Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Last Monday, Berachain officially launched the Proof of Liquidity (PoL) mechanism, which aims to address the incentive misalignment issues present in traditional PoS blockchains by creating an incentive flywheel directly at the public chain level through a built-in bribery model similar to Curve's veCRV.

For a detailed explanation of the PoL mechanism, please refer to the article "In-depth Explanation of Berachain PoL Mechanism: A More Aggressive Bribery Model than Curve." This article focuses on the current only leader in the Berachain ecosystem — the foundational protocol Infrared Finance, which ranks first in real-time TVL.

Infrared Finance: PoL Liquidity Staking Protocol

Infrared Finance is positioned as a liquidity staking protocol under the PoL mechanism.

Since January 2024, Infrared Finance has completed three rounds of financing:

In January 2024, Infrared Finance announced the completion of a $2.5 million seed round financing, led by Synergis, with participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital, Ouroboros Capital, Decima, OakGrove Ventures, DoraHacks, TenzorCapital, AlexShin, AlbertChon, CharlesLu, Mr.Block, ChrisSpadafora, DCFGod, and others.

In June 2024, Infrared Finance announced the completion of a strategic round of financing, with Binance Labs as the sole investor, though the specific amount was not disclosed.

In March 2025, Infrared announced the completion of a $16 million Series A financing, led by Framework Ventures, with participation from Citizen X, Halo Capital, No Limit Holdings, NGC Ventures, and Selini Capital.

Unlike traditional PoS networks, Berachain, which adopts the PoL mechanism, has two native tokens: BERA and BGT — where BERA is used for gas and staking, while BGT is used for governance and incentive allocation. BGT is non-transferable and cannot be traded; it can only be converted one-way into BERA, but BERA cannot be converted back into BGT.

In response to this unique structure, Infrared Finance has launched two liquidity staking tokens for BERA and BGT: iBERA and iBGT.

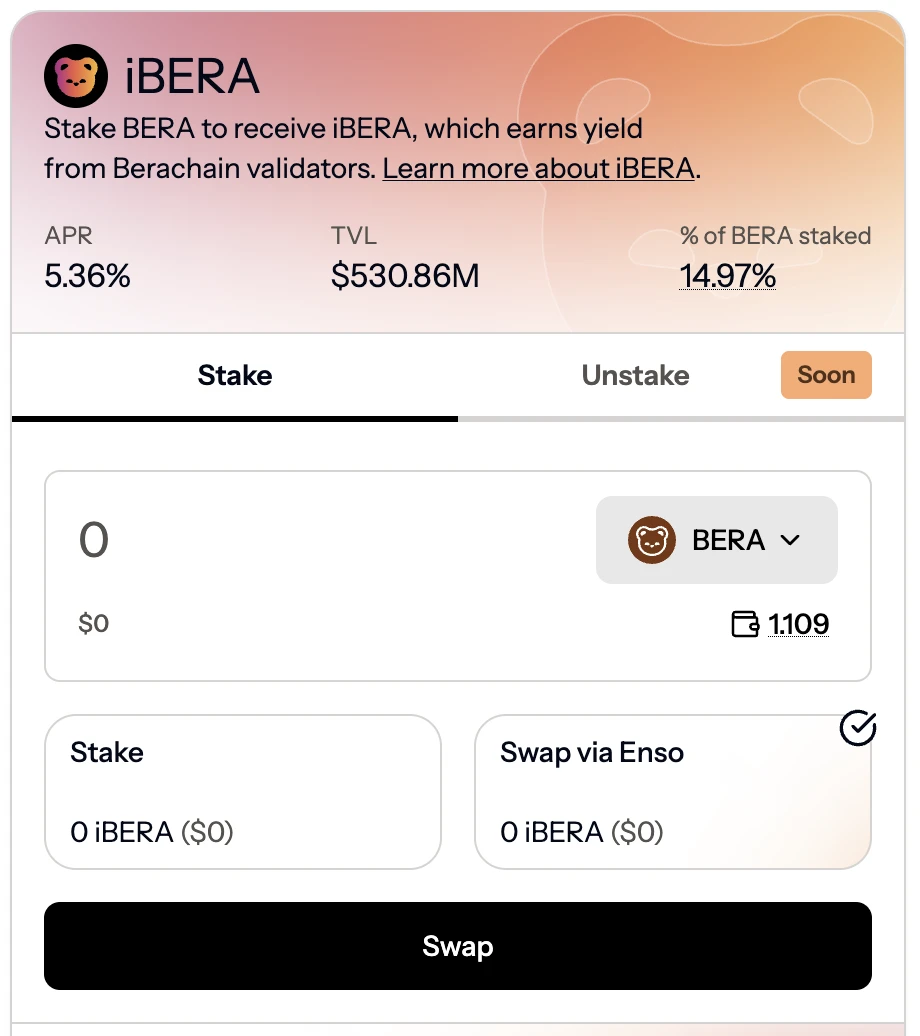

iBERA is straightforward; you can think of it as a liquidity staking token (LST) similar to Lido's stETH or Jito's jtoSOL. iBERA currently does not support reverse redemption, but redemption channels will be opened in the future.

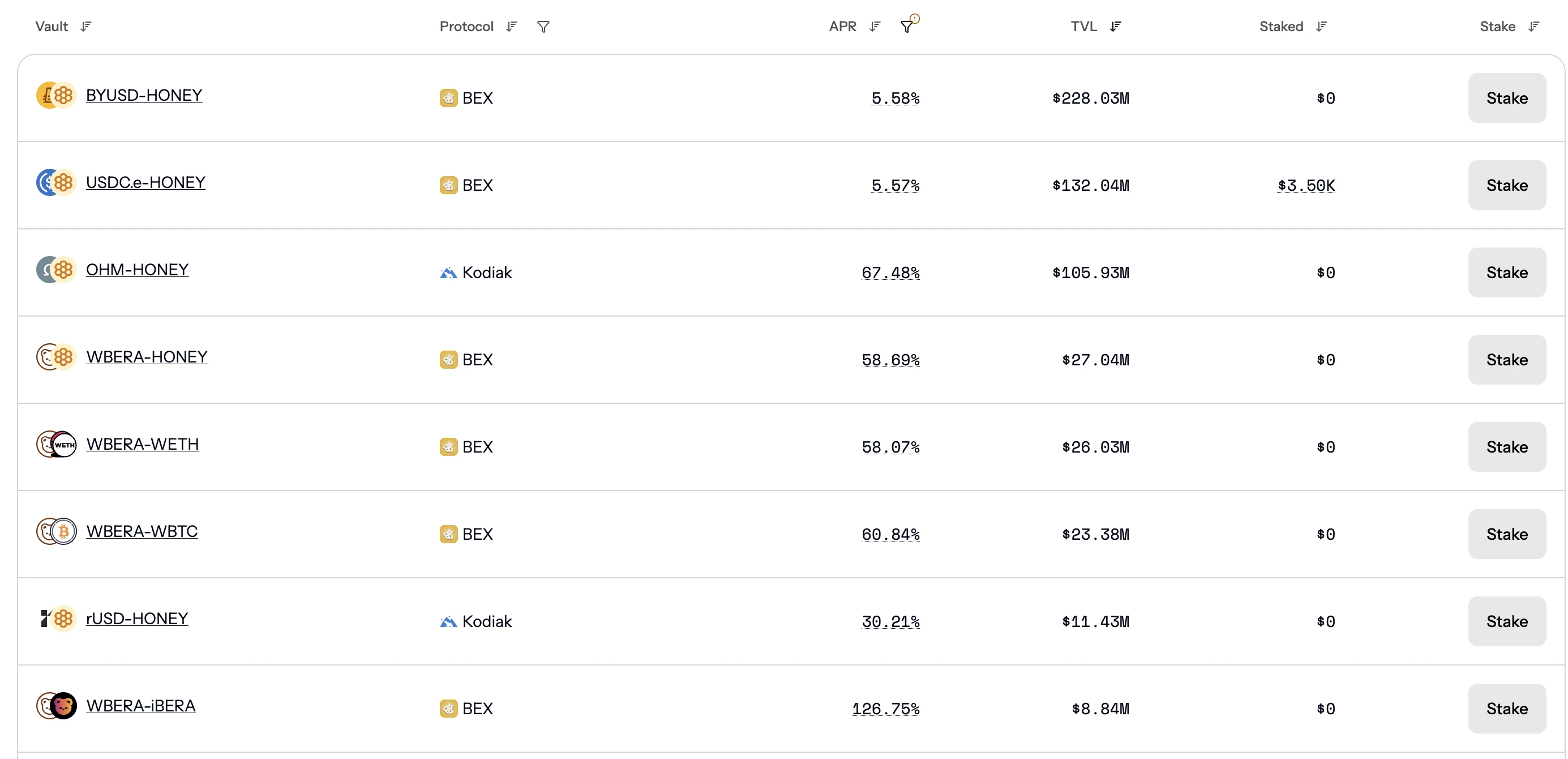

The key lies in iBGT. Since BGT cannot be traded, users cannot actively stake BGT as iBGT; instead, they can only stake liquidity (such as LP tokens from DEXs like BEX) into Infrared Finance. Infrared Finance will use the BGT incentives obtained from this liquidity to generate iBGT on a 1:1 basis and distribute it to users — in simple terms, users who originally provided liquidity on Berachain would receive BGT incentives, but after staking liquidity through Infrared Finance, the BGT would go to Infrared Finance, and users would receive iBGT. iBGT can be freely traded, but due to the limited liquidity of BGT, it can never be redeemed back into BGT.

Interaction Logic

From the perspective of obtaining potential airdrops, the current interactions with Infrared Finance mainly revolve around iBGT and iBERA, especially the former.

The simplest operation is to stake BERA to obtain iBERA, which requires no further explanation.

Next is obtaining iBGT, which requires users to stake liquidity tokens from various DeFi protocols on Berachain, such as BEX, Kodiak, etc.

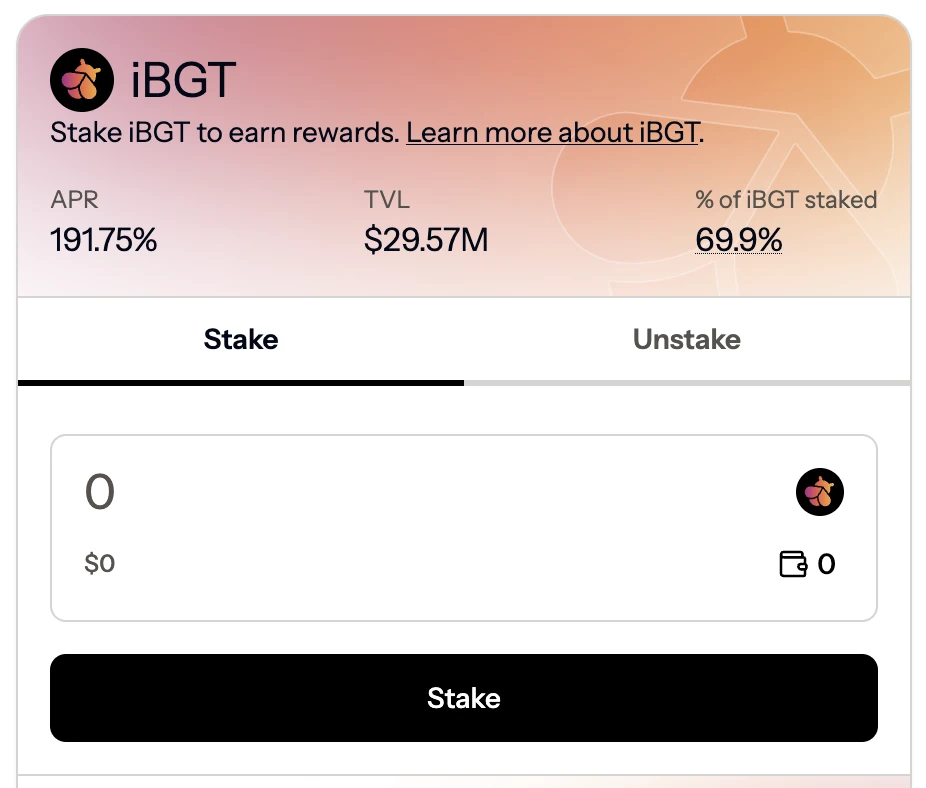

After receiving iBGT incentives, users can choose to stake iBGT again to receive higher incentive returns (currently at 191.75%).

In addition to the paths mentioned above within the protocol, users can also directly purchase iBERA and iBGT on the secondary market. However, due to significant restrictions on obtaining iBGT and the higher subsequent incentives, iBGT currently has a noticeable premium over BGT (BERA), so it is recommended that users obtain it by providing liquidity.

It is worth mentioning that Pendle has also opened pools for iBERA and iBGT, with very attractive annualized returns (iBGT can reach up to 541%). Therefore, another potential participation model is a "spot pool, equivalent contract short" hedging strategy, which can earn considerable annualized returns while participating in interactions.

As the foundational protocol with the largest financing scale and highest TVL in the entire Berachain ecosystem, Infrared Finance's future development is expected to be highly tied to Berachain. If one is optimistic about Berachain's unique PoL Ponzi mechanism, using Infrared Finance in the long term may be a more cost-effective choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。