Every Morph Pay cardholder is writing the history of the next generation of Web3 payments.

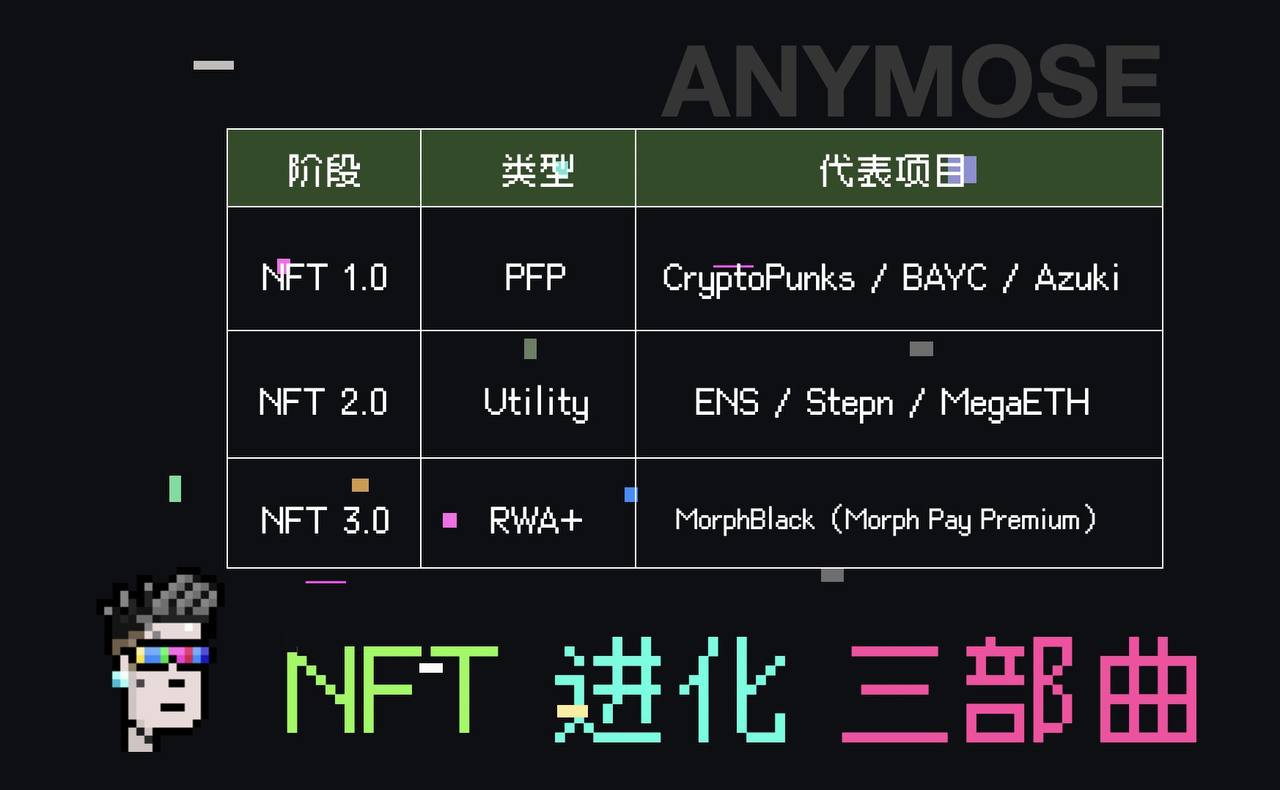

Each cycle of Crypto contains a narrative thread of decentralization, from the earliest ICOs, to the DeFi Summer of 2021, and now to the on-chain narratives of this cycle. Different asset issuance methods and changes in the financial rights landscape are profoundly influencing the development of Web3. At the Crypto Native level, NFTs have officially entered the 3.0 era; at the Web2 traffic entry level, the PayFi that connects traditional finance with the Web3 world is the next billion-level track that will change the world.

On February 25, the global consumer-grade public chain Morph, dedicated to promoting the large-scale adoption of Web3, officially launched Morph Pay, a comprehensive financial ecosystem that integrates Web2 banking infrastructure with Web3 decentralized financial yield capabilities. Morph Pay is not just a traditional Pay Card; it is a product of the era that has emerged under the RWA + NFT 3.0 wave.

This article will explore Morph Pay's rise in the PayFi track and the iterative logic of NFTs from 1.0 to 3.0.

PayFi, but not just PayFi

PayFi creates new financial primitives and product experiences based on the time value of money, creatively constructing forms of capital circulation in financial markets. It is estimated that the market size in the payment sector alone exceeds $40 trillion, while PayFi has only expanded into a small portion of that market. Conservatively, if PayFi can capture 10% of the global digital payment transaction total, the PayFi market size is expected to reach $180 billion by 2030.

One-click payment tool with 30% APY integration

The pain point in the payment sector lies in the cumbersome multi-party reviews and manual processes involved in traditional finance and funding supply chains. A simple remittance requires filling out complex application forms and waiting for manual approval from banks, while high remittance fees and processing costs make it difficult for traditional payments to benefit consumers.

From this perspective, Morph Pay addresses the challenges of traditional payments for users. Leveraging its platform-level advantages, Morph Pay will support multi-currency payment functions as well as Google Pay and Apple Pay, allowing for convenient cross-border payments with just a password.

As a payment product launched by the consumer-grade public chain Morph, Morph Pay will not only create a one-stop DeFi yield aggregation solution for users, supporting annualized returns on crypto asset deposits of up to 30%, but also allow users to automate operations through smart contracts, using DeFi yields directly for daily payments, achieving seamless integration of asset appreciation and payment scenarios. Additionally, users will be able to participate in exclusive ecosystem airdrops and incentive activities provided by Morph and its ecosystem partners, such as the rapidly developing BulbaSwap and Momodrome.

Buy Now Pay Never is no longer an empty promise painted on a PPT or an industry slogan.

High-end black card with large-scale Web2 application

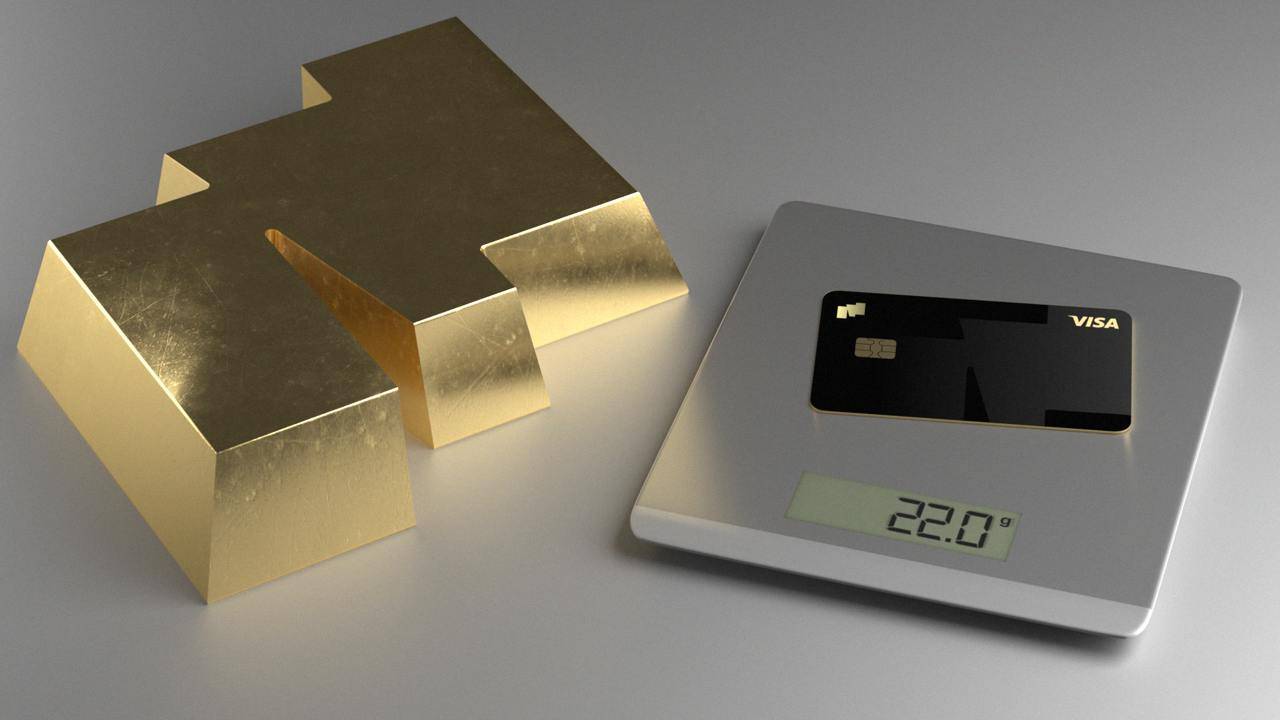

MorphBlack, as the flagship version of Morph Pay, is crafted from 22 grams of black gold material, creating a physical black card that combines financial tool and luxury attributes.

In traditional finance, black cards are often seen as symbols of wealth and status, representing that cardholders possess significant economic strength and social standing. For example, holders of the American Express Centurion Black Card are often political leaders, billionaires, and social elites. In China, customers holding black cards are also regarded as top clients of banks. The first black card for young people, Morph Black, has also "grandly" opened the door to high-end financial services in the crypto world: cardholders can enjoy invisible privileges such as global airport lounges and discounts at high-end hotels, as well as lifetime no annual fee, no lock-up restrictions, and instant fiat currency exchange services, providing users with a frictionless experience that truly realizes "crypto assets are available for immediate use."

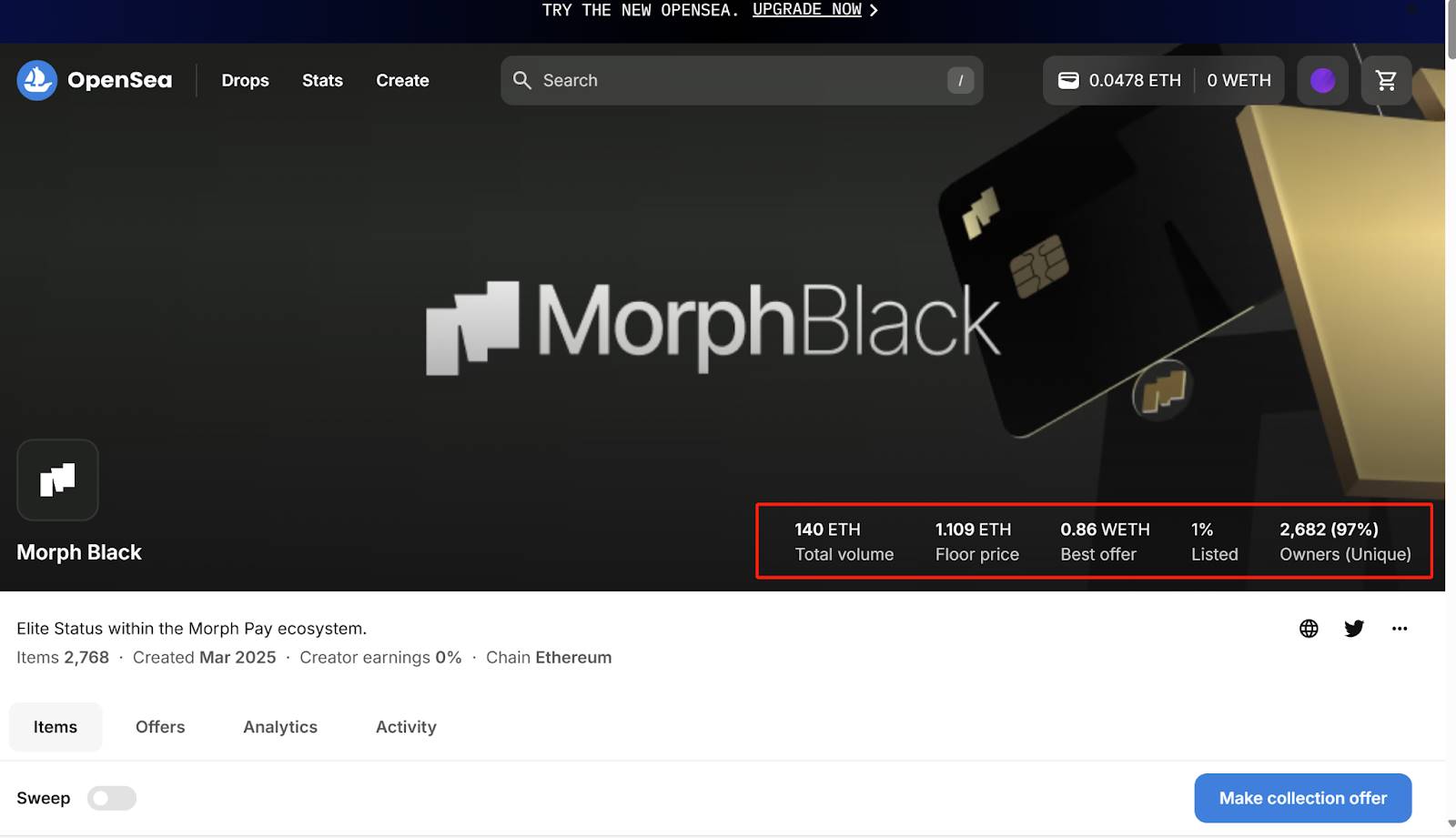

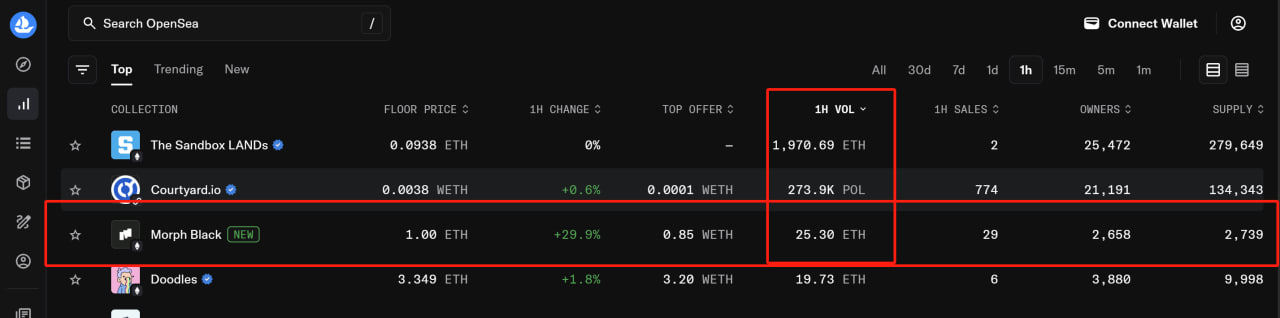

However, Morph Pay is not limited to reinventing the wheel in PayFi; while providing users with a better payment experience, the emergence of MorphBlack announces the official arrival of the NFT 3.0 era with a physical card.

Opening the future of financial infrastructure from NFT 3.0

In 2022, the NFT market experienced an unprecedented bubble burst. The plummeting prices of high-value NFTs like BAYC and Azuki led many to proclaim that "NFTs are dead," but the truth is far from what it seems. Just as Google and Amazon emerged after the internet bubble, the evolution of NFTs has never stopped; it is moving from "bubble frenzy" to "virtual-real symbiosis," and NFTs have not died; they have simply shed their extravagant exterior and evolved into a more resilient form. When MorphBlack materializes NFTs into a bank card, it changes not only the payment method but also the restructuring of financial structures between the digital and physical worlds.

Pre-NFT era: Awakening in the bubble

NFT 1.0 represents the gold and bubble of PFP avatars. In 2017, CryptoPunks ignited the first fire of NFTs with algorithmically generated pixel avatars; in 2021, BAYC sparked a frenzy with the social identity symbol of the "Ape Club." NFTs in this stage were purely "digital identity symbols," with people spending lavishly for artistic narratives and community belonging. However, when the market discovered the limited practical value of PFPs, the bubble burst dramatically.

NFT 2.0 represents "detaching from the real to the virtual, the awakening of utility." After the tide of PFPs receded, the industry began to explore endowing NFTs with more practical value, leading to the emergence of utility-based NFTs, marking the beginning of the NFT 2.0 era. For example, ENS domains are essentially built on the Ethereum ERC-721 standard, meaning each ENS domain is actually an NFT. This allows users to manage ENS domains like other NFTs, including buying and selling on NFT trading markets. Similarly, game item NFTs, like Stepn, have sparked a craze for running shoes, merging real-world actions with virtual economies and endowing NFTs with more practical attributes.

These reforms in NFTs continue to this day, with equity-based NFTs becoming mainstream. Katio grants NFT holders rights to airdrops and voting, while MegaETH cleverly utilizes SBT as an innovative financing solution in this cycle. NFTs in this stage began to carry actual functions, but their essence remained "online tools," failing to break through the boundaries of the digital world.

Post-NFT era: The "materialized existence" of NFTs

By 2025, with the advancement of Web3 compliance processes, the evolution of NFTs will reach a critical turning point: transitioning from NFT 2.0 to NFT 3.0. NFTs will deeply integrate with real-world assets (RWA), becoming a bridge connecting the physical economy. The revolutionary product marking this transition is Morph's launch of the world's first physical NFT bank card, Morph Black.

Morph Black integrates on-chain and off-chain rights. NFTs are no longer just small cards that can only blow financial bubbles on-chain; they are unique high-end digital identities that can be used for payments, consumption, and use in real-life scenarios. Morph Pay's move aligns perfectly with the era of RWA and PayFi.

From a vertical perspective, Morph Black integrates multiple Web3 Native rights.

(1) Holding a Morph Pay card automatically makes one a co-builder of the ecosystem, with priority access to potential airdrops from Morph and its ecosystem partners (such as BulbaSwap, Momodrome, etc.). According to the official tokenomics, 10% of ecosystem tokens will be specifically used to incentivize Pay users, meaning early participants will enjoy long-term dividends from the protocol's development.

(2) Morph Pay truly returns governance rights to the community. Cardholders can deeply participate in protocol development through proposal voting, parameter adjustments, and other means, such as deciding on airdrop distribution rules, yield pool weights, and other key matters. The model of cardholders as shareholders upgrades users from mere fund providers to co-builders of the ecosystem.

(3) Targeting high-net-worth users, the Morph Black card builds an underlying yield pool through institutional risk management protocols like Ethena/Huma, combined with liquidity subsidies and airdrop expectations from the Morph ecosystem, creating a compound yield engine with annualized returns of up to 30%. This model of low-risk base yields and ecological bonuses achieves returns that traditional finance finds hard to reach while ensuring fund safety.

From a horizontal perspective, Morph Black opens up a comprehensive financial ecosystem that integrates Web2 banking infrastructure with Web3 decentralized financial yield capabilities. Morph Pay supports withdrawals of up to $1 million USDT per transaction without review, completely solving the difficulties of liquidating large assets. At the same time, the Morph Pay team has also created an extreme rate and cashback system, with crypto-to-fiat exchange rates as low as 0.3% and 1% cashback on cross-border consumption, allowing digital assets to release real purchasing power in daily scenarios without fear of withdrawal troubles. Morph Black is one of the first to truly map RWA to on-chain rights and achieve real-world applications in the Web2 world, marking the accelerated arrival of NFT 3.0.

Conclusion

In the current PayFi track, traditional U cards essentially draw traffic from Web2 to Web3; they are fundamentally just savings cards that attract external traffic with high APY in Crypto. Morph Pay is the first true Web3 U card in a practical sense, integrating on-chain rights and the Morph ecosystem, bridging the gap from Crypto Native to real-world scenarios.

As a global consumer-grade public chain, Morph has not yet undergone TGE, and the Morph ecosystem is continuously improving. In the future, it will collaborate with more projects, financial institutions, and payment solutions to deepen the integration between Morph Pay and the Morph ecosystem, building broader application scenarios. The journey from PayFi to the involvement of NFT 3.0 is just the beginning; everything is still early. Here, every consumption is Buy Now Pay Never; here, every payment is a push towards the era of equity NFTs. In this deeply transformative era, Morph Pay will reshape the future Web3 financial landscape with the "soul weight" of 22 grams.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。