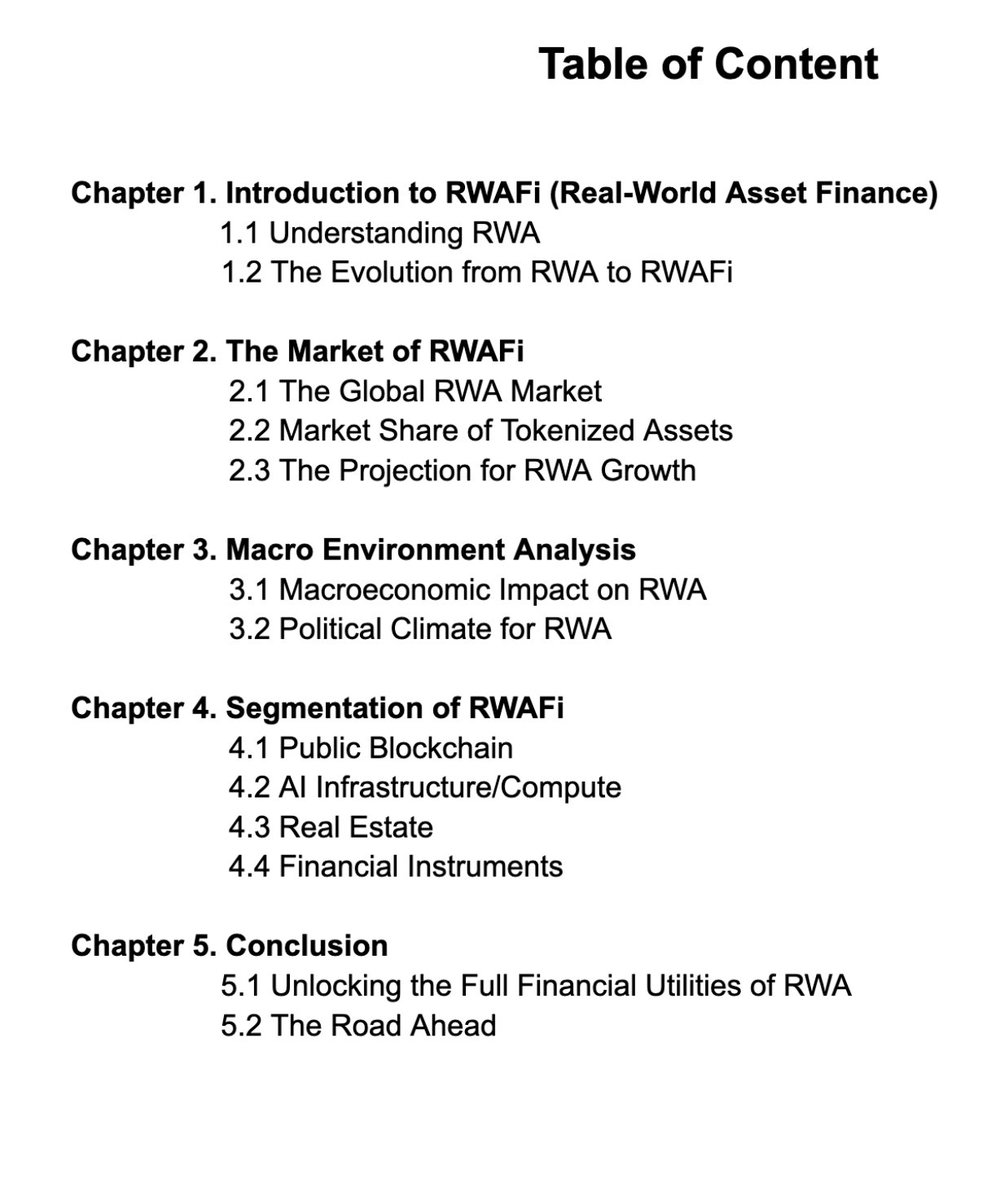

RWA is a long-term track that we are optimistic about in this cycle, and we have invested a lot of research into it. Today, I saw this RWA report co-authored by #Plume and #GAIB, which is very interesting. #RWAFI is a key link connecting traditional finance (TradFi) and decentralized finance (DeFi), and it will be very important in future financial markets! 🧐

1️⃣ Core Opportunities:

The market size potential of #RWAFI is enormous. Although the current on-chain RWA market is about $17.9 billion, it is still just the tip of the iceberg compared to the traditional asset market. The partial ownership model brought by tokenization lowers the entry barrier, allowing global investors to access high-value assets that were previously difficult to reach, such as commercial real estate or infrastructure projects. In addition, the efficiency of blockchain reduces intermediaries, speeds up settlement, and lowers transaction costs.

One of the most attractive aspects is yield generation. It is not just about the digital packaging of assets; more importantly, it allows these assets to become productive within the DeFi ecosystem. For example, using tokenized RWA as collateral to generate yield through liquidity pools, or even building a derivatives market, thus creating new strategies that surpass traditional yields.

2️⃣ Key Market Trends

Currently, tokenized U.S. Treasury bonds dominate (over 50%), with offerings like #Ondo Finance's OUSG tokenized Treasury bonds and USDY interest-bearing stablecoins catering to this demand. However, I am more focused on some emerging areas:

AI Computing (@gaib_ai): Tokenizing GPU computing power to make it an interest-bearing asset driven by AI demand, combining AI and crypto trends, with huge potential.

Public Chain Infrastructure (@plumenetwork): An L1 public chain specifically built for RWA, focusing on compliance and composability, laying the foundation for the RWA ecosystem.

Real Estate (@PropyInc): Automating real estate transaction processes using smart contracts, with a target market expected to reach $3 trillion by 2030.

3️⃣ Investment Strategies and Outlook

Although RWAFI faces regulatory uncertainties and macroeconomic challenges (such as rising interest rates), global policy trends are moving towards clearer regulations, creating conditions for institutional capital to enter the market.

We believe that the core value of #RWAFI lies in the integration of TradFi assets and DeFi innovations. We focus on the following investment directions:

Infrastructure Layer: Blockchain platforms like #Plume that support the RWAFI ecosystem.

Emerging Asset Classes: Projects like #GAIB that tokenize AI computing resources.

Integrated Platforms: Projects that can effectively integrate RWA yields into DeFi.

RWAFI effectively releases the financial utility of real-world assets, and its potential should not be overlooked. We have always been focused on projects with strong fundamentals, clear regulations, and true integration with the DeFi ecosystem. #Plume is a project we are very proud of in our RWA investment portfolio, and it is worth long-term attention and expectation! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。