Author: Nancy, PANews

In the world of cryptocurrency, a "money printer" is operating with astonishing efficiency: the stablecoin giant Tether. This company, supported by a team of just over a hundred people, serves hundreds of millions of users globally and generates profits in the hundreds of billions of dollars. The driving force behind all this is Giancarlo Devasini, who has not only made a remarkable transition from plastic surgeon to a key player in crypto finance but has also led Tether from marginal innovation to the center of the global financial stage through strategic planning.

Today, Tether not only firmly holds the throne of stablecoin supremacy but is also ambitiously expanding into diverse fields such as mining, media, and agriculture through significant investments, initiating a bold global expansion campaign.

A team of a hundred earns billions in profit, the seventh largest buyer of U.S. Treasury bonds

As the world's largest stablecoin issuer, Tether has transformed from a niche financial experiment into a giant in the crypto industry, demonstrating remarkable profitability and market influence.

Over the past decade, Tether's publicly disclosed net profit has reached hundreds of billions of dollars. Although Tether lacked detailed financial data during its early development stages, the company began to fully disclose financial reports in 2022 to enhance transparency. According to comprehensive public data, Tether's cumulative net profit reached at least $19.9 billion in just over two years from the fourth quarter of 2022 to the end of 2024.

In particular, in 2024, Tether achieved over $13 billion in total profit with a streamlined team of only about 150 employees, which translates to an average profit of approximately $93 million per employee, making it one of the highest per capita profit companies globally, far surpassing traditional financial giants like BlackRock, and even rivaling Visa in trading volume.

From the perspective of profit composition, U.S. Treasury bonds are undoubtedly Tether's core profit engine. Since the Federal Reserve began raising interest rates in 2022, Tether has invested a significant amount of reserve funds into U.S. Treasury bonds, gradually becoming one of the major buyers of these bonds. In 2024 alone, Tether purchased $33.1 billion in U.S. Treasury bonds, making it the seventh largest holder, surpassing countries like Canada, Mexico, Norway, South Korea, Germany, and Saudi Arabia. As of the quarterly reserve report at the end of December last year, Tether held a total value of $94 billion in U.S. Treasury bonds.

In addition to asset allocation, the widespread adoption of the stablecoin USDT is also a crucial pillar for Tether's profit capture. As a dollar-pegged digital asset, USDT not only transcends the limitations of traditional financial instruments in functionality but also plays multiple roles in global financial transactions: in high-inflation countries like Venezuela and Turkey, USDT has become the preferred tool for residents to combat currency devaluation and evade capital controls, providing a safe haven for people in economically turbulent regions. In some restricted markets and gray areas, USDT serves as a flexible and hard-to-trace financial medium.

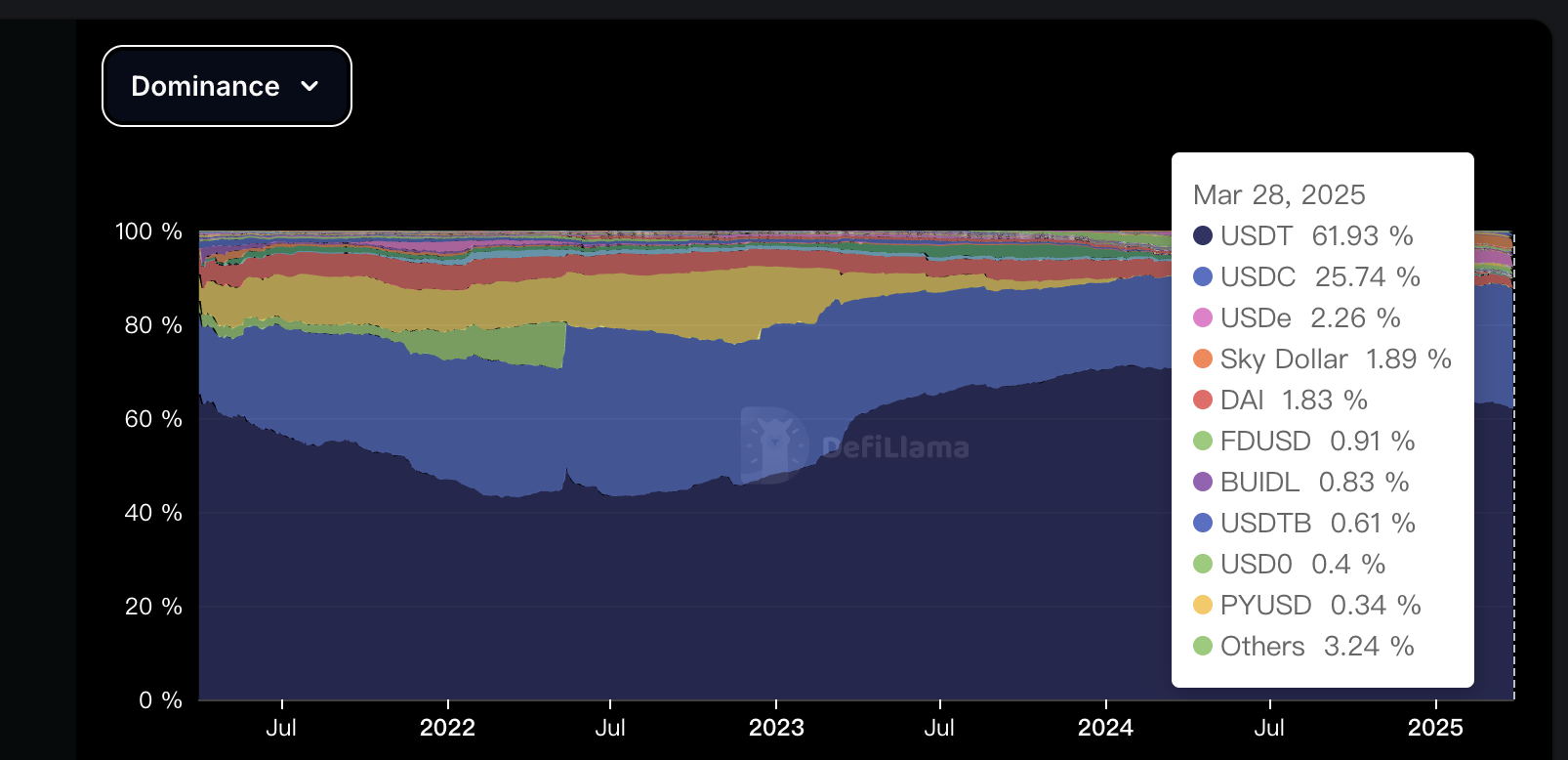

Currently, USDT dominates the global stablecoin market, becoming the most widely used stablecoin. According to DeFiLlama data, as of March 28, 2025, the issuance scale of USDT has exceeded $143.7 billion, with a market capitalization of over $144.8 billion, accounting for approximately 61.9% of the stablecoin market. Furthermore, Tether CEO Paolo Ardoino revealed that the number of USDT users globally is conservatively estimated to have surpassed 400 million, with rapid growth expected to reach 1 billion soon.

From behind the scenes to the forefront, the actual helmsman was once an Italian plastic surgeon

The mastermind and actual helmsman behind this largest crypto money printer is recognized as Tether's former CFO, Devasini. According to Forbes, Devasini holds 47% of the shares, making him Tether's largest shareholder, with a net worth of $9.2 billion. However, this core figure of Tether maintains a low-profile life in Lugano, Switzerland, the Bitcoin hub, rarely giving interviews, and even stating on his business card, "No title, no job, nothing."

Devasini's journey is quite legendary. According to previous reports by The Wall Street Journal, Giancarlo Devasini, born in Turin, Italy, was initially a plastic surgeon before venturing into the electronic product import business in Hong Kong. In 1995, Italian prosecutors accused him of being involved in a software piracy ring, committing fraud. Subsequently, Devasini founded a tech company, Solo, in Italy, which once had annual revenues exceeding 100 million euros before he sold it just before the 2008 financial crisis. Now, this approximately 60-year-old Italian has become one of the core figures in crypto finance.

This all began in 2012 when the Bitcoin white paper ignited Devasini's interest in cryptocurrency. He even posted on a Bitcoin forum asking if anyone would be willing to buy DVDs or CDs for 0.01 Bitcoin each (then about 11 cents), promising free delivery for bulk orders.

During that time, Devasini also met Bitfinex founder Raphael Nicolle. With his rich business experience and connections, he established key banking relationships for Bitfinex, promoting the platform's internationalization, including relocating its registration to the British Virgin Islands and setting its headquarters in Hong Kong, gradually becoming a core figure at Bitfinex. In 2014, he co-founded Tether with Bitfinex executives and launched USDT.

Devasini is deeply involved in Tether's issuance decisions and fund management, playing a key role in collaborations with major clients. For example, Alameda Research once applied for and received billions of dollars in USDT support from Tether, with Devasini being considered the driving force behind it. Bloomberg cited chat records submitted by former Alameda CEO Caroline Ellison, showing that Devasini told Alameda traders, "We are one big family… We will conquer the world." FTX founder SBF also publicly supported Devasini, stating, "Devasini is very proud of the business he has built at Bitfinex and Tether. He responds around the clock, not just to crises or incredible opportunities, but also to daily operations. Those who criticize Tether 'without reason' seem reckless."

Additionally, reports indicate that Devasini actively seeks political allies to secure regulatory "protection" for Tether. The Wall Street Journal previously reported that Devasini privately stated last year that Howard Lutnick, chairman of Cantor Fitzgerald and U.S. Secretary of Commerce, would use his political influence to mitigate the threats facing Tether. U.S. Senator Elizabeth Warren also pressured Lutnick during his nomination period to clarify his relationship with Tether. It is worth noting that Cantor manages part of Tether's reserves and holds a 5% ownership stake. However, Tether denied market claims regarding Lutnick's influence on regulatory actions.

Now, Tether is expanding at an astonishing pace, and Devasini is stepping from behind the scenes to the strategic forefront, transitioning to the role of group chairman, focusing on macroeconomic strategy, aiming to deepen USDT's application in global digital assets.

Accelerating diversification strategy, heavy investments in mining and media

In the context of tightening regulations and increasing market competition, Tether is weaving a cross-industry business network through diversified investments.

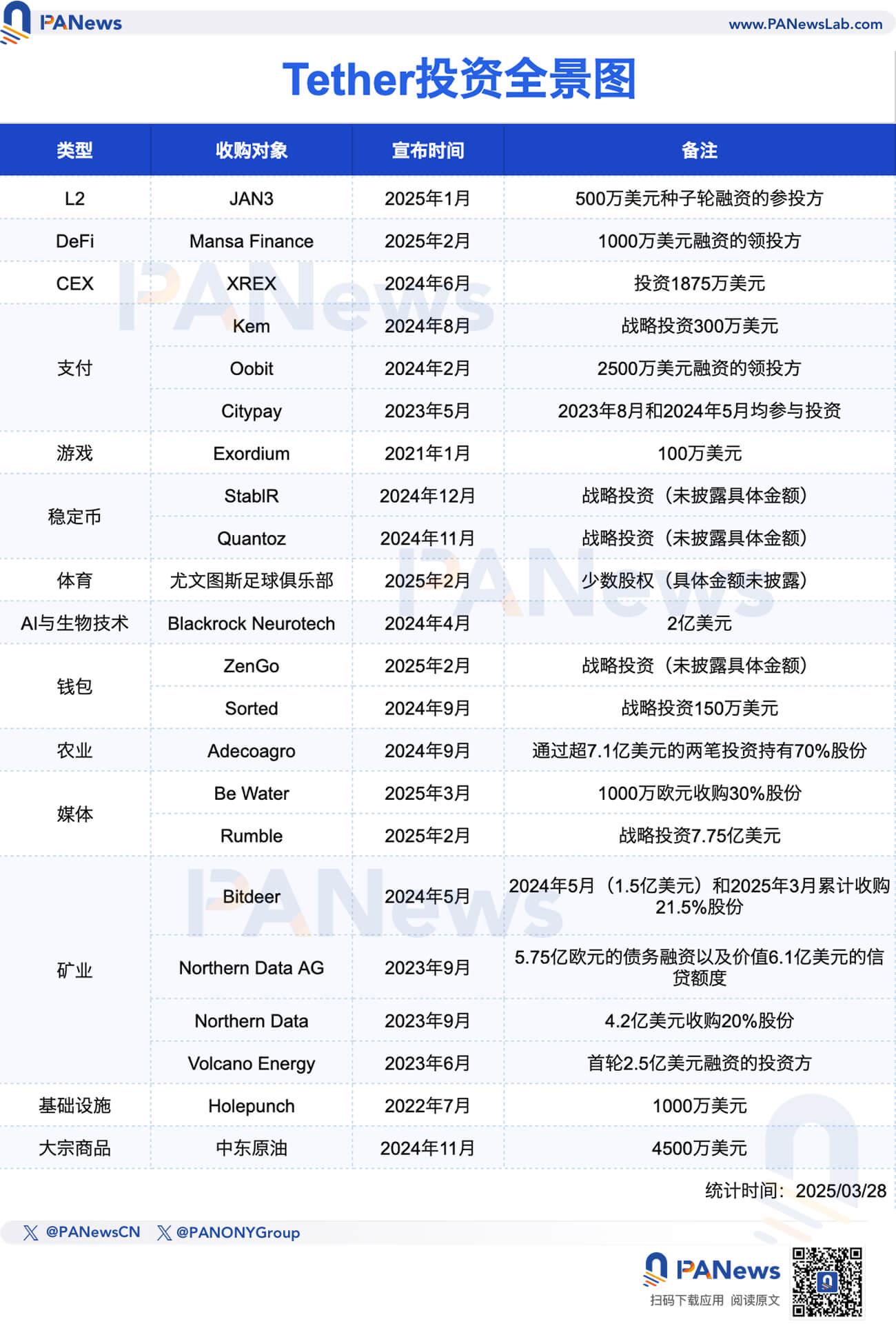

According to incomplete statistics from PANews, since 2021, Tether has publicly disclosed a total of 22 investment projects spanning various fields including crypto, media, sports, agriculture, commodities, and biotechnology. Among these, the crypto sector is Tether's core investment direction, particularly in mining, payments, stablecoins, and wallets, which account for more than half of the total investment count.

In terms of funding scale, Tether's investments in mining are the most generous, with a cumulative investment exceeding $2.1 billion, far surpassing other sectors. The largest single investment was in the German mining company Northern Data AG, where Tether provided $575 million in debt financing and a $610 million credit line. Volcano Energy, Northern Data, and Bitdeer also received hundreds of millions in investments. Following that is the media industry, where Tether's total investment reached $780 million, the vast majority of which was directed towards Rumble ($775 million). PANews previously reported that this substantial investment has strong political implications, resembling a business backed by Trump, as Rumble has close ties to former U.S. President Trump and has even been referred to as a "Trump concept stock," with U.S. Vice President J.D. Vance's venture capital fund Narya Capital Management also participating in Rumble's investment. In the agriculture sector, Tether holds up to 70% of Argentine agricultural giant Adecoagro through two investments, totaling over $710 million. Additionally, Tether acquired a majority stake in biotechnology company Blackrock Neurotech for $200 million, with a valuation of $350 million.

From a temporal perspective, from 2021 to September 2024, Tether primarily focused on crypto construction, especially in mining and payment directions. After that, its investment pace significantly accelerated, and its strategic direction became increasingly diversified, expanding from a single field to a global layout across multiple industries.

Although Tether has successfully built a powerful crypto business empire through diversified investments and its dominant position in the stablecoin market, as the crypto market matures and the regulatory environment continues to evolve, Tether will face more complex challenges in the future, which will depend on how it balances innovation, compliance, and expansion in the unpredictable global stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。