Cryptocurrency exchange Coinbase (Nasdaq: COIN) released its inaugural Ethereum Validator Report last week, giving the public an inside glimpse into the firm’s staking operations for the first time.

Coinbase is the second largest staker of ether ( ETH), second only to liquid staking behemoth Lido. America’s largest exchange stated in its most recent shareholder letter published in February, that its goal in 2025 is to grow its subscription and services revenue, the latter of which includes staking. That revenue clocked in at $2.3 billion in 2024.

And now, with 120,000 validators under its care, 3.84 million ETH staked, worth more than $8 billion at current prices, and performance metrics that exceed industry averages across the board, Coinbase certainly looks and plays the part of a marquee Ethereum staking provider.

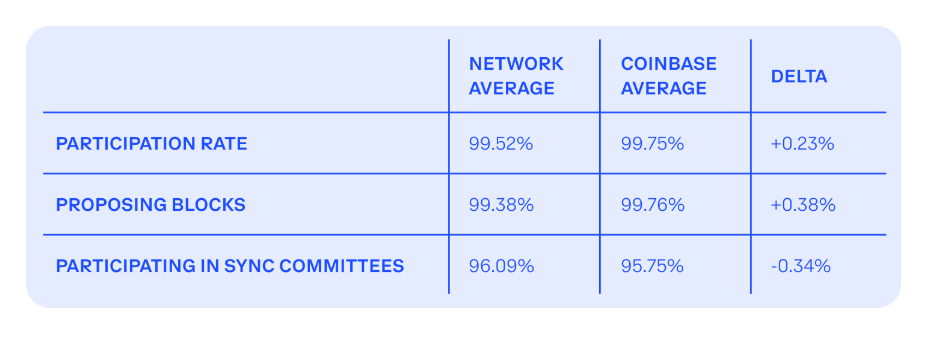

(Coinbase validator performance metrics / coinbase.com)

The firm’s validators were online and available 99.75% of the time, and processed transactions at a 99.75% “participation rate.” Coinbase proposed blocks at a 99.76% rate, above the corresponding network average of 99.38%. Participation in so-called “sync committees” that help light clients sync blockchain data more effectively, was the only area where Coinbase was below the network average.

COIN closed the day at 203.04, up 6.94% over 24 hours.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。