Perhaps the article with the most memes among those that clarify the situation.

Written by: Alex Liu, Foresight News

Background Overview

Hyperliquid is a decentralized exchange built on its own Layer 1 blockchain, with its core business being perpetual contract trading, and platform governance is managed by a group of validators. The community's liquidity pool constitutes the so-called HLP treasury (this portion of liquidity acts as the counterparty for contracts), and the platform manages and safeguards the entire system's liquidity and risk exposure through the HLP treasury.

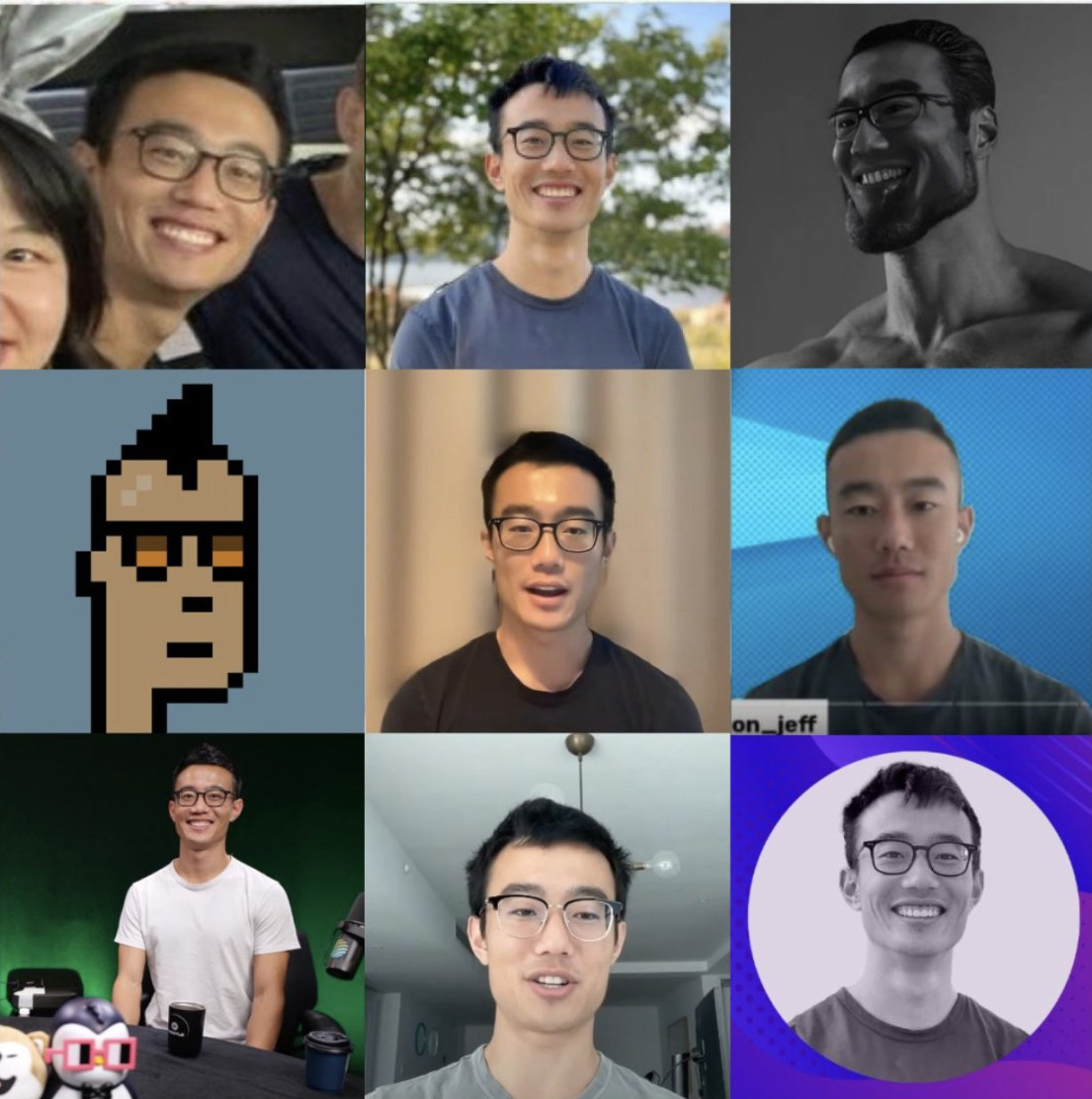

However, the current leading HYPE stakers and Hyperliquid validators are shown in the image below, indicating that the Hyper Foundation can completely dominate the platform's decision-making.

This incident originated from a memecoin called JELLYJELLY (abbreviated as JELLY), which was launched on the Solana chain by Venmo co-founder Iqram Magdon-Ismail. It once reached a market value of $250 million but later fell to tens of millions, approximately $10 million before the incident.

The market value of JELLYJELLY is extremely unstable, and its low liquidity makes its price susceptible to manipulation by large funds. Against this backdrop, on the evening of March 26, a trader executed a meticulously planned operation using market mechanisms, causing Hyperliquid's system to face unprecedented shocks.

Incident Progress: Manipulation, Forced Liquidation, and Platform Response

Trader Operations and Market Manipulation

On March 26, a trader established a short position worth approximately $6 million in JELLY on the Hyperliquid platform. Subsequently, he employed a series of market manipulation strategies: first, he purchased a large amount of JELLY tokens, deliberately driving up the spot price. At the same time, he executed a "remove margin" operation, triggering the platform's automatic liquidation mechanism, transferring his short position to the HLP treasury. Notably, during this process, another address (0x20e8fD36dcdEF8DfbB983B0bc06c658105b9a808) also established a long position and gained over $8 million in unrealized profits as the price surged.

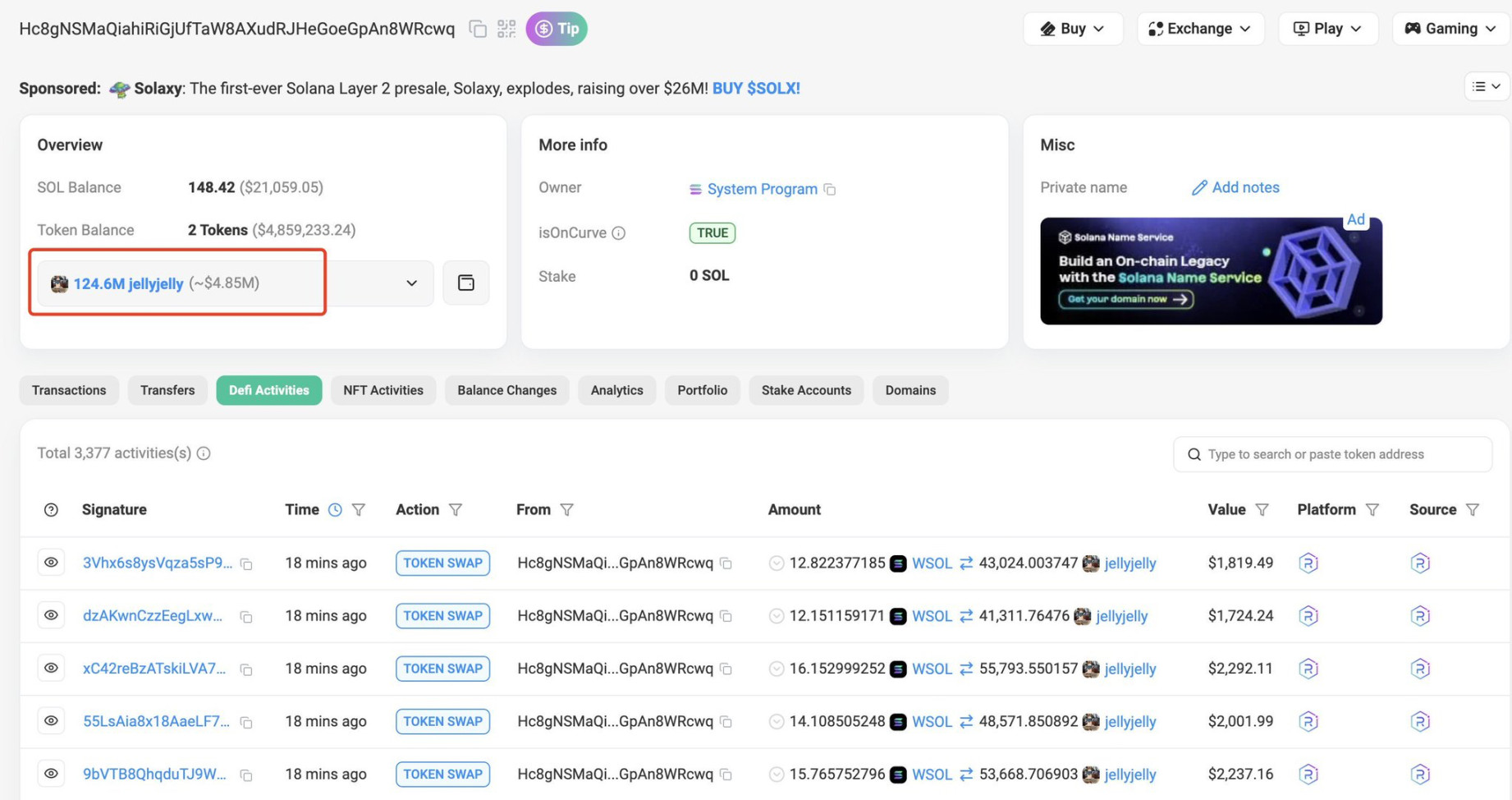

An address purchased a large amount of jellyjelly spot, causing the price to rise over 4 times.

This series of operations is a typical case of market manipulation. According to CoinDesk data, after the HLP treasury took over this position, it faced unrealized losses of up to $13.5 million as the price of JELLY continued to rise. If the price of JELLY continued to climb to higher levels, the Hyperliquid HLP treasury would face even greater pressure, potentially triggering a chain liquidation that could severely damage user assets in the HLP. If the worst-case scenario occurred, Hyperliquid would likely declare failure.

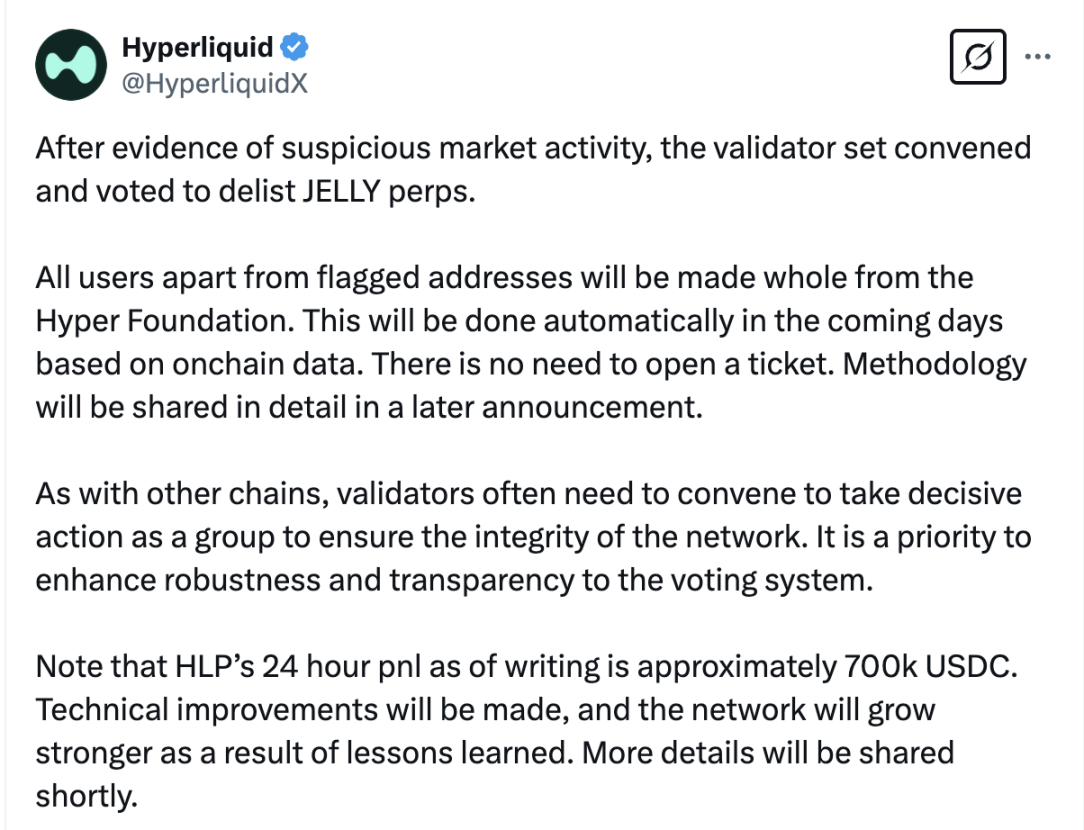

Platform's Emergency Response and Delisting Decision

Hyperliquid issued a statement: "After discovering evidence of suspicious market activity, we decided to delist the JELLY contract through a vote at the validators' meeting. All users, except for those marked as violating addresses, will be fully compensated by the Hyper Foundation. Compensation will be automatically executed based on on-chain data, without the need to submit a ticket, and specific methods will be detailed in subsequent announcements." In simple terms, unable to bear the loss, they pulled the plug. The decision to delist was, in fact, a rather centralized process.

The degree of centralization among Hyperliquid validators has been mentioned earlier, so let's bring back a well-known meme:

A well-known meme: The validators of Hyperliquid, depicted in various forms of Hyperliquid founder Jeff.

The announcement also mentioned that within 24 hours before the incident, the HLP treasury had made a profit of approximately $700,000 USDC, indicating that the overall financial situation remained relatively stable. Where did the previously mentioned over $10 million unrealized loss in HLP go?

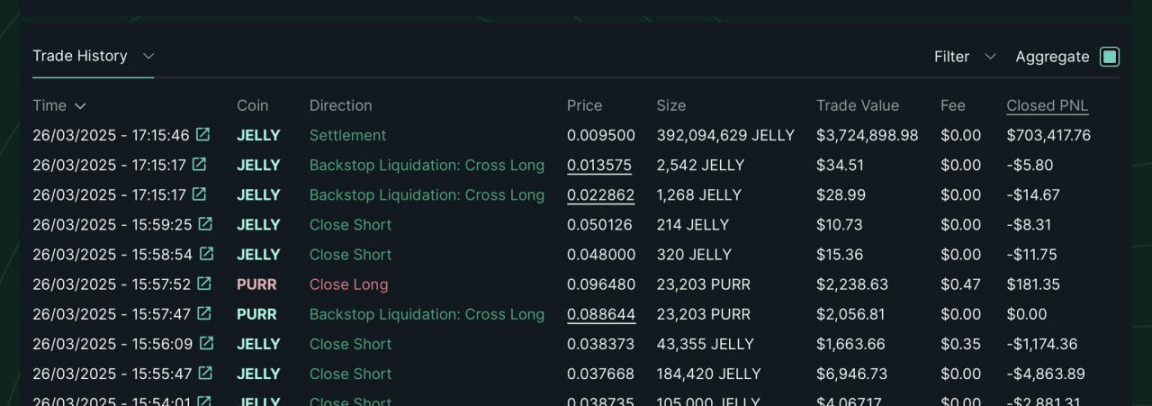

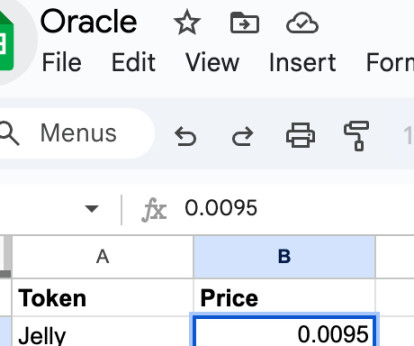

It turns out that despite the external oracle price being $0.05 at the time, Hyperliquid ultimately liquidated JELLY at a price of $0.0095, allowing the platform to gain approximately $700,000 in "unexpected profit."

The above image shows the community mocking Hyperliquid's centralized pricing of JELLY, likening it to manipulating Oracle prices like editing an Excel sheet.

Points of Controversy and Industry Reflection

Doubts About Decentralization and Neutral Decision-Making

The most striking aspect of this incident is the controversy surrounding the platform's governance method. As a trading platform that claims to be "decentralized," Hyperliquid quickly made the delisting decision through a so-called validators' meeting and voting mechanism, which some community members viewed as "centralized decision-making," contrary to the decentralized spirit promoted by DeFi. The blatant disregard for the oracle's custom liquidation price further highlights its centralized nature.

Arthur Hayes bluntly stated on X: "Let's stop pretending Hyperliquid is decentralized, and let's not pretend traders really care about that. I bet HYPE will soon return to square one because speculators will never stop their operations." This viewpoint sparked widespread discussion in the market regarding the platform's actual governance structure and decision-making transparency.

The Role of Binance and Other Centralized Platforms

Additionally, another point of controversy in the incident is the involvement of centralized exchanges. Before and after this incident, centralized platforms like Binance and OKX successively launched JELLY derivative contracts, leading some market participants to suspect whether there was coordinated attack or competitive strategy. Some believe that centralized platforms, leveraging their more robust risk control mechanisms and liquidity advantages, exert strong pressure on DeFi platforms, even using this opportunity to suppress competitors, thereby having a long-term impact on the overall market landscape. Although this point remains inconclusive, the underlying logic raises deep reflections on the future boundaries and competitive strategies between DeFi and CeFi.

Impact

Short-Term Impact: Financial Losses and Reputation Risks

In the short term, this incident dealt a double blow to Hyperliquid: on one hand, the platform was forced to take over massive loss positions due to the automatic liquidation mechanism. Although it ultimately achieved some profit through low-price liquidation, the systemic risk was clearly exposed; on the other hand, the platform's "centralized decision-making" approach raised users' doubts about its commitment to decentralization, leading to a rapid withdrawal of funds by some users. Data shows that within hours of the incident, the net outflow of the platform's stablecoin USDC reached $140 million.

Long-Term Outlook: An Inevitable Topic of Risk Management for DeFi Platforms

In the long run, the Hyperliquid-JELLY incident reveals the severe challenges DeFi platforms face in managing low liquidity assets, responding to market manipulation, and designing automated liquidation mechanisms. The incident exposed that even in a "permissionless" decentralized system, there remains a risk of exploitation due to algorithmic rule defects. In the future, the DeFi ecosystem needs to build stronger risk warning and governance frameworks to ensure efficient technical operation while protecting user interests in extreme market conditions. Additionally, how to appropriately introduce human intervention to prevent systemic risks while maintaining decentralized principles may become a key issue that the industry urgently needs to address.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。