The original text is from Grayscale Research

Translation|Odaily Planet Daily Golem (@web3golem)_

Editor’s Note: At the beginning of each quarter, Grayscale selects the Top 20 tokens with the highest growth potential from hundreds of digital assets. In Q2 2025, Grayscale focused on RWA, DePIN, and IP tokenization, adding three new tokens to the Top 20: IP, SYRUP, and GEOD. This article also reviews the overall performance of the crypto market in Q1 2025.

To help readers better understand the performance of the "Grayscale Select" tokens, Odaily has compiled the performance of six newly added tokens by Grayscale in Q1 2025. The results show that, influenced by the overall market downturn in Q1, the prices of these six tokens have all declined since January 1, 2025, with VIRTUAL dropping by more than 80%. The complete content is detailed below.

Summary:

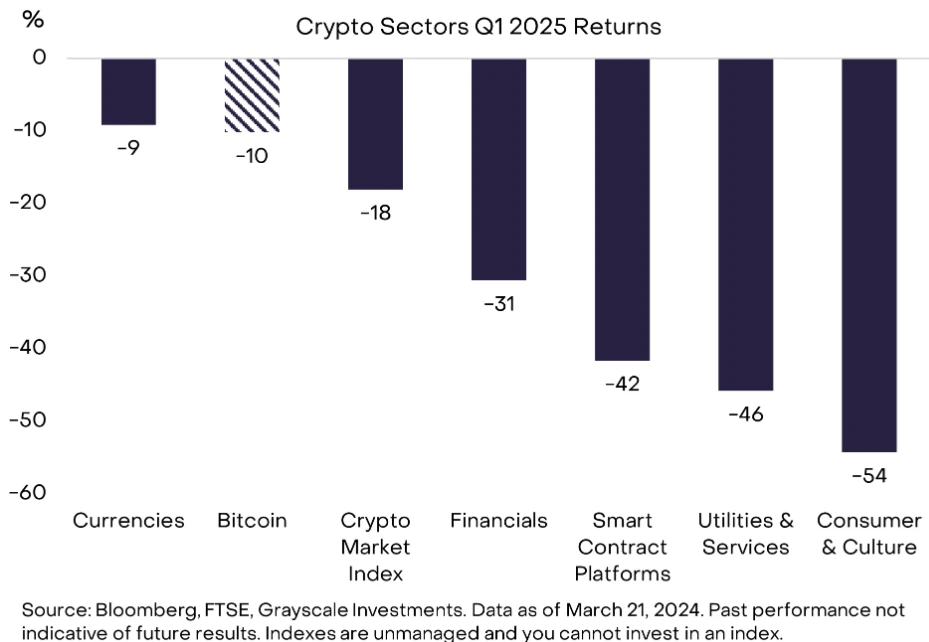

According to the FTSE/Grayscale Crypto Sectors Index, cryptocurrency valuations fell in Q1 2025, alongside declines in tech stocks and other risk assets.

Overall, indicators of Bitcoin network activity performed well in the first quarter. In contrast, the usage of smart contract platforms declined as meme coin trading on Solana slowed. The application-related crypto asset categories accounted for three of the five crypto markets defined by Grayscale, generating over $2 billion in revenue in Q1.

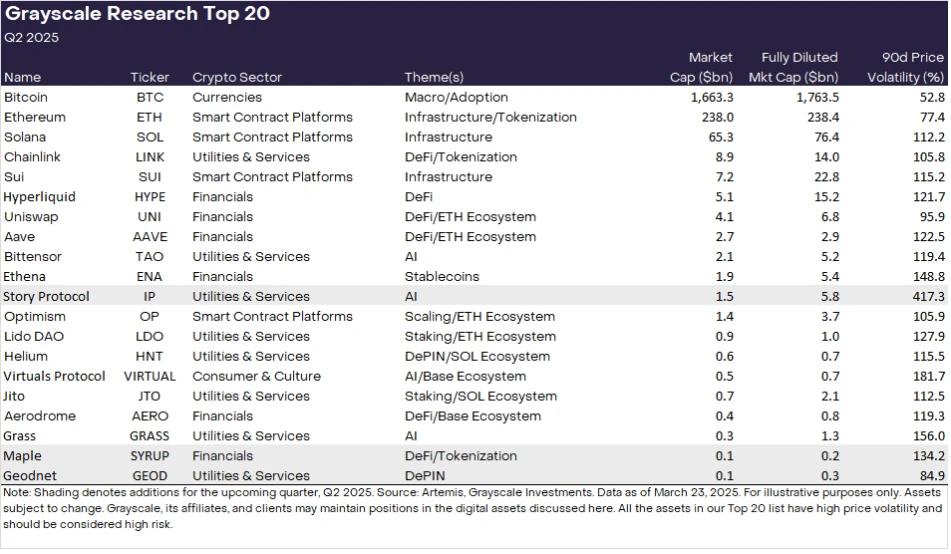

Meanwhile, Grayscale updated the Top 20 potential tokens in Grayscale Research. The Top 20 represents a diversified set of assets in the cryptocurrency space, which Grayscale believes have high potential in the upcoming quarter. The three new assets this quarter are Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP). All assets in the Top 20 list exhibit high price volatility and should be considered high-risk assets.

Currently, the entire digital asset industry has over 40 million tokens (excluding NFTs). To track them, Grayscale Research categorizes them into five different cryptocurrency markets based on the actual usage of the underlying software. Investors can monitor the performance of each sub-market through Grayscale's Crypto Sectors tool. As of the latest data, the Crypto Sectors framework now covers 227 different assets, with a total market capitalization of $2.6 trillion, accounting for approximately 85-90% of the total cryptocurrency market capitalization.

Crypto Sectors divides digital assets into five sub-markets

Q1 2025 Summary: Cryptocurrency Valuations Decline Across the Board

Cryptocurrency valuations fell across the board in Q1 2025, similar to tech stocks and other risk assets. For the quarter (as of Friday, March 21), the market capitalization-weighted cryptocurrency industry price index dropped by 18%, although Bitcoin and some other cryptocurrencies saw smaller declines or even price increases (e.g., XRP). The weakest sub-market this quarter was consumer and culture, primarily due to the decline in prices of DOGE and other meme coins.

Cryptocurrency valuations declined in Q1 2025

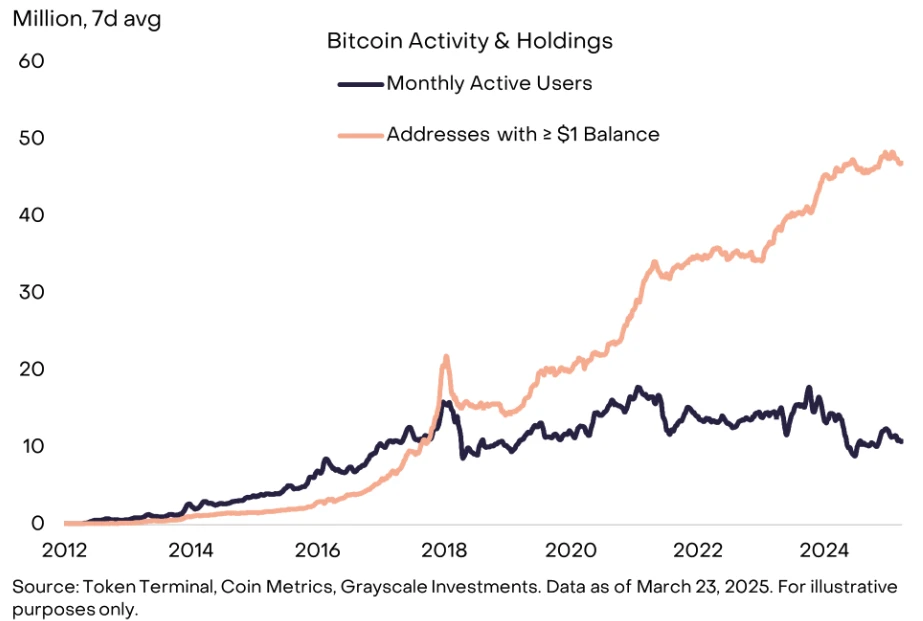

In Q1, indicators of Bitcoin network activity generally performed well. For example, the number of addresses with a balance greater than or equal to $1 reached a new high of 48 million. In contrast, the number of monthly active on-chain users remained roughly flat compared to the previous quarter, at 11 million. The widening gap between these two indicators suggests that recent demand for Bitcoin may come from users interested in its function as a "store of value" rather than as a "medium of exchange." Bitcoin's hash rate increased to nearly 800 exahash (EH/s) in Q1, indicating that a network of 5-6 million Bitcoin mining machines worldwide is attempting to solve proof-of-work algorithms at a rate of approximately 800 trillion hashes per second.

Steady growth in the number of Bitcoin "hodlers"

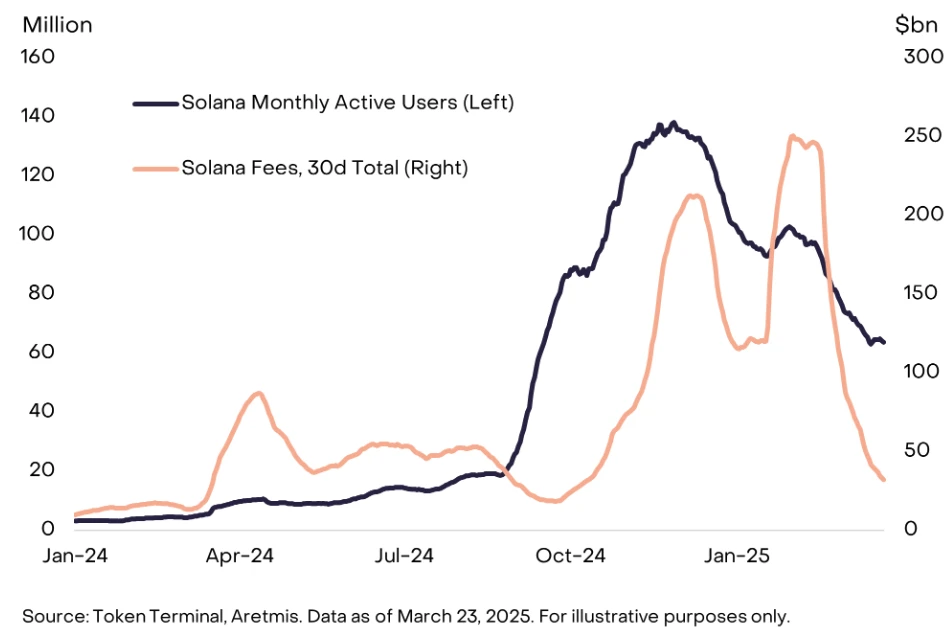

At the beginning of 2025, the fundamental indicators in the smart contract platform sector generally declined, primarily due to a slowdown in meme coin trading activity on the Solana blockchain. Although meme coins do not provide real-world utility and may pose particularly high risks to investors, interest in meme coin trading may have brought many new users to the Solana ecosystem.

According to data from Token Terminal, Solana's monthly active users peaked at 140 million at the end of Q4 2024, averaging nearly 90 million in Q1 2025. Even with the slowdown in meme coin trading, Solana still generated approximately $390 million in fees in Q1, accounting for about half of the estimated total fees for smart contract platforms.

Solana's monthly active users peaked at ~140 million

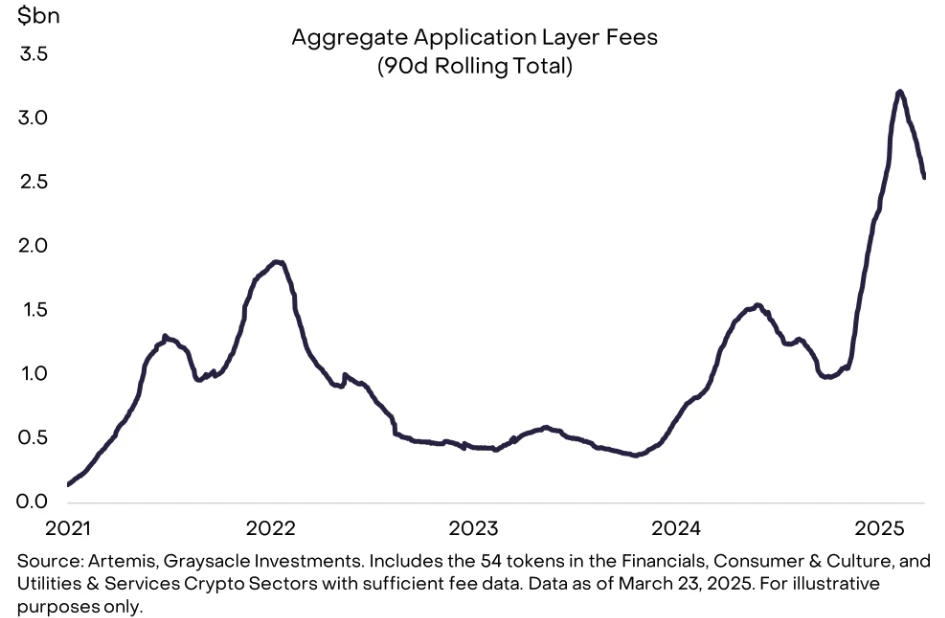

The Grayscale Crypto Sectors framework includes three application-related crypto asset categories: finance, consumer and culture, and utilities and services. These sub-markets encompass all components of on-chain economic activity, including user-facing applications, related application infrastructure (such as oracle and cross-chain bridges), and dedicated blockchains. Therefore, this category is highly diversified, and Grayscale believes it is best to evaluate them based on peer assets focused on specific areas. That said, we estimate that the total fees generated by assets in these three application-related crypto categories amount to approximately $2.6 billion, a 99% increase compared to Q1 2024.

Blockchain applications generated over $2 billion in quarterly fees

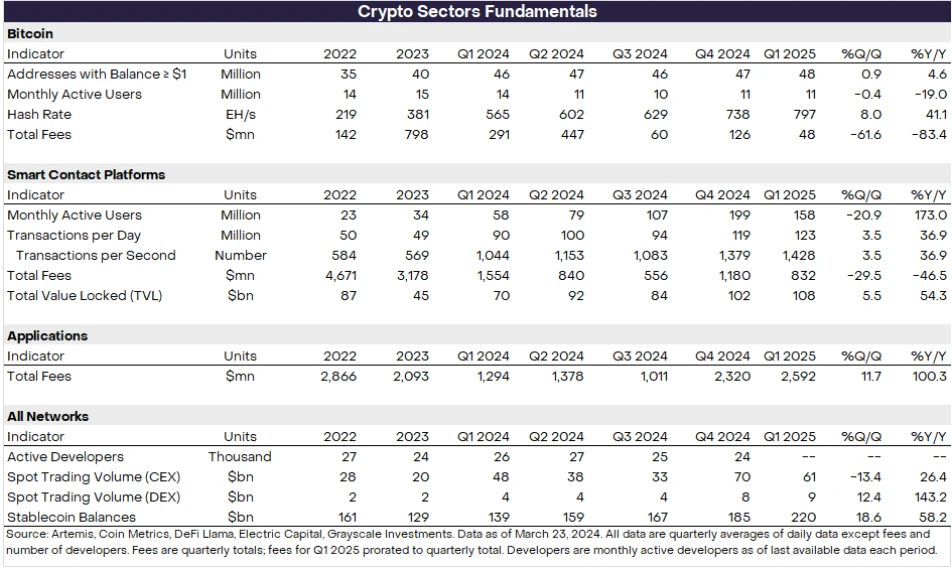

The following chart provides some key fundamental statistics for various segments of the digital asset market. Overall, these indicators show robust growth compared to the same period last year, but mixed changes compared to the previous quarter.

Grayscale Research Top 20 Token List

Each quarter, the Grayscale Research team analyzes hundreds of digital assets to inform the reassessment process for the FTSE/Grayscale Crypto Sectors Index. Following this process, Grayscale Research generates a list of the top 20 assets in the Crypto Sectors. The top 20 represent a diversified set of assets in the cryptocurrency industry, which Grayscale believes have high potential in the upcoming quarter. The assessment combines a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks.

Performance of Newly Added Tokens in Q1 2025

In the past quarter, Grayscale Research was inspired by emerging assets at the blockchain application layer (rather than the infrastructure layer). The Q1 2025 Grayscale Top 20 list added HYPE, ENA, VIRTUAL, JUP, JTO, and GRASS_ (recommended reading: Grayscale Q1 2025 Select: 20 Tokens with High Growth Potential)._

According to CoinGecko data, the performance of these six newly added tokens since Grayscale's disclosure (January 1, 2025) is as follows:

Hyperliquid (HYPE): Price on January 1, 2025, was $24, down 33% to date; the price peaked at $27.94 in Q1 2025, a relative increase of 16%; the price hit a low of $12.15 in Q1 2025, a relative decrease of 49.37%, with the lowest price up 33% to date.

Ethena (ENA): Price on January 1, 2025, was $0.91, down 53% to date; the price peaked at $1.27 in Q1 2025, a relative increase of 39.5%; the price hit a low of $0.33 in Q1 2025, a relative decrease of 63%, with the lowest price up 30% to date.

Virtual Protocol (VIRTUAL): Price on January 1, 2025, was $4, down 80% to date; the price peaked at $4.99 in Q1 2025, a relative increase of 24%; the price hit a low of $0.53 in Q1 2025, a relative decrease of 86%, with the lowest price up 52% to date.

Jupiter (JUP): Price on January 1, 2025, was $0.82, down 30% to date; the price peaked at $1.26 in Q1 2025, a relative increase of 53%; the price hit a low of $0.46 in Q1 2025, a relative decrease of 43%, with the lowest price up 23% to date.

Jito (JTO): Price on January 1, 2025, was $3.2, down 22% to date; the price peaked at $3.5 in Q1 2025, a relative increase of 9.3%; the price hit a low of $2.1 in Q1 2025, a relative decrease of 34%, with the lowest price up 19% to date.

Grass (GRASS): Price on January 1, 2025, was $2.6, down 38% to date; the price peaked at $3.4 in Q1 2025, a relative increase of 30%; the price hit a low of $0.9 in Q1 2025, a relative decrease of 65%, with the lowest price up 77% to date.

In summary, since Grayscale's disclosure, the prices of these six tokens have experienced significant pullbacks in Q1 2025, and if one had held these tokens since Q1, they would all be in a loss position without exception, earning not a dime. However, if one could identify the bottom range and buy in until now, there would be decent gains.

New Tokens Added in Q2 2025

This quarter, Grayscale will focus on tokens that reflect non-speculative applications of blockchain technology in the real world, categorized into the following three types: RWA (Real World Assets), DePIN (Decentralized Physical Infrastructure), and IP (Intellectual Property Tokenization).

Based on the above themes, the following three assets have been added to the Top 20 list for Q2 2025:

Maple (SYRUP): Maple is a decentralized finance (DeFi) protocol focused on institutional lending through its two core platforms: Maple Institutional (for qualified investors) and Syrup.fi (for DeFi native users). The protocol's total value locked (TVL) has grown to over $600 million, generating $20 million in annualized network fee revenue in the past 30 days. It also aims to establish Maple Institutional as a trusted institutional loan originator by collaborating with traditional financial institutions.

Geodnet (GEOD): Geodnet is a DePIN project for collecting real-time location data. As the world's largest provider of Real-Time Kinematic (RTK) services, Geodnet offers geospatial data with an accuracy of up to 1 centimeter, providing affordable solutions for users such as farmers. In the future, Geodnet may provide value for autonomous vehicles and robotics. The network has expanded to over 14,000 devices in 130 countries, with annualized network fee revenue growing to over $3 million in the past 30 days (approximately 500% year-over-year growth). Notably, compared to other assets in the top 20, GEOD has a lower market capitalization and fewer listed exchanges, making it potentially riskier.

Story (IP): Story Protocol is attempting to tokenize the $70 trillion intellectual property (IP) market. In the AI era, proprietary IP is used to train AI models, leading to copyright infringement claims and large-scale lawsuits, such as the previous lawsuit dispute between The New York Times and OpenAI. By bringing IP on-chain, Story will enable companies to use their IP for AI model training while allowing individuals to invest in, trade, and earn IP royalties. Story has already brought songs from Justin Bieber and BTS on-chain and launched an IP-focused blockchain and token in February.

Q2 2025 Top 20 List

In addition to the new themes mentioned above, Grayscale remains optimistic about themes from previous quarters, such as Ethereum scaling solutions, the intersection of blockchain and AI development, and DeFi and staking solutions. These themes are represented in the Top 20, including Optimism, Bittensor, and Lido DAO.

This quarter, Akash, Arweave, and Jupiter have been removed from the Top 20. However, Grayscale Research still recognizes the value of these projects, as they remain important components of the crypto ecosystem. Nevertheless, the new Top 20 list may provide a more attractive risk-return profile for the next quarter.

Investing in crypto assets involves risks, some of which are unique to the crypto asset class, including smart contract vulnerabilities and regulatory uncertainties. Additionally, all assets in the top 20 exhibit high volatility and should be considered high-risk, thus not suitable for all investors. Given the risks associated with the asset class, any investment in digital assets should be considered in the context of the investor's portfolio and financial situation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。