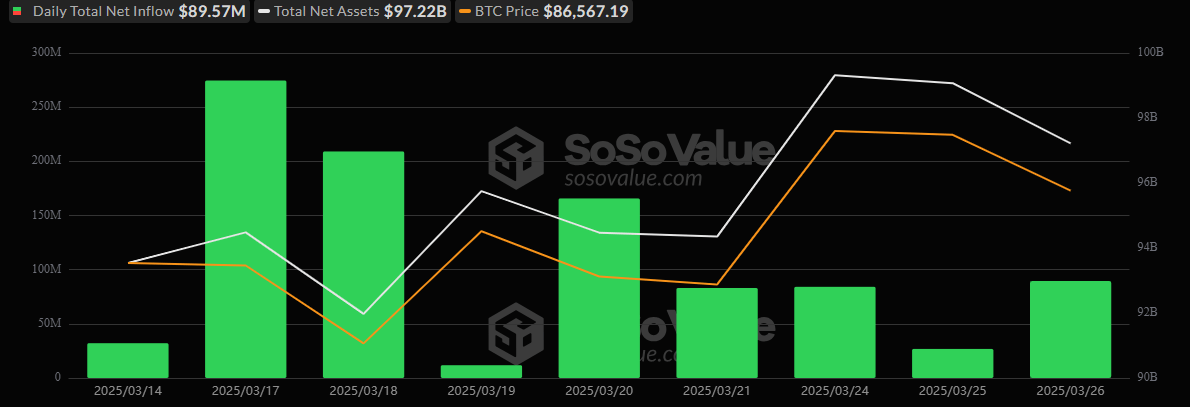

Bitcoin ETFs Mark 9 Consecutive Days of Inflows with $90 Million Fund Influx

Bitcoin ETFs continued their winning streak, securing a 9th straight day of inflows with an $89.57 million addition. Blackrock’s Ishares Bitcoin Trust (IBIT) was the sole recipient of new funds, attracting a substantial $107.89 million.

However, Bitwise’s BITB saw an $18.32 million exit, slightly dampening the day’s net inflow. The remaining ten bitcoin ETFs held steady with no activity. The total trading volume for bitcoin ETFs surged to $1.87 billion, reinforcing strong investor engagement. However, total net assets for bitcoin ETFs declined to $97.22 billion, a $1.78 billion dip from the previous day’s close.

Source: Sosovalue

Meanwhile, ether ETFs struggled once again, extending their outflow trend with a $5.89 million net loss. Grayscale’s ETH led the downturn with a $4.90 million outflow, while Fidelity’s FETH saw a smaller withdrawal of $996,090. As a result, total net assets for ether ETFs dipped below the $7 billion threshold, closing at $6.84 billion.

With bitcoin ETFs maintaining consistent inflows and ether ETFs facing persistent outflows, the divergence in investor sentiment remains evident, with investors fully inclined toward bitcoin at the moment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。