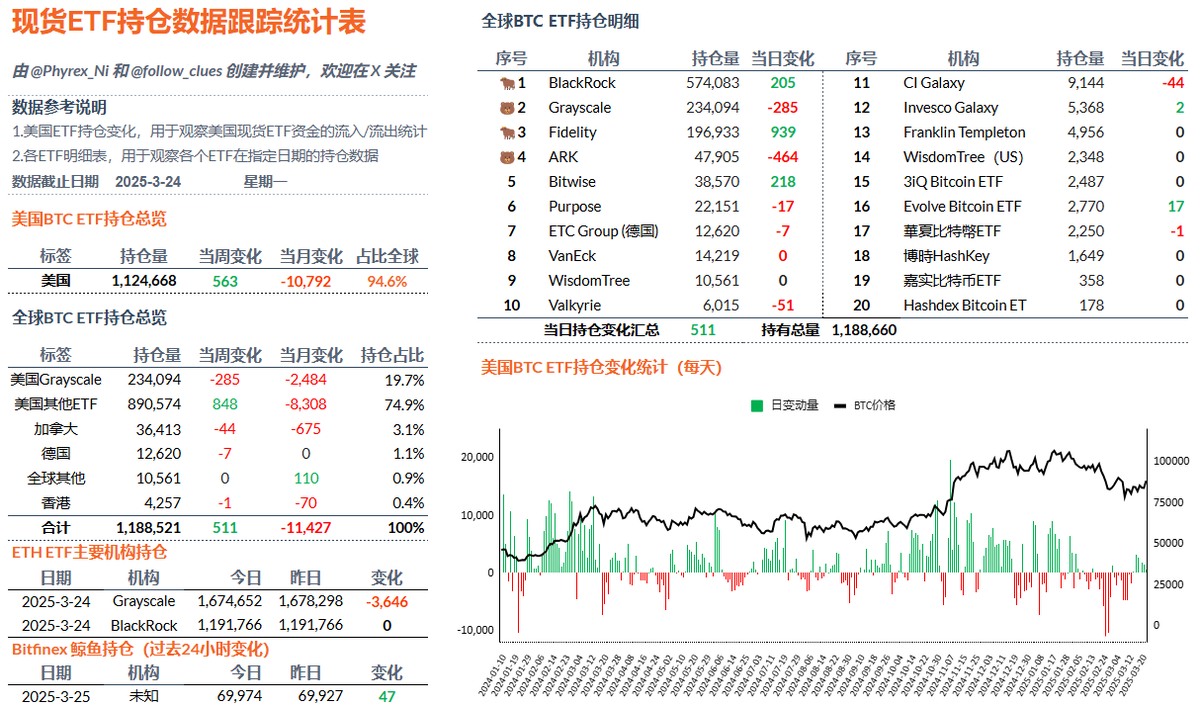

Yesterday, the slight rebound in Bitcoin's price reflected a recovery in investor sentiment, which we had already observed last week from the spot ETF data. Therefore, while the spot ETF cannot determine the price trend of $BTC, it can reveal the sentiment of American investors.

Recently, it has been the seventh consecutive working day of net inflows from American investors, and both BlackRock and Fidelity investors have made purchases. However, it is still uncertain whether the overall risk market has shifted from a rebound to a reversal. Although Trump has softened his stance on tariffs, many investors are still concerned that the U.S. economy may enter a recession.

The Federal Reserve remains the biggest obstacle to liquidity. Today, the pre-market stock index futures are performing well, and the VIX has dropped to 17, indicating that investor sentiment is indeed gradually warming up.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。