The core PCE price index, which excludes volatile food and energy costs, pushed the annual inflation rate to 2.8%, remaining stubbornly above the Fed’s 2% target. Overall, PCE prices rose 0.3% for the month and 2.5% year-over-year, driven by persistent increases in services and goods costs, including health care, financial services, and recreational goods. The data shows ongoing inflationary pressures complicating the central bank’s path to rate cuts.

Consumer spending, a key driver of economic activity, grew just 0.4% in February to $87.8 billion, below analyst projections. Gains were led by spending on goods ($56.3 billion), particularly motor vehicles and recreational items, while services outlays rose $31.5 billion. However, declines in food services, accommodations, and gasoline spending offset some growth. Real PCE, adjusted for inflation, inched up 0.1%, signaling weaker demand amid elevated prices.

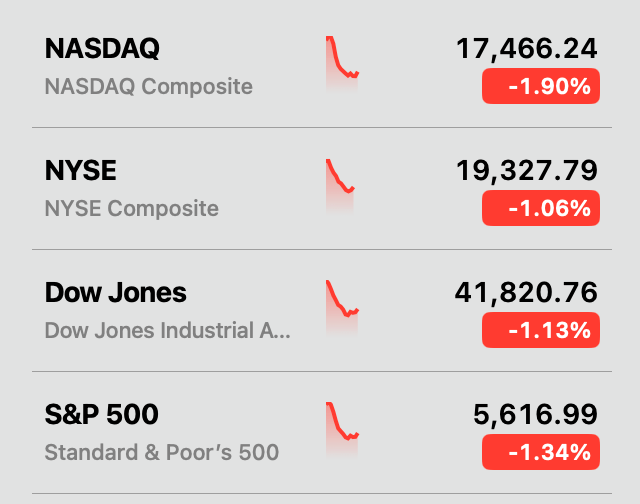

U.S. stocks at 11:30 a.m. ET on March 28, 2025.

Financial markets reacted sharply to the report, with all major U.S. stock indices falling hard on Friday following the news.

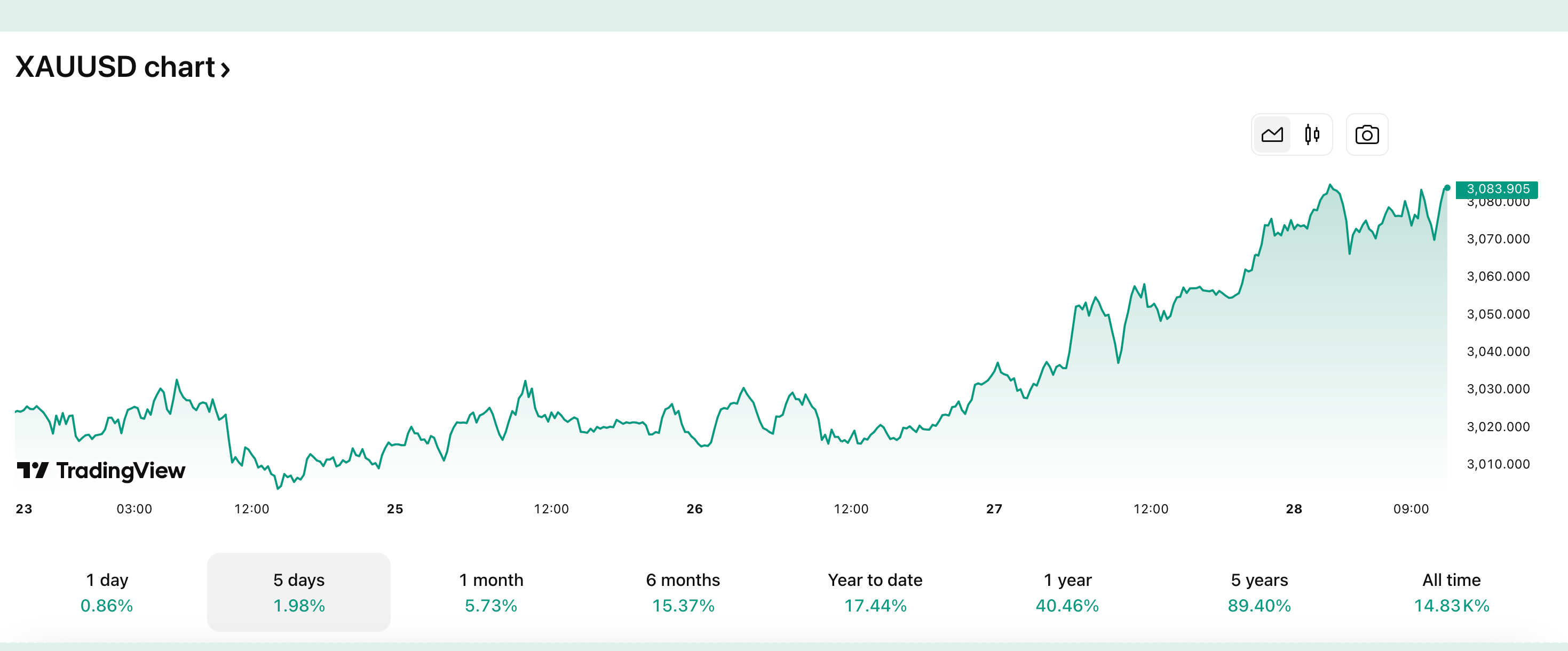

Bitcoin ( BTC) plunged to an intraday low of $83,920 per unit, as investors retreated from crypto assets. Gold, a traditional inflation hedge, remained firm at $3,071 per ounce at 11:30 a.m. ET on Friday, reflecting heightened economic uncertainty.

BTC/USD price on March 28, 2025.

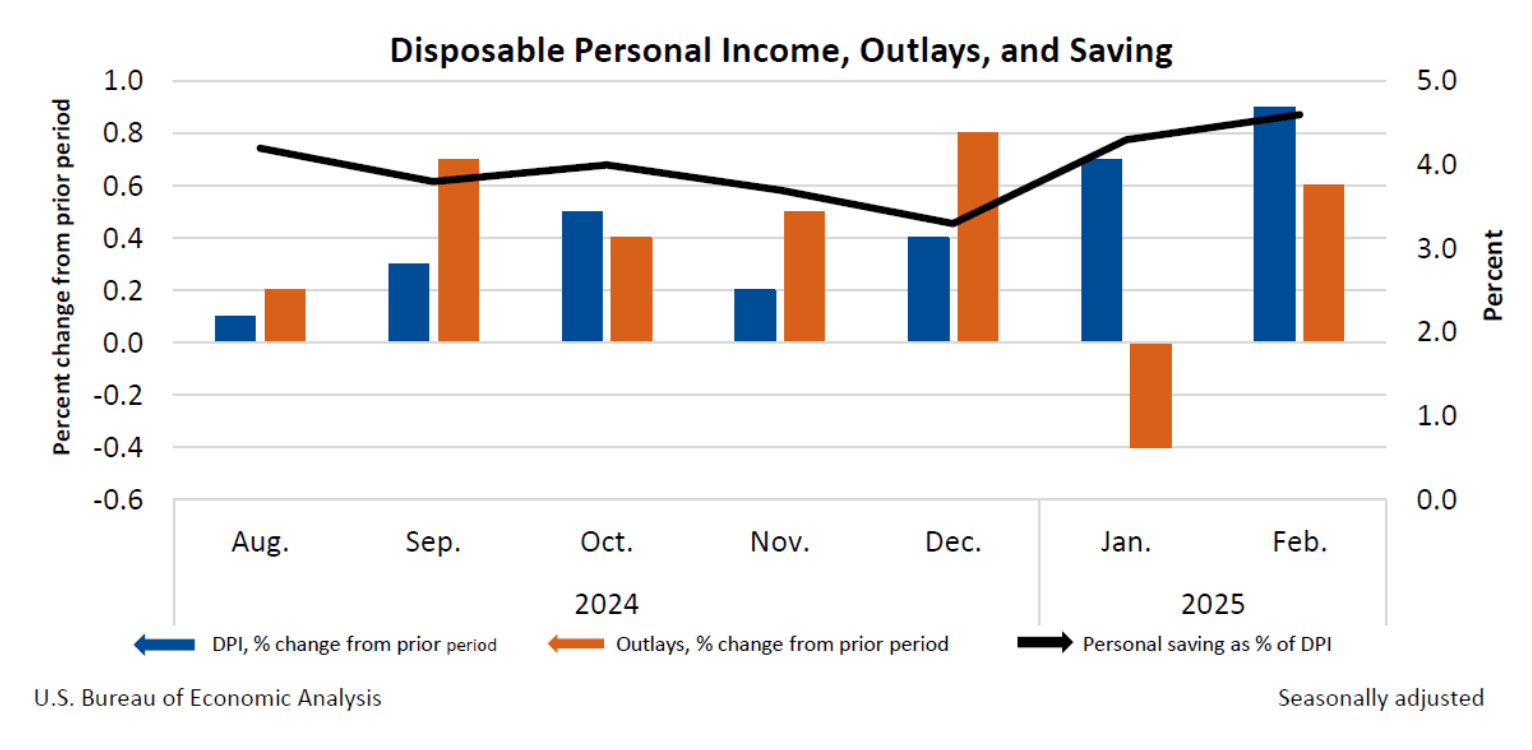

The Commerce Department noted personal income climbed 0.8% in February, bolstered by wage growth and transfer receipts like healthcare subsidies. Disposable income rose 0.9%, though real disposable income—adjusted for inflation—grew just 0.5%. Meanwhile, the personal saving rate held at 4.6%, suggesting households remain cautious.

Gold price on March 28, 2025.

Revisions to prior data showed weaker income growth in January, with wages revised down to 0.2% and farm proprietors’ income slashed by $33.9 billion due to delayed relief payouts. Federal workforce adjustments stemming from DOGE, including deferred resignation programs, did not impact February’s employment metrics, per the Bureau of Economic Analysis.

The report sets the stage for a tense Fed policy meeting in April as the central bank’s policymakers attempt to balance resilient inflation against signs of moderating consumer momentum. The Commerce Department explained that updated income and spending data for March will be released on April 30.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。