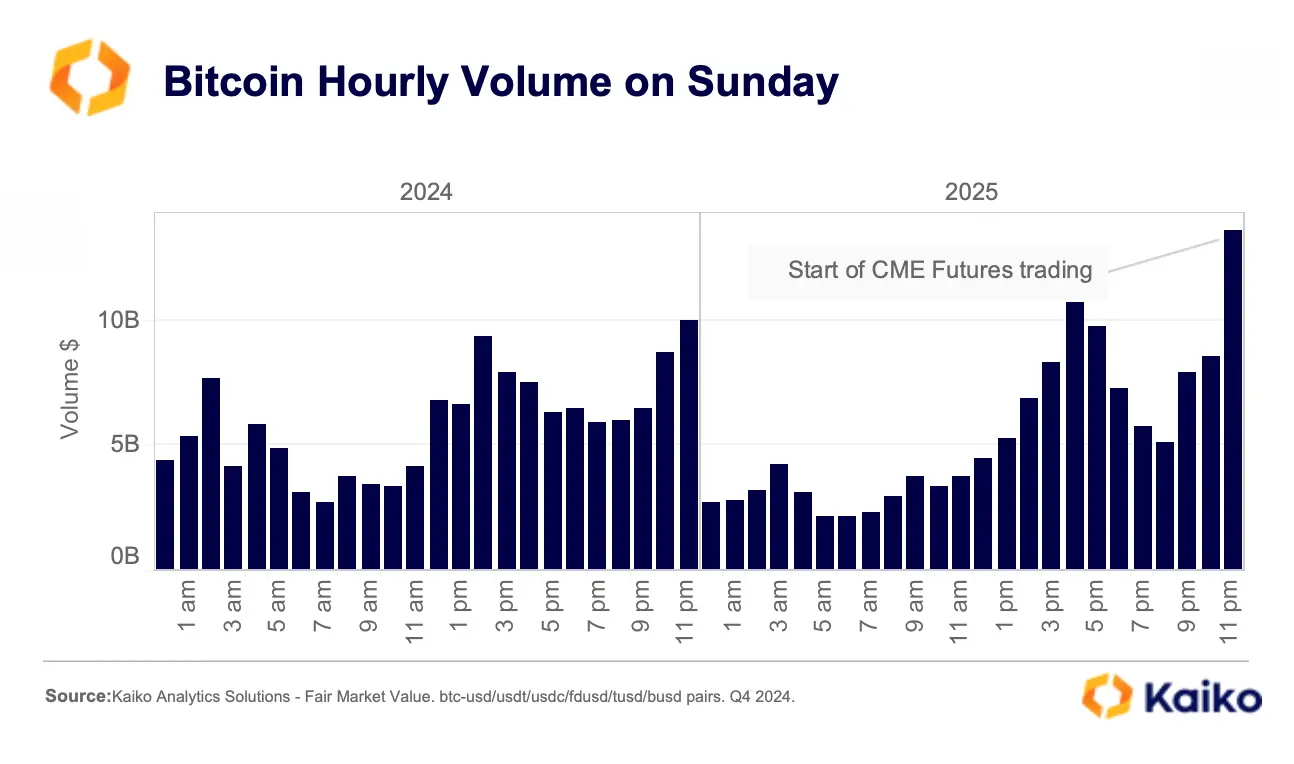

The study reveals bitcoin’s average daily 1% market depth—a measure of liquidity—tends to dip midweek, hitting lows on Tuesdays and Wednesdays, then climbing to peaks by Friday. This diverges from 2024, when weekends posted the shallowest liquidity. Saturday and Sunday transaction levels have climbed this year, with Sundays displaying the sharpest rise.

A pronounced jump in Sunday activity near 23:00 UTC aligns with the launch of CME Futures trading, implying institutional players are steering this change. “Demand for continuous trading by traditional investors has been growing, pushing two of the biggest U.S. stock exchanges—Nasdaq and the NYSE—to offer round-the-clock trading,” the analysis observed.

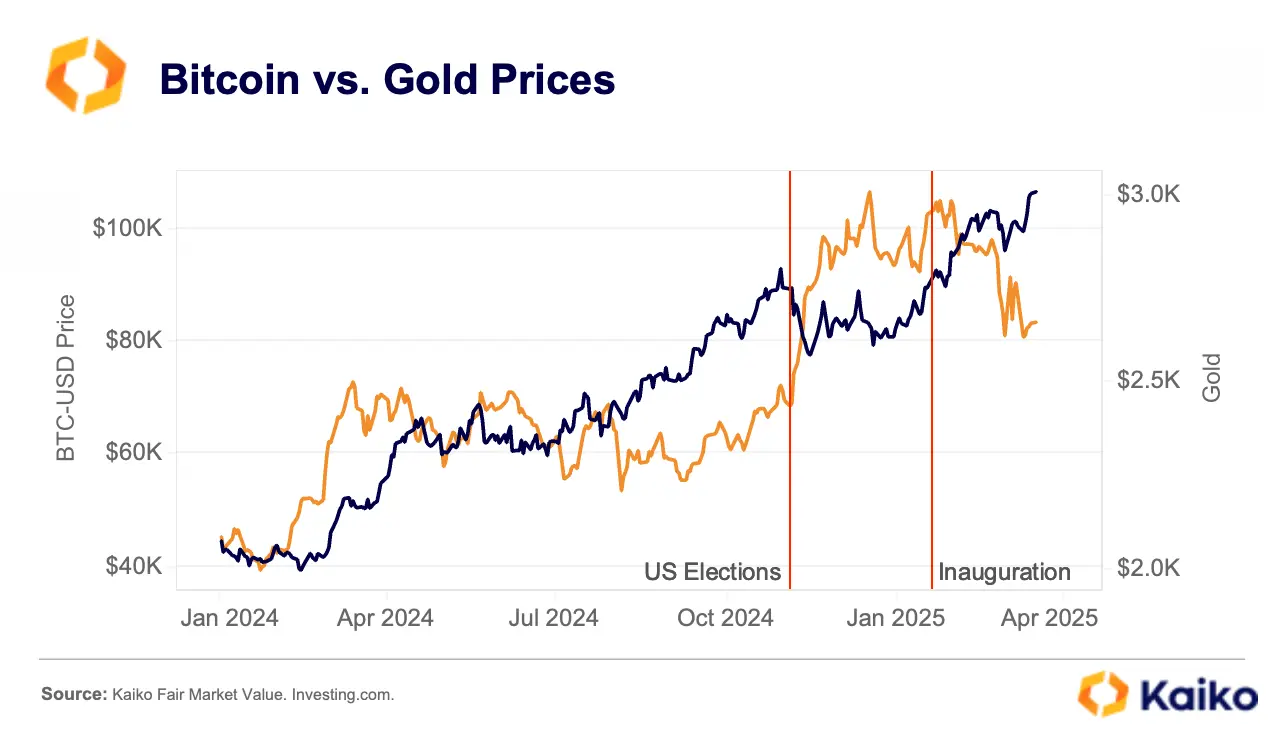

Kaiko Research experts argue this mirrors wider investor appetites for ceaseless market entry, buoying bitcoin’s weekend traction. Despite gains, Kaiko researchers further detailed that bitcoin has lagged behind gold in 2025, with the shiny yellow metal outshining BTC so far this year. Gold’s resilience spotlights the enduring rivalry between classic stability assets and digital alternatives.

Kaiko’s findings illuminate shifting bitcoin trading rhythms as the asset matures. While weekends regain momentum, midweek lethargy reflects persistent unpredictability. Liquidity providers now favor weekends, which may steady prices during once-dormant windows. The insights showcase BTC’s evolving stature in global finance, navigating institutional embrace amid unresolved hurdles.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。