Weekend homework isn't that easy either. How should I put it? I've said most of what needs to be said. Let's first enjoy the tranquility before April. Starting in April, the difficulty will increase. This difficulty doesn't mean that the entire risk market will definitely decline; it's not like that. Rather, it means that after entering April, the game of tariffs, GDP, macro data, etc., may lead the market into a larger volatility range. Any single direction could be quite dangerous.

I remember saying at the beginning of the month when it fell below $80,000 that shorting isn't very profitable right now because there hasn't been any information to further elevate panic. However, in April, it could be different, especially with the GDP data. If it really aligns with the GDPNow expectation of -2.8%, I think the market's sentiment towards trading recession may become more severe.

On the other hand, I don't have much concern about tariffs, as the market has already anticipated them. After all, we have a president who doesn't play by the rules. The biggest impact of tariffs is inflation, and inflation affects the Federal Reserve's monetary policy. While this trouble exists, it's not that scary for now, but combined with GDP data, it could become more troublesome.

Of course, for $BTC, I still believe that even if things aren't going well now, it won't be too bad when liquidity recovers. However, for other altcoins, as Bitcoin's volatility increases, it may become even more challenging.

Although we've entered the weekend in the last 24 hours, the market has shown slight panic due to the drop in BTC prices. Many investors who bought the dip yesterday couldn't hold on and chose to exit, while earlier investors remained quite calm. In fact, we can see from the trading volume that the actual volume isn't high, and the selling pressure isn't very strong, mainly due to insufficient liquidity.

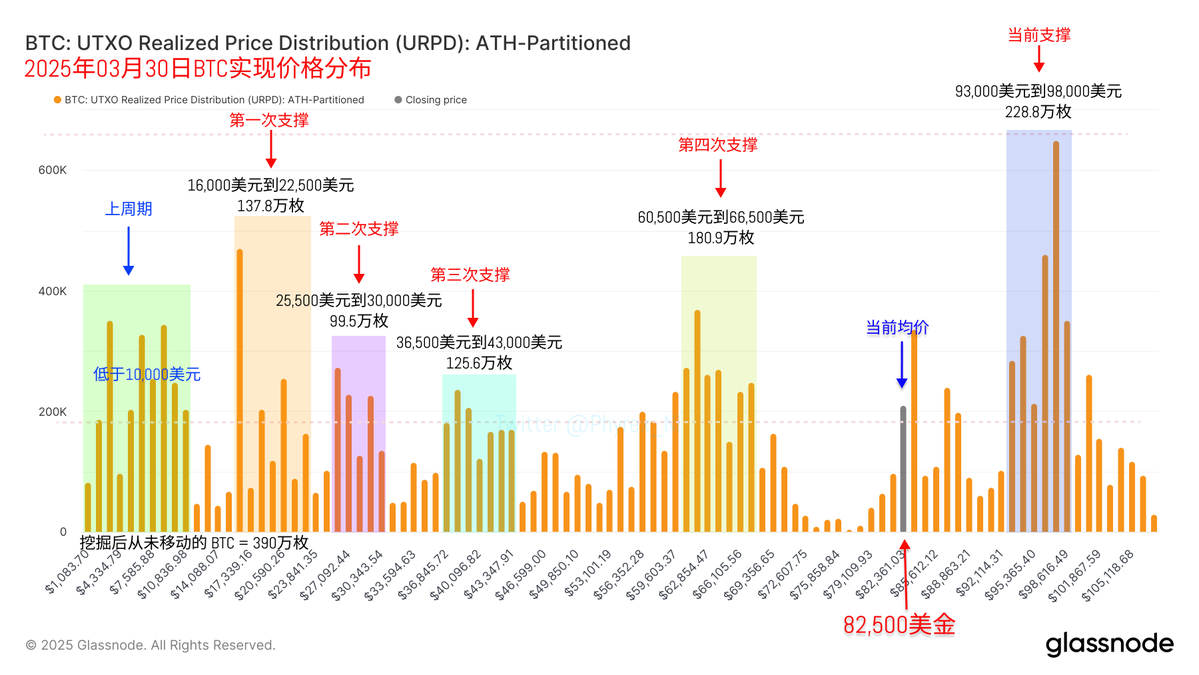

Looking at the dense chip area from $93,000 to $98,000, it is still slowly declining. This group of investors hasn't shown signs of panic yet, and it should be able to hold for a short time.

In any case, trading in April requires more caution. Tariffs aren't necessarily 100% negative, and there may still be opportunities for relief. If the Russia-Ukraine war can stop in April, it could hedge some inflation issues. As for GDP, let's hope the GDPNow data is wrong.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。