🧐New Pendle pools are online, with a head mining APY of up to 500%! This article teaches you how to navigate the Berachain financial gold mine——

I really love Pendle——

In a time when there aren't many market hotspots, having a stable yield pool is quite a rare thing,

And you can also earn points from multiple projects at the same time, which is why whales prefer to manage their finances on Pendle.

Today, Pendle announced the launch of several new Berachain pools, and I jumped in right away; the APY is impressive, and the head mining is truly enticing!

After some research, there are a few ways to play——

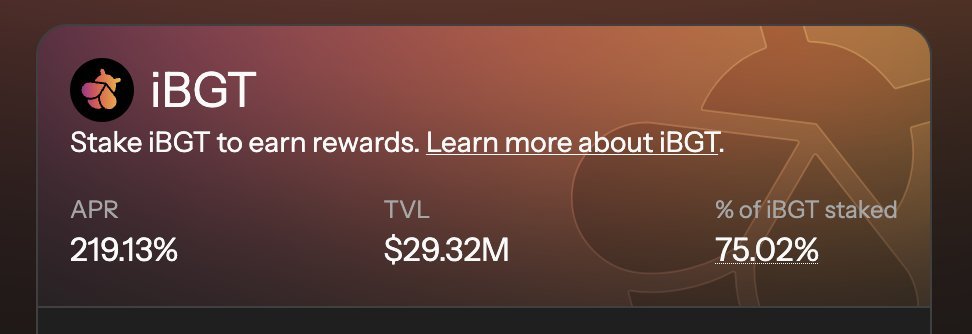

1️⃣ Focus on the head mining of @InfraredFinance's iBGT and iBERA

iBGT is the liquid version of Infrared's BGT, and iBERA is the liquid staking version of BERA.

1)PT iBGT: 90-day APY of 125%, meaning if you buy 100 iBGT now, you can get back 122 at maturity, with fixed interest and no risk to the principal.

2)YT strategy: When Implied APY > Underlying APY, it's suitable to buy YT and sell at the right time. However, YT carries the risk of value depreciation before maturity, so this strategy is more suitable for users who are bullish on BERA and BGT returns.

3)LP mining: LP = a certain amount of PT + iBGT/iBERA, you can earn PT returns + all underlying BGT/BERA returns + transaction fee sharing + $pendle rewards.

The annualized return of the LP pool is variable, but since it is a newly opened pool, the current APY is as high as 500%, which is the charm of head mining! Future annualized returns will fluctuate with TVL.

Additionally, both iBGT and iBERA holders of YT and LP can earn extra Infrared points.

Currently, iBGT's price performance is good, steadily rising this week from 7u to 11u, a 60% increase. If this momentum can be maintained, it would be like continuously mining a gold mine that keeps appreciating in Pendle, leading to even more substantial returns.

2️⃣ USDe, SUSDe from @ethena_labs, and eBTC from @EtherFi can also be layered into the BERA pool.

The returns you can earn:

1)sUSDe: 30x Sats points in ethena + native staking returns (ethena's fourth quarter has already started)

2)USDe: 50x Sats points in ethena

3)eBTC: Points boost from 6 projects (Babylon, Lombard, EtherFi, Symbiotic, Veda, Karak) + native staking returns

Summary——

If you are playing with stablecoins or prefer lazy finance, it’s very suitable to layer into the Pendle pool through ethena/etherfi, which will add about 5% annualized returns on top of the original basis, and you can also earn project points for airdrop opportunities.

If you are optimistic about Berachain and do not want to hold or sell BERA/BGT assets in the short term, you can opt for 90-day PT, YT, or LP. Long-term holders can choose PT, while short-term players and those who can handle high volatility can choose YT.

DeFi players looking to mine head can directly jump into LP; right now, head mining has low risk and high returns, and the earnings in one month may far exceed those in the following three months.

The financing background and amount of Berachain are unprecedented and explosive; it is essentially a DeFi chain with numerous earning opportunities in its ecosystem.

The launch of Pendle pools is a good attempt, and if it wants to expand its ecosystem in the future, it may introduce more liquid lockers, such as high-quality assets on Honeyjar and Origami, which could become part of the yield circulation on the bear chain DeFi chain.

In such a wealthy and resource-rich L1, those who enter first will be the ones who get full!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。