The Blackrock USD Institutional Digital Liquidity Fund (BUIDL), tokenized by Securitize, will now operate on Solana, expanding its multi-chain presence to seven networks, including Ethereum, Polygon, and Avalanche. Cross-chain interoperability is facilitated by Wormhole, enabling seamless transfers.

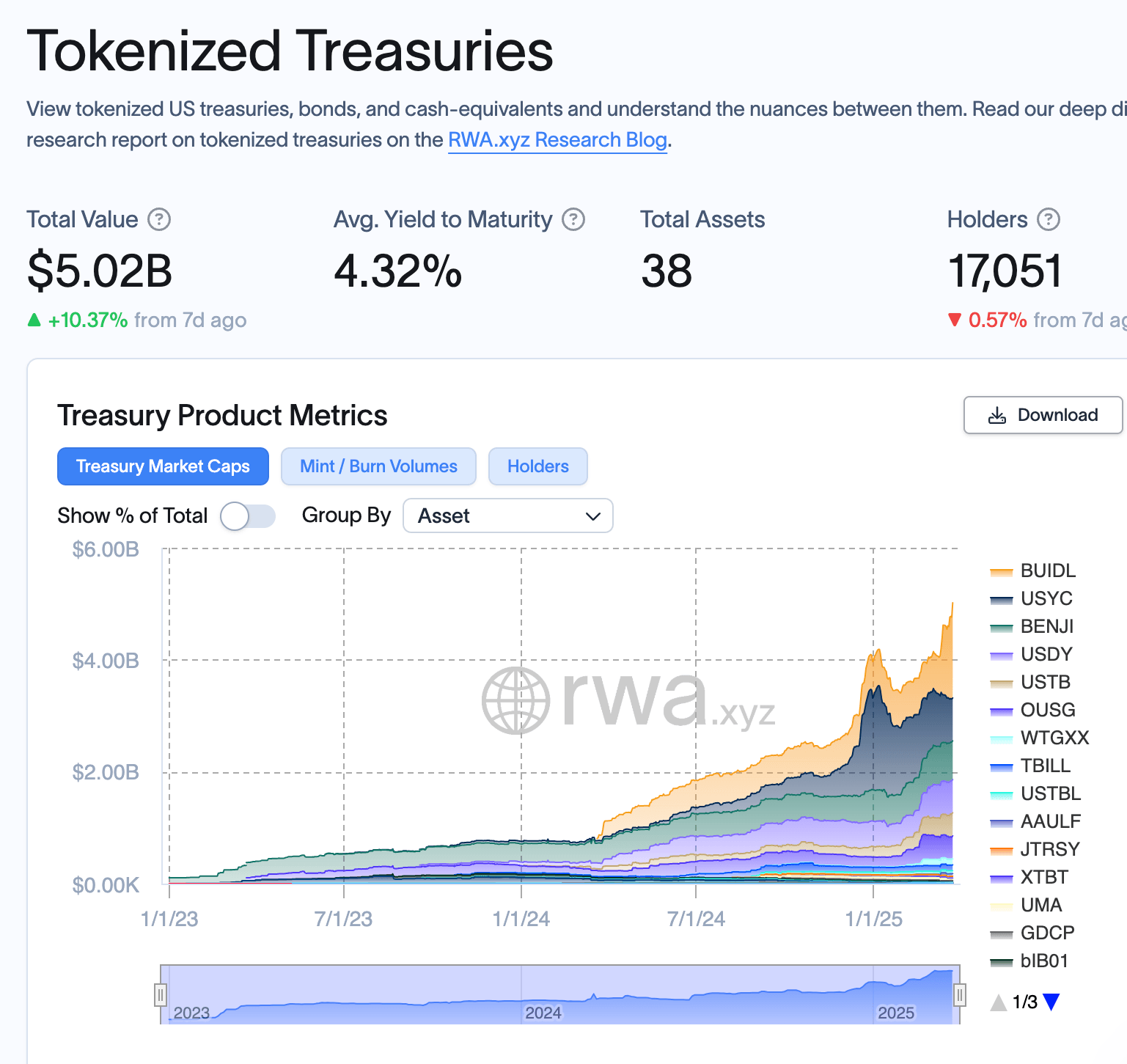

Tokenized treasuries reached an all-time high of $5 billion this month.

BUIDL, launched in March 2024 as Blackrock’s first public blockchain-based fund, provides institutional investors with onchain access to U.S. dollar yields, daily dividends, and 24/7 peer-to-peer transactions. Solana’s integration aims to capitalize on its high-speed, low-cost infrastructure for enhanced efficiency.

The tokenized treasury market’s $5 billion milestone reflects accelerating institutional adoption. Custodians Anchorage Digital, Copper, and Fireblocks support BUIDL, while Bank of New York Mellon oversees cash and securities custody.

Securitize CEO Carlos Domingo cited a growing demand for tokenized real-world assets (RWAs), emphasizing Solana’s technical capabilities as critical for accessibility. Solana Foundation President Lily Liu highlighted the network’s developer ecosystem and cost efficiency as advantages for institutional adoption.

“In the year since BUIDL’s launch, we’ve experienced significant growth in demand for tokenized real-world assets, reinforcing the value of bringing institutional-grade products onchain,” Securitize’s CEO stated.

BUIDL crossed $1 billion in assets under management (AUM) and the fund remains accessible only to qualified investors. The expansion highlights a broader shift among traditional financial (TradFi) institutions toward blockchain solutions to improve liquidity and reduce operational costs. BUIDL’s multi-chain strategy aligns with efforts to navigate evolving regulatory frameworks while meeting diverse investor needs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。