Original Title: The State of Web3 Funding - Q1 2025

Original Author: Decentralised

Original Translation: zhouzhou, BlockBeats

Editor's Note: In the past few years, early-stage funding in Web3 has expanded, but capital is concentrated in a few companies, making financing more difficult. After the collapse of FTX, LP funds have gathered in a few leading funds, making it even harder for startups to secure financing. Token liquidity has decreased, investment return cycles have lengthened, and the market is more focused on profitability and PMF. Venture capital will not disappear; the Web3 infrastructure has matured, and AI development brings new opportunities. In the future, capital will favor founders with long-term competitiveness rather than short-term token gains. The key question is which founders and investors can persist until the end and find the ultimate answers to the industry's evolution.

Below is the original content (reorganized for readability):

The State of Web3 Funding in Q1 2025

A rational market participant might think that capital will fluctuate, much like many things in nature, and it has its cycles. However, venture capital in the crypto space resembles a one-way waterfall—a continuous experiment in gravity.

We may be witnessing the final phase of a frenzy that began with the smart contract and ICO wave in 2017, accelerated in the low-interest-rate environment during the COVID period, and is now returning to a more stable level.

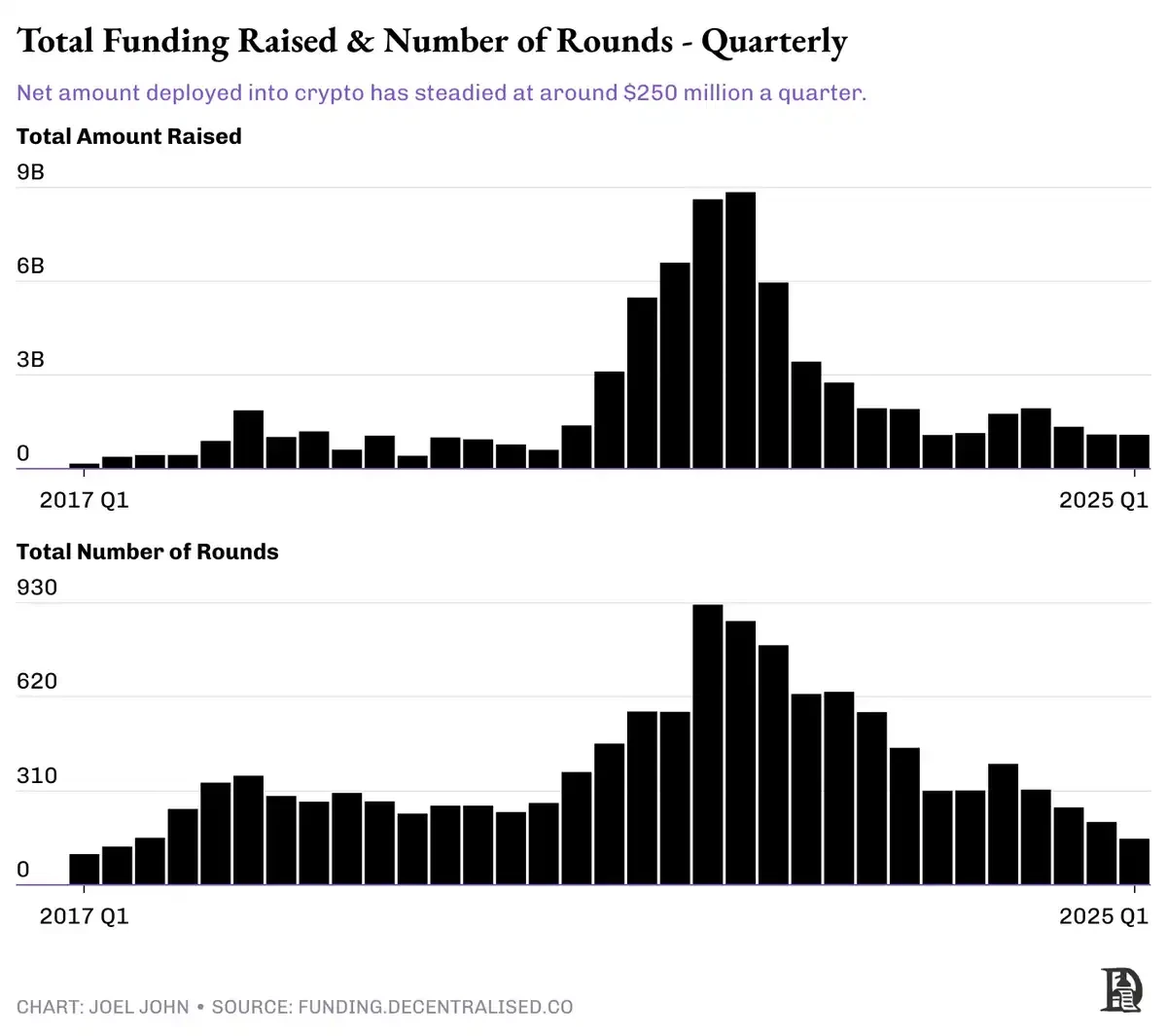

In 2022, crypto venture capital peaked at $23 billion. By 2024, this figure plummeted to $6 billion. The reasons for this decline are primarily threefold:

The frenzy of 2022 led to excessive capital inflow—venture capital invested in many products like DeFi and NFTs at extremely high valuations in a seasonal market, but ultimately failed to deliver the expected returns. OpenSea was once valued at $13 billion, becoming the pinnacle of the market bubble.

Difficulty in fundraising and the disappearance of valuation premiums—In 2023/2024, many funds faced obstacles in fundraising. Projects that successfully listed on exchanges also struggled to replicate the high valuation premiums of 2017-2022. Due to the lack of valuation increases, funds found it challenging to raise new capital, especially when many investors' returns lagged behind Bitcoin.

AI has replaced crypto as the "next big thing"—Large capital institutions have shifted their focus to AI, and the crypto industry has lost its speculative frenzy and premium that once marked it as "the most promising frontier technology."

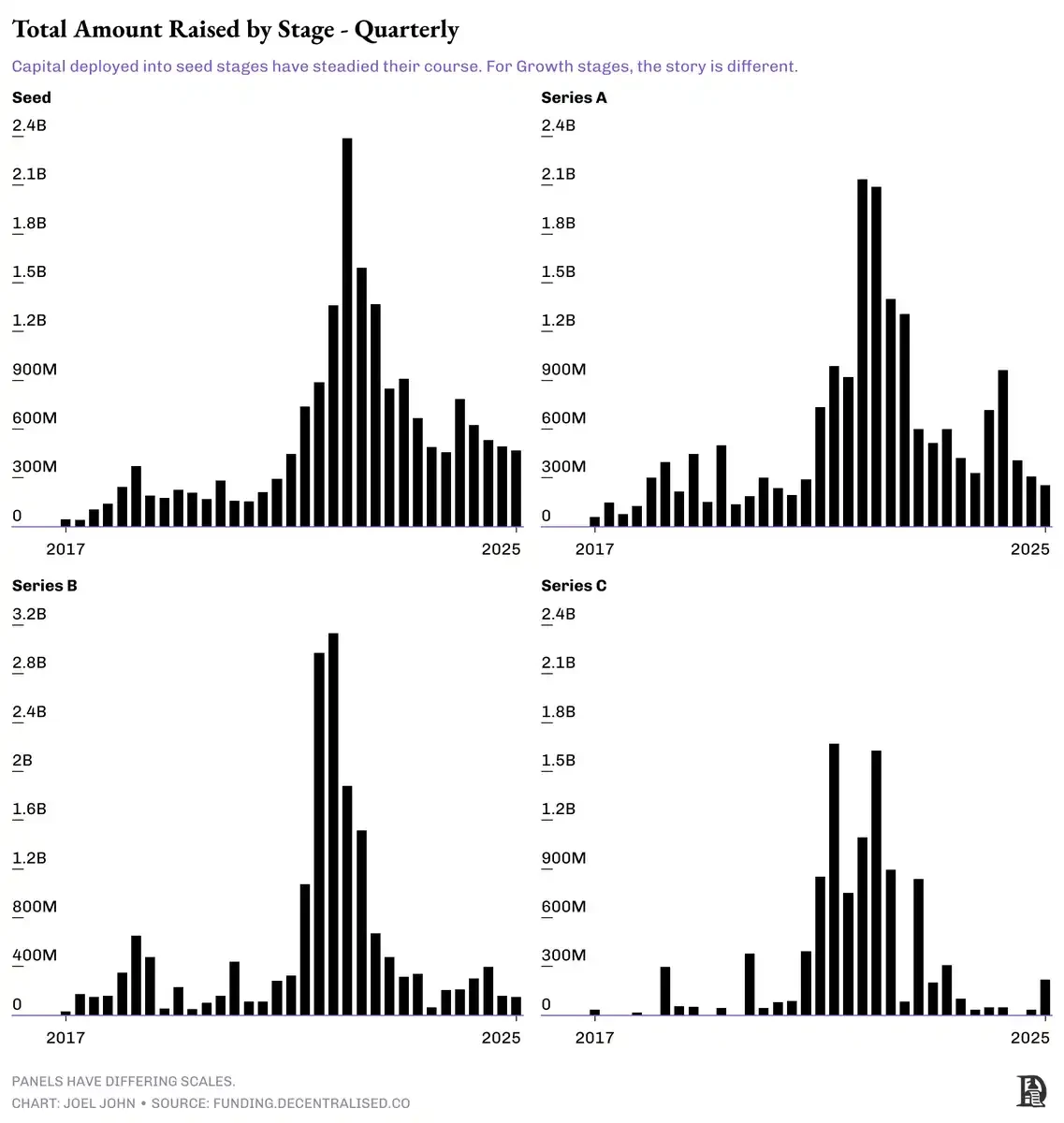

However, the deeper issue is that very few startups can grow to Series C or D rounds. Some may argue that the primary exit strategy in the crypto industry is token listings, but when most tokens list and immediately drop in value, it becomes difficult for investors to exit. This is particularly evident when comparing data across funding rounds.

Since 2017, of the 7,650 companies that received seed funding, only 1,317 successfully entered Series A, a progression rate of 17%. Among them, 344 advanced to Series B, while only about 1% (±1%) made it to Series C. The probability of reaching Series D is merely 1 in 200, comparable to other industries as per @Crunchbase statistics. However, the crypto industry has a unique situation: many companies in growth stages bypass traditional funding paths through tokenization. This reflects two core issues:

Without a healthy token liquidity market, crypto venture capital will stagnate. This gap will be filled by liquidity market participants like @SplitCapital and @DeFianceCapital.

If there are not enough companies growing to later stages and successfully going public, investors' risk appetite will decrease.

From the data across various funding stages, the market is sending the same signal: although capital inflow in seed and Series A rounds remains relatively stable, active investments in Series B and C rounds have significantly decreased. Does this mean it's a good time for seed funding? Not necessarily. The key lies in the details.

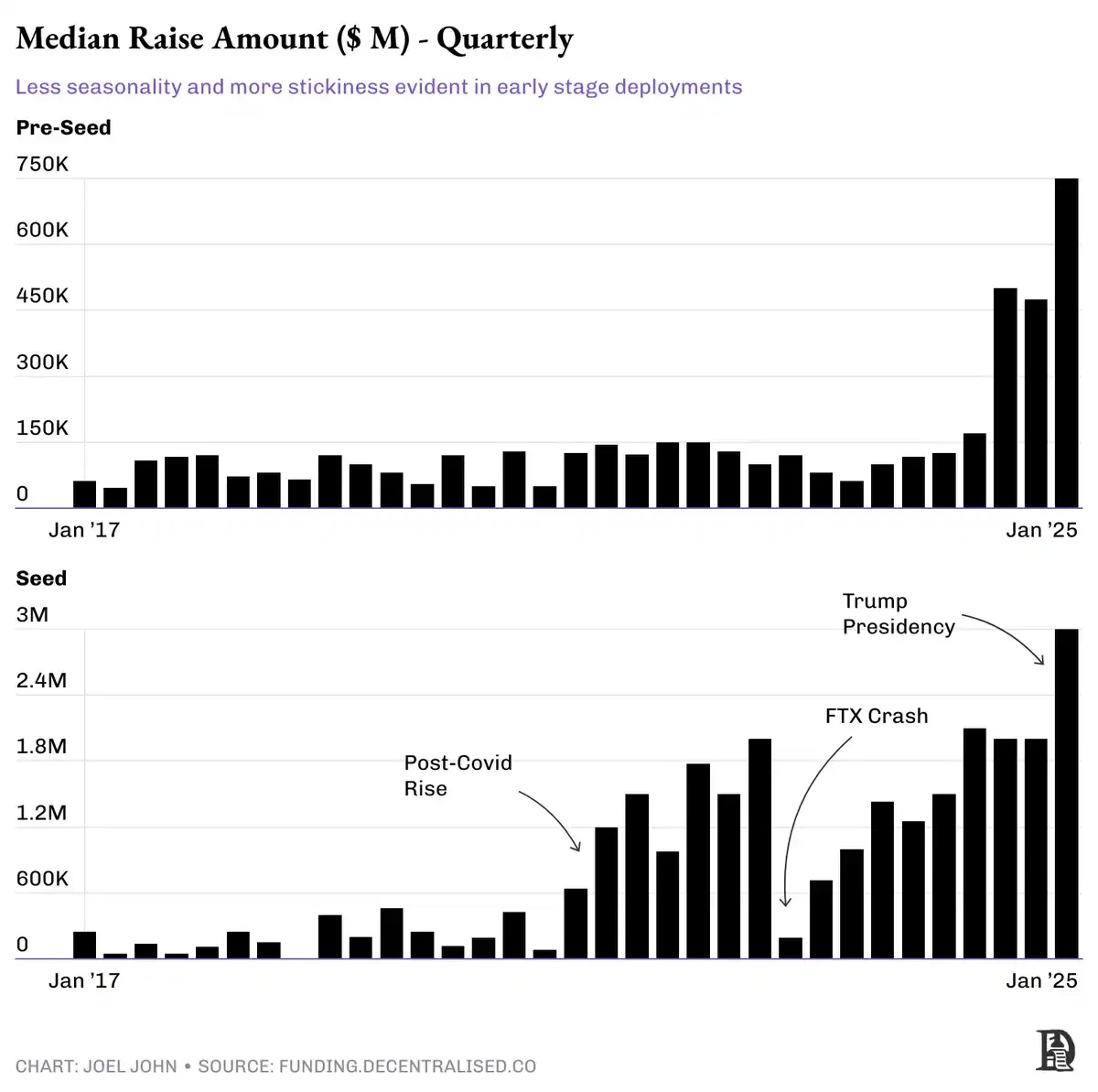

The data below shows the median amounts for pre-seed and seed funding each quarter. It can be seen that the overall trend is steadily increasing. Two noteworthy points are:

Since the beginning of 2024, the amount of pre-seed funding has significantly increased.

The nature of seed funding has changed over the past few years.

We observe that although the willingness to invest early capital has decreased, the scale of pre-seed and seed funding that startups receive has actually increased. The past "friends and family round" is now filled by early-stage funds, and this trend has also affected seed funding. Since 2022, the scale of seed funding has expanded to cope with rising labor costs and the longer time required for the crypto industry to achieve product-market fit (PMF). However, the decrease in product development costs has somewhat offset this trend.

The increase in funding amounts means that companies are valued higher (or face more equity dilution) at early stages, which also implies that higher valuation growth will be needed in the future to deliver returns to investors. Additionally, there was a noticeable increase in funding amounts in the months following Trump's election. This may be related to changes in the fundraising environment for fund general partners (GPs) after Trump's rise to power—interest from fund of funds (FoF) and traditional allocators increased, pushing the early market into a "risk appetite" mode.

What does this mean for founders? Currently, the amount of early funding in Web3 is greater than ever, but capital is concentrated among fewer founders, with larger funding amounts, while requiring companies to grow faster than in previous cycles.

As traditional liquidity channels (like token issuance) are drying up, founders need to invest more effort to demonstrate their credibility and the potential of their businesses. The era of "50% discount, new round of high valuation funding within two weeks" is over. Funds can no longer profit by "inflating valuations," and founders cannot easily secure funding; the vested tokens in employees' hands no longer enjoy the rapid appreciation dividends.

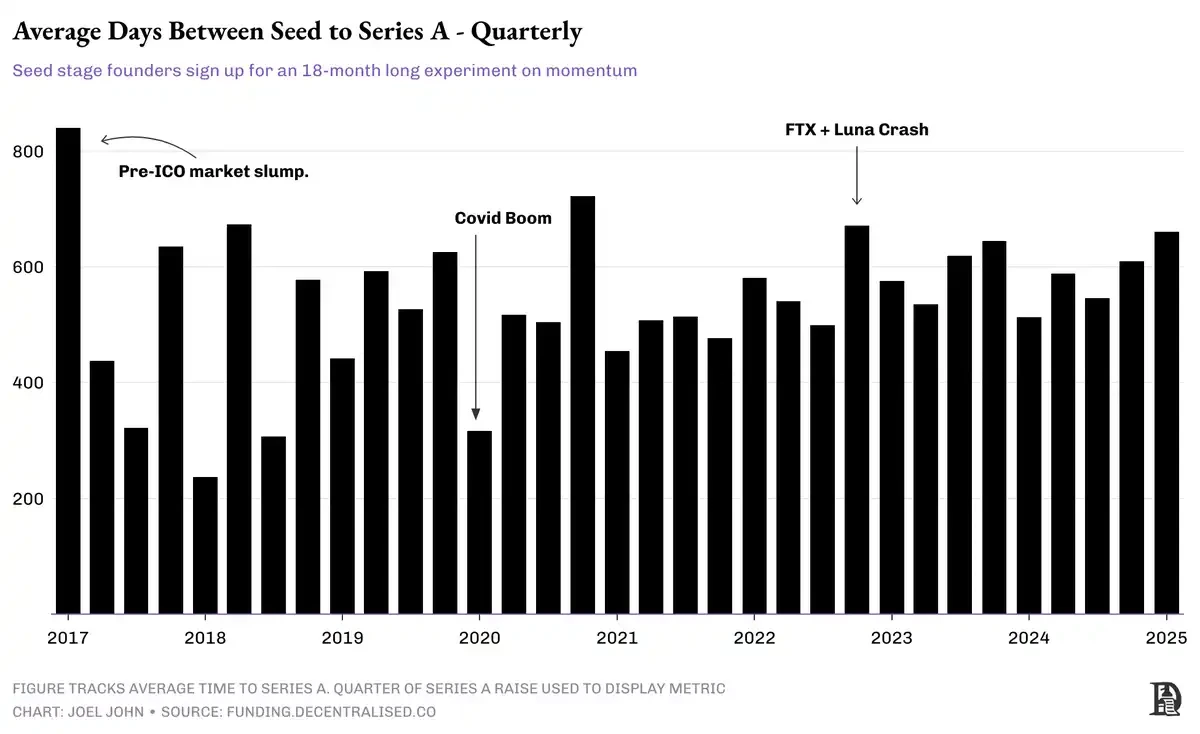

One angle to validate this trend is the velocity of capital flow. The chart below shows the average time startups take to move from seed to Series A. The lower the value, the faster the capital flow, meaning investors are willing to invest larger amounts at higher valuations to support new seed-stage companies before they mature.

Another key factor is how liquidity in the public market affects the private market. Investors often increase their investments in the private market when there is a pullback in the public market. For example, during Q1 2018, the market experienced a sharp decline, and Series A funding subsequently dropped significantly. The same situation occurred again in Q1 2020—at the time, the market was collapsing due to the COVID pandemic. For those investors holding capital, the attractiveness of investing in the private market increases when public market investment opportunities diminish.

In Q4 2022, after the collapse of FTX, the market's risk appetite significantly decreased. Unlike previous instances where private market funding increased during public market pullbacks, this collapse directly destroyed the appeal of the crypto industry as an asset class. Prior to this, several large funds had invested heavily in FTX's $32 billion valuation funding, only to lose everything in the end. As a result, investor interest in the entire industry has sharply declined.

After the collapse of FTX, funds began to concentrate on a few leading companies, which became the "kingmakers" dominating the capital flow in the market. Most LPs' (limited partners) funds flowed into these top funds, which are more inclined to deploy capital in later-stage projects, as this allows them to absorb more capital. In other words, the financing environment for startups has become more challenging.

The Future of Crypto Venture Capital?

For the past six years, I have been observing this data, and each time I reach the same conclusion—startup financing is becoming increasingly difficult. At 24, I may not have realized that the evolution of the industry follows this pattern. Market booms attract a large influx of talent and capital, but as the industry matures, the difficulty of financing inevitably increases. In 2018, projects could secure funding simply by being "on the blockchain"; by 2025, investors are more focused on profitability and product-market fit (PMF).

As token liquidity decreases, venture capitalists must reassess their liquidity and capital deployment strategies. In the past, investors expected to see returns through tokens within 18-24 months, but now this cycle has lengthened. Employees also need to put in more effort to receive the same amount of tokens, and these tokens often trade at lower valuations. This does not mean that there are no profitable companies in the industry; rather, like in the traditional economy, ultimately only a few companies can capture most of the economic value.

Will venture capital disappear? From a jokingly pessimistic viewpoint, perhaps yes. But the reality is that Web3 still needs venture capital.

The infrastructure layer has matured, capable of supporting large-scale consumer applications.

Founders have experienced multiple market cycles and have a deeper understanding of how the industry operates.

The internet's reach continues to expand, and global bandwidth costs are decreasing.

The development of AI is expanding the possibilities for Web3 applications.

These factors together create an unprecedented opportunity period. If the venture capital industry wants to "make venture capital great again," they need to focus on the founders themselves, rather than how many tokens they can issue. Today, capital allocators are more willing to spend time supporting founders with the potential to dominate the market. This shift represents the growth process of Web3 investors from "When will the tokens be issued?" in 2018 to "What is the limit of the market?" in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。