Behind the unassuming protocol is the former technical director of Uniswap and the author of the v4 white paper.

Written by: Alex Liu, Foresight News

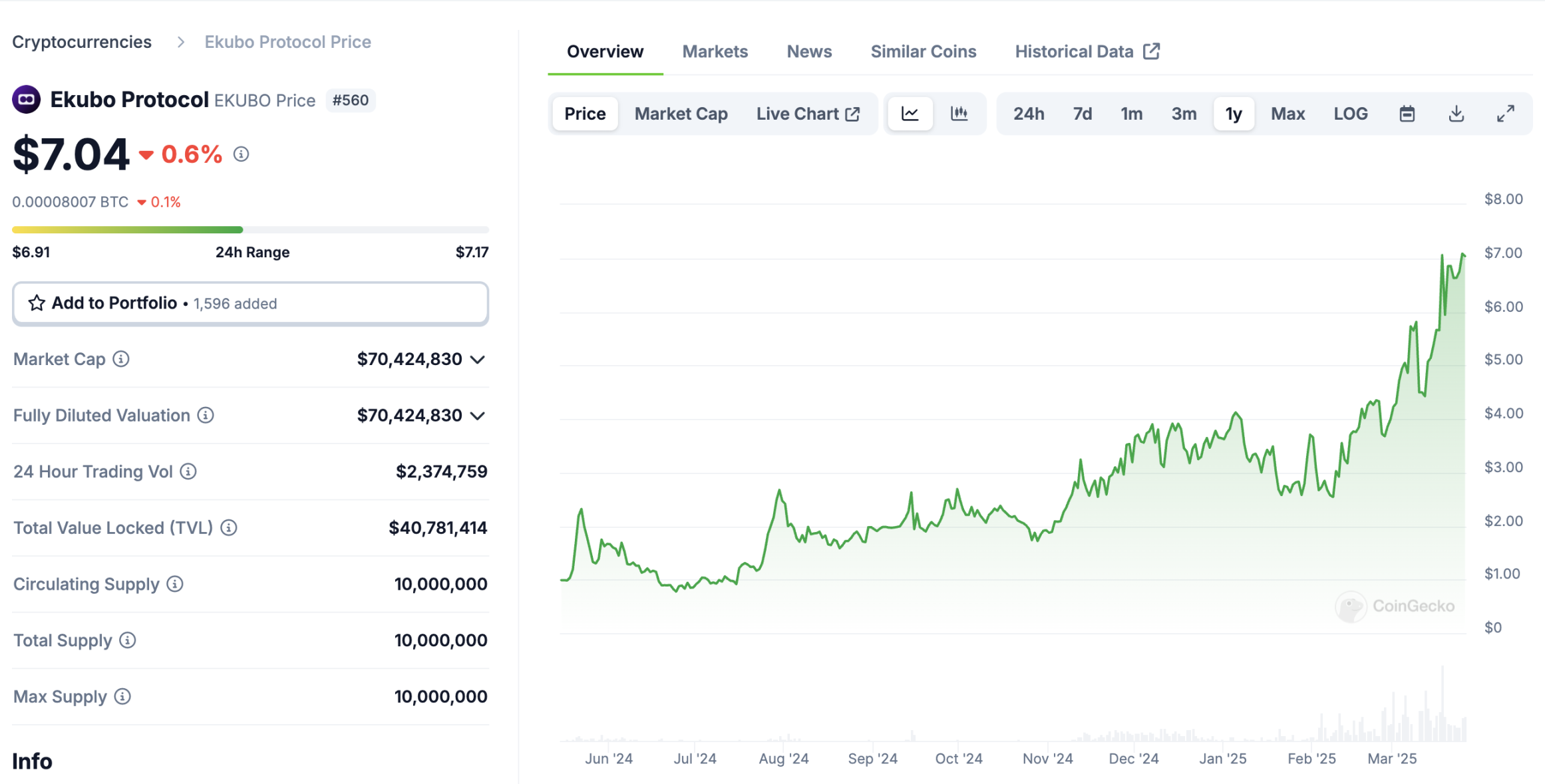

The crypto market in 2025 is shrouded in the gloom of a bear market. BTC has fluctuated from $100,000 to around $80,000, and mainstream DeFi tokens have generally fallen over 60% from their highs. The Ethereum Layer 2 Starknet token STRK has plummeted from over $2 to below $0.2. However, against the backdrop of the overall downturn in the Starknet ecosystem, a DEX protocol named Ekubo has emerged with astonishing growth—its native token EKUBO has increased more than 7 times in the past year, rising against the trend.

EKUBO rose from under $1 to over $7

Surging Against the Trend: Technological Innovation Drives Value Capture

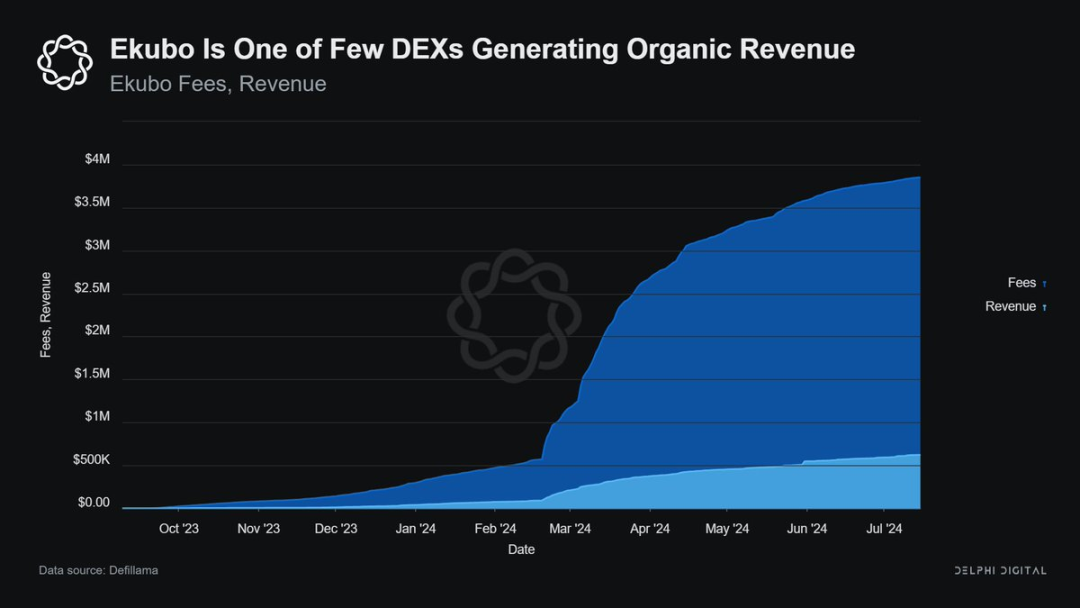

Ekubo's protocol fees and revenue

The performance of Ekubo's token is not a castle in the air, but is highly tied to the protocol's fundamentals: throughout 2024, Ekubo accounted for over 80% of DEX trading volume in the Starknet ecosystem; the protocol generated $650,000 in revenue through withdrawal fees, part of which is used for repurchasing EKUBO through an automated buyback mechanism.

Unlike many projects that rely on token incentives to "inflate volume," over 70% of Ekubo's trading volume comes from aggregator routing, indicating that its liquidity efficiency has been spontaneously validated by the market.

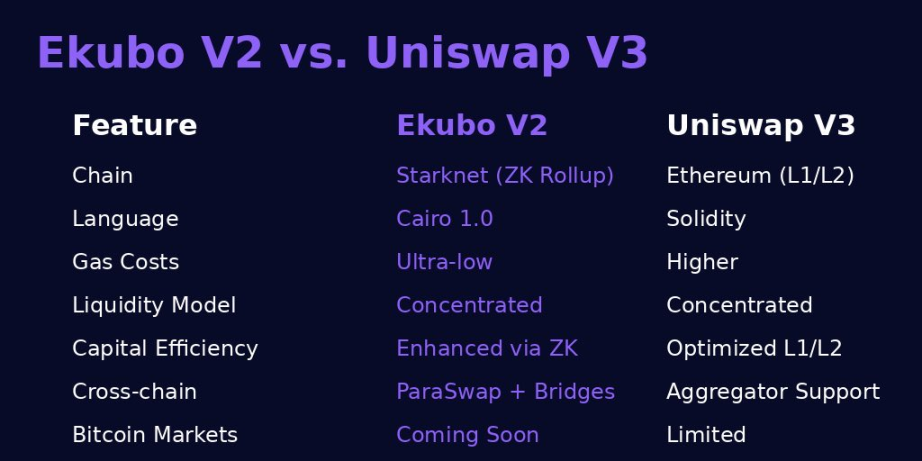

The core of its counter-trend growth stems from Ekubo's innovation in the DEX space. While most projects are still patching up within the framework of Uniswap v3, Ekubo targets the design philosophy of the next-generation AMM—extreme capital efficiency and scalability.

Technological Breakthrough: Redefining AMM Efficiency

As the native DEX of the Starknet ecosystem, Ekubo has deeply utilized the features of the Cairo language and ZK-Rollup since its inception. Its V1 version launched in 2023 showcases three major designs:

- Ultra-fine Price Range (Tick): Compared to Uniswap V3's 1 basis point (0.01%) price range, Ekubo has reduced the Tick to 0.0001 basis points, allowing liquidity providers (LPs) to deploy funds with CEX-level precision. This "nano-level" price granularity not only reduces trading slippage but also increases the market depth that Ekubo can capture by nearly a hundred times at the same liquidity scale.

- Singleton Architecture and Delayed Settlement: Through a unique "Till" model, Ekubo delays all transaction verification and token transfers to the final stage of transaction processing. This design reduces the Gas cost of contract interactions by 30% while achieving atomicity for cross-pool transactions—users can complete complex operations across multiple pools in a single transaction without worrying about intermediate state risks.

- Open Extension System: Ekubo allows developers to create custom liquidity pools without permission and integrate advanced features such as oracles and TWAMM (Time-Weighted Average Market Making). For example, its on-chain TWAMM extension has provided automated treasury asset diversification services for multiple DAOs, distributing the impact of large sell-offs across hundreds of blocks.

From Starknet to EVM: Cross-Chain Expansion

If the technological advantage is the cornerstone of Ekubo's rise, then its EVM-compatible version launched in March 2025 has opened up growth ceilings. With deep optimizations for Solidity contracts, Ekubo V2 achieved 30% lower Gas consumption on the Ethereum mainnet compared to Uniswap V4, and seamlessly integrated with platforms like ParaSwap and Kyber through aggregator interfaces.

The market reacted swiftly. Within just 48 hours of the EVM version's launch, the TVL surpassed $2.7 million, with a trading volume of $1.3 million on the first day.

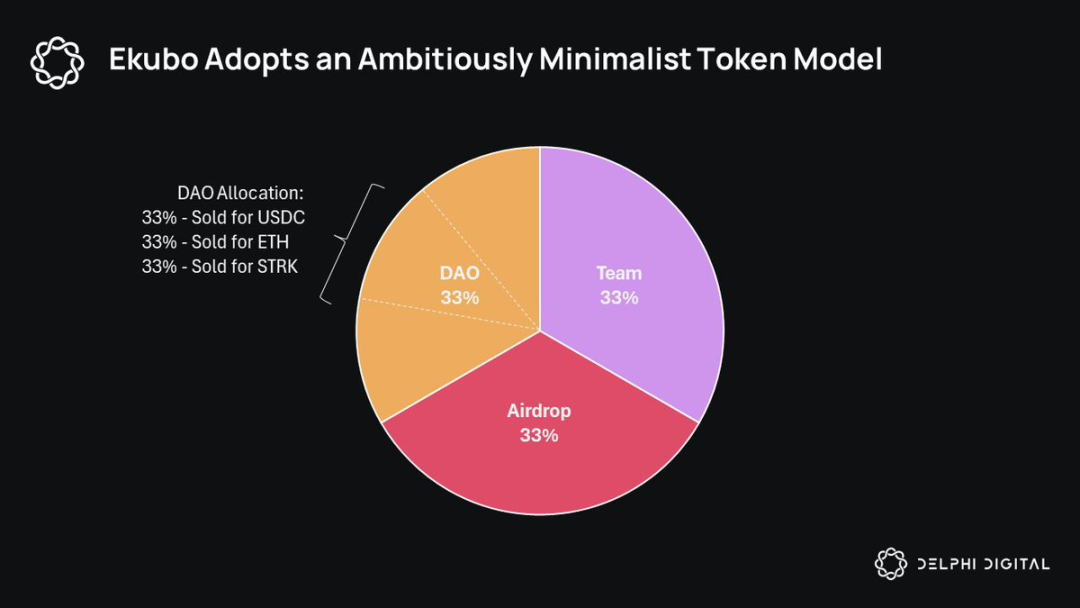

Token Economics: DAO Governance and Value Return

Ekubo's token model also disrupts tradition. The token EKUBO is entirely controlled by the DAO, with the team and community each receiving 33.3%, and the remaining 33.3% fairly sold through the TWAMM mechanism. This "no VC, no pre-mining" launch method avoids concentrated selling pressure on the token, and users must pay a fee equivalent to the trading fee rate of the pool (e.g., 0.3%) when withdrawing liquidity; this revenue directly enters the DAO treasury and is used for weekly on-chain EKUBO buybacks and burns, further strengthening value capture.

Team and Capital: The Breakthrough of a Low-Key Powerhouse

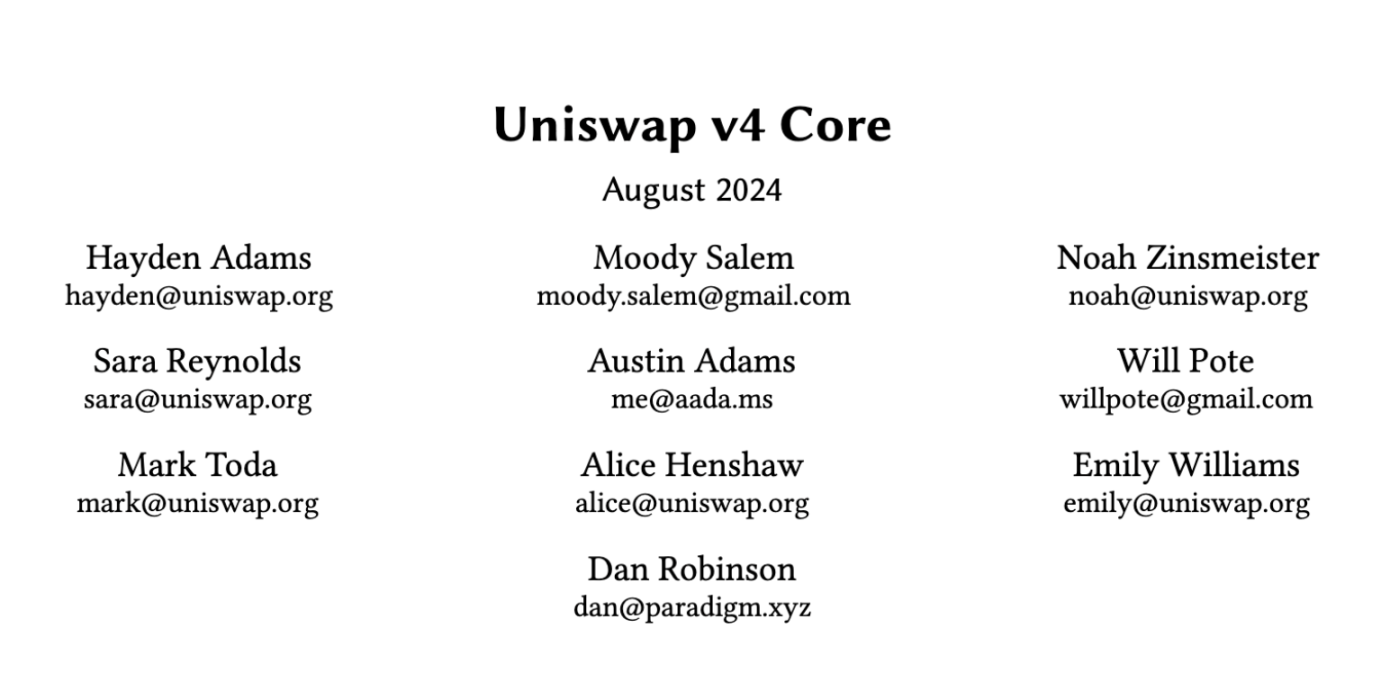

The driving force behind Ekubo, Moody Salem, was a core architect of Uniswap V3/V4. This developer, known for his "minimalism," chose to practice his AMM philosophy on Starknet after leaving Uniswap in 2023. His involvement not only brought top-tier technical genes to Ekubo but also facilitated deep interaction with the Uniswap community—In 2024, Moody proposed that the Uniswap DAO invest 3 million UNI for 1/5 of EKUBO's supply, but it was not ultimately executed.

Moody's name appears second only to founder Hayden on the Uniswap v4 white paper

On the capital side, the entry of Delphi Ventures became a key turning point. This top venture capital firm, which made early bets on Starknet, publicly disclosed its holdings in EKUBO in March 2025, noting its "hub potential in the Bitcoin L2 era." Combined with Starknet's plans to support Bitcoin settlement layers in mid-2025, Ekubo is expected to become the first DEX infrastructure across the ETH/BTC ecosystem.

Delphi Ventures disclosed its holdings in EKUBO on X

Conclusion

Ekubo's comeback proves a simple truth: while most projects are caught up in token models and marketing rhetoric, true disruptors are still deeply engaged in code and mathematics. By pushing AMM efficiency to theoretical limits, building a sustainable economy for the DAO, and embracing a multi-chain integrated future, Ekubo has set a new paradigm for decentralized trading. The market's choice has long indicated that only protocols that genuinely create value deserve the label "resilient."

Disclosure: The author of this article holds EKUBO.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。