Time fast-forwarded to March 2025, Solayer sprinted ahead of the TGE, occupying the hardware-accelerated nested TVL model, Sonic fully ramped up efforts in gaming and NFTs, and Eclipse launched its mainnet, crazily integrating Ethereum ecosystem projects. At this point, Solana's average daily TPS was around 1,500, raising a soul-searching question: Solana is already so fast, what is the necessity of SVM? Furthermore, even if SVM is needed in the market, why is SOON still necessary?

SVM (Solana Virtual Machine) sounds similar to EVM and MoveVM, all technologies that are restless and want to do something on other chains. Indeed, Solana is already fast enough; it hasn't experienced downtime even during the meme frenzy of the past six months! Therefore, to answer this soul-searching question, we need to return to the essence of the question: what is SVM and what shortcomings does it address for Solana?

1. Fast? But not flexible enough

If we only discuss the speed of cars, the Xiaomi Su7 ultra can naturally outpace any horse-drawn vehicle, but do the owners of those vehicles only care about speed? When it comes to cars, safety, brand value, comfort, and other factors can all be key considerations for customers. In the blockchain space, a chain's flexibility and versatility in facing complex applications and cross-chain interoperability are also very important.

This is Solana's shortcoming. Solana's native runtime is not as universal and flexible for developers as EVM. The existence of SVM is to decouple Solana's core consensus mechanism (Proof of History + Proof of Stake) from its execution layer, allowing developers to build more complex applications on Solana's infrastructure, rather than just simple transfers or DeFi protocols.

SVM can process tasks in parallel using multithreading. Although Sealevel already has this capability, SVM further abstracts it, allowing developers to easily write multithreaded smart contracts, enhancing the execution efficiency of complex applications. Its versatility is also further improved; SVM can be seen as an independent virtual machine that can theoretically connect to any other public chain. Can Solana become the Android of the blockchain world? It all depends on SVM!

2. Many? But not widespread enough

Today, the Solana ecosystem is already very prosperous. In 2025, the foundation began to focus on PayFi, Depin, and RWA, but the age-old question remains: can we avoid reinventing the wheel? Many mature protocols or applications have already emerged on Ethereum and other public chains, and Rust makes it difficult for newcomers on the development side. In contrast, the EVM ecosystem has long established a relatively mature development environment with tools like Truffle, Hardhat, and Remix.

At this time, SVM becomes particularly important. Competing for ecosystem dominance is essential; if you don't act, Aptos and Sui are already making strides with MoveVM. Is Solana still guarding its DeFi nest? Is it still focused on NFTs? AI computing, enterprise applications, and gaming are continuously expanding the boundaries of the ecosystem.

3. Stable, but not fair enough

Solana has long been mocked as a "data center chain." Why? In the blockchain trilemma proposed by Vitalik Buterin, Solana resolutely chose security and scalability (performance) over decentralization. So philosophically, SVM carries the task of rekindling the dream of decentralization.

How to achieve this? Through modularity and open-source, the blockchain industry is moving from monolithic chains to modular blockchains, and SVM is Solana's response to this trend. It allows Solana's execution layer to evolve independently and even be used in a "plug-and-play" manner by other projects.

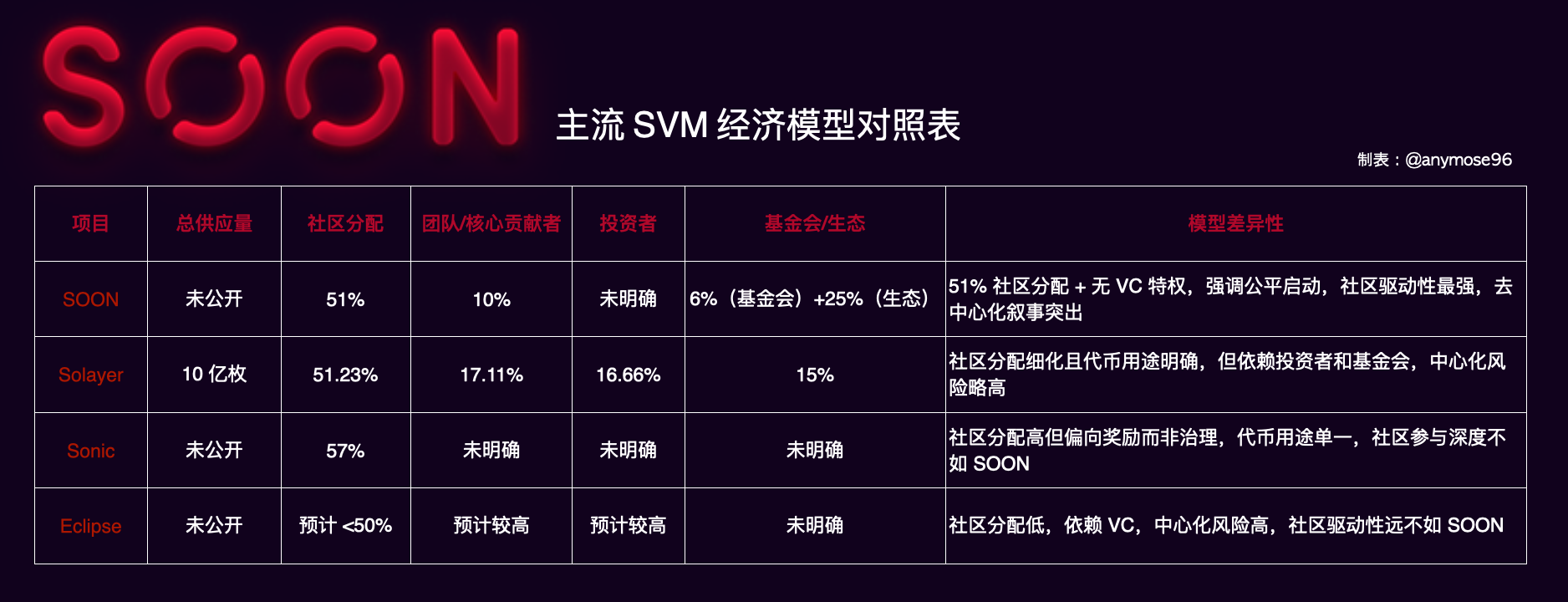

Since SVM is praised so highly, how should one choose among the many SVMs claiming uniqueness in the market? Sonic, Eclipse, and Solayer have already emerged, while SOON seems to carry a hint of mystery. If we take SOON as a reference and compare it horizontally with other SVMs, we find that in terms of economic models, technical paths, and cumulative effects, Solana's SVM is indeed flourishing and competing brilliantly.

Let's first discuss the reference: SOON.

In terms of technical path, SOON aims to expand the application range of SVM through "Decoupled SVM" technology. SOON is not limited to the Solana ecosystem but promotes its high-performance execution environment to other L1 blockchains, creating an efficient, scalable, and cross-chain compatible Rollup solution. The SOON Stack is a modular framework that allows developers to deploy SVM Rollups on different L1s, with SOON Mainnet being its first instance, settling on Ethereum.

Here, we need to explain "Decoupled SVM." For example, Solana is like a super-fast sports car, and its engine, SVM, is particularly powerful, capable of handling a large number of tasks simultaneously, much faster than ordinary cars (like Ethereum's EVM). Normally, this engine is installed in Solana's car, only usable by Solana itself.

"Decoupled SVM" is like taking this powerful engine out of Solana's car and turning it into an independent toy. You can install it in other cars, like Ethereum's or BNB Chain's, allowing those cars to also run very fast. No matter which car it is installed in, this engine can work as usual, helping them accelerate tasks (like processing transactions, running applications) without relying on Solana's original chassis (consensus mechanism or network rules).

In this sense, SOON is a high-performance Layer 2 solution that utilizes SVM's parallel processing capabilities, aiming to solve blockchain scalability, interoperability, and user experience issues through modular design.

In terms of economic model, undoubtedly, the 51% community allocation makes SOON stand out, a ratio that is quite rare in the SVM space. SOON adopts a "no pre-mining, no VC privileges" fair launch model, emphasizing community governance and participation. This design is similar to early projects like Solana and Polkadot, attempting to reduce the risk of early investor sell-off through decentralized distribution while enhancing community belonging.

The 51% community allocation is far higher than the industry average (which usually allocates 20%-30% to the community), and this is not just a marketing gimmick but its core philosophy—making the community the leading force in project development. Looking back, one of the core drivers of SVM is "decentralization," and SOON undoubtedly excels in this regard.

To summarize, in terms of technology, SOON breaks the limitations of a single ecosystem with its cross-chain design of Decoupled SVM, pursuing universality and developer applicability; in terms of economic model, it attempts to recreate the decentralized spirit of early blockchains through extremely high community allocation and fair launch, empowering the community. The combination of community-driven and technological innovation has created a project that is both idealistic and realistically promising.

Now, let's continue to break it down and compare it with other SVM projects.

Community-Driven x Decoupled SVM

In comparison to Sonic: Sonic's community rewards serve more the gaming users rather than empowering developers; Eclipse and Solayer rely more on institutional resources, and the depth and breadth of community participation are not as strong as SOON.

The uniqueness of SOON's economic model lies in its strong decentralized narrative: 51% community allocation + no VC privileges. SOON's fair launch model is the most radical in the SVM space, granting the community the greatest power. Through on-chain activities (like the Big Bang event) to distribute tokens, SOON's community participation model is more flexible and may evolve into DAO-style governance in the future.

Given the current progress of the TGE, SOON's token utility and vesting plan have not been fully disclosed, and its transparency is slightly lower than that of Solayer.

Decentralized Narrative x Cross-Chain Ambition

SOON builds a decentralized narrative through fair launch and community governance while using cross-chain technology to break down the barriers of a single ecosystem. This combination of "idealism + pragmatism" not only aligns with the core values of Web3 but also adapts to the market reality of multi-chain coexistence. Other projects like Sonic focus more on vertical fields (gaming), while Eclipse and Solayer are limited to specific ecosystems (Ethereum or Solana), making their narrative and technical coverage not as broad as SOON.

From a technical path comparison, SOON has the strongest cross-chain versatility. The Decoupled SVM allows it to adapt to multiple chains (like svmBNB), with a scope far exceeding that of Solayer, Sonic, and Eclipse. EVM compatibility lowers the barrier for developers, making it more attractive compared to the Rust development of Solayer and Sonic.

In terms of drawbacks, if we solely compare performance (30k TPS), it is lower than Solayer's 1MM TPS, and the technical validation is still insufficient.

Furthermore, as SOON approaches its TGE, it needs to find a reference point to summarize operational lessons from a god's-eye perspective. Solayer, as a recent TGE SVM project, can actually provide SOON with many insights.

Strategic Level: The Importance of Clear Positioning and Narrative

Solayer's transition from a staking protocol to hardware-accelerated SVM led to multiple directional adjustments, resulting in a blurred narrative and unclear market positioning, ultimately failing to effectively attract investors and users after the TGE. SOON's "Decoupled SVM" positioning is its core advantage and should continue to strengthen this narrative, avoiding frequent shifts to other directions. At the same time, it must clarify that SOON is the "preferred high-performance cross-chain Rollup," distinguishing itself from Sonic (game specialization) and Solayer (hardware acceleration) to avoid market confusion.

Technical Level: Technical Implementation Needs Validation Data Support

Solayer claims 1 million TPS and 100Gbps bandwidth, but after going live, it lacks supporting empirical data, and the user experience has not significantly improved, leading to skepticism about it being a "PPT chain." SOON's svmBNB has achieved 30,000-100,000 TPS and should regularly release on-chain data (such as transaction volume, latency, and gas costs) to enhance technical credibility.

In prioritizing user experience optimization, it should ensure that the cross-chain bridging process is simple (such as one-click bridging ETH to SOON Mainnet) and supports mainstream wallets (like MetaMask and Phantom) to lower the usage threshold. SOON's InterSOON protocol should prioritize seamless migration of popular assets (like USDT and USDC) and dApps (like Uniswap and PancakeSwap).

Community Level: Community Participation Determines Success or Failure

Although Solayer has 200,000 depositors participating in activities, the community's activity level is low, failing to convert into long-term supporters. SOON's fair launch is an advantage; compared to Solayer's hardware reliance, which has been criticized as "centralized" and a "rich man's game," alienating ordinary users, SOON should continuously promote its model of "no pre-mining, no private investor privileges" to attract retail trust.

In the future, it could further introduce a DAO mechanism to allow the community to participate in key decisions (such as token allocation and new chain support). By launching developer tutorials and retail participation guides (like "how to bridge to svmBNB"), it can lower participation barriers and expand its user base.

Let's Summarize the Full Text

Overall, while Solana's TPS is already fast, the necessity of SVM lies not in being "a bit faster," but in being "smarter and more open." It aims to transform Solana from a high-performance solo player into a stage capable of hosting thousands of applications. Speed is Solana's starting point, while SVM is the bridge to a grander future.

Among the existing SVM contenders, SOON's advantages lie in its technological foresight (Decoupled SVM + cross-chain compatibility) and developer-friendliness, which give it the potential to become a "dark horse" in the SVM space. However, its weaknesses also need to be addressed in a short time through practical implementation (such as the widespread application of svmBNB) and stronger community operations.

Compared to its competitors, SOON's differentiation lies in "universality" and "cross-ecosystem synergy," but to truly stand out, it must prove its execution capability in 2025, especially in attracting developer and user traffic.

Do you think SOON's strategy can lead it to victory in the SVM space?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。