Today's homework begins with the story of rebounds and reversals. A lot of time and content has been spent marking the potential issues we might encounter in the pinned tweet. The actual result is that, although we can see a positive direction developing, it is still not enough to break out of the reversal path. The Federal Reserve's monetary policy and Trump's tariffs are still full of uncertainties.

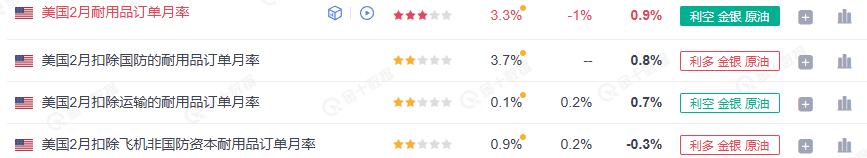

Today's decline does not have significant negative news; it is still centered around tariffs. Yesterday, Trump mentioned that the tariffs on April 2 might not be so tight, and the market responded positively. Today, Trump stated that the tariffs on April 2 are not so easy, and the auto tariffs might need to be reshuffled. Additionally, the significant drop in U.S. durable goods orders indicates a cautious attitude from businesses regarding the uncertainty of Trump's tariffs.

With tariffs in the foreground and the Federal Reserve in the background, St. Louis Fed President Bullard expressed that due to tariffs, U.S. inflation is likely to remain above 2% for a long time, which would also lead the Fed to be less eager to cut interest rates. He believes that the second round of tariff effects may not be a one-time increase in inflation.

Therefore, from the current essential situation, April still faces many challenges, especially when Trump's proposals are highly uncertain. Additionally, there is the GDP data for April, and some institutions have already estimated a 25% probability of a recession in the U.S. by 2025.

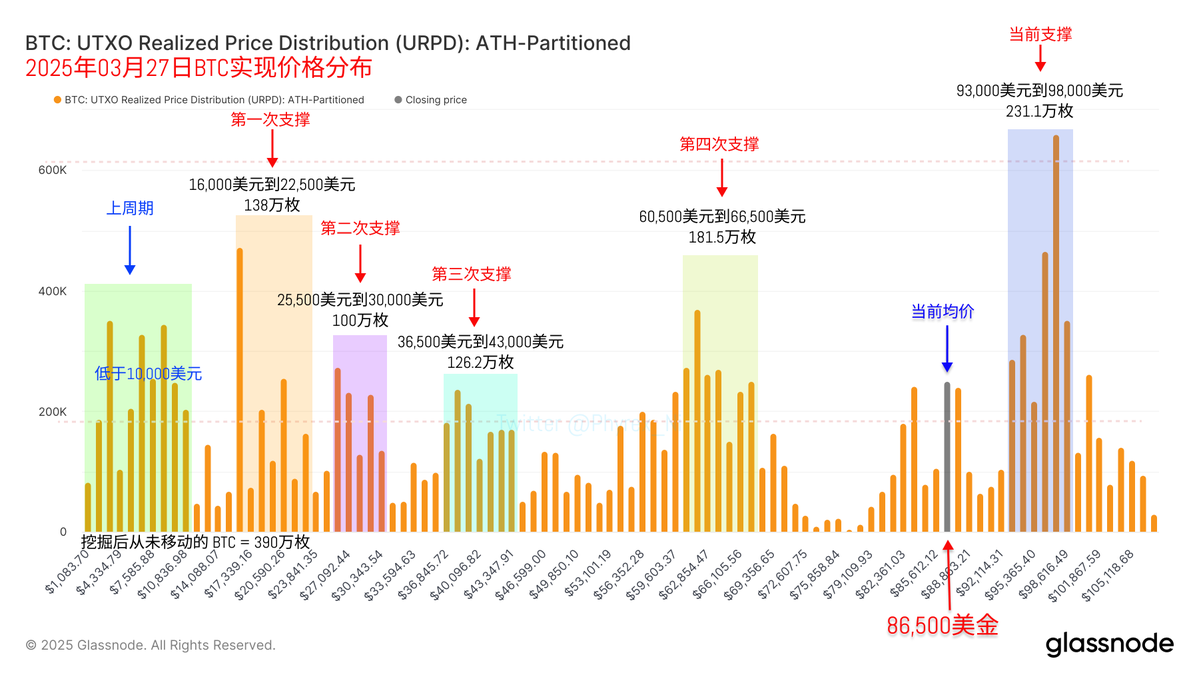

Looking back at the #Bitcoin data, BTC is still highly correlated with U.S. stocks. When there is no independent positive data, the fluctuations in U.S. stocks largely affect the price movements of $BTC. However, despite the decline, the trading volume remains pitifully low, and the same applies during price increases. If we look at the trading volumes from Binance and Coinbase, we can see that it is almost at the lowest level in the past two years. This also indicates that BTC has entered a "garbage time," which means slight fluctuations.

From the turnover data, short-term investors still dominate the turnover, but both turnover rate and trading volume are declining, indicating that investors' buying and selling sentiment has also entered garbage time.

It is important to note that we are still in an event-driven phase as the dominant factor for fluctuations. In other words, in the absence of changes in the macro background, events are the main reason for price increases and decreases.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。