Michael Saylor, co-founder and executive chairman of software intelligence firm Microstrategy (Nasdaq: MSTR), which recently rebranded as Strategy, launched a poll on March 26 on social media platform X asking how much bitcoin Gamestop Corp. (NYSE: GME) would need to acquire in order to gain legitimacy among bitcoin enthusiasts.

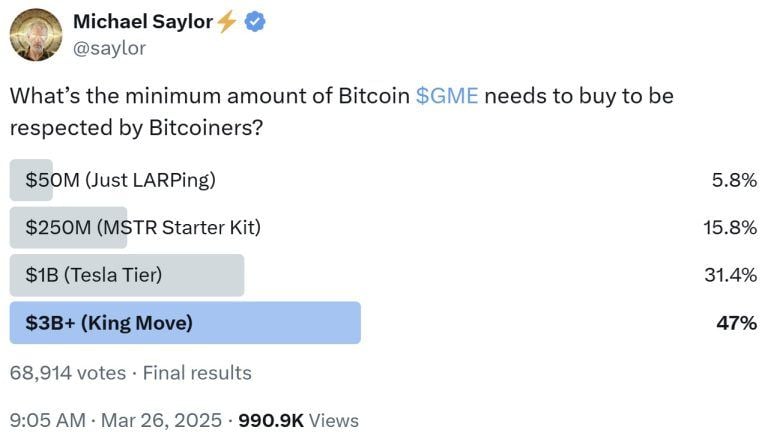

Saylor asked his 4.2 million followers how much bitcoin Gamestop would need to buy to gain credibility among bitcoin supporters. The 24-hour poll, which drew 68,914 votes, offered four escalating purchase tiers. The $3 billion-plus option, which Saylor called the “King Move,” led with 47% of the vote. The $1 billion “Tesla Tier” received 31.4%, indicating many see a billion-dollar investment as the threshold for corporate seriousness. The $250 million “MSTR Starter Kit,” referencing Microstrategy’s 2020 entry, garnered 15.8%, while just 5.8% backed the $50 million “Just LARPing” option. Saylor’s post attracted nearly 1 million views.

Gamestop announced its bitcoin strategy on March 25, revealing that its board of directors had “unanimously approved an update to its investment policy to add bitcoin as a treasury reserve asset.” The company stated that a portion of its current cash balance, along with proceeds from future capital raises, could be used to acquire BTC. “The company’s investment policy permits investments in certain cryptocurrency assets, including bitcoin and U.S. dollar-denominated stable coins.”

The following day, Gamestop said it would raise $1.3 billion via a private offering of convertible senior notes, with the option to issue an additional $200 million. “Gamestop expects to use the net proceeds from the offering for general corporate purposes, including the acquisition of bitcoin in a manner consistent with Gamestop’s Investment Policy,” the company detailed. On March 27, Gamestop’s stock experienced a significant decline of over 20% following the company’s announcement of a $1.3 billion convertible bond offering aimed at financing bitcoin acquisitions.

Meanwhile, Strategy has continued its aggressive bitcoin accumulation. On March 24, it disclosed the purchase of 6,911 BTC for $584.1 million at an average price of $84,529 per coin. Saylor stated that the company has achieved a year-to-date bitcoin yield of 7.7% in 2025. As of March 23, Strategy holds 506,137 BTC acquired for approximately $33.7 billion at an average price of $66,608 per coin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。