Financial giant Vanguard Group may soon have indirect exposure to bitcoin through its holdings in Gamestop (NYSE: GME), marking an unexpected twist in the company’s traditionally cautious approach to cryptocurrency. The development follows a series of moves by Gamestop, a company in which Vanguard is among the largest shareholders.

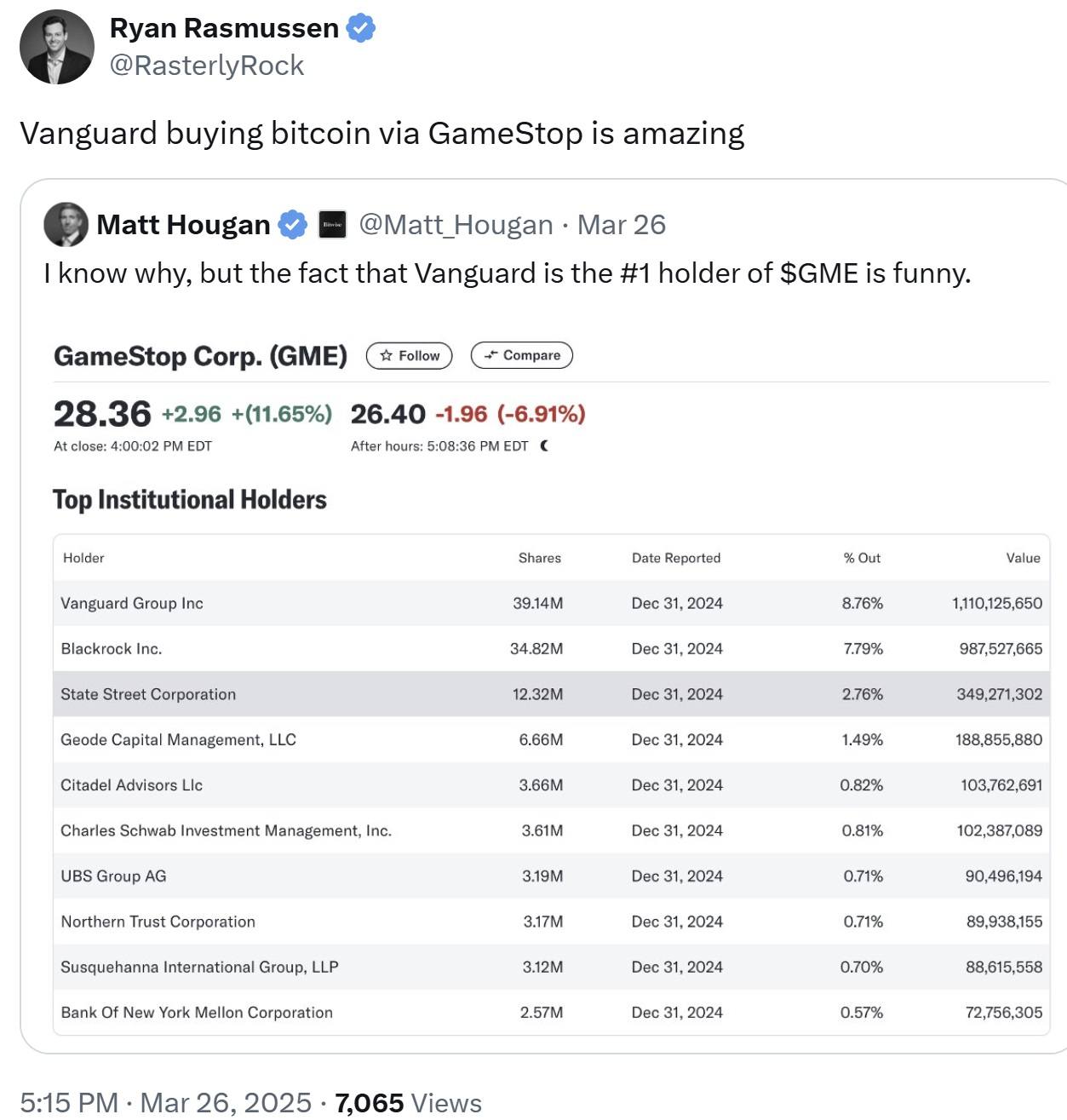

Vanguard holds the top institutional stake in Gamestop, positioning it at the center of attention after the retailer unveiled a strategic shift toward bitcoin. On March 26, Ryan Rasmussen, Head of Research at asset management firm Bitwise, posted on social media platform X: “Vanguard buying bitcoin via Gamestop is amazing.” The comment underscored the unusual nature of the situation, as Vanguard has consistently avoided direct involvement with crypto assets. Rasmussen’s comment was in response to Bitwise’s chief investment officer, Matt Hougan, who pointed out that Vanguard is Gamestop’s largest shareholder.

Gamestop revealed a strategic bitcoin reserve plan last week and announced plans to raise funds for it through a convertible bond offering. The company did not disclose how much bitcoin it intends to acquire or the timeline for implementation. The move signals a broader entry into digital assets and aligns Gamestop with other public companies, such as Microstrategy—now rebranded as Strategy—and Tesla, that have adopted bitcoin as a treasury reserve asset.

Vanguard’s indirect connection to bitcoin through Gamestop stands in contrast to its established position on digital assets. While other asset managers, including Blackrock and Fidelity, have embraced cryptocurrency through the launch of bitcoin and ether spot exchange-traded funds (ETFs), Vanguard has opted to stay on the sidelines. In December 2024, Vanguard reaffirmed its anti-bitcoin stance, calling digital assets speculative and lacking intrinsic value. Duncan Burns, head of investments and head of Equity Index Group for Asia-Pacific at Vanguard Australia, said bitcoin had no role in long-term portfolios and warned of potential investor losses. CEO Salim Ramji, despite prior crypto ETF experience at Blackrock, previously confirmed that Vanguard would not offer crypto ETFs, emphasizing a focus on core strengths like active fixed income and cost efficiency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。