hand, despite WLFI's strong market promotion, its actual situation is not optimistic. Although WLFI has completed a total of $550 million in token sales and subsequently invested about $343 million in various tokens, it still faces an overall paper loss of approximately $109 million, with a loss rate of one-third. This undoubtedly casts a shadow over the project's future development. Therefore, WLFI may leverage the opportunity of developing stablecoins to achieve dual goals of revenue and ecological expansion.

Image from ARKHAM

3. Building a core pillar of the DeFi ecosystem. As a DeFi project built on the Aave V3 protocol for lending platforms, WLFI understands the indispensable role of stablecoins in the ecosystem. Issuing its own stablecoin can not only enhance the platform's trading and lending capabilities but also provide more application scenarios for WLFI's governance tokens. Some analysts even predict that WLFI may use stablecoins to support asset reserve strategies in the future and combine them with real-world assets (RWA) to further expand the issuance scale.

4. Collaborating with Wintermute to leverage the market influence of the Trump family. The close ties with the Trump family undoubtedly add a unique competitive advantage to WLFI. By leveraging the family brand effect, WLFI is expected to attract more investors and users, forming a unique positioning that distinguishes it from traditional stablecoin projects.

At the same time, Wintermute has previously announced plans to expand into the US market, and this USD1 test deployment may become an important opportunity for its entry into the US market. After receiving signals of recognition from the "highest authority" in the US, how to seize this golden moment will be key to Wintermute's subsequent actions. In the face of a global stablecoin market with over $200 billion in assets, it remains to be seen what advantages WLFI will leverage to break through.

Perspective: Opportunities and Risks Coexist

The author believes that while WLFI's issuance of USD1 demonstrates great ambition, the risks cannot be ignored.

The Trump family has always excelled in marketing, and this move may attract market attention in the short term; however, in the face of fierce competition and increasingly stringent regulatory policies (such as MiCA's restrictions on Tether), whether WLFI can achieve long-term stable development remains highly uncertain. Meanwhile, although Wintermute's involvement may help ensure liquidity, it could also make WLFI a victim of large capital games.

Whether WLFI's USD1 is a new opportunity in the DeFi space or another gamble by the Trump family in the digital asset field, its future direction is worth continuous market attention. Only time will tell if WLFI can stand out in this fiercely competitive stablecoin market by leveraging its own advantages.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。