Source: Cointelegraph Original: "{title}"

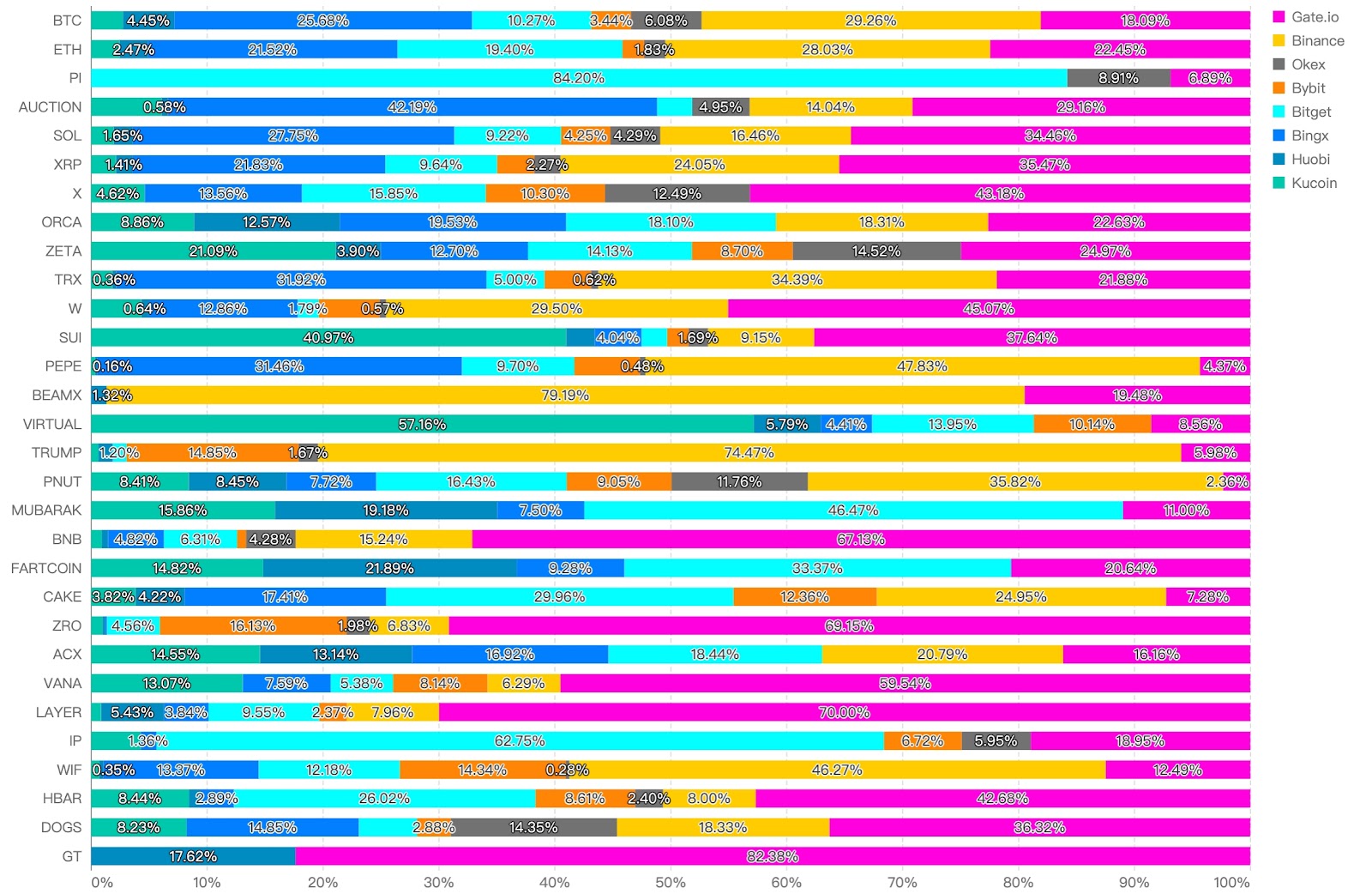

In the fierce competition among cryptocurrency exchanges, Gate.io has gradually become an "Alpha hunting ground" that cannot be ignored by global investors with its unique spot trading ecosystem.

As a leading global trading platform, Gate.io's spot trading consistently ranks among the top three core supports, deeply coupled with its network of over 22 million global users and its ecological system. The platform covers over 600 spot trading pairs (including mainstream assets like BTC, ETH, and cutting-edge tokens such as AI, DePIN, and the Bitcoin ecosystem), creating the industry's richest asset matrix, with innovative projects accounting for 58%, forming an "early bird bonus" capture mechanism.

Gate.io's competitiveness is further reflected in the three-dimensional interaction between spot and derivative products, as well as wealth management products. The perpetual contract market supports over 600 cryptocurrencies, with the underlying spot depth feeding back into derivative liquidity—BTC/USDT order book surpassing $110 million, with a slippage of only 0.02% for million-dollar trades, and ETH price spread stabilizing at $0.07 during extreme market conditions (compared to an average of $0.22 among competitors). Innovative products within the ecosystem, such as FORM token mining, achieve hourly profit settlement and spot fund reuse through a million-dollar prize pool and "GT staking yield enhancement" mechanism, driving a quarterly increase of 210% in user staking volume. This closed-loop design of "asset richness - liquidity - yield scenarios" has attracted over 200 quantitative institutions to migrate in Q1 2025, confirming the unique value of its ecological synergy.

Revolution in Listing Efficiency: Predicting the Market's "Wealth Radar"

Value discovery in the cryptocurrency market occurs on an hourly basis. Gate.io has compressed the traditional exchange's listing process, which typically takes weeks, to an extreme through technological innovation. Its self-developed intelligent listing evaluation system (internally codenamed "Prophet Engine") integrates 380 data dimensions, covering GitHub code update frequency, on-chain whale holding fluctuations, social media sentiment indices, etc., to achieve precise predictions of project value.

Taking the recently surging Mubarak (MUBARAK) as an example, Gate.io launched this token globally on March 14, with a maximum increase of 7400% on the first day and a single-day trading volume exceeding $470 million, accounting for 63% of the total trading volume on CoinMarketCap. While Binance was preparing for the listing review, Gate.io users had already completed the first round of 70x profit harvesting through spot and contract linkage strategies. Another case is AO (AO), where Gate.io launched a HODLer airdrop event on March 19, allowing users holding 1 GT to share 3,333.33 AO tokens. After its spot trading went live, it quickly attracted market attention, further solidifying the platform's strategic positioning as "the stop before Binance."

Data Confirms Efficiency

Gate.io's Liquidity High Point: BTC Spot Depth Leads the Industry

According to CoinGecko's Q1 2025 data, Gate.io's BTC/USDT order book depth of $128 million firmly ranks first among global exchanges, 42% higher than the second place, with a slippage rate of only 0.015% for million-dollar trades (industry average 0.12%). This advantage stems from deep cooperation with top market makers such as Jump Trading and Hudson River Trading, combined with its self-developed "Quantum Order Engine" technology, achieving a processing capacity of 18 million transactions per second. During extreme volatility when Bitcoin surpassed $100,000, Gate.io maintained a price spread of $0.03 (compared to an average of $0.2 among competitors), with a single-day BTC spot trading volume accounting for 31.6% of the global market, becoming the preferred liquidity pool for both institutions and retail investors.

In addition to BTC, Gate.io also shows significant depth advantages in mainstream coins like ETH and SOL, as well as emerging assets: the ETH/USDT order book depth exceeds $65 million (compared to Binance's $48 million). The platform optimizes fund distribution in real-time through a "liquidity heat map," resulting in a slippage rate of only 0.08% for non-mainstream coins like the DePIN protocol Peaq (PEAQ), attracting over 170 quantitative institutions to settle in. This comprehensive depth coverage has allowed Gate.io to rank first in TokenInsight's "Comprehensive Liquidity Index" for six consecutive quarters, validating its competitive logic of "depth as a barrier."

The Competitive Game with Binance: From Traffic Competition to Rule-Making

Gate.io reconstructs the industry landscape through differentiated strategies, forming an ecological moat of "technology empowerment + community co-governance":

- User-as-Market-Maker System

- Price Discovery Power Struggle

Conclusion: The Dialectic of Speed and Depth Value

Gate.io's spot ecosystem proves that in the crypto world, the essence of trading efficiency is the capture of time value. From Mubarak's 7400% lightning surge to ONDO's zero slippage trading experience, the platform transforms its technological advantages into real wealth distribution rights through the triple flywheel of "intelligent listing - depth construction - ecological incentives." As institutional investors evaluate: "Here, we trade not only assets but also time slices of market evolution."

With the rise of AI-driven new token waves, Gate.io, with its coverage of over 600 cryptocurrencies, 128% excess reserves, and millisecond response speed, is evolving from a trading platform into the value center of crypto assets. This data and algorithm-driven spot revolution may be reshaping the industry's power structure—when speed becomes justice, depth is trust, and Gate.io has already grasped the key to unlocking a new era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。