1. Market Observation

Keywords: Ghibli, ETH, BTC

Spot gold broke through $3070/oz during the Asian session on Friday, setting a new historical high, with an increase of over 16% year-to-date. New York futures gold surpassed $3100/oz. Several investment banks, including Goldman Sachs and JPMorgan Chase, have raised their gold price targets. Goldman Sachs believes that central bank gold purchases and inflows into gold ETFs are the main driving factors, while JPMorgan analysts predict that gold may challenge the $4000 mark in the future. Meanwhile, OpenAI's latest multimodal model, GPT-4o, has sparked a wave of remade MEME images in the style of Hayao Miyazaki's animations on social media, with its outstanding image generation capabilities, particularly in replicating Ghibli style, driving a rapid increase in the $Ghibli token.

In terms of market performance, Bitcoin and Ethereum have shown divergent trends. BTC ETFs have seen a stable inflow of $944.9 million since March 14, while ETH ETFs have experienced an outflow of $112.1 million during the same period, reflecting a clear divergence in institutional investors' attitudes towards the two major cryptocurrencies. On-chain data from Glassnode shows that since March 11, Bitcoin whales have accumulated over 129,000 BTC, marking the largest accumulation rate since late August 2024. Notably, QCP Capital analysts point out that despite GameStop's plan to raise $1.3 billion for BTC allocation, market sentiment remains subdued. From a valuation perspective, there is still significant growth potential in the cryptocurrency market. Analyst PlanB notes that compared to the $20 trillion gold market, Bitcoin's current $2 trillion market cap is clearly undervalued, especially considering Bitcoin's 120-year scarcity ratio (S2F) far exceeds gold's 60 years. Currently, the market prediction platform Polymarket expects Bitcoin's target price for 2025 to be $138,000, indicating about a 60% upside from the current price. Market participants believe BTC needs to hold key price areas to maintain a bull market, including the previous high of $73,800 and the peak of $69,000 in 2021. The "minimum price prediction" model created by network economist Timothy Peterson shows that BTC has a 95% chance of not falling below $69,000, while the annual average price of $76,000 is also seen as important support.

However, the uncertainty in the macroeconomic environment is bringing new challenges to the market. The U.S. core PCE price index year-on-year for the fourth quarter remains at 2.8%, with the final annualized GDP growth rate exceeding expectations at 2.4%, and unemployment claims dropping to 224,000, indicating that the economic fundamentals remain robust. However, Boston Fed President Collins warned that a new round of tariff measures could inevitably push inflation levels higher, suggesting that current interest rates should remain unchanged. Additionally, potential adjustments to trade policies by the Trump administration have introduced new uncertainties to the market, prompting investors to be more cautious in their decision-making and closely monitor policy trends and market changes. The market will focus on the U.S. PCE inflation data to be released tonight to further assess the health of the economy and the direction of Federal Reserve policy.

2. Key Data (As of March 28, 13:30 HKT)

Bitcoin: $86,192.01 (Year-to-date -7.91%), Daily Spot Trading Volume $23.855 billion

Ethereum: $1,924.41 (Year-to-date -42.28%), Daily Spot Trading Volume $14.935 billion

Fear and Greed Index: 44 (Neutral)

Average GAS: BTC 1.06 sat/vB, ETH 0.38 Gwei

Market Share: BTC 61.2%, ETH 8.3%

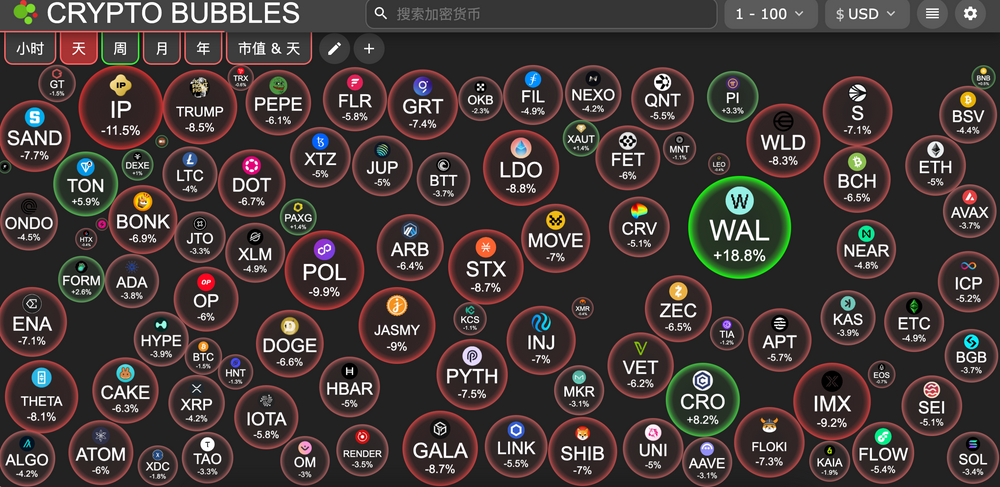

Upbit 24-hour Trading Volume Ranking: WAL, XRP, SAFE, ORCA, CARV

24-hour BTC Long/Short Ratio: 0.9712

Sector Performance: Meme sector down 6.88%, GameFi sector down 6.71%

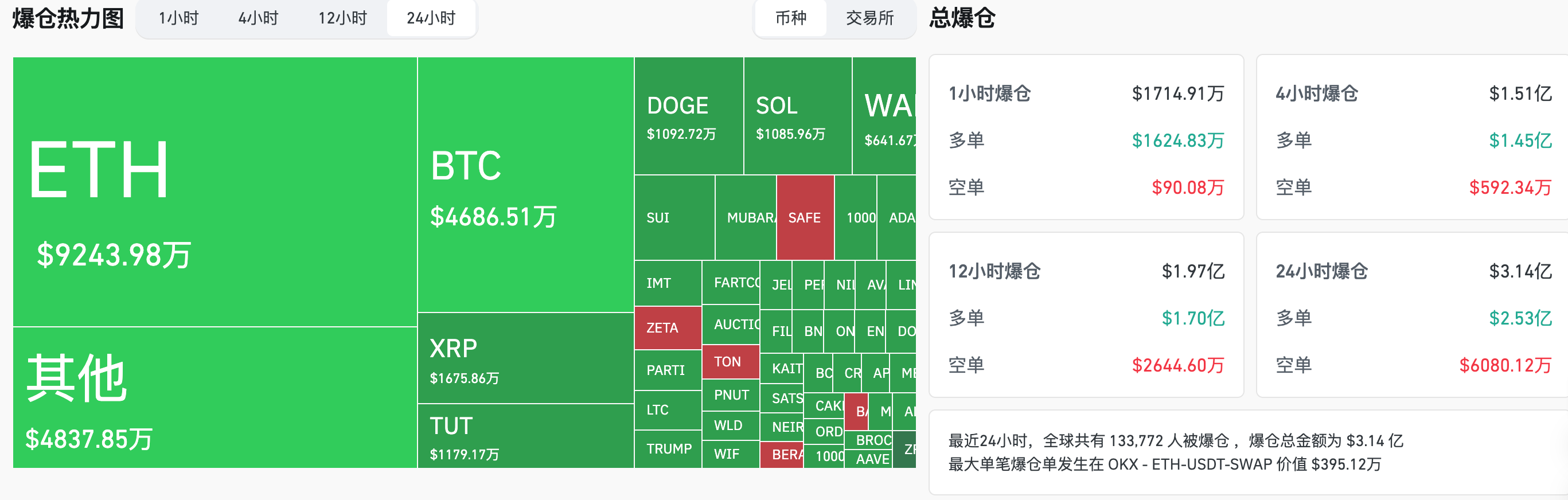

24-hour Liquidation Data: A total of 133,772 people were liquidated globally, with a total liquidation amount of $314 million, including $46.86 million in BTC liquidations and $92.43 million in ETH liquidations.

3. ETF Flows (As of March 27 EST)

Bitcoin ETF: $89.0638 million

Ethereum ETF: -$4.2159 million

4. Today's Outlook

21Shares plans to liquidate two Bitcoin futures and Ethereum positions around March 28

Binance's first voting for token listing ends, with 21 tokens included in the "voting" pool

U.S. February Core PCE Price Index Year-on-Year (March 28, 20:30)

- Actual: Not released / Previous: 2.6% / Expected: 2.7%

Today's Top 500 Market Cap Gainers: CRO up 7.99%, ORCA up 7.11%, TON up 5.64%, FORM up 2.93%, BERA up 1.73%.

5. Hot News

Binance Alpha has Launched GhibliCZ (Ghibli) and Ghiblification (Ghibli)

Arthur Hayes: April Will Be a Turning Point for the Market, Global Liquidity Will Erupt Again

Ethereum Testnet Pectra Tentatively Set to Launch on Mainnet on April 30

Ethereum L2 Network Corn, Focused on Bitcoin DeFi, Launches Airdrop Query Page

Glassnode: Since March 11, Bitcoin Whales Have Accumulated Over 129,000 BTC

Incoming SEC Chair Paul Atkins Holds $6 Million in Crypto-Related Assets

QCP Capital: The Market Generally Lacks Short-Term Optimism, Upside Potential Will Remain Limited

Deribit: Over $14.3 Billion in BTC and ETH Options Will Expire in Q1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。