Original Title: Resolv 2025 and Beyond

Original Author: @Iv4n_Ko, Founder of @ResolvLabs

Original Compilation: zhouzhou, BlockBeats

Editor's Note: This article explores key issues in the development of stablecoins, such as sources of yield, risk isolation, and distribution strategies. The author points out that relying solely on limited market capacity and centralized exchange strategies has a ceiling, thus requiring more diverse revenue channels (such as LSTs, LRTs, etc.) and decentralized risk management mechanisms. By introducing a tranching-like approach to layer risks, stablecoins can become more robust. The article also emphasizes the importance of network effects and distribution channels, suggesting that future competition among stablecoins will focus on compliance and global expansion capabilities.

The following is the original content (reorganized for readability):

We are accustomed to seeing the leaders in the stablecoin market as "transactional." Indeed, USDT and USDC perform excellently in payments and entry/exit. However, we have only scratched the surface of a potentially larger use case. This underrated narrative is the "investment" stablecoin, driven by broader crypto-native returns. They replace traditional treasuries and become the perfect channel for stable crypto yields.

By adopting a flexible hybrid approach to obtain these yields, Resolv aims to establish a true yield-driven center. Our goal is to provide the infrastructure for comprehensive investment solutions that evolve with the growth of the industry. This is our area of expertise and our passion.

The yield-bearing stablecoin market will become enormous, as cryptocurrencies can serve as an excellent source of alpha, with a global asset base. However, there are still two main obstacles hindering the growth of this potential: scalability and risk. Scalability is limited because the on-chain market is relatively small—yields compress quickly.

Cryptocurrency risk remains a "nightmare" in the minds of traditional finance people: for many, even a 5x return is not enough to "touch crypto." We need to build a yield generation solution that can scale with the market while keeping crypto-related risks within manageable limits.

Yield Expansion

So, how can we enhance the scalability of yield sources supporting stablecoin returns?

While somewhat oversimplified, the answer is:

- Choose the most scalable sources

- Increase the number of yield sources

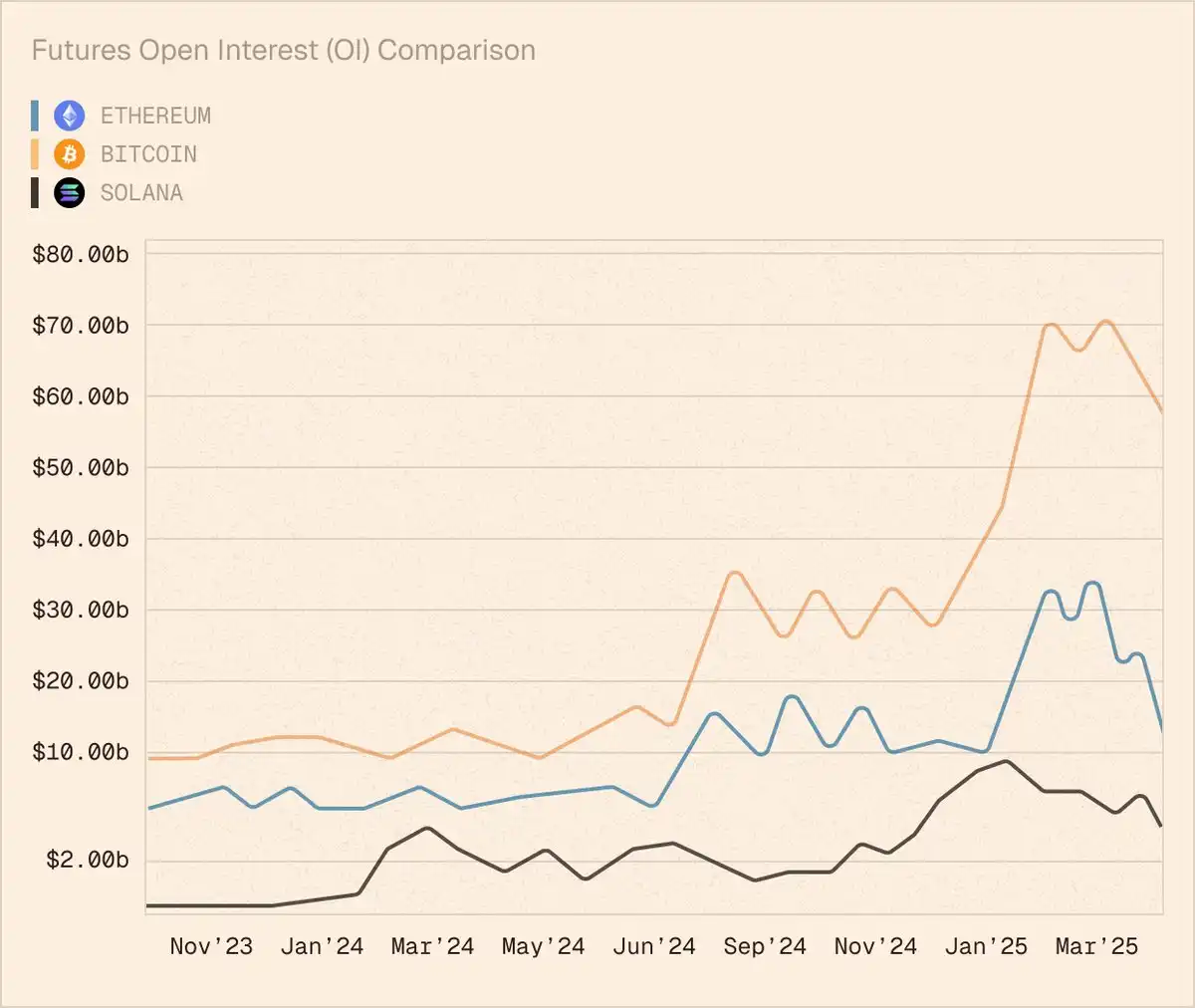

Delta-neutral strategies serve as a good yield source, primarily relying on perpetual futures, and the futures market is vast. Its trading volume is 5 to 10 times that of the spot market. The open interest is also considerable: about $60 billion for Bitcoin, about $10 billion for Ethereum (though it has recently dropped nearly 3 times), and about $5 billion for Solana.

However, there is still a bottleneck here. If you look at these three assets, the actual market capacity (before feeling a significant impact) is about $20 billion. This is decent, but if we want to build on a larger scale and look to the future, it is not enough.

More importantly, the counterparty exposure limits with centralized exchanges (where futures trading occurs) and the liquidity of decentralized exchanges restrict the opportunities for any single strategy operator. Not to mention, if a single entity holds the majority of positions, it poses a significant systemic risk.

In simple terms, this means we need diversification. Not just within a single delta-neutral strategy, but across underlying assets and exchanges.

These sources can vary: from LSTs (liquid staking tokens) and LRTs (liquidity providing tokens) to lending markets. These sources can be created by external providers and projects, operated by third parties, and overseen by specialized risk managers. We can also address the issue of liquidity fragmentation—because these sources all support a single stablecoin, thus driving the liquidity flywheel.

To make this work, we need a modular approach and an on-chain-centric architecture. You might ask, "Well, are you just combining a bunch of crypto yields and seeing how it goes?"

The answer is not so simple.

We will certainly see more projects building in the yield-bearing stablecoin space. And there will be different yield sources—from delta-neutral to MEV, AI agents, and high-frequency trading strategies. While not delving into the scalability issues of specific solutions, they will share a commonality—risk exposure (though the specific risks of each source will differ).

This leads us to the next topic—risk isolation.

Risk Isolation

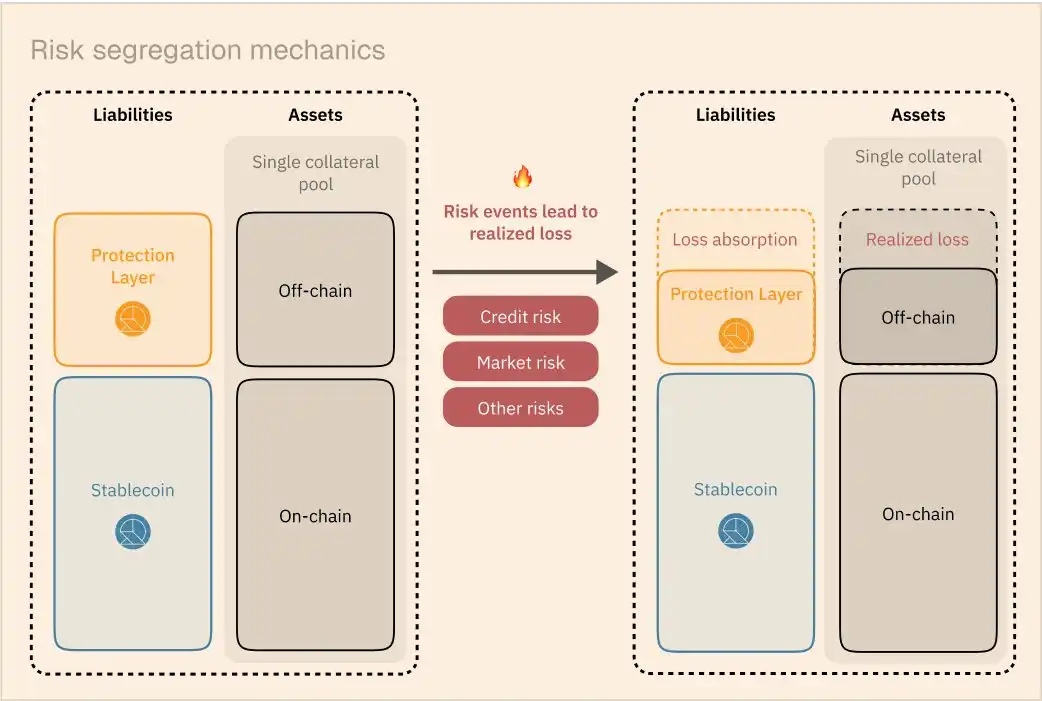

Each yield source has a specific set of risks. For example, in delta-neutral strategies, the main risks are fluctuations in funding rates (holding perpetual futures can lead to losses, which in turn affect the stablecoin's peg) and counterparty risk (whether CEX or DEX).

Other sources will also have their unique risks. When you combine multiple different sources to support stablecoins, you will face a higher risk of decoupling. Once the peg is lost, the "end" of the stablecoin will come—this has been witnessed multiple times in the past. Stablecoins cannot tolerate losses.

If you mix these different sources together, you cannot create a stable product.

The solution is to isolate the risk into a separate tool that will absorb any potential losses.

This tool will be more volatile than the stablecoin but will offer higher returns. In traditional finance, this concept is known as "tranching."

Resolv adopts this approach to curb the risks of yield sources.

In this case, the stablecoin (USR) is the senior tranche, while a separate token (RLP) acts as the junior tranche. In effect, RLP serves as a scalable decentralized external insurance fund.

Stablecoin projects typically have some form of insurance fund, but they are internal: these funds sit within the project's treasury, are limited in size (you need to raise funds separately for them and pay interest), have low transparency, and are relatively rigid.

An externalized insurance fund, like RLP, grows alongside USR, self-balances, is transparent, and is market-driven.

RLP earns a portion of the total TVL of the protocol (the total TVL of USR and RLP), and since RLP's TVL is just a small part of it, the returns RLP receives exceed expectations. This effect can be seen as built-in leverage, which cannot be replicated without the asset base of USR.

Additionally, RLP is liquid and integrated into lending markets and yield stripping protocols. Imagine if your delta-neutral strategy had this tool.

[For financial enthusiasts like us, more background information: In the future, we may have separate RLP tokens for different types of risk exposures. There could be a "Binance RLP" to handle credit risk (analogous to credit default swaps in traditional finance), or a "HyperLiquid RLP" to handle smart contract risk. New markets and tradable risk instruments could emerge from this.]

In short, we can strip the risks of specific strategies and sell these risks to the market in the form of high-yield RLP tokens.

By holding "above-average crypto-driven returns without involving crypto-related risks," we can increase our distribution to more conservative user groups.

Distribution

Distribution is crucial. Future competition in crypto will hinge on this. Frankly, I believe stablecoins will have an advantage here, both in the cryptocurrency space and in traditional finance. In the crypto realm, stablecoins serve as the perfect liquidity flywheel, driving the TVL of blockchains and projects. They already have a mature product-market fit.

When comparing stablecoins to structured products in traditional finance, stablecoins are superior in almost every aspect: liquidity, transferability, capital efficiency (you can use them as collateral and create leverage), and self-custody.

Let’s try to imagine potential users as a continuous spectrum.

On the left are crypto-native users, farmers, and power users; on the right are some people hiding cash under their pillows (as well as some conservative family offices and hedge funds). As we move along this spectrum, we will encounter more "sticky" users.

Starting with the liquidity flywheel and crypto-native mechanisms, the goal is to continuously move right by penetrating more traditional tracks (like new banks). This is our main goal for the coming years, as global licensing gradually progresses and is established.

In the crypto space, network effects provide excess returns, so being able to convert other market participants into your distribution agents is a huge advantage.

By involving third parties in yield generation (as strategy initiators or risk managers), Resolv is expanding the network effect. Look at how Morpho introduces new product opportunities and liquidity through risk managers, facilitating growth. Similarly, Pendle uses the liquidity flywheel to drive project integration, further increasing network effects.

We see many projects trying to build "vertical moats" by controlling every stage of value generation, keeping economic benefits to themselves, but in doing so, they become unable to collaborate and scale with other projects.

In contrast, we will build "horizontal moats," where distribution and revenue generation benefit all participants in the process. We hope to remain as neutral as possible in this process to optimize the best output of the product.

Stablecoins inherently have a distribution advantage, and network effects further amplify this advantage.

On the Note of Relevance

For any crypto project, there is an "elephant in the room"—that is, the moat, the ability to stay in sync with the market, and maintain relevance. We believe this is a huge issue, as many projects fade into obscurity after a few years of narrative. To stay ahead of competitors in the super dynamic crypto market, you must be able to integrate new sources of yield and leverage emerging narratives. This is precisely what we can achieve through a modular approach.

Don't forget that token incentives are also an important source of crypto yields. Liquidity shifts from one project to another, seeking early liquidity incentive drops and massive APYs. By allocating liquidity to a broader range of yield sources (projects), we can also capture this portion.

Roadmap

Looking ahead, it's always exciting to see how major events unfold, but there is still a lot of concrete work to be done. Let's take a look at the plans for the coming months.

Our plans align with the key elements mentioned earlier—these include sources of yield, risk, and distribution.

First and foremost, we are integrating with Superstate, a process that is currently underway. This is our first collaboration with a third-party yield source, and through this partnership, we can benefit from more stable and diversified funding rates.

To broaden our asset base, we will add BTC as a foundational asset to our portfolio. Our focus on on-chain methods allows us to utilize different BTC LSTs / LRTs in stablecoin support, so we expect more partnerships and higher returns driven by related solutions.

In terms of distribution, our goal is to place our products where demand is strongest, so expanding to new chains and emerging ecosystems is an important part of our growth. Currently, our TVL on Base has exceeded $150 million, and we are very confident in HyperBullish, but more progress is on the way.

Additionally, don't forget other distribution channels, such as wallets and CEXs (more news on this will be coming soon). Another significant source of liquidity comes from the financial reserves of crypto projects (managed by asset management companies like Karpatkey) and funds supporting other stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。