Finally able to finish my homework earlier. The situation today was already mentioned in yesterday's homework; if you don't look, there's nothing I can do. Yesterday, I detailed the risk-averse behavior of American investors, mentioned that the core PCE might exceed expectations, and indeed that happened. Of course, the market decline today was not solely due to the core PCE data, but also the exaggerated inflation expectations from the University of Michigan.

It's too late to say anything now. I spent a lot of time and energy explaining the conditions for a reversal to my friends, which are not currently met. The difficulty will rise sharply in the coming April, with tariffs starting on April 2 and GDP data in the middle of the month, both of which will give the market a headache.

Tariffs can be said to be the biggest factor affecting the market right now. There's no point in saying too much; I just hope that the tariffs are a one-time deal. A few days ago, a friend asked me if the interest rate cut expectations in the fourth quarter could boost the market. My answer was that 100,000 to 150,000 is an increase, and 50,000 to 80,000 is also an increase. Even if it goes up, it's just one outcome.

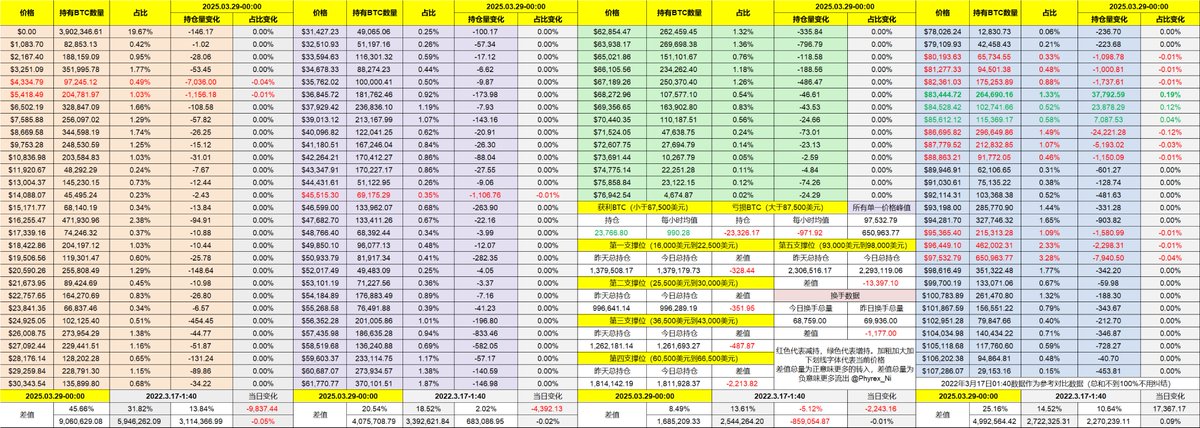

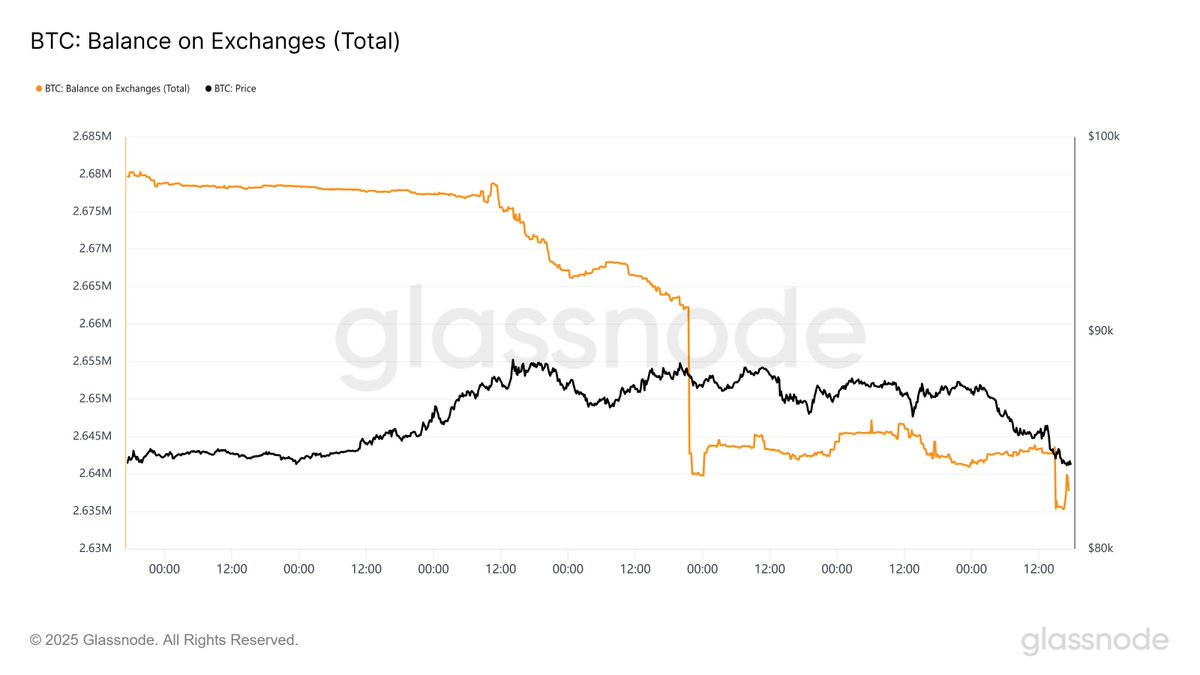

The data for Bitcoin is somewhat better than I expected. Although the price is down, there is no sign of panic among on-chain users. This wave of selling should be due to the reduction of holdings by users on the exchanges themselves.

I looked at the inventory data from the exchanges and indeed found that the BTC inventory on Coinbase is decreasing, while the BTC inventory on Binance is increasing. This indicates that more investors are preparing to sell their BTC on Binance, while Coinbase users are buying in larger quantities, perfectly illustrating the trading habits of users on one exchange selling during a downturn, while users on another exchange are accustomed to buying during a downturn.

Of course, there is no right or wrong; you are responsible for your own positions.

It seems that on-chain investors are gradually becoming desensitized to tariffs and inflation data. If that's the case, it's a good thing, as it at least indicates that if there isn't extremely negative data, the price stability of $BTC should still be quite high, maintaining a wide fluctuation trend. Moreover, the trading volume is indeed not high, so let's wait and see. But always remember, every rise is a rebound; although the heights of the rebounds may differ, the outcomes after the rebounds are generally the same.

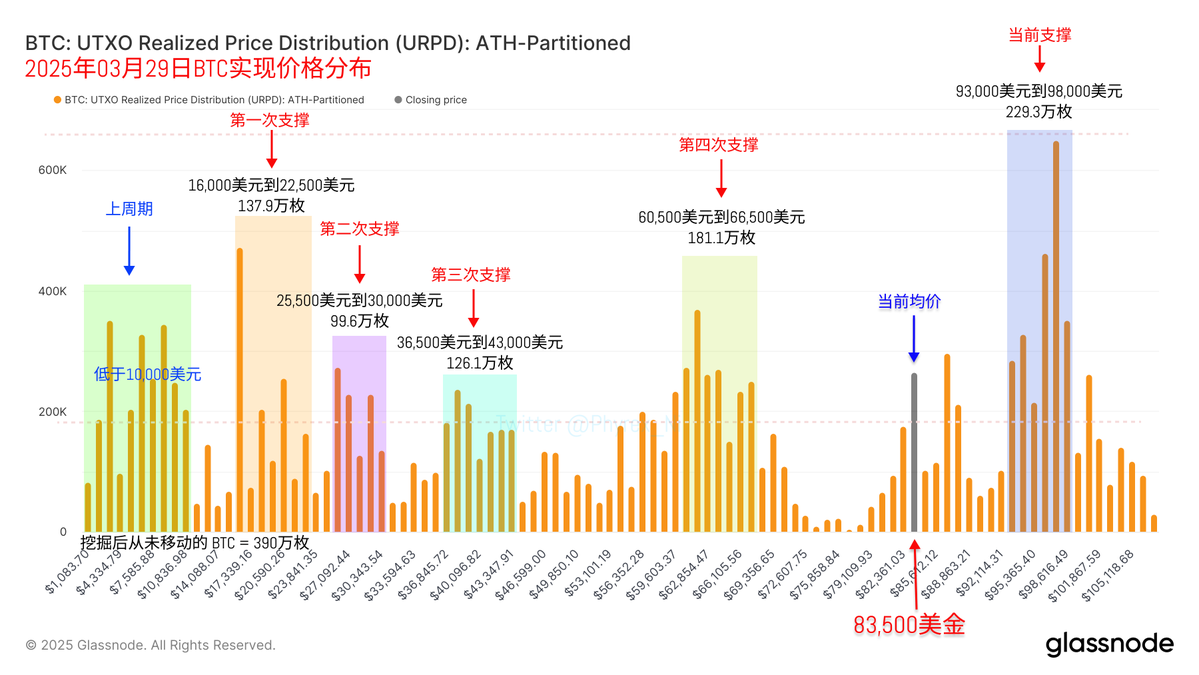

Investors in the $93,000 to $98,000 range are still quite stable, with daily exits around 10,000 BTC. This amount is not significant for a densely concentrated chip area, and as long as this portion of chips does not experience panic selling, there shouldn't be much of a problem.

Meanwhile, a bottoming trend has begun between $83,000 and $85,000; it's just uncertain whether it can smoothly turn into a moat.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。