Source: Cointelegraph Original: "{title}"

As the world's largest decentralized prediction market, Polymarket has come under fire for a controversial outcome, raising concerns about potential governance manipulation in high-risk political bets.

A betting market on the platform asked whether U.S. President Trump would accept a rare earth mineral deal with Ukraine before April. Although such an event did not occur, the market was settled as "yes," provoking strong opposition from users and industry observers.

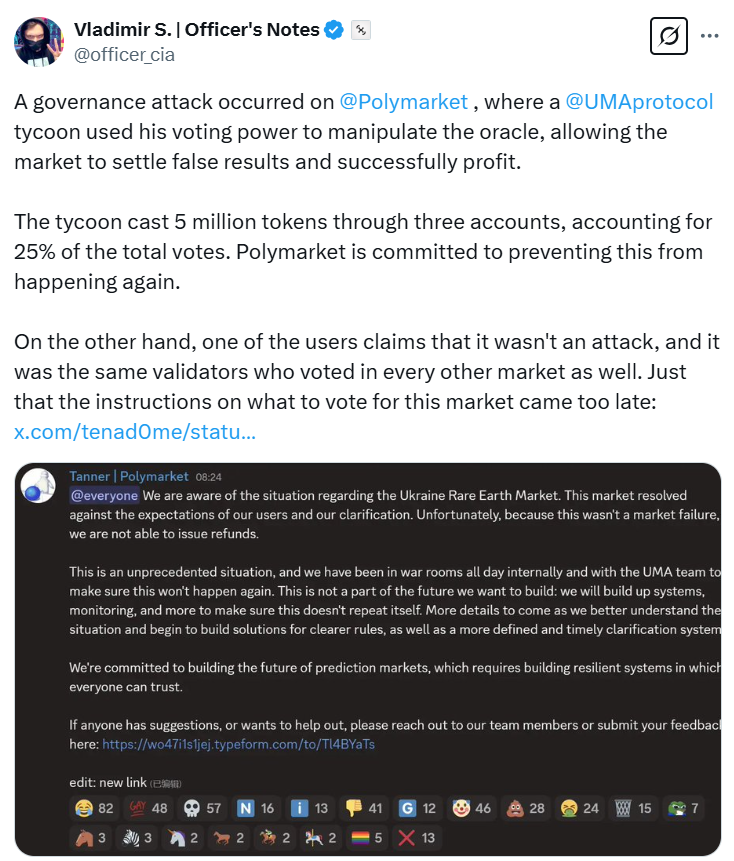

According to crypto security researcher Vladimir S., this could point to a "governance attack," where a whale from the UMA protocol "manipulated the oracle using his voting power to settle the market with false results and successfully profited."

"This tycoon cast 5 million tokens through three accounts, accounting for 25% of the total vote. Polymarket has promised to prevent this from happening again," he wrote in a post on X on March 26.

Source: Vladimir S.

Polymarket uses UMA protocol's blockchain oracles to obtain external data to settle market outcomes and verify real events.

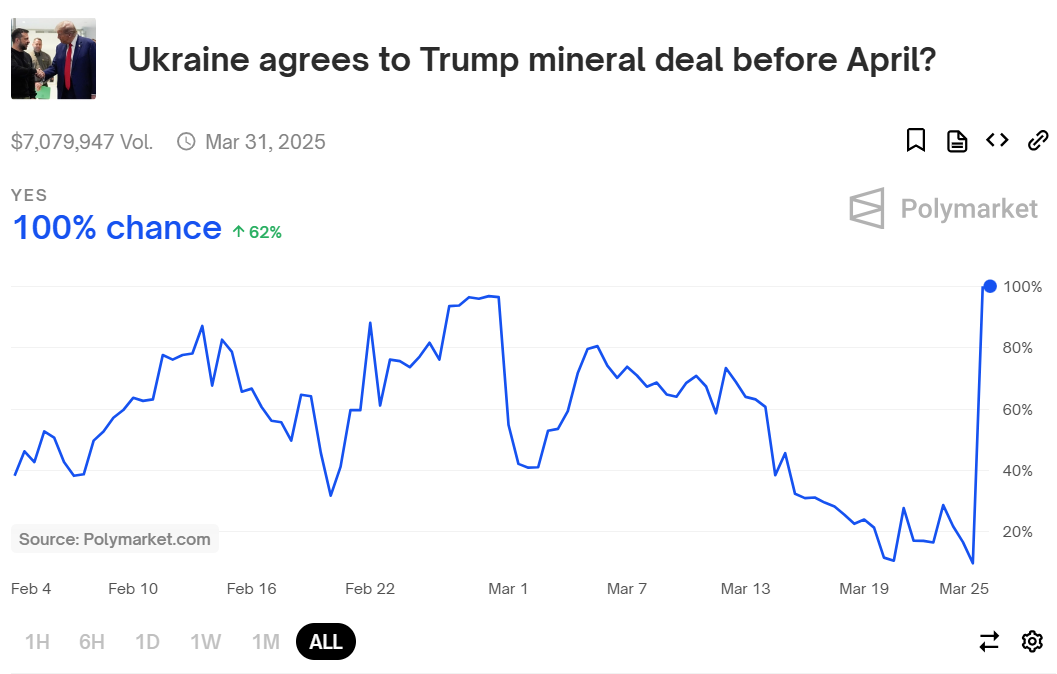

Polymarket data shows that the market accumulated over $7 million in trading volume before settling on March 25.

Source: Polymarket

However, not everyone believes this was an organized attack. A Polymarket user using the pseudonym Tenadome believes the outcome was due to negligence.

"There is no 'tycoon' 'manipulating the oracle,'" Tenadome wrote in a post on X on March 26, adding:

"The voters determining this outcome are the same group of UMA whales who vote in every controversy, most of whom are either affiliated with or part of the UMA team, and do not trade on Polymarket; they simply choose to ignore clarifications to gain rewards and avoid being cut."

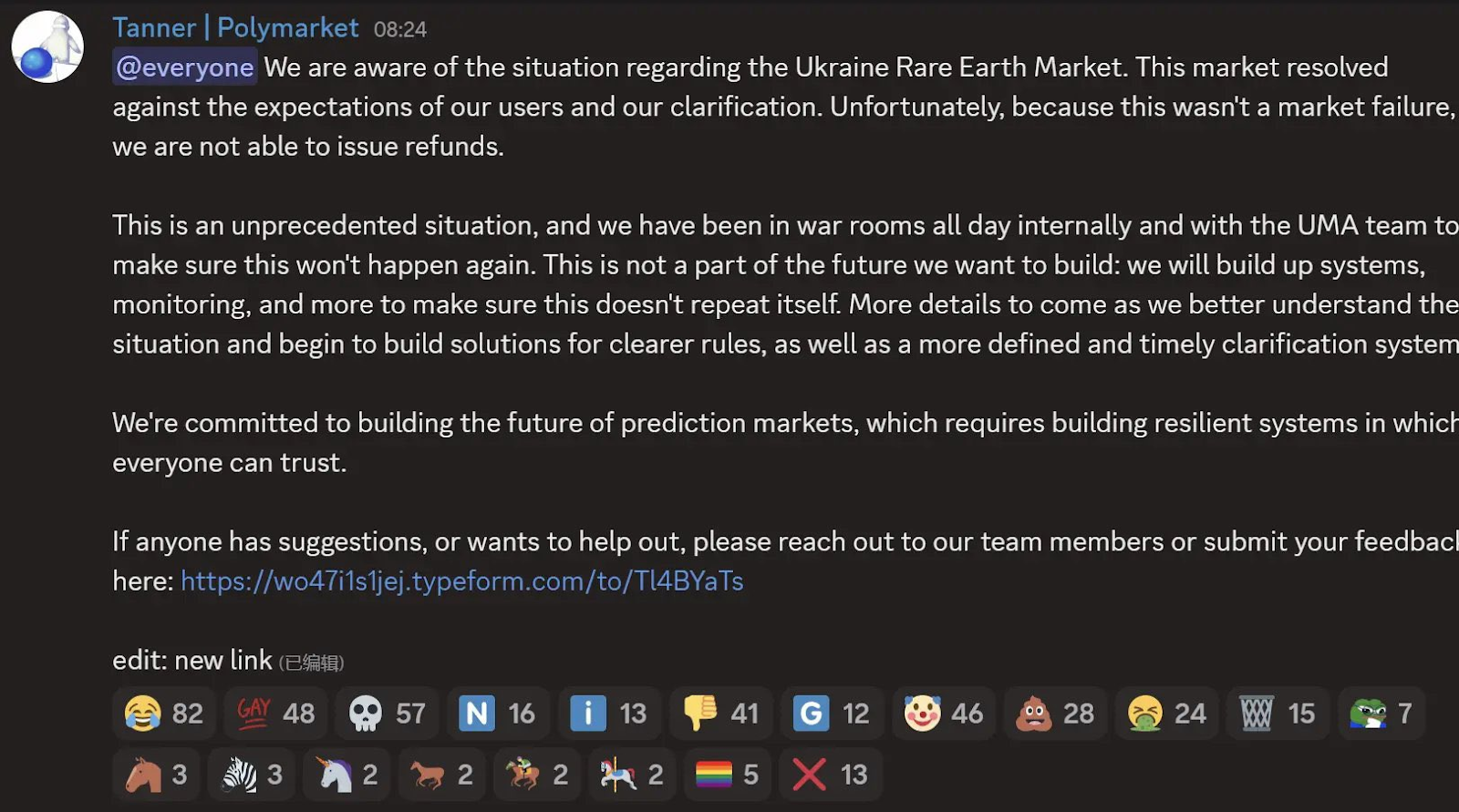

Despite user frustration, Polymarket moderators stated that refunds would not be issued.

"We are aware of the situation regarding the Ukrainian rare earth market. The resolution of this prediction market contradicts our users' expectations and our clarifications," Polymarket moderator Tanner said, adding:

"Unfortunately, because this is not a market failure, we cannot issue refunds."

Source: Vladimir S.

Polymarket stated it will establish a new monitoring system to ensure that this "unprecedented situation" does not happen again.

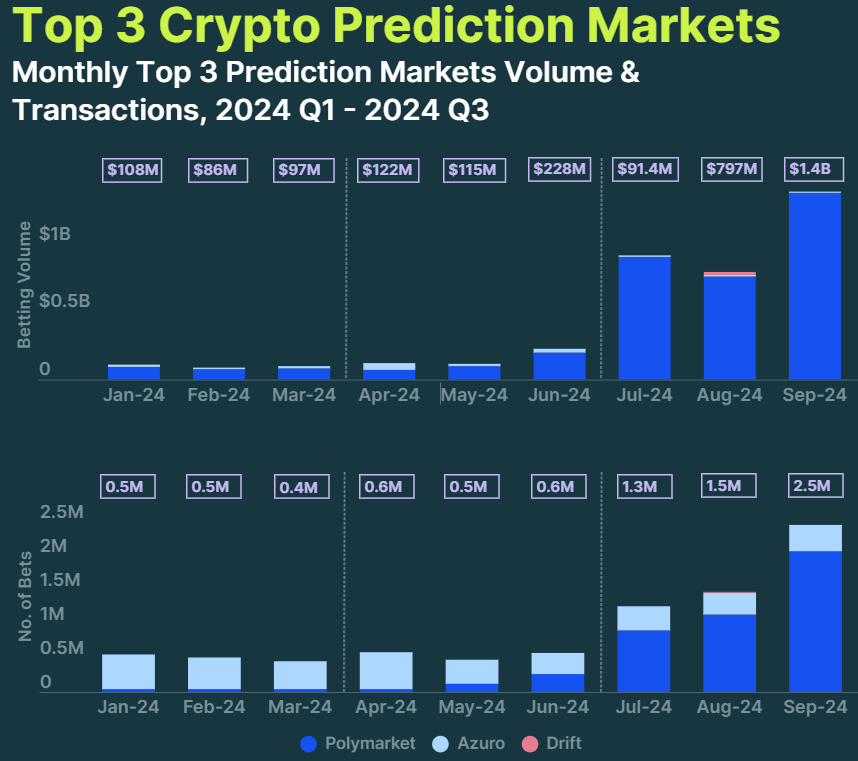

The prediction market saw significant growth in the third quarter of 2024, primarily driven by betting on the U.S. presidential election.

The top three cryptocurrency prediction markets. Source: CoinGecko

Betting volume in prediction markets grew by over 565% in the third quarter, reaching $3.1 billion across the three major markets, compared to just $463.3 million in the second quarter.

As the most prominent decentralized platform of its kind, Polymarket held over 99% market dominance as of September.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。