Author: Nancy, PANews

The stablecoin market is experiencing explosive growth, with market capitalization rapidly climbing and more new players entering the field. Recently, the Trump family's crypto project WLFI announced plans to launch an institutional dollar stablecoin, USD1. This move not only showcases the Trump family's ambitions in the crypto space but is also seen as a key step to align with regulatory trends and leverage brand effects to capture market share.

Launching on Ethereum and BNB Chain, targeting the institutional market

WLFI's intention to enter the stablecoin space has long been evident.

As early as last October, former Paxos CEO Rich Teo announced his joining of WLFI as the head of stablecoin and payment operations. Paxos had issued several stablecoins, including the BUSD stablecoin launched in collaboration with Binance, but due to regulatory turmoil, the market cap of this stablecoin has fallen from a peak of $24 billion to just $50 million currently. Shortly after Rich's arrival, Decrypt reported, citing sources, that WLFI planned to issue its own stablecoin, which is still in the development stage and may take some time to launch.

In mid-March this year, Bloomberg reported that WLFI had discussed collaboration with Binance. Insiders revealed that the discussions included the potential joint development of a dollar-backed stablecoin. According to four insiders, it is currently unclear how far the negotiations have progressed or whether any deal or collaboration will be reached.

Recently, market rumors have been confirmed, with WLFI officially announcing that USD1 is set to launch. According to the official introduction, USD1 is a stablecoin that can be exchanged 1:1 for US dollars, fully backed by short-term U.S. government bonds, dollar deposits, and other cash equivalents. Initially, USD1 will be minted on the Ethereum and BNB Chain blockchains, with plans to expand to other protocols in the future. Its reserve assets will be custodied by BitGo, one of the largest digital asset custodians in the U.S., and will be regularly audited by a third-party accounting firm.

Unlike algorithmic stablecoins or anonymous DeFi projects, USD1 combines the flexibility of DeFi while relying on the credibility and security of traditional finance, avoiding high-risk yield promises. Unlike other dollar stablecoins that are more geared towards retail users, USD1 primarily targets institutional clients, positioning itself as a secure and efficient tool for cross-border payments and transactions, while also supporting the broad application of the DeFi ecosystem. However, the target users of USD1 do not seem to be retail investors; WLFI co-founder Zach Witkoff emphasized, "USD1 is a digital dollar stablecoin tailored for sovereign investors and large institutions, capable of seamlessly and securely supporting cross-border transactions."

Blockchain explorers show that USD1's smart contract was deployed three weeks ago, with a total supply of approximately 3.5 million tokens and only six token holders, including the market maker Wintermute address, which has conducted some test transfers.

Binance founder CZ also welcomed the deployment of USD1, stating that USD1 does not need to replace USDT and USDC, and that the more stablecoins there are, the better. He also reminded that many scammers have created tokens with the same name, but trading has not yet been opened, so people should be cautious not to fall for scams.

Intense competition in the stablecoin market, what competitive advantages does USD1 have?

The stablecoin market is expanding at an astonishing rate, and its position in the global financial market is becoming increasingly significant.

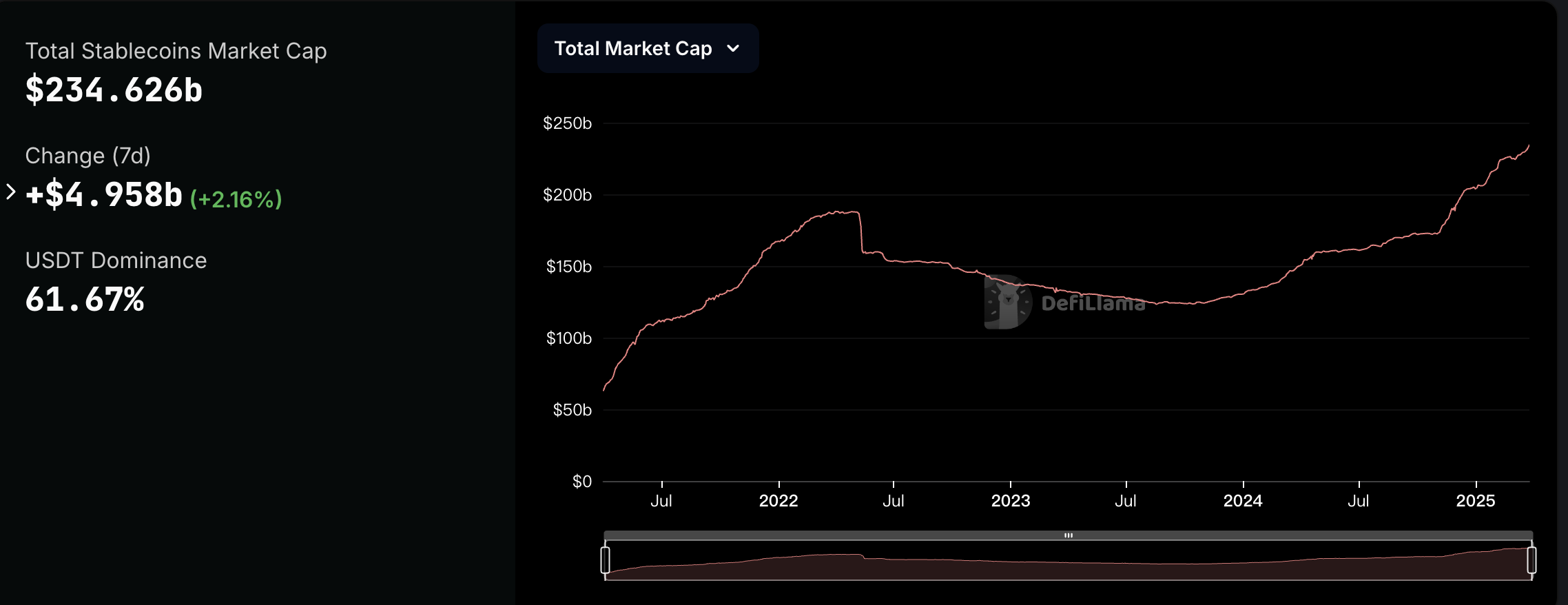

According to DeFillama data, as of March 26, the total market capitalization of stablecoins exceeded $234.62 billion, setting a new historical high, with a year-on-year growth of 65.3%. Among them, the dollar stablecoins USDT and USDC dominate the market, accounting for nearly 87.3% of the total market share. ARK Invest even predicts that the stablecoin market size could eventually exceed $1 trillion, with Bitwise Chief Investment Officer Matt Hougan further pointing out that once stablecoins reach this scale, the overall landscape of the crypto market will be reshaped.

At the same time, according to stablecoin reports previously released by Dune and Artemis, by February 2025, the supply of stablecoins is expected to reach $214 billion, with active addresses reaching 30 million; the annual transaction volume is projected to reach $35 trillion, which is twice that of Visa's annual throughput. Notably, the report also pointed out that while centralized exchanges remain the primary venues for stablecoin liquidity, DeFi has driven a significant portion of the transaction volume.

The rapid development of stablecoins is inseparable from the increasingly完善 global regulatory framework, with significant progress made in stablecoin regulatory compliance in the U.S., EU, Japan, Singapore, and others, providing greater space for the innovation and promotion of compliant stablecoins. For example, recently USDC became the first stablecoin officially approved for use in Japan, and Thai regulators have recognized USDT as a legal cryptocurrency. Meanwhile, market competition is becoming increasingly fierce, with new players accelerating their entry. For instance, Fidelity is reportedly planning to launch a stablecoin, OpenAI CEO Sam Altman's World Network is in talks with Visa for stablecoin payment wallet collaboration, and crypto payment giant MoonPay has acquired stablecoin company Iron at a high price.

Despite this, USD1 still possesses significant competitive advantages. On one hand, new developments in U.S. stablecoin regulation may clear obstacles for compliant dollar stablecoins, including recent statements from U.S. President Trump emphasizing that the return of the dollar to stablecoins will help expand the dollar's dominance and calling on Congress to pass landmark legislation to establish simple, common-sense rules for stablecoins and market structure.

It is understood that multiple stablecoin bills are currently being actively advanced in the U.S., including the STABLE Act, GENIUS Act, and Waters, which aim to provide a clear regulatory framework for dollar-pegged payment stablecoins, promote innovation while protecting consumers, and enhance the global competitiveness of the digital dollar. Among them, the GENIUS Act is particularly noteworthy, as it was jointly initiated by both parties in the U.S. in February 2025, explicitly proposing the establishment of a federal regulatory framework that excludes payment stablecoins from the category of securities, thus not subject to SEC (U.S. Securities and Exchange Commission) regulation. Issuers will be subject to federal or state-level regulation based on their scale, while the bill explicitly prohibits algorithmic stablecoins to reduce systemic risk. The GENIUS Act has received bipartisan support and White House backing, and recently passed the Senate with a vote of 18 in favor and 6 against, making it the most likely proposal to be signed into law by mid-2025. According to Bo Hines, executive director of the U.S. President's Digital Asset Working Group, the U.S. stablecoin regulatory bill may be submitted to President Trump for signature within two months.

On the other hand, the Trump brand effect will also bring strong financial and resource support to WLFI. In terms of funding, WLFI has raised as much as $550 million through community public offerings, with $390 million being net income. In terms of resources, stablecoins play a crucial role in the DeFi ecosystem, and WLFI has established deep connections with leading DeFi projects through diversified investments, including top projects like Aave, Uniswap, Ethena, Chainlink, and Ondo Finance.

Overall, as the global stablecoin market rapidly expands and the regulatory framework matures, the launch of USD1 represents a strategically significant move for WLFI, leveraging policy dividends, differentiated institutional positioning, and the influence of the Trump brand to build a unique competitive advantage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。