1. Bitcoin Market

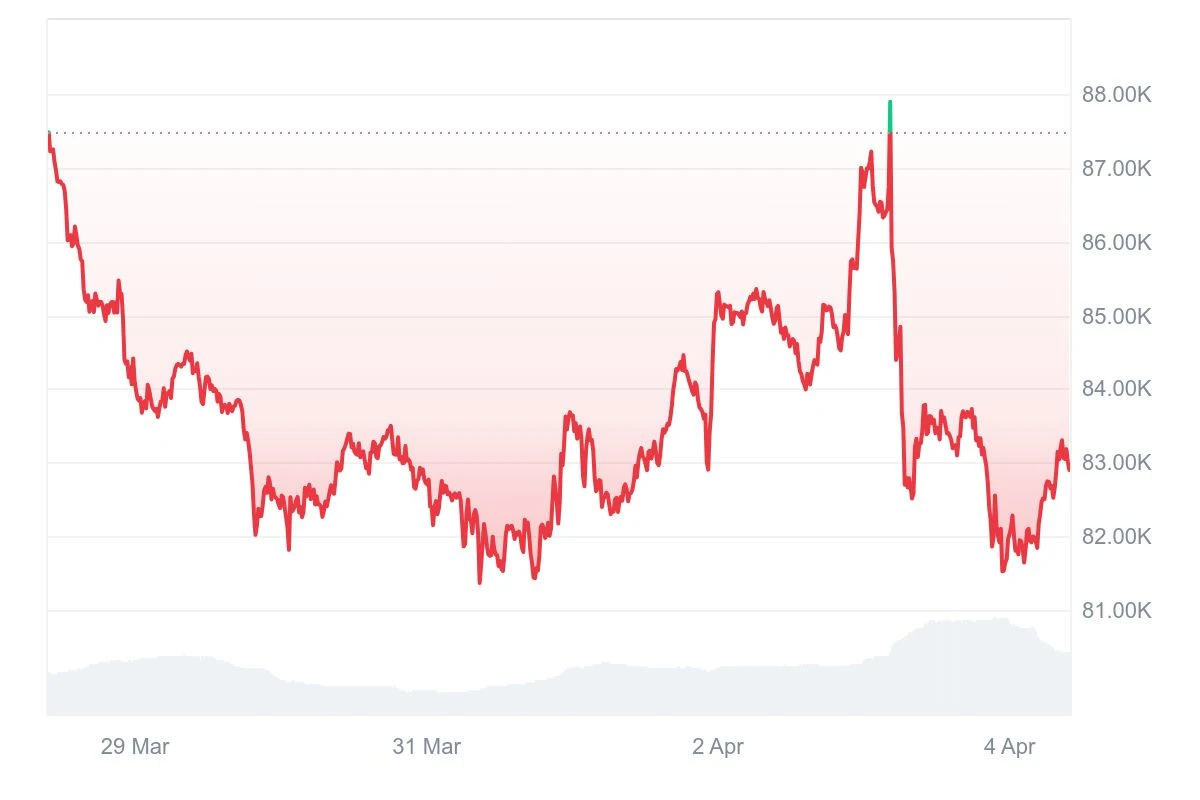

From March 29 to April 4, 2025, the specific trends of Bitcoin are as follows:

March 29: After experiencing a decline on the previous trading day, Bitcoin's price stabilized around $83,840, briefly rebounding to $84,543. However, the rebound was limited, and it subsequently entered a new round of decline, breaking below the $84,000 support level, oscillating down to $82,014, and after a slight rebound, continued to decline, reaching a low of $81,878.

March 30: Bitcoin's price showed signs of stabilization, with the $82,000 support level temporarily effective, halting the downward trend and entering a phase of oscillating upward. The price rose to $83,478 but then fell back to $82,270.

March 31: Bitcoin officially broke below the key support level of $82,000. After opening, it maintained a downward oscillation, dropping to $81,491 in the early morning. The market saw intense battles between bulls and bears, and in the evening, it further fell to $81,459 before stopping the decline and starting a rebound, showing a pattern of oscillating upward, quickly rising to $83,633 by noon.

April 1: Bitcoin's price briefly consolidated around $83,470 but weakened again after failing to stabilize effectively, falling back to $82,314. It then entered a new round of upward movement, breaking through the previous high, reaching a maximum of $85,291, during which it briefly plummeted to $82,692 but quickly recovered, successfully breaking through the $85,000 integer level.

April 2: The price maintained a consolidation around $85,000, then oscillated down to $83,989. After a short-term correction ended, it quickly surged, breaking through the $86,000, $87,000, and $88,000 levels, showing strong bullish momentum.

April 3: Bitcoin continued its upward trend, reaching a high of $88,377 during the day, but then experienced a sharp correction, quickly falling to a low of $82,529, forming a cliff-like drop. Although it rebounded to around $83,600, selling pressure remained, and the price fell below $82,000 again, further probing down to $81,532.

April 4: Bitcoin stopped its decline and stabilized, with the price gradually rising. As of the time of writing, Bitcoin was at $82,902, showing initial signs of short-term stabilization in the market.

Summary

This week, Bitcoin's overall trend exhibited a typical oscillating structure of "decline - rebound - further decline." At the beginning of the week, Bitcoin fell stepwise from the $87,000 range to $82,000, forming a short-term weak pattern; in the mid-term, the price oscillated between $82,000 and $84,000; in the latter part of the week, volatility significantly increased. Although it briefly broke through $88,000 to set a new high, the market's risk aversion intensified due to former U.S. President Trump's announcement of a new round of tariff policies, leading to a rapid and substantial price correction, forming a "cliff-like" drop. The current price stabilizes around $82,900, with short-term market sentiment appearing cautious. Future trends need to pay attention to macro policy changes and the effectiveness of key support levels.

Bitcoin Price Trends (2025/03/29-2025/04/04)

2. Market Dynamics and Macroeconomic Background

Capital Flow

1. Exchange Capital Flow

Bitcoin Spot ETF Capital Flow (Data from Farside Investors):

March 31: The total net outflow from Bitcoin spot ETFs was approximately $60.6 million.

April 1: The net outflow expanded to $157.8 million.

April 2: Market sentiment warmed, with a net inflow of approximately $334 million.

Bitcoin Supply on Exchanges:

As of April 1, the supply of Bitcoin held by exchanges had dropped to 7.53% of the total supply, the lowest level since February 2018, reflecting reduced selling pressure and increased confidence among long-term holders.

2. Institutional Investor Movements

GameStop: On March 25, GameStop announced plans to raise $1.3 billion through debt financing to purchase Bitcoin, aiming to use it as a financial reserve asset to combat inflation and align with technological and monetary trends. However, this move raised market skepticism, causing its stock price to drop over 13%.

MicroStrategy: As of March 30, MicroStrategy (now known as Strategy) increased its Bitcoin holdings to 528,185 coins, accounting for over 2% of the circulating Bitcoin supply. Nevertheless, analyst Gus Gala from Monness Crespi Hardt downgraded its stock rating to "sell," indicating potential challenges for the company's future financing.

3. Whale Account Capital Movements

Unusual Movements of Long-Term Held Bitcoin:

On March 30, CryptoQuant analyst Maartunn reported that approximately 8,000 long-term dormant (5-7 years) Bitcoins underwent a large-scale transfer, with a total value of about $674 million. This transfer occurred within a single block, and the market generally believed it could bring selling pressure, leading to a bearish sentiment. However, it could also be an internal adjustment of whale accounts or a cold wallet reorganization by institutional investors, not necessarily indicating direct selling.

Technical Indicator Analysis

Death Cross: Recently, the 50-day moving average (MA) crossed below the 200-day MA, forming a typical "death cross" sell signal. This usually indicates that the market may enter a downward trend.

Relative Strength Index (RSI): The current RSI value is approximately 72, nearing the overbought zone, which may indicate a risk of price correction in the short term.

Support and Resistance Levels: Key support levels are between $75,815 and $72,856; if the price breaks through the resistance level of $105,000, it may further test the target of $110,000.

Market Sentiment Analysis

1. Market Sentiment Indicator Analysis

Fear & Greed Index:

According to CoinMarketCap data, this week the fear and greed index dropped from 27 on March 29 to 24 in the middle of the week, briefly rebounding to 29 on April 2, before falling back to 24. This fluctuation reflects the ongoing instability of market sentiment, with the market initially shrouded in fear, influenced by uncertainty and price volatility, leading to insufficient investor confidence. The rebound on April 2 may be related to changes in capital flow and short-term buying interest, but due to the lack of clear upward momentum in the market, fear sentiment reasserted dominance, indicating that investors remain cautious overall and lack confidence in future trends.

2. Market Sentiment Overview

In the past week, Bitcoin's price experienced significant volatility, first sharply dropping to $82,000, then starting to rebound on April 1, and briefly touching $88,000 on April 3 before quickly falling back to around $82,500. Overall, market sentiment still leans towards caution and fear. Although the early April rebound temporarily boosted confidence, the price failed to stabilize effectively, indicating insufficient bullish strength, while selling pressure remains heavy. In this context, short-term traders tend to buy low and sell high, while long-term holders are in a wait-and-see mode, awaiting further clarification of market trends.

Macroeconomic Background

New U.S. Tariff Policy: On Wednesday (April 2), U.S. President Donald Trump announced new reciprocal tariff policies against multiple countries. The U.S. will impose a 10% comprehensive tariff on all imported goods and higher rates on other countries deemed to perform poorly in trade. Additionally, Trump stated that a 25% tariff would be imposed on foreign automobiles. This news caused Bitcoin's price to rapidly drop from nearly $88,000 to about $83,000. Cryptocurrency-related stocks also declined, with Strategy (formerly MicroStrategy) falling about 7%, Coinbase Global down 6%, and Robinhood down 9%. The market is concerned that these tariffs may suppress economic growth and exacerbate inflation, thereby affecting investors' preferences for risk assets.

Cryptocurrency Options Expiration and Market Volatility: Reports indicate that over $14 billion in options contracts are set to expire on Friday, which may lead to increased volatility in the cryptocurrency market. Additionally, GDP data released on Thursday may also impact market sentiment and trading decisions.

Global Liquidity and Bitcoin Price Trends: According to a report from Merkle Tree Capital, the global M2 money supply has been rising since the end of 2024. The Federal Reserve announced it would reduce quantitative tightening (QT) from $25 billion per month to $5 billion starting in April. This increase in liquidity has historically been associated with a lag of about 10 weeks before supporting Bitcoin prices, which may provide support for Bitcoin prices in the coming months.

U.S. Economic Data and Market Expectations: This week, investors are focused on March employment data, new trade policies, corporate earnings reports, and the latest dynamics in manufacturing and services. In particular, Friday's employment report, Tuesday's job openings data, Wednesday's ADP private sector hiring report, and Thursday's weekly unemployment claims data will provide important clues about the health of the U.S. economy, potentially influencing investors' attitudes toward risk assets.

3. Hash Rate Changes

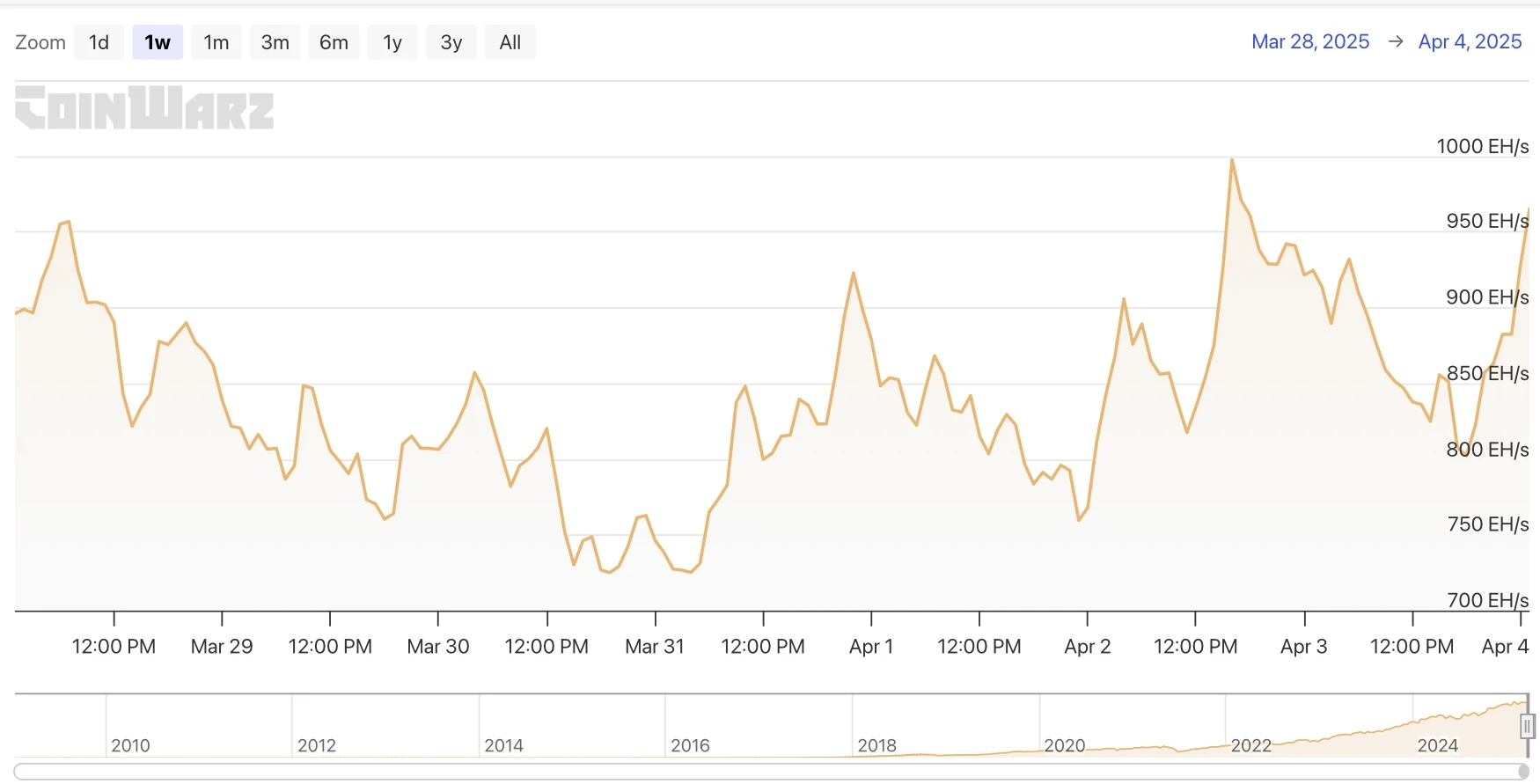

From March 29 to April 4, 2025, Bitcoin network hash rate exhibited fluctuations, with the following specifics:

On March 29, the Bitcoin network hash rate fell from 862.01 EH/s to 786.65 EH/s, then briefly rebounded to 848.43 EH/s but failed to maintain the upward momentum, dropping again to 769.28 EH/s, showing high volatility characteristics. On March 30, the hash rate initially rose to 857.02 EH/s but quickly fell back to 781.84 EH/s due to volatility. Although there were signs of recovery afterward, it again dipped to 730.04 EH/s and maintained a level below 750 EH/s for an extended period, indicating that some miners may have temporarily exited the network due to profit pressure. On March 31, the hash rate saw a significant increase, quickly rising to 848.00 EH/s, and after a brief pullback, surged again, reaching a high of 922.66 EH/s, indicating a recovery in miner activity. On April 1, the hash rate rapidly dropped to 822.27 EH/s and continued a downward trend, falling to a low of 759.35 EH/s, overall showing a weak correction pattern. On April 2, the hash rate rebounded strongly again, rising to 905.68 EH/s, then slightly falling to 817.41 EH/s, but subsequently surged again, reaching a daily high of 997.51 EH/s, the peak for the week, before slightly adjusting to around 940 EH/s. On April 3, the hash rate fell back to 824.77 EH/s, then further dipped to 802.10 EH/s, but gradually recovered in the latter half of the day, rebounding to 965.17 EH/s as of the time of writing, showing signs of rapid recovery in computing power.

This week, the overall hash rate of the Bitcoin network exhibited a pattern of "oscillating decline - rapid recovery - severe volatility." In the first half of the week, the hash rate dipped below 750 EH/s, indicating that some miners temporarily exited the network during the price adjustment period. As market sentiment warmed, computing power quickly recovered, approaching 1,000 EH/s in the latter half of the week, reflecting the network's high resilience and miners' rapid responsiveness.

Continuous attention is needed on the impact of subsequent price fluctuations on small and medium-sized miners, as well as the upcoming difficulty adjustment rhythm's effect on hash rate stability.

Bitcoin Network Hash Rate Data

4. Mining Revenue

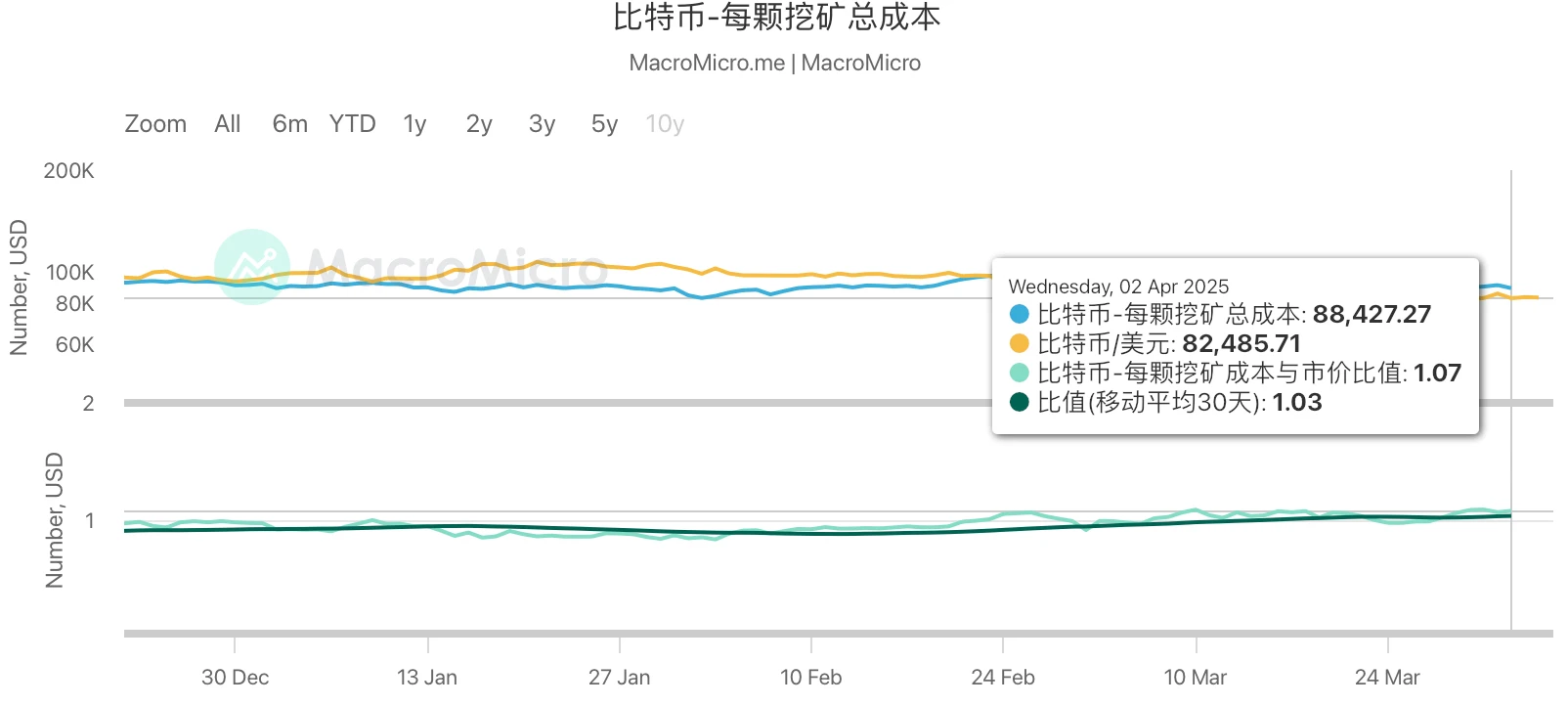

According to MacroMicro's latest model estimates, as of April 2, 2025, the unit production cost of Bitcoin is approximately $88,427.27, while the spot price on that day is about $82,900, resulting in a Mining Cost-to-Price Ratio of 1.07. This ratio is significantly above 1, indicating that the current market price is below the average mining cost across the network, with the overall network operating below the breakeven point, and most miners are experiencing compressed profits or losses.

This phenomenon reflects that, in the current market environment, miners' profit margins are significantly squeezed, especially for those with high electricity costs or using low-efficiency equipment. In particular, small and medium-sized mining farms relying on the previous generation of ASIC miners may have entered a marginal loss or even a total loss zone. Historical data shows that when the cost-to-price ratio remains above 1, it usually leads to the exit of some inefficient computing power from the market, pushing the overall network hash rate down and triggering a downward adjustment in mining difficulty to rebalance operational costs and entry thresholds.

Additionally, it is worth noting that an increase in the Mining Cost-to-Price Ratio often coincides with weak market sentiment or rapid price corrections. Therefore, this indicator can also serve as a predictive signal for miners' survival pressure and a potential leading indicator for market bottoms, possessing certain forward-looking reference value.

According to Hashrate Index data, as of April 4, 2025, the Bitcoin hash price is $46.51 per PH/s per day, showing a slight rebound month-on-month, but overall remains in a low range. Hash price, as a core indicator of miners' unit computing power income, is influenced by Bitcoin prices, mining difficulty, and block transaction fees. The recent decline in Bitcoin prices, coupled with an increase in difficulty, has put pressure on hash price levels, further compressing miners' profitability.

If Bitcoin prices cannot achieve an effective rebound in the short term, while energy and maintenance costs remain high, there may be a trend of computing power migration or centralization in certain regions. Especially for miners with access to cheap electricity resources or deploying high-efficiency mining machines, their competitive advantage will be further strengthened, accelerating the market towards concentration at the top.

Bitcoin Mining Cost Data

5. Energy Costs and Mining Efficiency

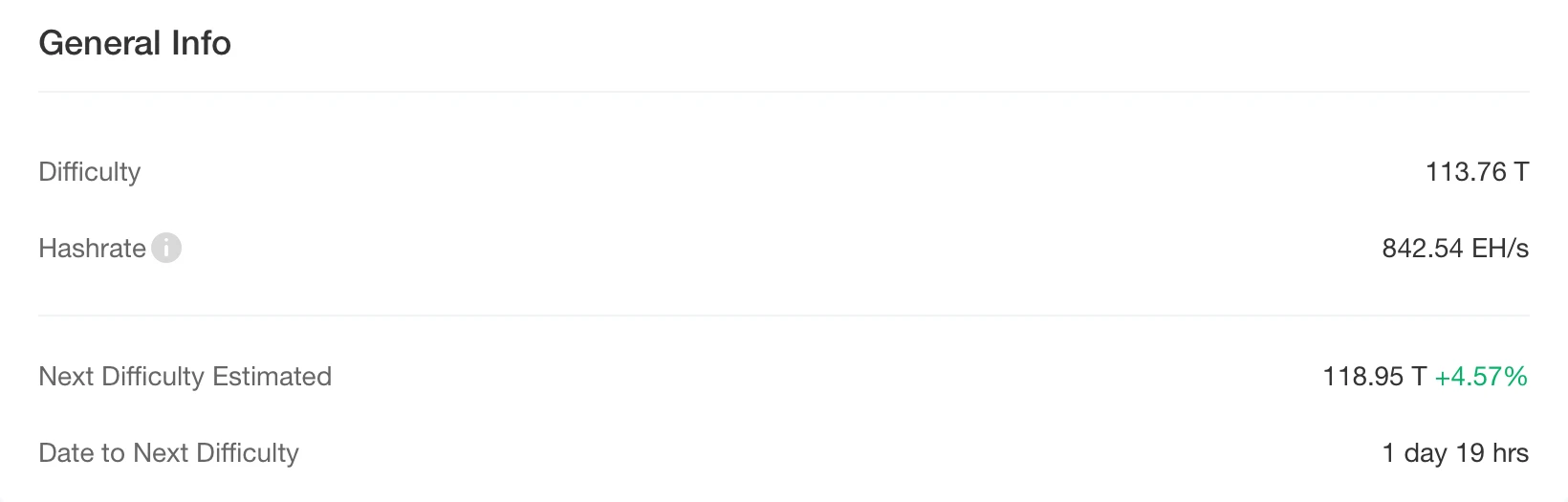

According to CloverPool data, as of the time of writing, the total hash rate of the Bitcoin network has reached approximately 842.54 EH/s, with the current network mining difficulty at 113.76 T. Based on block interval estimates, the next round of difficulty adjustment is expected to occur in about one day, with the current estimated increase of approximately +4.57%, which may raise the difficulty to 118.95 T.

This round of difficulty increase means that the efficiency of mining Bitcoin per unit of computing power will further decline, specifically manifested as a reduction in output per unit of energy consumption (i.e., a decrease in energy efficiency ratio), which equates to a contraction in marginal returns for miners. Against the backdrop of relatively pressured Bitcoin prices, this trend will exacerbate the profitability pressure on mining farms with high electricity prices and high operating costs, particularly for miners who have not timely deployed high-efficiency ASIC equipment, significantly increasing potential risks.

Based on current difficulty and hash rate levels, the average block time on the network is still slightly faster than 10 minutes, which is also a direct factor driving further difficulty increases. Meanwhile, as major global mining regions gradually enter spring and summer, the end of the dry season in some areas may continue to release computing power resources in the short term, further raising the overall network difficulty level.

Additionally, it is noteworthy that if Bitcoin prices remain at current levels (around $82,900) or continue to decline, while network difficulty continues to rise, it will directly lead to a continuous decline in hash price (mining revenue per EH/s per day), further compressing miners' unit energy consumption returns.

As Bitcoin approaches an important halving cycle window (expected in mid-April 2025), the aforementioned trends will become more influential. Miners need to optimize their energy structure and equipment iteration strategies in advance to adapt to the upcoming dual challenges of "halving unit output + rising difficulty."

Bitcoin Mining Difficulty Data

6. Policy and Regulatory News

U.S. Bitcoin Legislation Accelerates—Multiple States Promote Self-Custody Rights and Government Investment

California Submits "Bitcoin Rights Bill"—Establishes Self-Custody Rights, Limits Government Intervention

On March 29, 2024, the California legislature officially submitted the "Bitcoin Rights Bill" numbered AB-1052, aimed at safeguarding California residents' rights to self-custody of Bitcoin and other digital assets, prohibiting the government from taxing or imposing restrictions on the use of Bitcoin for payments. The bill also establishes a legal framework for unclaimed digital assets and amends the 1974 Political Reform Act to clarify that public officials cannot promote or issue digital assets. Supporters believe that if passed, the bill will serve as a reference model for national Bitcoin regulation.

Rhode Island Proposes Tax-Free Bitcoin Trading Policy—$10,000 Monthly Limit to Encourage Adoption by Businesses

On March 29, 2024, the Rhode Island Senate submitted Bill No. 0451, proposing to exempt residents and businesses from state capital gains tax for up to 10 Bitcoin transactions per month, with each transaction not exceeding $1,000. The bill emphasizes that this policy applies only to state taxes and does not affect federal tax obligations, while requiring complete transaction records to be kept for tax audits. Chris Perrotta, chair of the Rhode Island Blockchain Committee, stated that this initiative will lower barriers to Bitcoin trading and encourage more businesses to accept Bitcoin payments, positioning the state favorably in the blockchain economy competition.

Texas Proposes Government Bitcoin Investment Bill—Plans to Establish a $250 Million BTC Reserve

On April 2, 2024, Democratic lawmakers in the Texas House submitted a new bill proposing that the state government invest up to $250 million in Bitcoin and allow cities and counties to invest an additional $10 million. The bill aims to incorporate Bitcoin into public fund allocations to enhance fiscal diversification and long-term return potential. If passed, Texas will become the first state in the U.S. to officially establish a government Bitcoin reserve, potentially sparking discussions in other states about Bitcoin as a strategic asset.

Arizona House Committee Approves Bitcoin Reserve Bill—Enters Final Voting Stage

On April 3, 2024, the Arizona House Committee officially approved the Bitcoin Reserve Bill (SB 1025 and SB 1373). The bill has now entered the third reading process and will undergo final voting in the House. If successfully passed, it will be submitted for the governor's signature, making Arizona a significant promoter of Bitcoin fiscal strategy in the U.S.

Alabama and Minnesota Legislators Push for Bitcoin Reserves—Allowing State Investment in Bitcoin

On April 3, 2024, news emerged that legislators in Minnesota and Alabama have submitted companion bills similar to existing legislation, allowing states to purchase Bitcoin. On April 1, Minnesota Republican Representative Bernie Perryman submitted the "Minnesota Bitcoin Bill" (HF 2946) to the state House, following a similar bill proposed by Republican State Senator Jeremy Miller on March 17. Meanwhile, on the same day in Alabama, Republican Senator Will Barfoot introduced Senate Bill No. 283, while bipartisan representatives led by Republican Mike Shaw proposed the same House Bill No. 482, which allows the state to invest in cryptocurrencies but essentially limits it to Bitcoin.

A Senior Official in Brazil: Bitcoin Reserves are "Crucial" for Brazil's Prosperity

On March 29, news reported by Decrypt stated that Pedro Giocondo Guerra, a senior advisor to the Brazilian Vice President, recently stated on behalf of the government: "Strategic reserves of Bitcoin are crucial for the nation's prosperity. Discussions about establishing BTC reserves may be key factors in determining Brazil's prosperity, aligning with national and public interests." Brazilian Congressman Eros Biondini (PL-MG) previously proposed legislation to establish a "Strategic Sovereign Bitcoin Reserve" (RESBit), holding 5% of foreign exchange reserves (international reserves) in Bitcoin, with the Brazilian central bank using advanced monitoring systems, blockchain technology, and artificial intelligence to oversee transactions and custody.

Related Images

Bitcoin Adoption in the EU Limited by "Fragmented" Regulatory Framework

On March 29, news reported that while the U.S. is advancing landmark cryptocurrency regulations, attempting to establish Bitcoin as a national reserve asset, institutional adoption of Bitcoin in the EU remains slow. Since President Trump signed an executive order on March 7, planning to use confiscated cryptocurrencies to create a federal Bitcoin reserve, European businesses have largely remained silent on the matter.

According to Elisenda Fabrega, the Chief Legal Officer of Brickken (a European real-world asset tokenization platform), this stagnation may stem from Europe's complex regulatory framework. She stated, "The adoption of Bitcoin by European businesses is still constrained, and this hesitation reflects deeper structural divergences rooted in regulation, institutional signals, and market maturity. Europe has yet to take a clear stance on Bitcoin as a reserve asset."

7. Mining News

Galaxy Digital Plans to Scale Back Bitcoin Mining, Texas Data Center Shifts to AI-Related Business

On March 29, news reported that Galaxy Digital's financial report disclosed that the company plans to reduce its Bitcoin mining output in the coming quarters and transform its data center in Texas into an AI and high-performance computing (HPC) facility. This transformation is based on a 15-year hosting agreement signed with CoreWeave.

Hut 8 Mining and Trump's Second Son Announce Formation of American Bitcoin Company

On March 31, news reported that Hut 8 Mining and Eric Trump, the second son of U.S. President Donald Trump, announced the establishment of American Bitcoin, aimed at setting new standards for Bitcoin mining. American Data Centers, owned by Trump's eldest and second sons, will merge with American Bitcoin and hold a 20% stake in it.

American Bitcoin is a mining business primarily controlled by the publicly listed crypto mining company Hut 8. They plan to jointly create the world's largest digital currency mining enterprise and intend to establish their own "Bitcoin reserve."

JPMorgan: 14 Listed Bitcoin Mining Companies Lost 25% of Market Value in March

On April 2, news from Decrypt reported that JPMorgan stated in a report on Tuesday that Bitcoin miners continue to face challenges, with 14 listed mining companies experiencing the worst month on record in March. The Bitcoin miners tracked by JPMorgan, including MARA and Core Scientific, collectively lost 25% of their market value last month, amounting to approximately $6 billion. Additionally, the report indicated that companies with high-performance computing businesses "underperformed pure Bitcoin miners for the second consecutive month."

JPMorgan's data showed that these 14 listed mining companies also performed poorly in February, when they lost over 20% of their total market value, also around $6 billion.

Related Images

U.S. Senator Introduces FLARE Act to Support Bitcoin Mining Industry Development

On April 2, news reported that U.S. Senator Ted Cruz recently announced the introduction of the "Fostering Low-Emission Energy Utilization (FLARE) Act," a federal proposal aimed at converting wasted energy into effective use through targeted tax reforms. The federal bill seeks to amend the 1986 Internal Revenue Code to allow for permanent full expensing of property used to capture natural gas that would otherwise be flared or vented and used for value-added products. Cruz described this initiative as a strategic step to leverage the state's abundant energy supply and strengthen its leadership in the digital asset space. The senator stated, "I am committed to making Texas the preferred place for Bitcoin mining. The FLARE Act incentivizes entrepreneurs and cryptocurrency miners to utilize natural gas that would otherwise be stranded."

8. Bitcoin News

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

Fidelity Increases Bitcoin Holdings: On March 29, Fidelity purchased nearly $100 million in Bitcoin, bringing the total value of its Bitcoin ETF (FBTC) holdings to $16.6 billion.

El Salvador Bitcoin Holdings Update: As of March 30, El Salvador held 6,131.1 Bitcoins (approximately $505 million). By March 31, the holdings increased to 6,132.18 Bitcoins (approximately $606 million).

Metaplanet Increases Bitcoin Holdings: On March 31, Metaplanet issued a zero-interest bond of 2 billion yen (approximately $13.38 million) to purchase Bitcoin. On April 1, Metaplanet acquired 696 Bitcoins, raising its total holdings to 4,046 Bitcoins, with an average cost of approximately $86,300 per Bitcoin. On April 2, Metaplanet added another 160 Bitcoins, bringing the total holdings to 4,206 Bitcoins, with an average holding cost of approximately $86,300 per Bitcoin.

Japanese Game Developer enish to Purchase Bitcoin: On April 2, according to an official announcement, the publicly listed Japanese game developer enish announced that it would incorporate Bitcoin into its financial strategy, planning to purchase Bitcoin worth 100 million yen (approximately $670,000) between April 1 and April 4. The company positions Bitcoin purchases as an important component of its overall financial strategy.

BlackRock CEO Commits to Unlocking Private Investment Opportunities for the Public, Claims Dollar May Be Replaced by Bitcoin and Other Assets

On March 31, news reported that BlackRock CEO Larry Fink committed to opening private markets to millions of everyday investors, not just a select few wealthy individuals, and believes that individuals should share more in the economic growth. He stated that capitalism in recent years "has only served a few," leading to anxiety spreading throughout the economy. He noted that economic unease is more severe than "at any recent time," and expanding investment channels would help alleviate concerns.

In his annual letter to investors on Monday, Larry Fink also mentioned that the U.S. dollar's status as the global reserve currency "is not guaranteed to last forever" and warned that nations need to control their debt. He also suggested that the dollar could lose its status and be replaced by digital assets like Bitcoin.

Related Images

Survey: 25% of Respondents in Hong Kong Wish to Hold Virtual Assets, Bitcoin Most Popular

On April 1, news reported that a public opinion survey conducted by the Hong Kong University of Science and Technology's Business School regarding virtual assets and tokenized currencies showed that approximately 25% of respondents expressed a desire to hold virtual assets in the future, an increase of 6 percentage points compared to mid-September 2023, following a suspected fraud incident involving a cryptocurrency platform. The survey results indicated that 81% of respondents are interested in holding Bitcoin, an increase of 7 percentage points from the initial survey, while interest in non-fungible tokens (NFTs) has decreased by 11 percentage points, reflecting a shift in investor preference from speculative digital collectibles to other areas.

Arthur Hayes: Still Believes Bitcoin Can Reach $250,000 by Year-End

On April 1, news reported that BitMEX co-founder Arthur Hayes stated in a recent blog post: "Bitcoin value = technology + fiat liquidity. This technology is effective and will not undergo any significant changes in the near future, whether good or bad. Therefore, Bitcoin trading is entirely based on the market's expectations of future fiat currency supply. If my analysis of the Fed's major shift from QT to QE is correct, then Bitcoin touched a local low of $76,500 last month, and now we are starting to move towards $250,000 by year-end. Of course, this is not an exact science, but if I had to bet on whether Bitcoin would first reach $76,500 or $110,000, I would bet on the latter. Even if the U.S. stock market continues to decline due to tariffs, collapsing earnings expectations, or decreased foreign demand, I still believe the probability of Bitcoin continuing to rise is greater. Recognizing the pros and cons, Maelstrom is cautiously deploying capital. We do not use leverage and make small purchases relative to the size of our total investment portfolio. We have been buying Bitcoin and altcoins at all levels between $90,000 and $76,500. The speed of capital deployment will accelerate or slow down based on the accuracy of my predictions. I still believe Bitcoin can reach $250,000 by year-end."

Fidelity Research: Bitcoin is Preparing to Enter the Next "Acceleration Phase"

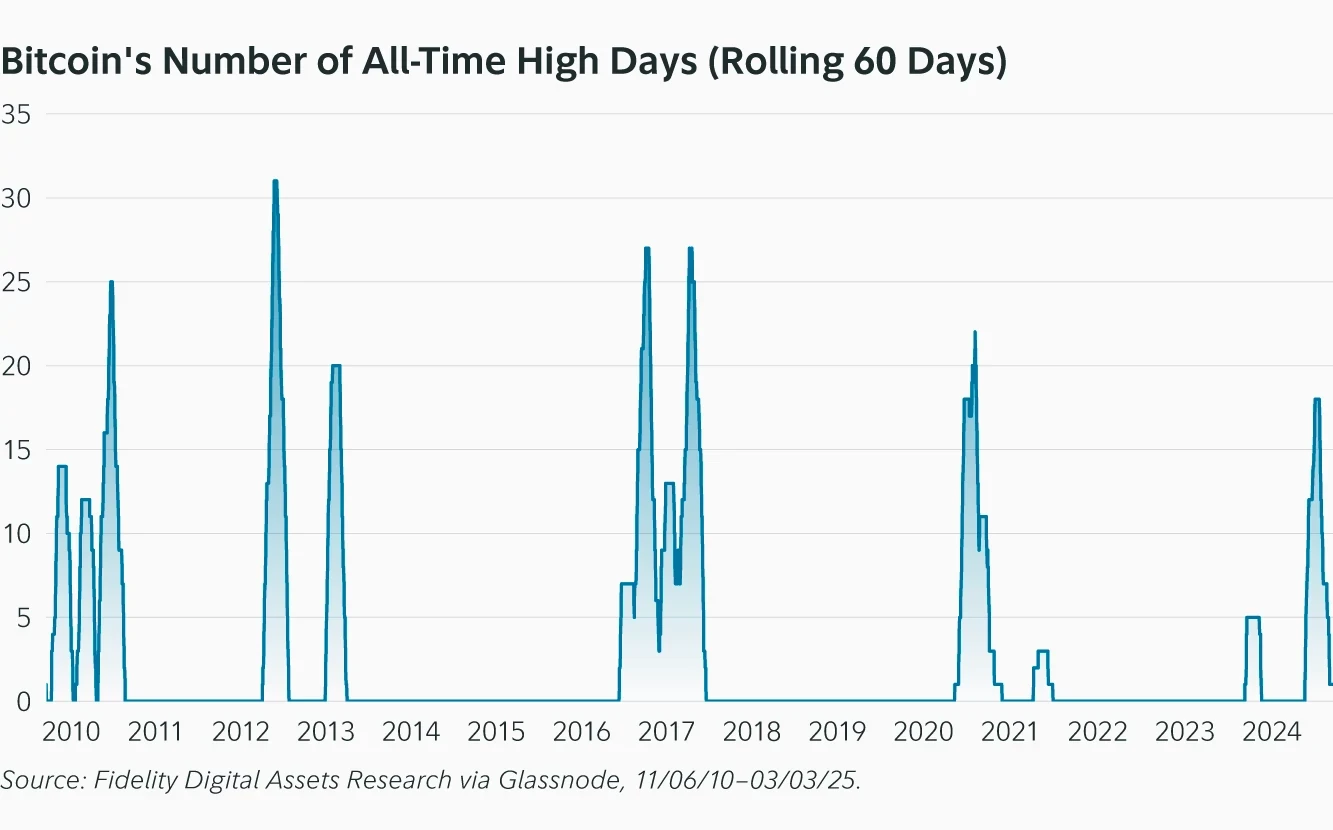

On April 1, news reported that research from Fidelity Digital Assets indicates that the Bitcoin bull market is not over, as the "acceleration phase" has not yet peaked. A report from Fidelity Digital Assets questions whether Bitcoin prices have already experienced a cyclical "peak" or if Bitcoin is on the verge of another "acceleration phase."

According to Fidelity analyst Zack Wainwright, the acceleration phase of Bitcoin is characterized by "high volatility and high returns," similar to the price movement when Bitcoin broke through $20,000 in December 2020. Despite Bitcoin's year-to-date return being a loss of 11.44% and the asset dropping nearly 25% from its historical high, Wainwright stated that the recent performance following the "acceleration phase" is consistent with Bitcoin's average drawdown compared to previous market cycles.

Related Images

Eric Trump: Bitcoin is One of the Greatest Store of Value Instruments

On April 2, news reported that Eric Trump stated: "Bitcoin is one of the greatest store of value instruments, highly liquid, and an excellent hedge against real estate."

Fidelity Research Analyst: Bitcoin May Enter Acceleration Phase, Base Price Could Stabilize Around $110,000

On April 3, news reported by Bitcoin.com stated that Fidelity Digital Assets research analyst Zack Wainwright indicated that Bitcoin may currently be in an acceleration phase, exhibiting high volatility and profit characteristics, similar to price breakthroughs in 2013 and 2017. He noted that Bitcoin prices rose 56% after the elections, and if a second rebound occurs, the base price could stabilize around $110,000, with expectations of reaching a peak in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。