The paths that are too comfortable for people are all downhill; the easiest walks are all with the wind. However, a zoo cannot raise a thousand-mile horse, and a well cannot produce a soaring dragon. What you ultimately become largely depends on whether you choose to run against the wind or just slide down the slope. The word 'effort' is too ordinary, but effort will make your life extraordinary.

Yesterday's market ultimately failed to show a clear direction. After a round of up-and-down pinning in the evening, it once again fluctuated above 87,000. However, from yesterday's trend, the market's direction is still bearish, with the lows starting to move downwards. Although the strength has not yet increased, the continuous high-level fluctuations indicate a clearer demand for the market to seek support further down. In terms of operations, the lowest point yesterday was around 85,800. Recently, we have mostly been in short positions, including the previous shorts at 86,000, 87,300, and yesterday's 87,500. The entire layout is already in place; now we just need to wait for the bearish strength to emerge!

On the chart, the four-hour 12 o'clock line change is below the upward trend line, followed by a direct drop. Currently, the market is around 86,000. From the perspective of the cycle structure, there are quite obvious bearish signs in the short-term market. The moving averages are starting to run down from the initial convergence, and the K-line is closing in the red. If the lows continue to refresh, it will establish a short-term bearish situation. In terms of technical indicators, the MACD shows a further increase in the bearish cycle, with the fast and slow lines running down from the zero axis, and other indicators are diverging downwards. Essentially, the current market structure is dominated by bears and is in a downtrend. The current resistance on the four-hour level is around 87,200, with short-term support at 85,000 and key support at 83,000-84,000.

Today is Friday, and with the end of the month and week approaching, these are critical time points. Recently, there has been ongoing discussion about tariff issues, which can be considered the main bearish influence at present. According to the previous stance of the old special on tariffs, April 2 will be the final implementation of the tariff policy. Affected by the news, it is highly likely that the market will first drop, just enough to clear out the bullish liquidity below, and after the bearish news is exhausted, a new round of market trends may begin.

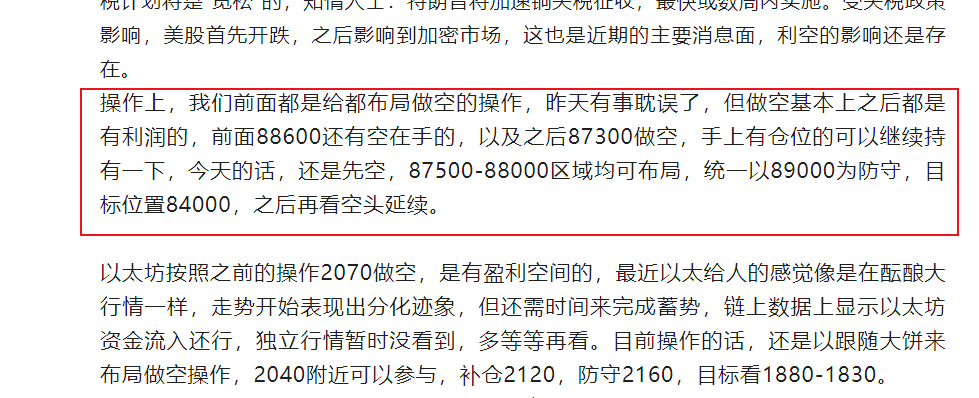

In terms of operations, there is really not much to say. The market has been like this for the past few days, and all our layouts are short, with very good entry positions provided. Now that the market is initially dropping, it is time for us to reap the rewards of our short positions, holding onto shorts and waiting for the target of 83,000-84,000 to arrive. If there is an opportunity around 87,000 today, we can participate in the layout again. A low buy below 84,000 may have a chance for a rebound, but it can only be a very short-term trade. We will operate based on real-time market trends at that time.

As for Ethereum, there is no need to say much. We have also been shorting, and the short position around 2,070 has now gained about a hundred points. Yesterday, we entered short again near the highest position close to 2,024, and those who entered short are also in profit now. Ethereum's performance is indeed puzzling; many whale accounts have been continuously buying ETH recently, but Ethereum's trend just cannot rise. It is uncertain when we will see an independent Ethereum market. For today's operations, those who are still holding shorts should continue to hold. If it reaches around 1,980, we can participate again, targeting 1,850-1,800.

【The above analysis and strategies are for reference only. Please bear the risk yourself. The article is subject to review and publication, and market changes are real-time. The information may be delayed, and strategies may not be timely. Specific operations should be based on real-time strategies. Feel free to contact us for market discussions.】

Scan to follow

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。