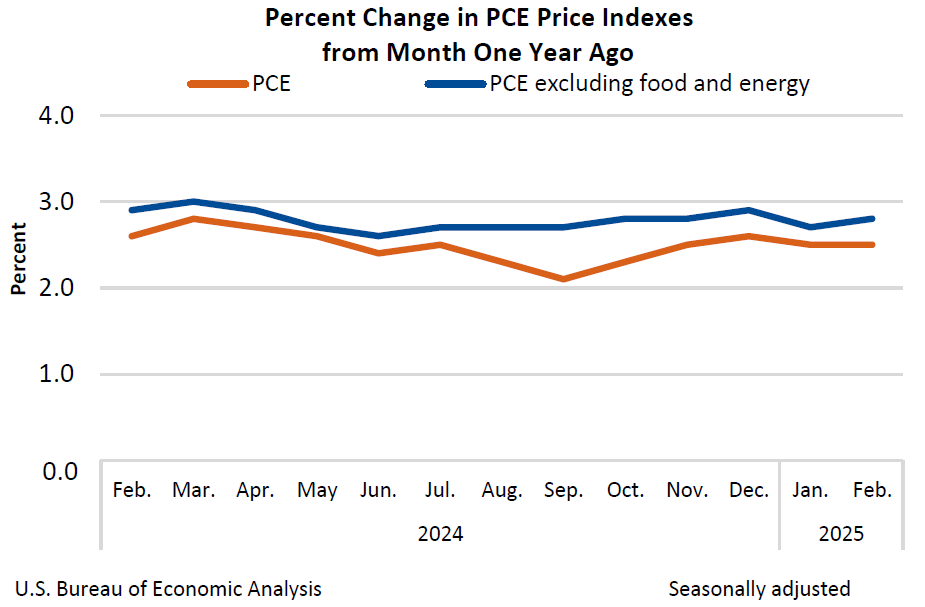

Both traditional and crypto markets took a dive this morning as the U.S. Bureau of Economic Analysis (BEA) published a higher-than-expected increase in the core PCE price index, a specific measure of inflation that excludes volatile food and energy prices.

The core PCE index rose by 0.4% in February to 2.8%, higher than the 0.3% increase expected by analysts. However, with food and energy included, the “all-items” PCE price index only went up by 0.3% last month, in line with analyst expectations.

(The core PCE price index rose higher than expected in February / bea.gov)

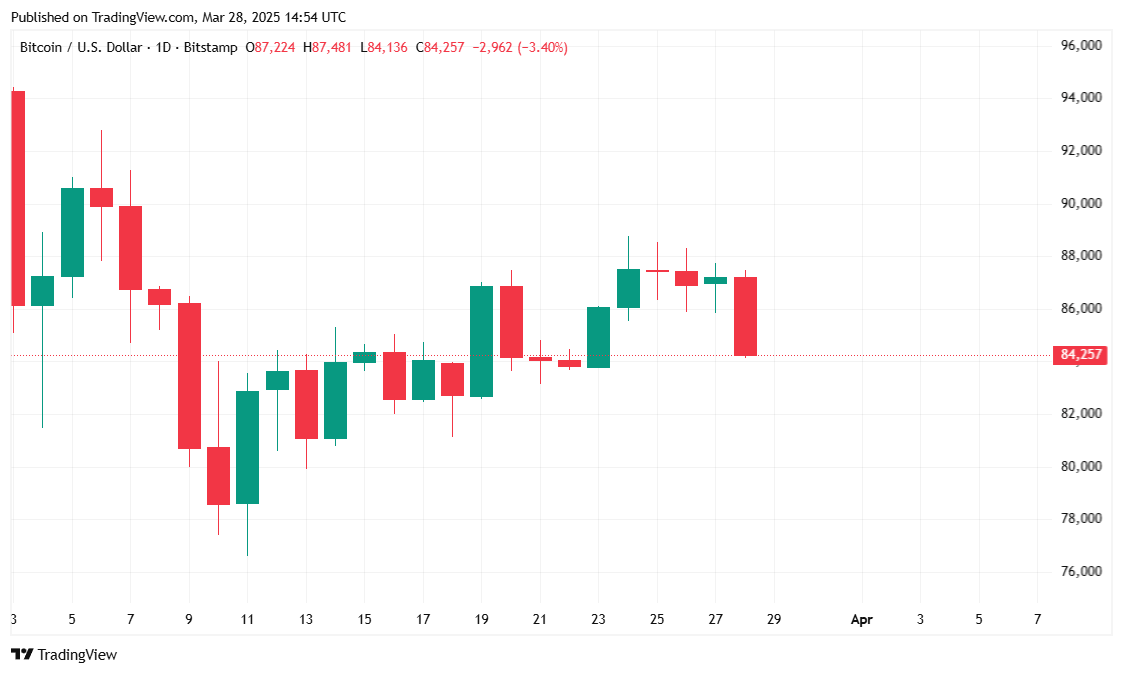

Bitcoin ( BTC) tumbled on the news, slipping below $85,000, although the cryptocurrency’s price remains slightly positive over the past week.

At the time of reporting, bitcoin is trading at $84,274.18, reflecting a 3.37% decline over 24 hours. However, on a weekly basis, BTC is still up 0.29%. The cryptocurrency traded between $84,145.77 and $87,702.17 over the past day, showing increased volatility as traders reacted to economic data.

( BTC price / Trading View)

Bitcoin’s 24-hour trading volume surged by 17.10% to $31.03 billion, signaling increased market activity, likely driven by reactions to the PCE inflation report. Meanwhile, bitcoin’s market capitalization now stands at $1.67 trillion, down 3.47% since yesterday as selling pressure mounted.

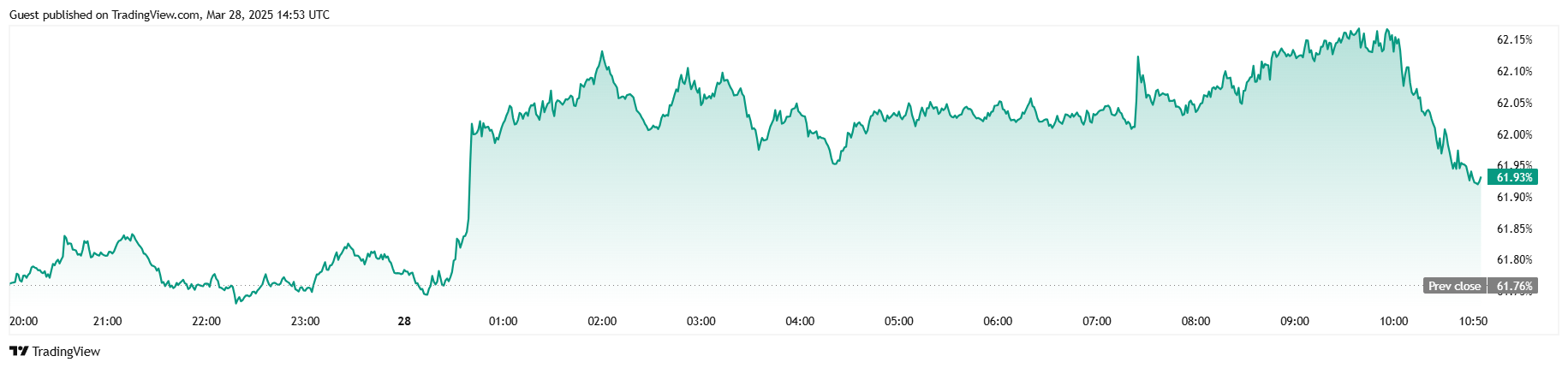

BTC’s market dominance has edged higher, rising 0.23% to 61.93%, indicating that altcoins may have suffered larger losses relative to Bitcoin.

( BTC dominance / Trading View)

However, futures data paints a concerning picture. According to Coinglass, BTC futures open interest fell 1.88% to $56.18 billion, suggesting traders are reducing leveraged positions. Additionally, total liquidations in the last 24 hours reached $22.34 million, with $22.33 million being long liquidations, showing that bullish traders were caught off guard by the sudden drop.

Bitcoin’s short-term trajectory remains uncertain as macroeconomic concerns weigh heavily on investor sentiment. With inflation data coming in hotter than expected, speculation around the Federal Reserve’s next move will be key in shaping BTC’s direction. If inflation remains persistent, markets may brace for prolonged tight monetary policy, potentially limiting bitcoin’s upside momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。