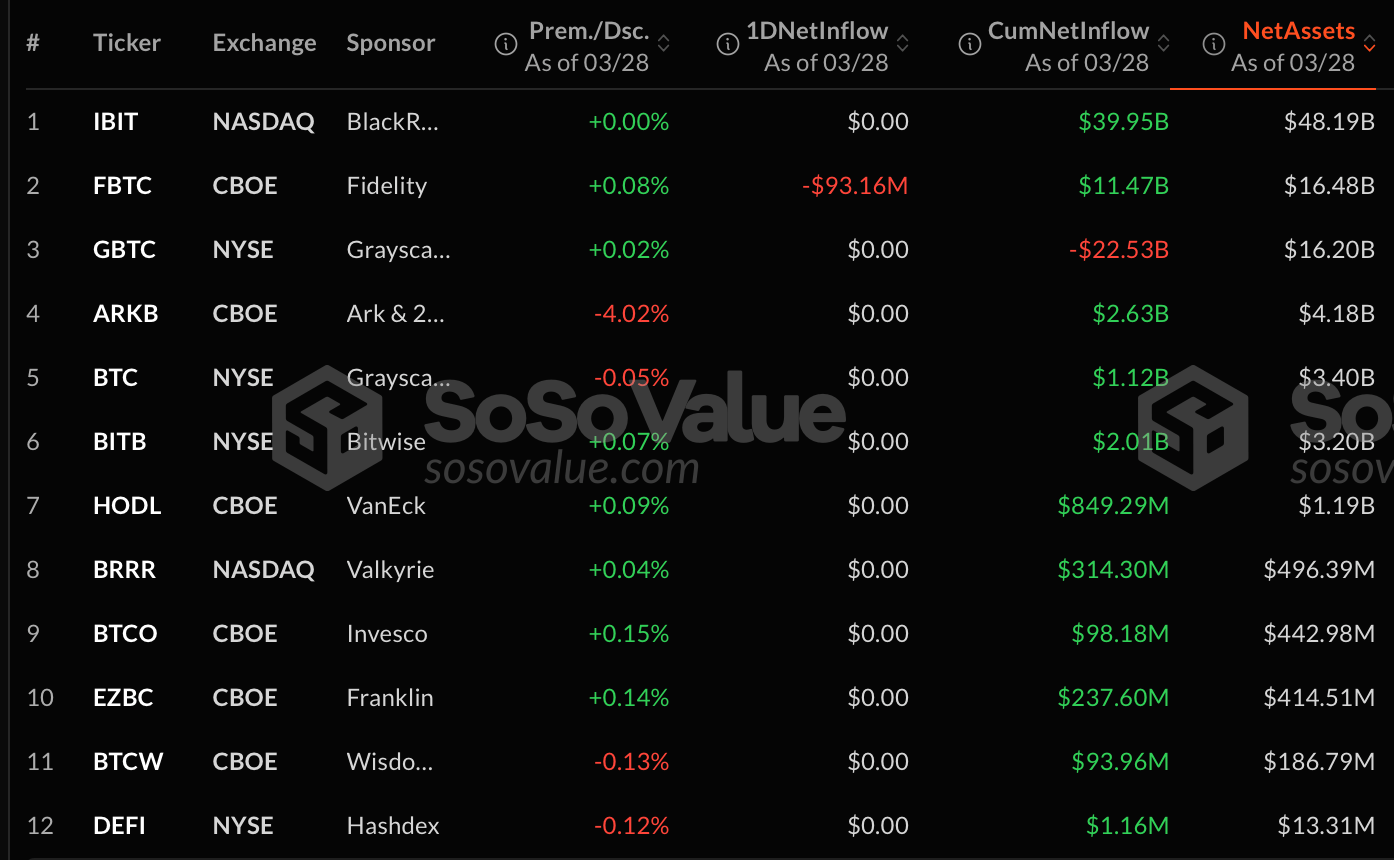

The abrupt shift punctuated a previously unbroken stretch of positive momentum for U.S. bitcoin ETFs, culminating in a $93.16 million withdrawal on March 28, according to sosovalue.com stats.

Eleven of the twelve bitcoin funds maintained equilibrium, with no net activity across their ledgers during the trading session. Fidelity’s FBTC singularly absorbed the financial tremor, accounting for the entire $93.16 million redistribution that day.

Data current through March 29, 2025, reveals that spot BTC exchange-traded funds have amassed a formidable $36.24 billion in net inflows since their Jan. 11, 2024 debut—a testament to their enduring gravitational pull in digital asset markets.

Friday’s session saw $2.22 billion change hands across the dozen funds, even as the cohort’s aggregate BTC holdings settled at $94.39 billion post-outflow, now commanding 5.68% of bitcoin’s total market value.

While bitcoin-focused funds navigated choppy waters, their ether-based counterparts charted a steadier course, eking out incremental gains. Once again, activity coalesced around a lone contender: eight of nine ether ETFs flatlined, while Grayscale’s ETHE siphoned $4.68 million into its coffers—a solitary bright spot.

Metrics from March 28 show ether funds collectively garnered $234.23 million in trading activity, with cumulative inflows since July 2024 cresting at $2.41 billion. The nine-fund alliance now safeguards $6.42 billion in ether reserves, constituting approximately 2.84% of the cryptocurrency’s aggregate valuation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。