1. Market Observation

Keywords: MOVE, ETH, BTC

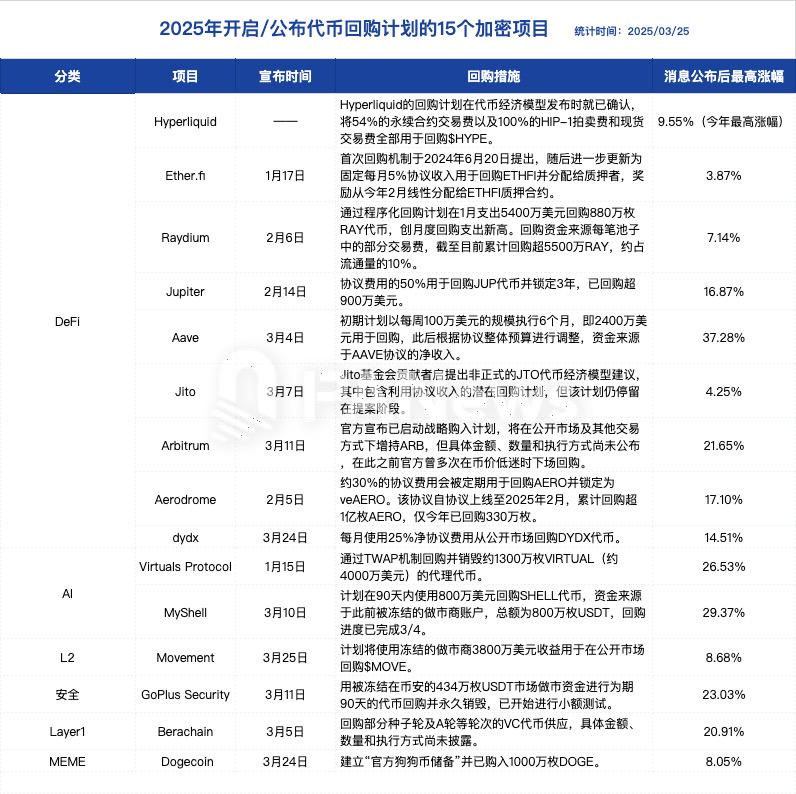

A "buyback wave" has swept through the crypto industry, with 15 projects including Aave, Arbitrum, and Movement announcing token buyback plans, with amounts ranging from millions to tens of millions of dollars. The sources of buyback funds include protocol revenue, seized assets, and fund expenditures. This move is not only a temporary measure to stabilize the market but is also seen as an important strategic layout for projects to reshape token economics and provide long-term value. Meanwhile, Immutable has received a notice of termination of the SEC investigation, bringing a clear regulatory signal to the Web3 gaming industry.

Bitcoin's price continues to show a high correlation with the US stock market, with volatility maintaining several times the level of US stocks. Investors on both sides are focusing on the Federal Reserve's interest rate cut expectations. Analyst Daan Crypto Trades points out that Bitcoin is currently maintaining a solid spot premium trading situation. If it can maintain this level and slowly rise above $90,000, it is expected to create new highs. The Greeks.live community briefing shows that there is a divergence in market sentiment regarding cryptocurrency trends, with some investors believing it is suitable to buy on dips, while bears expect Bitcoin to potentially drop to the $84,500 range.

In the regulatory field, the SEC announced it will hold four roundtable discussions from April to June 2025, covering key topics such as crypto trading, custody, asset tokenization, and DeFi. Commissioner Hester Peirce referred to this move as a "spring sprint towards crypto clarity," indicating that regulatory agencies are shifting from enforcement-oriented approaches to constructive dialogue. Notably, traditional financial institutions are increasingly accepting Bitcoin, with the GameStop board unanimously approving an update to its investment policy to include Bitcoin as one of the company's reserve assets. Additionally, the Oklahoma House of Representatives passed the "Strategic Bitcoin Reserve Act," further reflecting institutional and governmental recognition of Bitcoin. Furthermore, Ripple has reached a preliminary settlement agreement with the SEC, with the SEC agreeing to refund $75 million in fines, marking the imminent end of their long-standing legal dispute.

On a macro level, the market generally expects the Federal Reserve to shift from quantitative tightening (QT) to quantitative easing (QE), which could inject new liquidity into the financial markets. However, Benjamin Cowen, CEO of crypto research firm IntoTheCryptoVerse, warns that quantitative tightening has not completely ended, but rather the scale has decreased from $60 billion to $40 billion per month. Additionally, a recent Goldman Sachs report warns that the upcoming announcement of reciprocal tariff policies by Trump could lead to "sharp fluctuations followed by stabilization" in the market, with actual tax rates potentially reaching twice the market expectations.

2. Key Data (As of March 26, 13:30 HKT)

Bitcoin: $87,346.87 (Year-to-date -6.65%), Daily Spot Trading Volume $28.634 billion

Ethereum: $2,055.65 (Year-to-date -38.48%), Daily Spot Trading Volume $11.309 billion

Fear and Greed Index: 47 (Neutral)

Average GAS: BTC 1.4 sat/vB, ETH 0.36 Gwei

Market Share: BTC 60.7%, ETH 8.7%

Upbit 24-hour Trading Volume Ranking: MOVE, XRP, LAYER, BTC, CRO

24-hour BTC Long/Short Ratio: 1.0496

Sector Performance: Meme sector up 4.74%, Layer2 sector up 4.62%

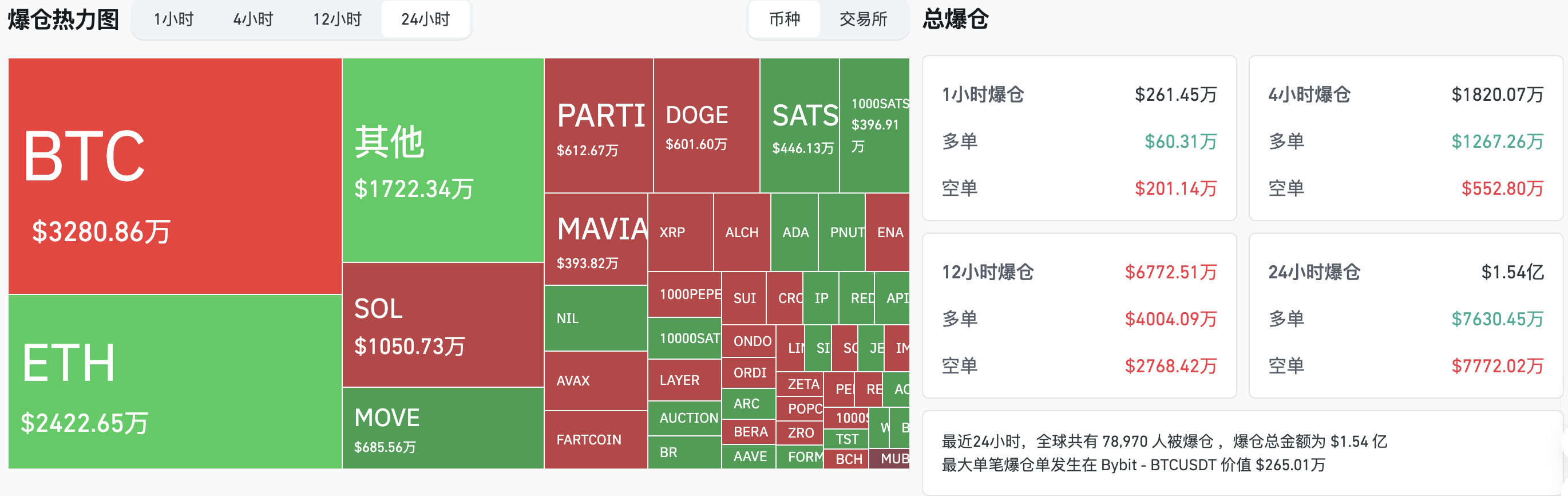

24-hour Liquidation Data: A total of 78,970 people were liquidated globally, with a total liquidation amount of $154 million, including $32.8 million in BTC and $24.22 million in ETH.

3. ETF Flows (As of March 25 EST)

Bitcoin ETF: $26.83 million

Ethereum ETF: -$3.21 million

4. Today's Outlook

Testnet Hoodi will activate the Pectra upgrade at epoch 2048

Celo officially activates Ethereum L2 mainnet, hard fork block height 31057000

GRASS Airdrop One claim ends (scheduled for March 27, block 329341917)

Chain Game Immortal Rising 2 completes $3 million financing, TGE scheduled for March 27

Binance launches the seventh phase of BNSOL super staking project Solv Protocol (SOLV)

Yield Guild Games (YGG) will unlock approximately 14.08 million tokens on March 27 at 22:00, accounting for 3.28% of the current circulating supply, valued at approximately $3 million.

Today's top gainers in the top 500 by market cap: WhiteRock (WHITE) up 64.41%, Movement (MOVE) up 29.04%, Gigachad (GIGA) up 26.88%, Particle Network (PARTI) up 25.61%, Solayer (LAYER) up 17.92%.

5. Hot News

The Movement wallet address received 10 million MOVE from Binance early this morningUSDC Treasury minted an additional 300 million USDC on Ethereum early this morningRipple will recover $75 million in court fines from the SEC and withdraw its appeal

Pionex: The losses from the GMX and MIM Spell hacker attacks have reached approximately $13 million

Bithumb will list Redstone (RED) and Nillion (NIL) trading pairs in Korean won

The Oklahoma House of Representatives passes the "Strategic Bitcoin Reserve Act"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。