Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: March 26, 14:12 Beijing time

Market Information

- The US spot BTC ETF has seen a net inflow for four consecutive trading days, reaching $360 million;

- Musk attended a cabinet meeting wearing a "Trump is always right" hat, and Trump praised him as a "patriot";

- BitMart: The cryptocurrency market is relatively sluggish, and overall sentiment remains neutral;

- US SEC Commissioner: The cryptocurrency industry needs clear and reasonable regulatory power boundaries;

- Kentucky has officially signed the "Bitcoin Rights Bill," safeguarding self-custody and node operation rights;

Market Review

Our strategy the day before yesterday was to go long on a pullback, but the market did not provide a pullback opportunity. Bitcoin directly surged to the 88794 position, and the long position at 84500 did not provide an entry opportunity. Those who went short faced minor losses with light positions. Currently, Bitcoin's price is fluctuating above 87000, with Ethereum reaching a peak of 2104. Ethereum's rise still targets the range, with a small profit of 130 points from the previous long at 1970. Ethereum's movement is too slow, so profits are not overly pursued. After reaching around 2100, Ethereum did not continue to rise and is currently fluctuating with Bitcoin. If Bitcoin's price breaks through resistance, there will be greater opportunities for upward movement in the future;

Market Analysis

BTC:

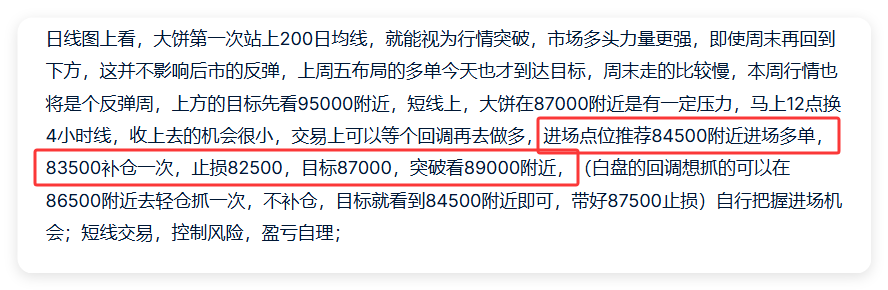

From the daily chart, after Bitcoin stands above the 200-day moving average, the trend is still more inclined towards bullish. After a short-term surge breaking through the 87000 resistance, it has not fallen back down again. The current trend is a fluctuating one. We should maintain some patience in trading. The doji star formed on the daily line cannot be considered a high position doji star since it is not at a high position or resistance level, so it cannot be viewed as a short signal. In trading, the 87000 resistance has turned into support, so we should focus on positioning around this point. It is recommended to enter long at 87000, add to positions at 86000, set a stop loss at 85000, and initially target 90000. After reaching that, we can see if it can continue to break through the short-term high around 92800. The pressure for this rebound is around 95500. Manage your entry opportunities accordingly; for short-term trading, control risks and manage profits and losses independently;

ETH:

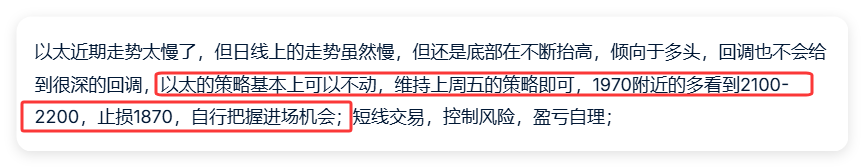

After a few days of rebound, Ethereum finally reached the 2100 position, and the long position made a small profit of 130 points before exiting. The 2100 point is still quite critical for Ethereum. After previously falling to this point, it rebounded, and now support has turned into resistance, requiring strength to break through. This time, it did not break through, and we need to pay attention to the strength of Bitcoin's upward movement in the future. Ethereum's current trend is also fluctuating, and trading should follow Bitcoin for a pullback long. It is recommended to enter around 2035, set a stop loss at 1940, and target 2200. Manage your entry opportunities accordingly; for short-term trading, control risks and manage profits and losses independently;

In summary:

Bitcoin stands firm on resistance showing bullishness, and the market will begin to rise;

The article is time-sensitive, pay attention to risks, the above is only personal advice, for reference only!

Follow the WeChat public account "Crypto Lao Zhao" to discuss the market together;

If you don't like it, you must have your own standards for what you like. All negativity is the opposite of positive perception. The matter itself is not important; what matters is what changes you can achieve through it and what impact it can have! Some prefer one-sided trends, some prefer fluctuations, some excel in rising markets, while others are obsessed with falling markets. No one is absolutely right, and no one is absolutely wrong. If you don't like it, it doesn't meet your standards; what you may not excel in could be someone else's strength.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。