Original|Odaily Planet Daily (@OdailyChina)

On March 26, Gamestop announced the formal establishment of a BTC strategic reserve, and its stock price subsequently surged—after hours, it rose 5.5% compared to the closing price, reaching $26.80; as of the time of writing (March 27), its stock price had increased to $28.36, with a daily increase of 11.65%. After companies like Strategy and Metaplanet established their own "dual-flying wheel" of currency and stock with BTC strategic reserves, Gamestop, once a "retail meme stock," is also set to join the BTC strategic reserve camp. It must be said that, to some extent, this has become an inevitable trend and a reflection of public sentiment.

With the announcement made, this long-standing suspenseful event has finally come to a conclusion. Odaily Planet Daily will summarize Gamestop's establishment of a BTC strategic reserve in this article and explore the subsequent effects of cryptocurrency on the U.S. stock market.

A long-standing plot twist: Gamestop also has its own "crypto hero dream"

Reflecting on past crypto failures: Wallets, NFT markets, and Meme coins

It is worth mentioning that as a well-known retailer in the gaming sector, this is not Gamestop's first foray into the cryptocurrency industry. Previously, at the end of the NFT bull market in 2022, it launched the Gamestop Wallet and an NFT market, which saw trading volume exceed $22 million about a month after its official launch. However, with the cooling of the NFT market and the high-pressure regulatory environment in the U.S. at that time, Gamestop ultimately streamlined its cryptocurrency-related business team by the end of 2022 and suspended Gamestop Wallet operations in August 2023, with plans to cease NFT market operations in February 2024.

It can be said that traditional listed companies do not always have a smooth experience in the cryptocurrency industry, unlike companies such as Strategy and Metaplanet. Especially during the Biden administration in the U.S., regulatory agencies have been extremely strict regarding cryptocurrency-related businesses, coupled with the instability of business models and market performance, Gamestop's initial experience in crypto was not smooth.

Later, what brought Gamestop back into the spotlight was the return of Roaring Kitty, the soul figure who led retail investors in the battle against Wall Street shorts, in May 2024. At that time, the nationwide meme coin craze also brought massive attention to the similarly named meme coin, and Gamestop's stock surged accordingly, but it ultimately could not avoid the fate of most meme coins.

In October last year, due to GameStop posting a picture of a smiling dolphin on X platform, the related meme token miharu briefly surged past $0.01, leading to a wave of "zoo meme coin market," with more details available in “WAP, 🐬, 🧲, is the Meme coin PVP battle entering the Next Level?”.

Although Gamestop has thrived in the cryptocurrency industry and has deeply embraced the essence of memes, as a company rooted in physical game retail, it still faces challenges from the development of digital downloads and cloud gaming. GameStop CEO Ryan Cohen was previously fined $1 million by the U.S. Federal Trade Commission for violating antitrust laws due to his actions.

According to Gamestop's previously released financial report, in 2024, Gamestop's total net sales reached $3.823 billion, a decrease of about 27.5% from the previous fiscal year's $5.273 billion; however, net profit grew from $6.7 million in the previous fiscal year to $131.3 million. As of February 1, 2025, GameStop's cash and cash equivalents stood at approximately $4.77 billion, a significant increase from the previous year's $921.7 million. This growth is primarily attributed to its strategies in cost reduction and asset divestiture, including the completion of the divestiture of its Italian operations and the closure of its German store operations.

In other words, Gamestop urgently needs to find new growth points beyond cost reduction and efficiency improvement, which is a significant reason for their focus on BTC strategic reserves.

The current trend: BTC strategic reserves become a lifeline: Meeting with big shots to seek solutions

As early as February 2021, U.S. CNBC host Jim Cramer stated that Gamestop should buy Bitcoin. He suggested that GME could issue $1 billion in stock to purchase $1 billion in Bitcoin and then watch the stock rise to $430.

It must be said that the original answer had already been revealed, but at that time, Gamestop had not yet grasped it.

On February 7 of this year, Gamestop CEO Ryan Cohen met with MicroStrategy founder and executive chairman Michael Saylor, sparking market speculation that Gamestop was about to enter the BTC strategic reserve.

Interestingly, Cohen joined the Gamestop board after buying Gamestop stock.

The subsequent developments indeed confirmed this market speculation, and Gamestop's move also brought a considerable potential buying demand for BTC.

Gamestop's potential buying demand: $4.77 billion + $1.3 billion

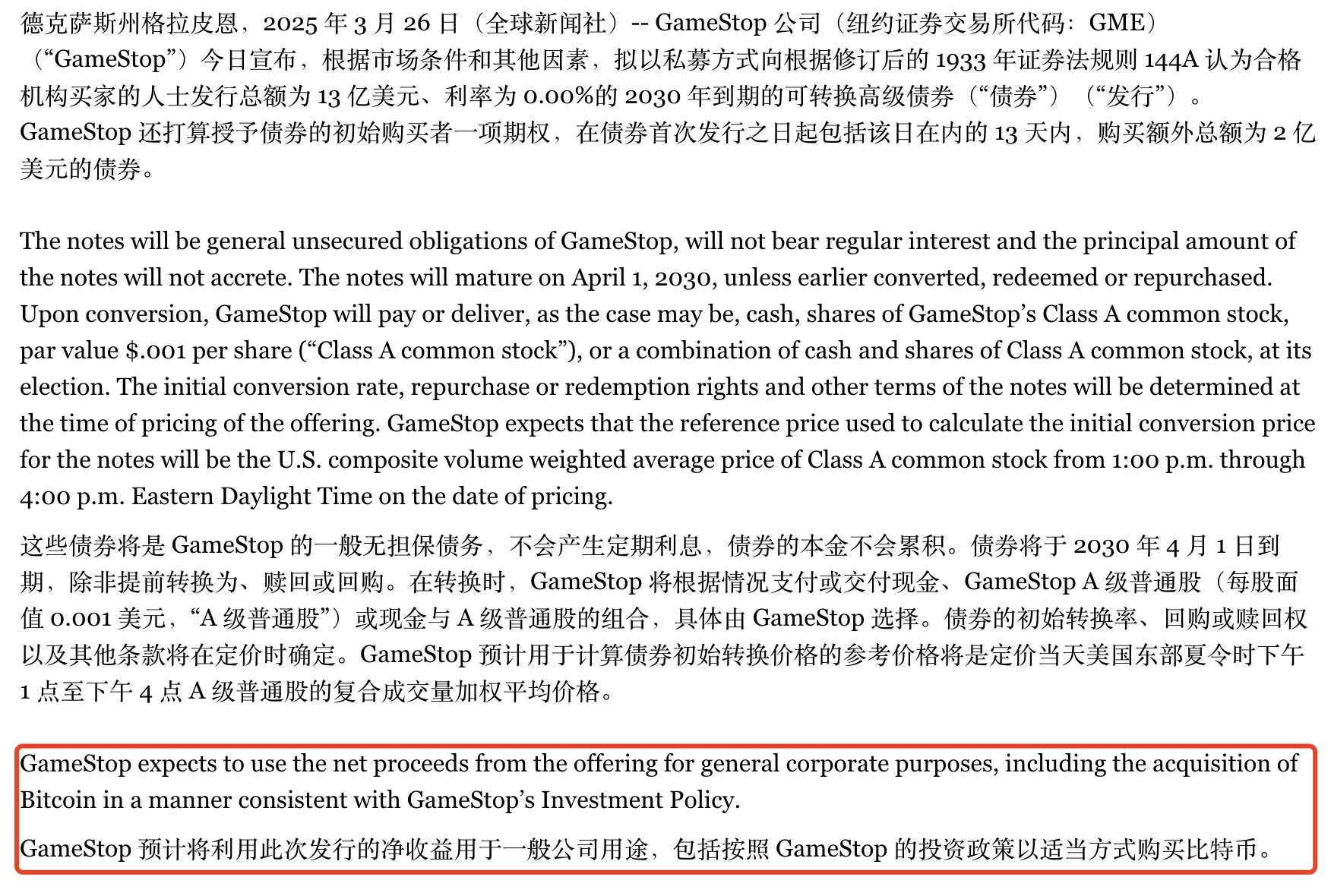

In addition to the existing $4.77 billion in cash and cash equivalents, Gamestop recently announced plans for a private placement of $1.3 billion in convertible senior notes, maturing in 2030; this will allow initial purchasers to buy notes totaling no more than $200 million. Furthermore, it emphasized that "the company intends to use the net proceeds from this offering for general corporate purposes, including acquiring Bitcoin in a manner consistent with GameStop's investment policy."

It is worth noting that as early as December 2023, Gamestop's board approved CEO Ryan Cohen to manage Gamestop's securities investment portfolio along with two independent board members and other necessary staff, and the decision to establish BTC strategic reserves was also unanimously approved by Gamestop's board.

Gamestop explicitly states that new revenue will be used to purchase BTC.

Aftermath: Some criticize, some support, but the possibility of selling BTC is not ruled out

On March 26, after Gamestop officially released the BTC reserve announcement, Strategy founder and CEO Michael Saylor immediately responded in the comments section: "A step in the right direction." He then posted: "Welcome to the Bitcoin camp."

Previously, ETF issuer Strive's CEO Matt Cole had written to GameStop Chairman and CEO Ryan Cohen on February 24, suggesting that GameStop redirect its nearly $5 billion cash reserve towards Bitcoin, transforming the company into "the top Bitcoin treasury company in the gaming industry." Cole stated that GameStop has significantly reduced its operating losses over the past two years and has generated interest income from cash obtained through equity financing to offset these deficits. However, the company's core challenge remains: the physical retail industry is in decline, and consumer preferences are shifting towards digital downloads. As an asset management company holding GameStop shares through exchange-traded funds, Strive believes GameStop has an "incredible opportunity" to change its financial future by becoming the Bitcoin treasury company in the gaming industry.

Saul Rejwan, managing partner of early cryptocurrency venture capital firm Masterkey, also believes that the role of Bitcoin as a corporate reserve asset is no longer marginalized; for companies looking to hedge against inflation, Bitcoin is becoming a viable option.

However, some have raised objections—Uber and Robinhood early investor Jason Calacanis questioned GameStop's Bitcoin reserve strategy, suggesting that this approach might just be a gimmick without a viable business model. He stated, "If you are a publicly traded company that can't come up with a business model, then just buy Bitcoin; if Strategy co-founder Michael Saylor wants to buy $1 trillion worth of Bitcoin, that might be a good suggestion." This implies that the business of Strategy is as insubstantial as air, with no business model other than purchasing BTC. In the eyes of these traditional investors, raising the company's stock price by buying BTC still seems quite radical.

Of course, Gamestop has not completely adopted Strategy's BTC reserve strategy—only buying and not selling— as revealed in its 10-K filing, Gamestop officially disclosed that "we have not set a limit on our Bitcoin holdings and may sell the Bitcoin we hold."

The dual effects of cryptocurrency and U.S. stocks: Tokenization of U.S. stocks and cryptocurrency U.S. stockification

It is foreseeable that as Gamestop joins the BTC strategic reserve camp, the trend of "U.S. stock tokenization," contrary to BTC ETFs and ETH ETFs, has gradually begun to emerge.

Looking at past cases of U.S. listed companies, countless public companies need to leverage BTC as an anti-inflation asset to preserve and increase the value of their assets; they can also use this to boost market profit expectations and thereby elevate their stock prices.

A new path for TradFi and DeFi: FundFi

Meanwhile, another manifestation of U.S. stock tokenization is "investment fund tokenization."

Previously, according to TokenFi disclosure, Ark Invest founder "Cathie Wood" is preparing to tokenize Ark Invest funds. While speaking at a digital asset summit in New York, she said, "We believe tokenization will be huge, and we hope to tokenize the ARKVX or the Digital Asset Revolution Fund."

Of course, compared to RWA asset tokenization, although the U.S. cryptocurrency regulatory environment has become more lenient with Trump's rise to power, this process still faces obstacles from U.S. regulations and laws.

The post-cryptocurrency IPO era after Coinbase: Kraken and eToro gearing up

Considering the imminent arrival of U.S. cryptocurrency IPOs on U.S. exchanges like Kraken and Israeli trading platform eToro, along with the certainty that many cryptocurrency ETFs are in the application process, perhaps one day in the future, cryptocurrencies will also be able to take the path of listing on U.S. stocks. At that time, the afterglow of ICOs may be replayed in the form of crypto IPOs.

Of course, perhaps when that day arrives, the decentralized space of cryptocurrencies will be further compressed; whether this is a blessing or a curse remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。