Many of these projects have buyback scales reaching tens of millions of dollars, but the execution transparency varies significantly. In a sluggish market environment, the price response to buybacks remains mostly muted.

Author: Nancy, PANews

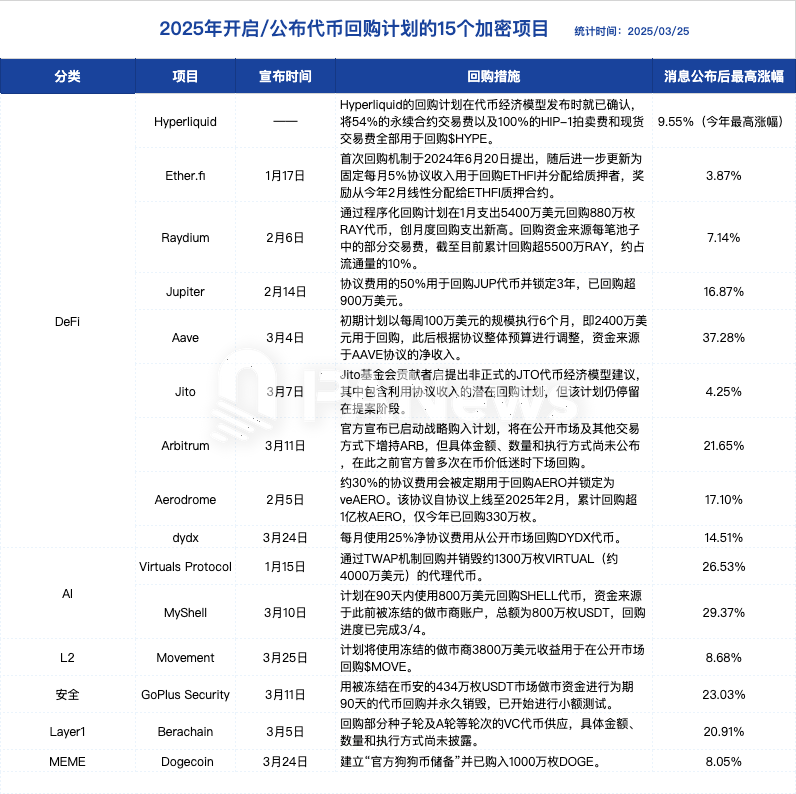

In recent months, the cryptocurrency market has continued to experience turbulence, leaving investor confidence precarious. Amid the ongoing bearish sentiment, a wave of "buyback enthusiasm" has quietly emerged, with project teams attempting to boost market confidence and drive token values upward with real capital. This article from PANews reviews 15 cryptocurrency projects that have initiated or announced token buyback plans in 2025, with the DeFi sector being the most active. Among these projects, many have buyback scales reaching tens of millions of dollars, but the execution transparency is inconsistent, and in a sluggish market environment, the price response to buybacks remains mostly muted.

DeFi as the main force in token buybacks, market response varies

To some extent, buybacks are not only a temporary measure for market rescue but are also seen as an important strategic layout for projects to reshape token economics and provide long-term value.

Among the 15 cryptocurrency projects, DeFi remains the main force in token buybacks, with 7 DeFi projects initiating or planning to initiate buyback plans, including Hyperliquid, Ether.fi, Raydium, Jupiter, Aave, Jito, and Arbitrum. This reflects the urgent need for optimization of token economic models in the DeFi sector. Of course, various fields such as AI, security, Layer 1, Layer 2, and MEME are also gradually exploring buyback mechanisms.

In terms of buyback scale, Hyperliquid, Raydium, Jupiter, Aave, Aerodrome, and Virtual Protocol have significant buyback efforts. For example, Raydium allocates a portion of transaction fees from each pool for buybacks, having cumulatively repurchased over 55 million RAY to date, accounting for about 10% of its circulation. In January alone, it spent $54 million on buybacks, setting a new monthly buyback expenditure record; Jupiter uses 50% of protocol fees for repurchasing JUP tokens and locks them for three years, estimating around $50 million for JUP buybacks based on last year's protocol revenue, having already repurchased over $9 million in just about a month; Aave initially planned to execute a $1 million weekly buyback for six months, totaling $24 million, with adjustments based on the overall protocol budget thereafter; Virtual Protocol has repurchased and destroyed about $40 million of VIRTUAL through a TWAP mechanism.

Additionally, three projects affected by Binance's investigation of market makers have also announced buyback plans, with Movement planning to use $38 million recovered from market makers for MOVE buybacks within three months. In contrast, projects like MyShell and GoPlus Security have relatively smaller buyback scales.

In terms of execution, many cryptocurrency projects have already initiated and are continuously executing buyback plans, demonstrating high transparency and execution capability. For instance, Hyperliquid began repurchasing tokens right after its TGE, with HYPEBurn data showing that as of March 25, over 189,000 HYPE tokens have been destroyed, valued at over $3.026 million; Aerodrome has been destroying tokens since the protocol's launch, having cumulatively repurchased over 100 million AERO, etc. However, some projects' buyback plans have not been fully disclosed or implemented, leading to certain uncertainties. For example, Jito's proposed buyback plan is still in the proposal stage, Berachain has only indicated that there will be buyback arrangements without disclosing specific amounts or execution methods; Arbitrum's official announcement stated that it has initiated a strategic purchase plan to increase its holdings of ARB in the open market and through other trading methods, but specific amounts, quantities, and execution methods have not been disclosed, although the official team has previously engaged in buybacks during periods of low prices.

From the market response perspective, some projects' buyback plans have had a positive impact on token prices. For instance, the highest price increases since the announcement of buyback plans for projects like Aave, MyShell, and Virtual Protocol have been relatively significant. However, about one-third of the projects saw their highest price increases below 10% after the announcement, indicating a relatively muted market response. This differentiation may relate to buyback scale, execution status, project fundamentals, and the overall market downturn.

Behind the buyback wave, value betting or self-rescue?

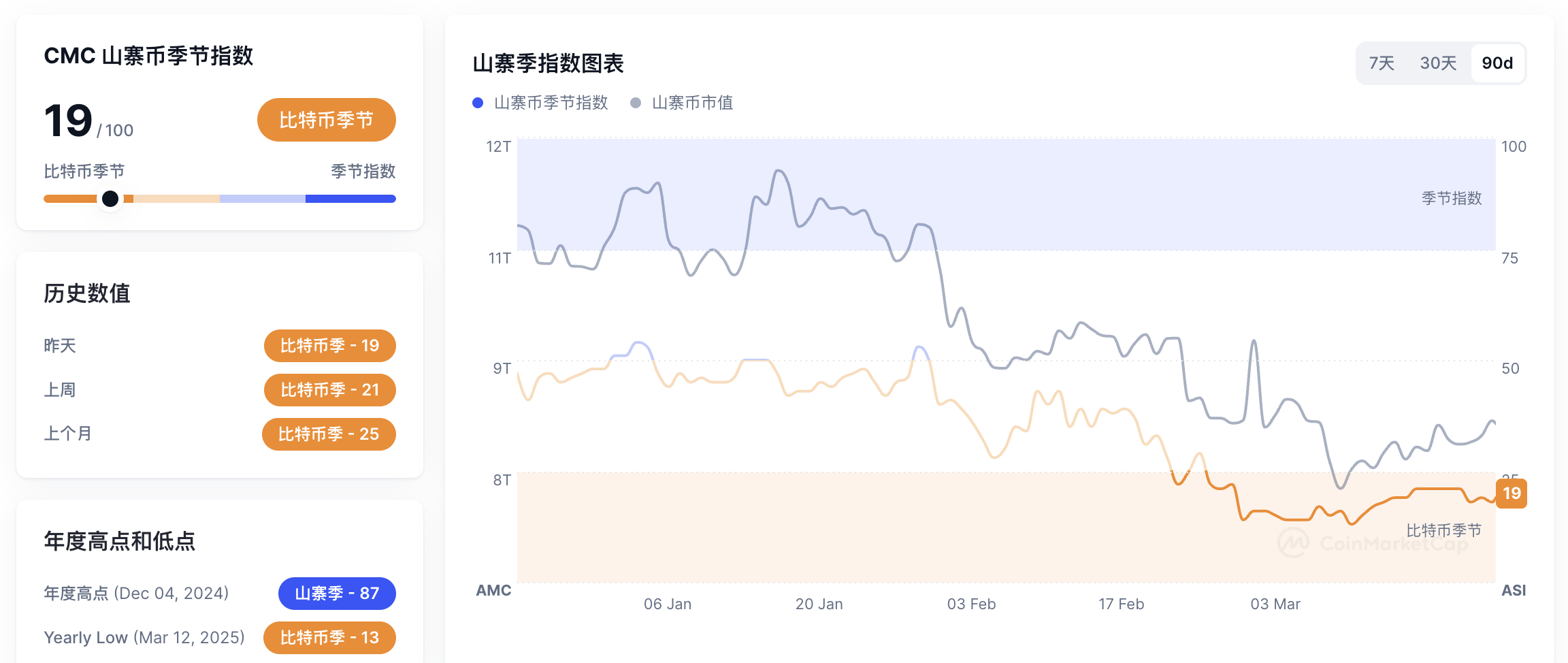

In this round of the crypto cycle, Bitcoin's market share has long dominated above 60%, while most altcoins have seen their market values halved or even plummet to rock bottom, sparking discussions about whether the "altcoin season" is coming to an end. According to Coinmarketcap data, as of March 25, the Altcoin Season Index has dropped to 19, a new low since December 4, 2024, with only 19 of the top 100 cryptocurrency projects outperforming Bitcoin.

Under market pressure, token buybacks have gradually become a standard strategy for many projects, but opinions on the market are divided. Supporters argue that buybacks reflect the project team's confidence in their own value, sending positive signals; skeptics point out that buybacks must align with the project's growth capabilities; some even believe that buybacks may become a tool for project teams to "offload" or provide short-term liquidity, failing to address core developmental issues.

For instance, in the view of @qinbafrank, the strong clearing of small coins over the past year has actually forced the market to evolve further: either focus on the real innovation value landing; or abandon the fantasy of high valuations from the first tier and start from low market values (allowing the second tier to also enjoy the growth dividends rather than just resolving the market); or projects with revenue should start injecting a portion of profits and income into the token economic model to enhance the value of each token. This is a promising start for the crypto market. Meanwhile, crypto KOL SleepinRain believes that when all projects treat buybacks as a solution for token prices, buybacks lose their inherent meaning. They become more like a search for exit liquidity for offloading. Mindless buybacks do not solve the issues of sustainable development and growth. Buybacks should serve the long-term vision of project teams. KOL @cryptowolfin also pointed out that price fluctuations depend on revenue growth and narrative, and buybacks themselves cannot determine long-term trends. When market conditions are good, project teams may spend money on buybacks at high prices, resulting in high costs. However, when token prices drop and revenues decline, they may lack sufficient funds to innovate or adjust strategies, leading to continuous price declines. Ultimately, what project teams should truly focus on is investing in growth and value distribution, rather than burning money at the wrong time.

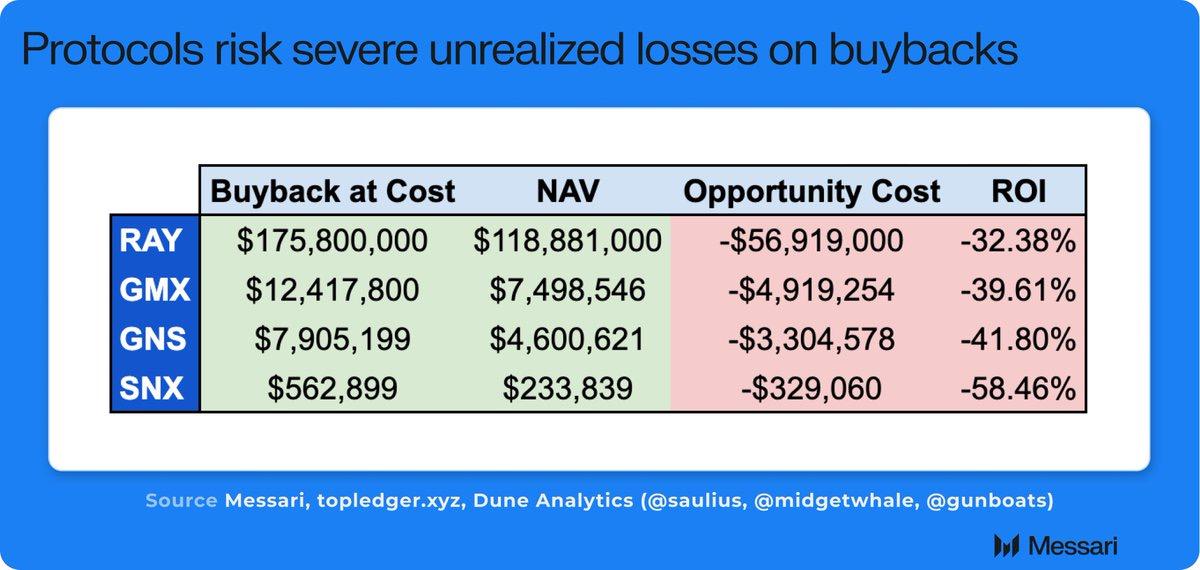

Messari researcher MONK recently pointed out that projects like RAY, GMX, GNS, and SNX have previously repurchased tokens worth millions of dollars through programmatic means, but these tokens are now valued significantly below their cost. Currently, the programmatic token buyback strategies of various crypto projects contain three major fallacies: first, buybacks are unrelated to price trends, which are primarily driven by revenue growth and narrative formation; second, when revenues are strong and prices rise, projects consume more cash reserves to buy tokens at unfavorable prices; finally, when prices and revenues decline, projects lack the necessary funds to invest in innovation and restructuring, even facing significant unrealized losses. Therefore, the current programmatic buyback strategies of crypto projects are largely "misallocation of capital," and it is recommended that projects focus on growth or distribute actual value to holders in the form of stablecoins/mainstream coins.

Whether buybacks can become an effective means to boost the market or are merely a capital game may only be answered by time. However, for investors, the effects of buyback plans are not immediate; in addition to focusing on the buyback amounts, they should pay attention to the project's long-term planning and actual execution status.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。