In this investment market, you are never an island. I really like a saying by Siddhartha Gautama: "No matter who you meet, they are the person meant to appear in your life, not by chance; they will definitely teach you something." So I also believe: "Wherever I go, that is where I am meant to be, experiencing what I am meant to experience, meeting the people I am meant to meet." To everyone reading this article, thank you for crossing paths with me!

Hello everyone, I am trader Gege. Continuing from the last article, let’s review the strategy. The long and short strategies provided for Bitcoin have yielded certain results. For Bitcoin, long positions were taken at 81300-80700, and short positions around 84000 with a 500 USD margin. The market rebounded at the 81200 level, then pulled back to the 81600 level, providing a space of 4000-5000 USD for both long and short positions, which should yield good results for short-term trading. The strategy for Ethereum is also aligned, with a long position at the current price of 1760 and a short position around 1850 with a 20 USD margin. The market rebounded above 1830 and then pulled back, with the holiday market performing as expected in the short-term strategy.

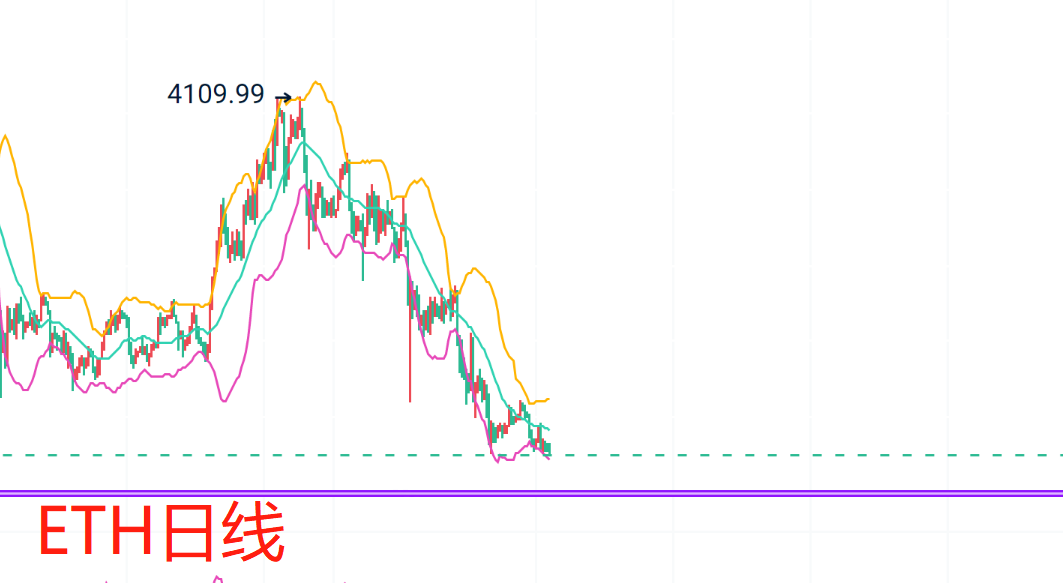

Tomorrow is Monday, and after the weekly close, I will update the technical outlook and short-term thoughts for the next week. I won’t say much today, just a brief update. The overall structure of Bitcoin has not changed for now, and we will continue to refer to the previous thoughts in the short term. The news is not friendly for the short-term market and may bring some shocks, so we will observe as we go along; just don’t be impatient in your operations. For Ethereum, the daily MA7 has been suppressing the K-line for four consecutive days since it broke down, maintaining a weak trend. It can only regain strength in the short term if it stands back above this level. If the Bollinger Bands fully open, the probability of a drop to the 1500 level will be very high. In the short term, like Bitcoin, we will continue to refer to the previous thoughts, and the short-term strategy will also be reused. That’s all for now; I will update again tomorrow.

Bitcoin short-term: Long positions at 81300-80700, and if it breaks below 80000, long positions at 78000-77000. Short positions around 84000 with a 500 USD margin, and if it breaks above 85000, short positions at around 300 USD.

Ethereum short-term: Long positions at 1660 with a 20 USD margin, and if it breaks below 1500, long positions at around 30 USD. Short positions around 1850 with a 20 USD margin, and if it breaks above 1900, short positions at around 20 USD.

The suggestions are for reference only. Please manage your risk when entering the market, and control your profit and stop-loss spaces accordingly. Specific strategies should be consulted in real-time.

Alright, friends, we will say goodbye until next time. I wish everyone success in their trading and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today’s brief update ends here. For more real-time suggestions regarding Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。