Risk Market and Bitcoin March Summary, April Outlook

First, the conclusion: The second quarter may be more challenging compared to the first quarter. Inflation, tariffs, the Federal Reserve maintaining interest rates, and Japan's interest rate hike may all impact the risk market. However, setbacks often coexist with opportunities, and the market will still have chances under certain conditions.

正文开始

A. Dot Plot

The most important event in March from a macro perspective was the Federal Reserve's interest rate meeting. At that time, the market expected three rate cuts and a pause or halt in balance sheet reduction. However, since the first rate cut in 2022, the market has never won in its game against the Federal Reserve, and this time was no different.

The signals from the two rate cuts projected for 2025 and 2026 are as follows:

Inflation remains stubborn, and the Federal Reserve has not yet seen a path to bring inflation back to 2%.

The economy remains robust, with no expectation of entering a recession.

Starting with inflation, Powell has previously stated that it is not necessary for inflation to reach 2% before rate cuts can occur; rather, a visible path to 2% inflation is required for rate cuts. In simpler terms, as long as inflation is on a sustained decline, the Federal Reserve will have the motivation to cut rates. However, the current reality shows that, on one hand, without tariff issues, the core PCE, which the Federal Reserve is most concerned about, does not show a clear downward trend.

The decline that started last night and continues to the present is a reaction to the core PCE, with the market expecting a slight increase in core PCE. This also confirms the Federal Reserve's expectations regarding inflation; currently, there is no clear indication that inflation will necessarily decline, not to mention the tariff issue.

Powell has also repeatedly stated that if tariffs are one-time, their impact on inflation will not be significant, as one-time tariff impacts are also short-term and will inevitably recover. However, whether tariffs are one-time is something even Powell and the Federal Reserve do not know. Almost no one can predict when Trump will do what, so the threat of tariffs to inflation is also a reason the Federal Reserve is hesitant to cut rates.

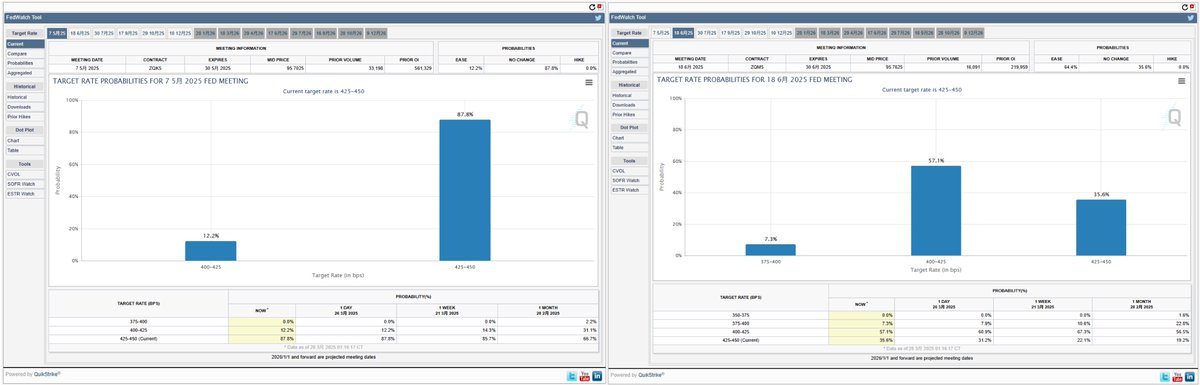

The new tariff policy will take effect on April 2, and it will not be until May that we can see April's inflation data. This means that there is almost no possibility of rate cuts in the first half of the year, as the Federal Reserve needs to observe more data to assess the impact of tariffs on inflation. Therefore, unless there are no adjustments to tariffs, it is highly likely that there will be no rate adjustments in the two interest rate meetings in the second quarter.

This means that in the interest rate domain, there are almost no expected positive factors in the second quarter.

B. Balance Sheet Reduction

In the March interest rate meeting, changes were also made to the balance sheet reduction, but it was not a pause or stop; rather, the scale of the reduction was lowered from $25 billion to $5 billion per month. The main reason for reducing the scale is to extend the duration of the balance sheet reduction, thereby continuing to advance monetary tightening policy in a more moderate manner. This also reveals the Federal Reserve's conservative and controlled approach to tightening liquidity.

Although the slowdown in the pace of balance sheet reduction may superficially seem to alleviate the "bloodletting" pressure on the market, the balance sheet reduction policy itself has not changed; it has merely shifted from "fast withdrawal" to "slow withdrawal." Therefore, the relief effect on market liquidity is very limited and cannot be seen as a true shift or easing signal.

C. Conclusion

From the perspective of the Federal Reserve's monetary policy, the challenges faced in the second quarter may be more severe than those in the first quarter. Inflation and non-farm data in the second quarter will still be very important, especially starting in May, as inflation data will relate to whether the dot plot changes in June.

Even if Trump starts calling for the Federal Reserve to lower interest rates, if the inflation issue cannot be resolved or if there is no expectation of an economic recession, the probability that the Federal Reserve will choose to continue observing data remains the highest.

Next, let's talk about the economy.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。