Original Authors: Alex Xu, Research Partner at Mint Ventures & Lawrence Lee, Researcher at Mint Ventures

In the previously published articles "Panning for Gold: Finding Long-term Investment Targets Through Bull and Bear Markets (2025 Edition) Part 1" and "Part 2", we reviewed and introduced Aave, Morpho, Kamino, MakerDao in the lending sector, Lido, Jito in the staking sector, and Cow Protocol, Uniswap, and Jupiter in the trading sector. This article, as the final piece in the series, will continue to introduce projects with strong fundamentals that have long-term potential for attention.

PS: This article reflects the authors' thoughts as of the time of publication, which may change in the future, and the views expressed are highly subjective and may contain errors in facts, data, or reasoning logic.

All opinions in this article are not investment advice, and criticism and further discussion from peers and readers are welcome.

4. Crypto Asset Services: Metaplex

Business Status

- Business Scope

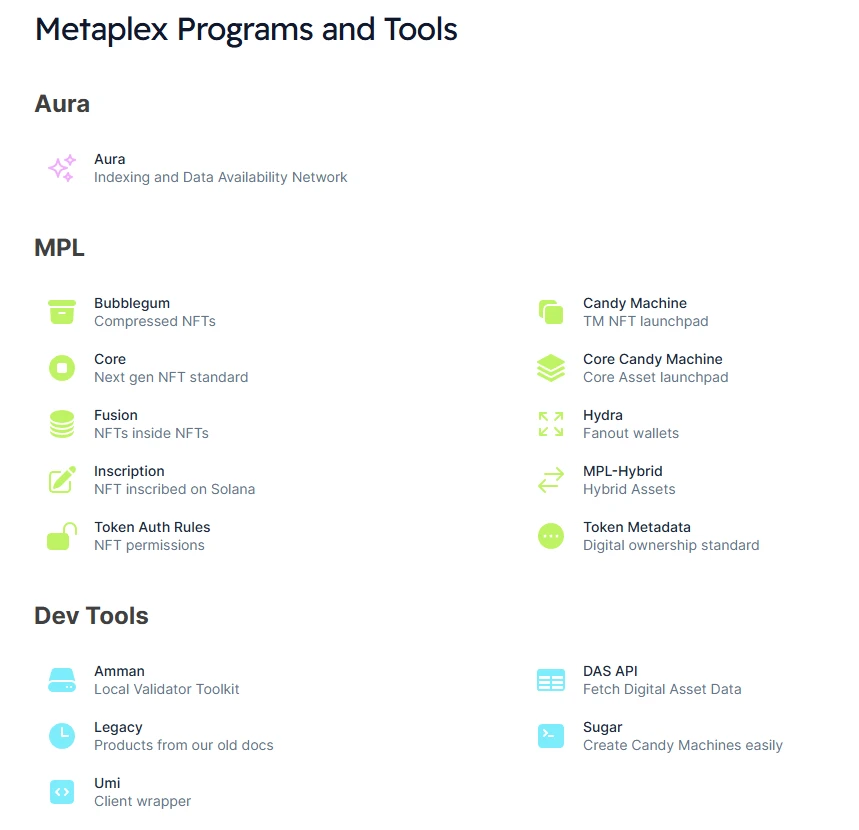

The Metaplex protocol is a digital asset creation, sales, and management system built on Solana and supporting SVM (Solana Virtual Machine) blockchains. It provides developers, creators, and businesses with tools and standards to build decentralized applications. The types of crypto assets supported by Metaplex include NFTs, FTs (fungible tokens), real-world assets (RWA), game assets, and DePIN assets.

In terms of crypto asset services, the services provided by Metaplex can be divided into two main categories: asset standards (Digital Asset Standard) and asset issuance, sales, and management (Program Library). The former provides asset issuers with a token issuance standard that has high compatibility within the SVM ecosystem and low creation and management costs, while the latter offers a series of tools and services for asset issuers to create, sell, and manage their assets.

Most NFT and FT asset issuers on Solana are users of Metaplex.

In the past six months, Metaplex has also expanded its business horizontally into other foundational service areas of the Solana ecosystem through its new business line, Aura Network, such as digital asset indexing (Index) and data availability (DA) services.

Metaplex's product and service matrix, source: Developer Documentation

In the long term, Metaplex aims to become one of the most important multi-domain foundational service projects in the Solana ecosystem.

In addition to Solana, Metaplex is currently also providing services on Sonic and Eclipse.

- Revenue Model

Metaplex's business model is relatively simple, generating revenue by providing on-chain asset-related services, including asset minting services, as well as digital asset indexing and data availability services.

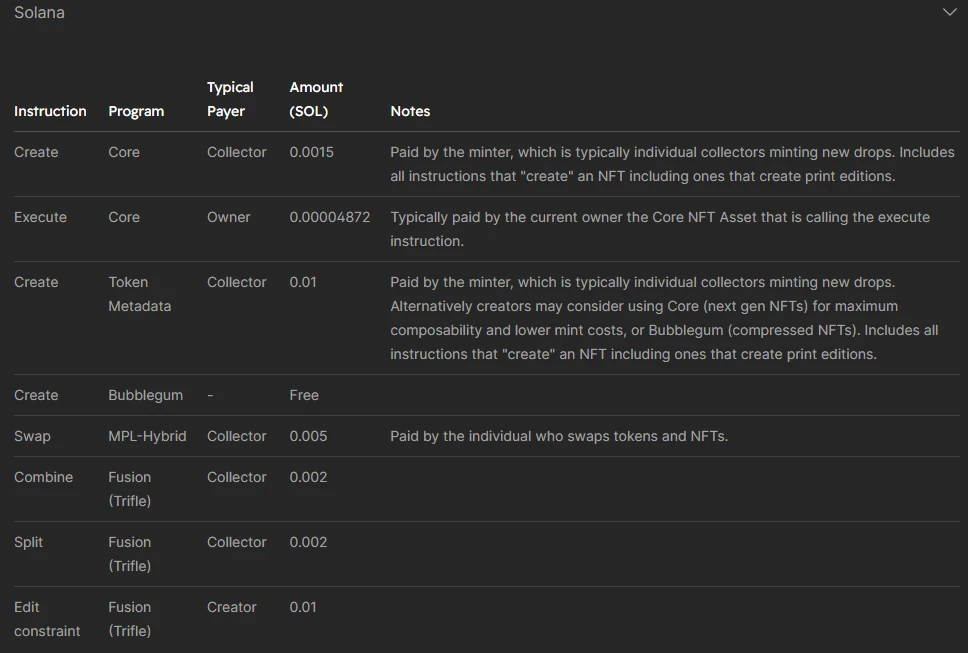

Metaplex offers a wide range of services and products, not all of which are chargeable. A detailed fee list for specific services is as follows:

MPL asset service fee standards, source: Developer Documentation

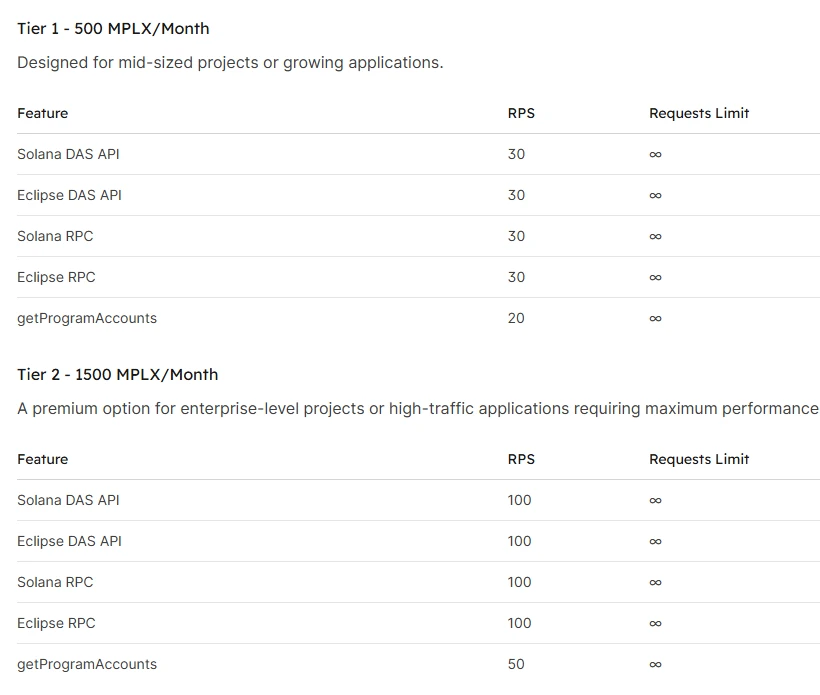

Aura service fee standards, source: Developer Documentation

The Aura business line is still in its early stages, and most of Metaplex's current revenue comes from asset minting and management services (MPL).

- Business Data

We will focus on observing two core indicators: the number of assets minted through its services and protocol revenue.

Before presenting and analyzing these two indicators, let's first look at the distribution of asset types issued by the Metaplex protocol.

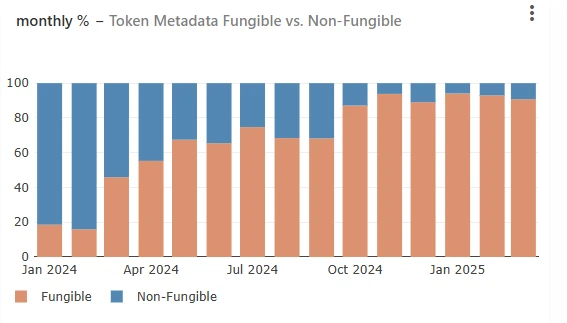

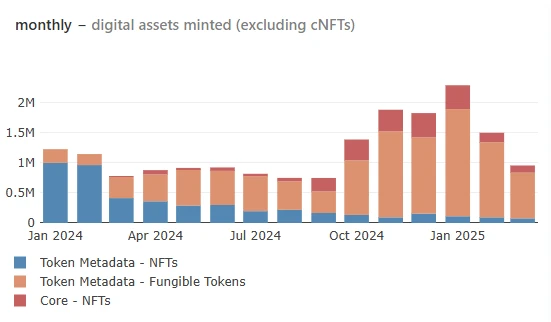

Data source: Metaplex Public Dashboard, same below

The above chart shows the trend of the proportion of NFT and FT assets that use Metaplex's Metadata (which provides additional data for digital assets, such as asset images, descriptions, etc., and is used by almost all assets).

We can see that at the beginning of 2024, the main asset issued by the Metaplex protocol was still NFTs, accounting for about 80%. However, since April of last year, the proportion of FT assets has rapidly increased and has become the main service asset category of Metaplex, currently accounting for over 90%.

Most of these FT assets are meme projects, and their issuers are currently the main customer group and revenue contributors for Metaplex.

This also means that the prosperity of memes on the Solana chain directly affects the business trajectory of Metaplex.

Now let's look at the specific business indicators.

- Number of Assets Minted (Monthly)

We can see that the number of assets minted by Metaplex has taken off since hitting a bottom in September of last year, reaching a historical peak in January of this year (over 2.3 million assets minted), and then gradually declining. The data for March has basically returned to the level of June of last year (about 960,000 assets minted), which highly correlates with the trading heat of memes in the Solana ecosystem. The higher the meme heat, the more assets are minted through Metaplex.

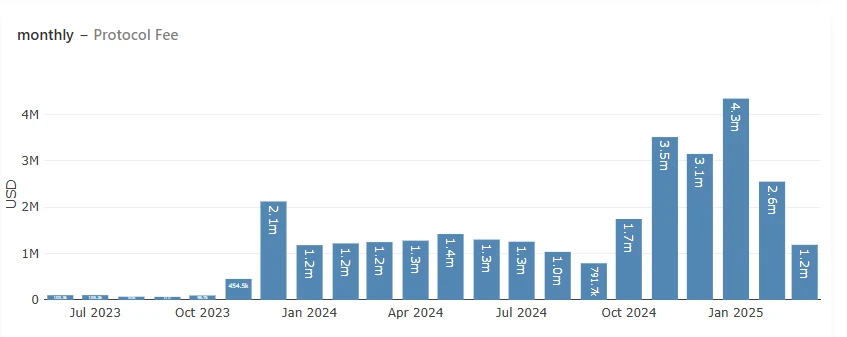

Protocol Revenue

The protocol revenue of Metaplex aligns with the trend of its asset minting numbers, peaking in January with a revenue of up to $4.3 million, and then quickly declining. The expected protocol revenue for March is estimated to be between $1.2 million and $1.3 million, returning to the level of the first half of last year.

Protocol Incentives

Unlike most Web3 protocols that rely on subsidies for business data, Metaplex does not provide subsidies for its business; its revenue is entirely organic, stemming from the genuine demand of asset issuers. However, it did conduct a round of token incentives worth $1 million from January to early March this year, in collaboration with Orca, Kamino, and Jito, to incentivize the liquidity of its token MPLX, which has now concluded.

Competitive Situation

As one of the earliest asset standard setters on Solana, Metaplex currently has no competitors in the asset standard and its derived asset service field within the Solana ecosystem.

- Competitive Advantages

Metaplex's competitive advantage comes from being the creator and maintainer of the asset standard in the Solana ecosystem, serving as the foundation for digital assets on Solana, ensuring interoperability and liquidity among NFTs, FTs, real-world assets (RWA), decentralized infrastructure (DePIN), game assets, and more within the ecosystem.

This means that issuers who issue and maintain assets based on Metaplex will face high time, technical, and economic costs if they later wish to switch their project assets to other protocols for management.

Moreover, new developers and projects will prioritize choosing asset service platforms that offer greater ecological compatibility, such as the Metaplex asset format, to ensure compatibility of their assets with other foundational infrastructures (like wallets) and products (DeFi, trading panels) in the Solana ecosystem.

In addition to asset services, the data indexing and data availability service Aura Network, which Metaplex is promoting, is also expected to create a second business growth curve for Metaplex in the future. Considering that the target audience for this service overlaps significantly with Metaplex's existing customer base, its newly expanded business may be more readily accepted and experienced by existing cooperative clients.

Major Challenges and Risks

The continued cooling of meme popularity on Solana could lead to a sustained decline in the number of assets minted and a decrease in business revenue; this trend has not yet stopped since January.

Metaplex's current revenue is collected as a one-time fee based on the types of assets created, and projects with relatively fixed asset types cannot provide Metaplex with sustained long-term revenue.

Valuation Reference

The protocol token of Metaplex is MPLX, with a total supply of 1 billion.

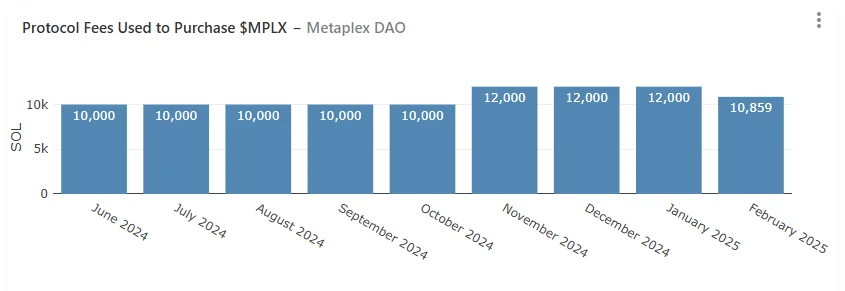

Currently, the utility of MPLX is mainly for governance voting. Additionally, Metaplex announced in March 2024 that it would use 50% of its protocol revenue for token buybacks (this standard has not been strictly enforced in practice, mostly between 10,000-12,000 SOL), with the repurchased tokens entering the treasury for the development of the protocol ecosystem.

As of now, the monthly buyback amount has been over 10,000 SOL.

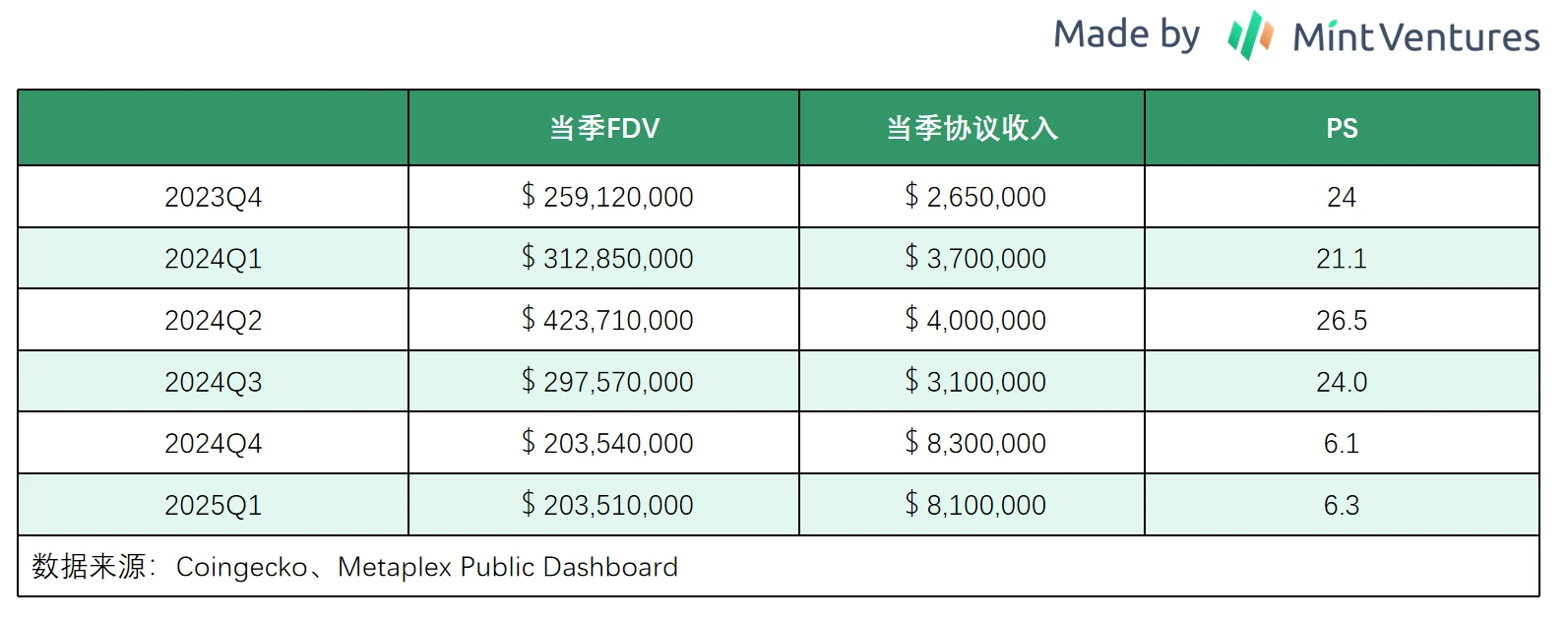

Considering the lack of comparable projects for Metaplex, we mainly observe its market capitalization relative to monthly protocol revenue for valuation reference from a vertical perspective.

As of now, compared to its protocol revenue in the first quarter, its valuation level is at a low point not seen in over a year, reflecting the market's pessimistic expectations for the asset issuance market on Solana.

5. Hyperliquid: Troubled Derivatives + L1

Hyperliquid is one of the few practical new projects in this cycle. Mint Ventures published an article about Hyperliquid at the end of last year, and interested readers can check it out.

Business Status

Hyperliquid's business can be divided into three parts: derivatives exchange, spot exchange, and public chain. Currently, all three parts of the business have been launched, but in terms of business volume and influence, the derivatives exchange is Hyperliquid's core business at present.

For the derivatives exchange, trading volume and open interest are its core indicators.

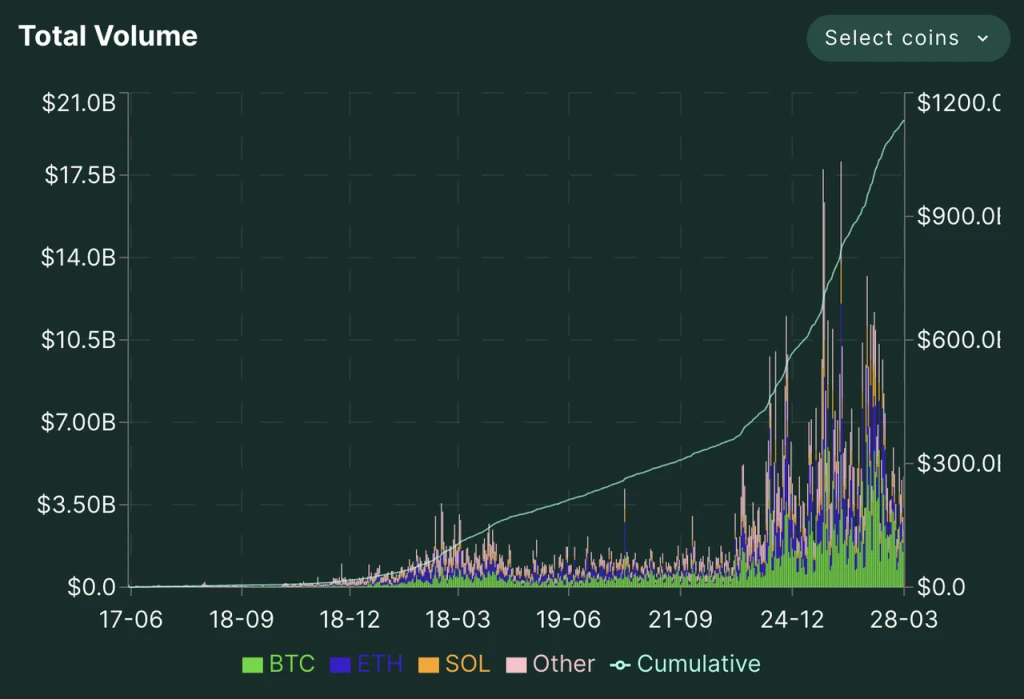

Hyperliquid's derivatives trading began a soft launch in June 2023, with a points activity starting in November 2023. After the official token airdrop at the end of November 2024, trading volume and open interest began to rise rapidly. Since December of last year, Hyperliquid's daily derivatives trading volume has averaged between $4 billion and $7 billion, with a single-day peak trading volume of $18.1 billion. Open interest has also risen rapidly, fluctuating between $2.5 billion and $4.5 billion since December.

Source: Hyperliquid Official Website

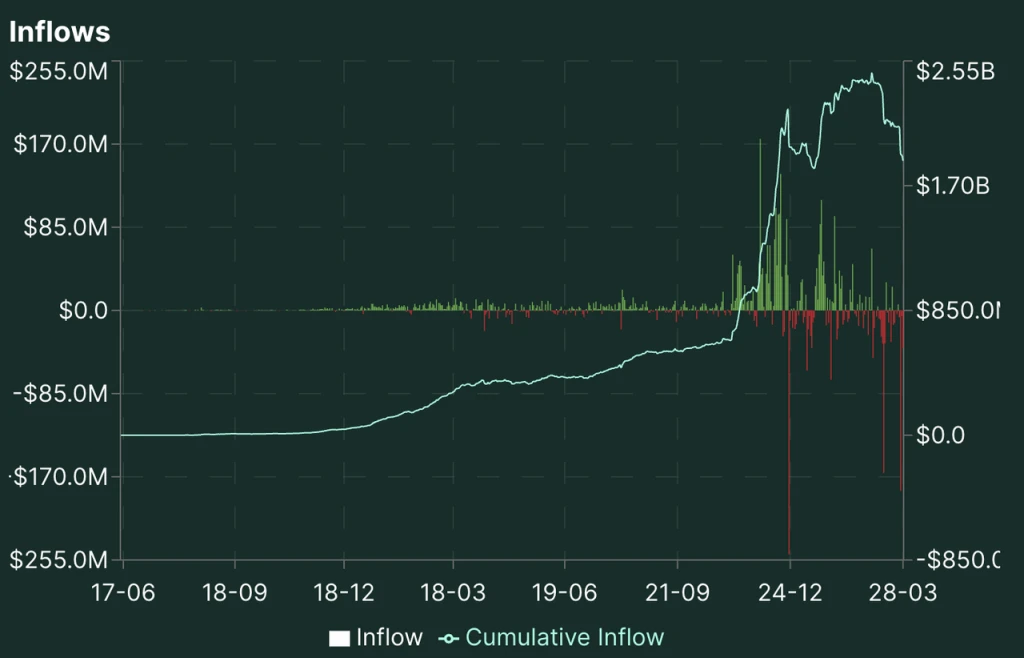

Hyperliquid's platform funds surged from November, fluctuating around $2 billion. However, recent attack incidents caused Hyperliquid's funds to drop sharply from $2.5 billion to $1.8 billion.

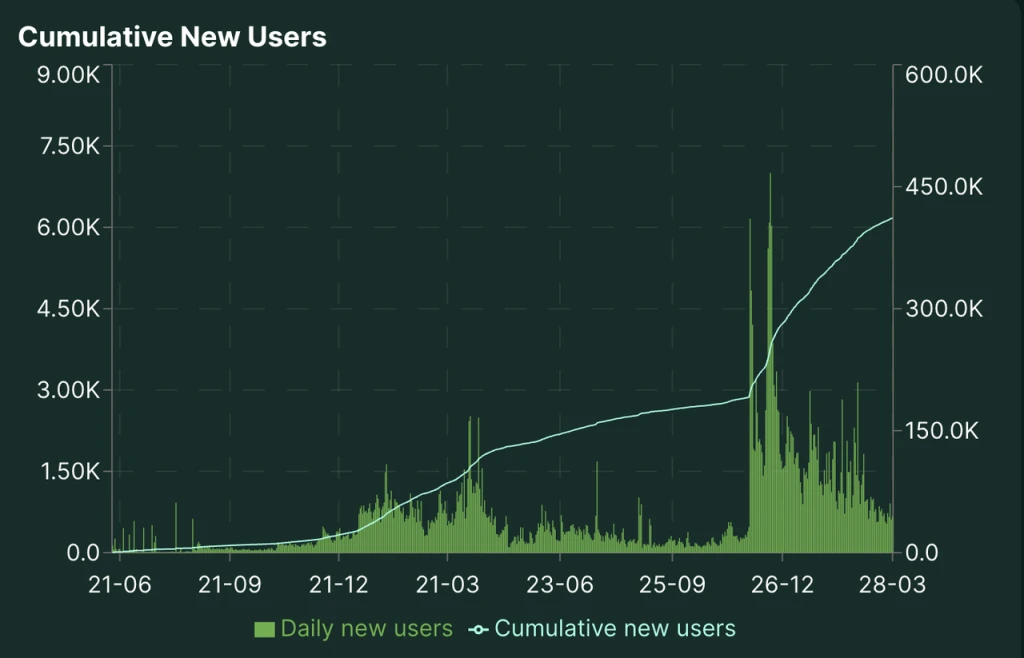

In terms of users, the number of Hyperliquid addresses has also risen rapidly, with nearly 400,000 cumulative trading addresses currently.

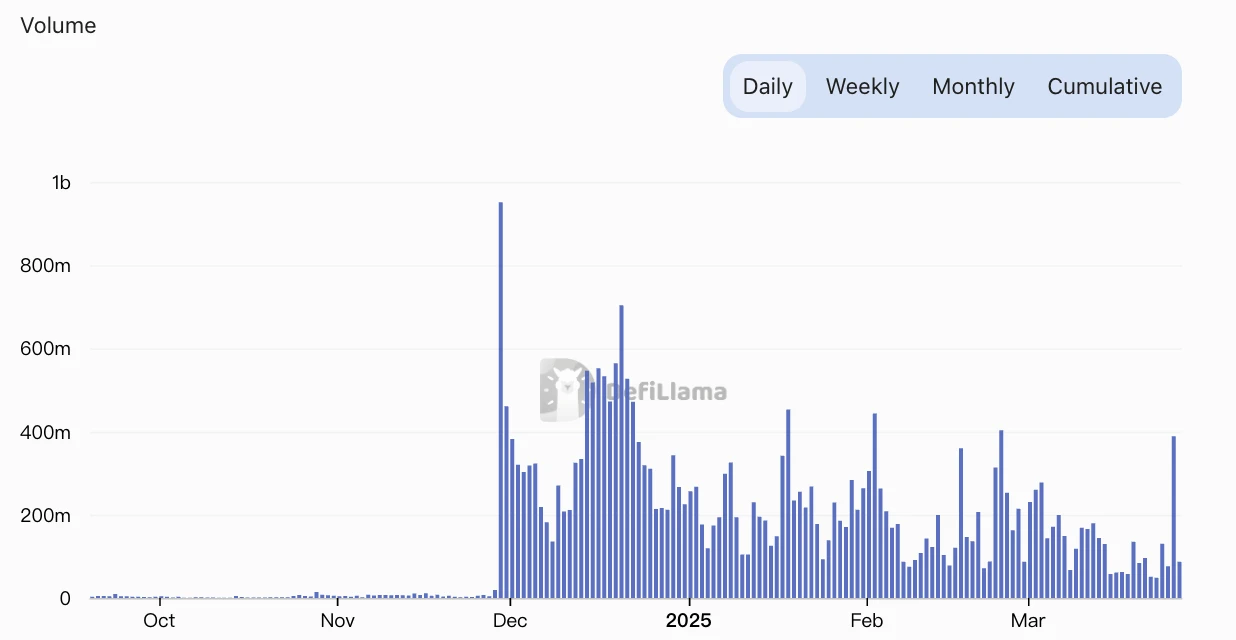

In the spot trading sector, Hyperliquid previously only supported the native assets of Hyperliquid L1, with the trading volume of HYPE itself accounting for the vast majority. However, in February of this year, Hyperliquid launched a decentralized BTC spot trading solution, uBTC, suitable for Hyperliquid. Nevertheless, Hyperliquid's BTC spot trading volume is approximately $20 million to $50 million daily, which is not a high proportion of Hyperliquid's average daily spot trading volume of around $200 million.

Hyperliquid Spot Trading Volume Source: DeFillama

Additionally, Hyperliquid's spot listing adopts a decentralized (HIP-1) approach, allowing anyone to participate in the public auction for spot listing qualifications. The auction amounts can be seen as Hyperliquid's "listing fees," and their trends are shown in the following chart:

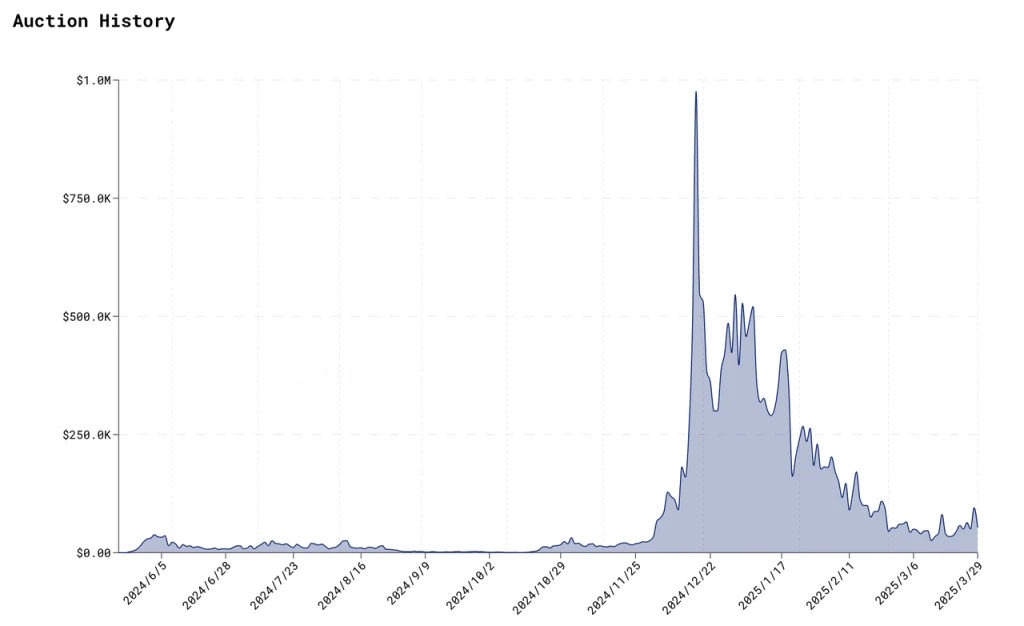

Historical Auction Prices for Hyperliquid's Spot Listing Qualifications Source: ASXN

It can be seen that Hyperliquid's listing fees fluctuate significantly, with a peak price of nearly $1 million in December. However, as market enthusiasm for altcoins has decreased, it has now dropped to around $50,000.

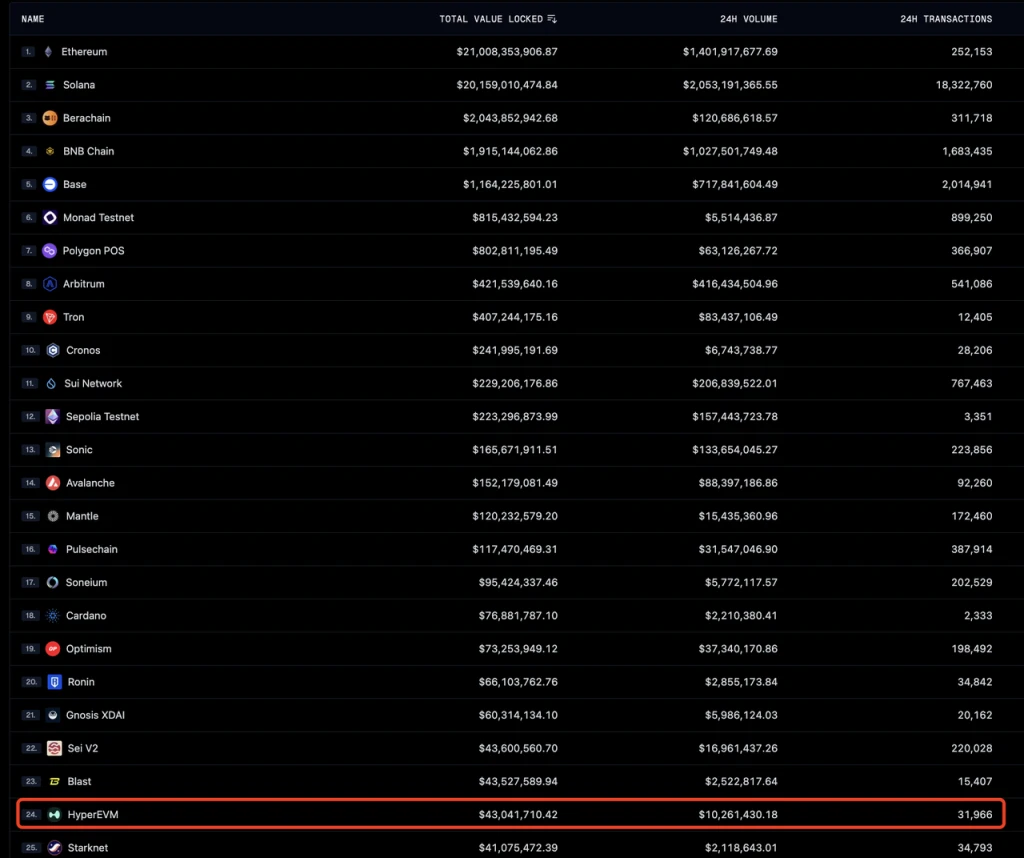

Hyperliquid's EVM component, HyperEVM, launched its Alpha version on February 18 of this year. On March 26, HyperEVM completed integration with the existing HyperCore. However, since many EVM protocols have not yet launched and key infrastructure like bridges is not fully developed, and the official has not introduced incentive measures, the overall activity of HyperEVM remains limited. In terms of TVL, trading volume, and transaction numbers, it ranks around 20th among all chains.

TVL, Trading Volume, and TX Data Across Chains Source: Geckoterminal

In terms of revenue distribution, all income collected by the protocol, including derivatives and spot trading fees and spot listing qualification auction fees, is allocated to HLP, while all other income is used to repurchase $HYPE tokens through the AF Assistance Fund.

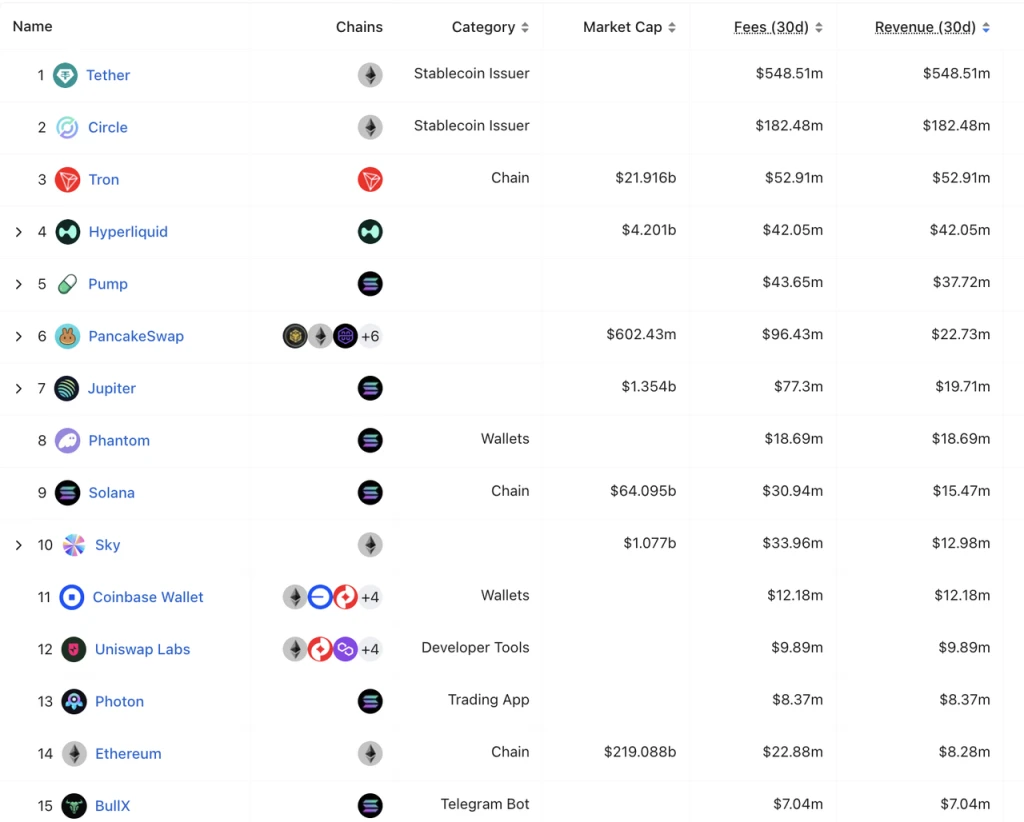

Hyperliquid's revenue in the last 30 days was $42.05 million, second only to Tether, Circle, and Tron, and higher than Solana, Ethereum, and many other applications like Pump Fun and Pancakeswap. Except for Tron, the revenues of other protocols are unrelated to their tokens (or have no related tokens).

Ranking of All Protocols' 30-Day Revenue Source: DeFillama

Competitive Situation

Since HyperEVM is currently in a state more akin to "online testing," we will primarily analyze Hyperliquid's competitive situation by distinguishing between the derivatives exchange and the spot exchange.

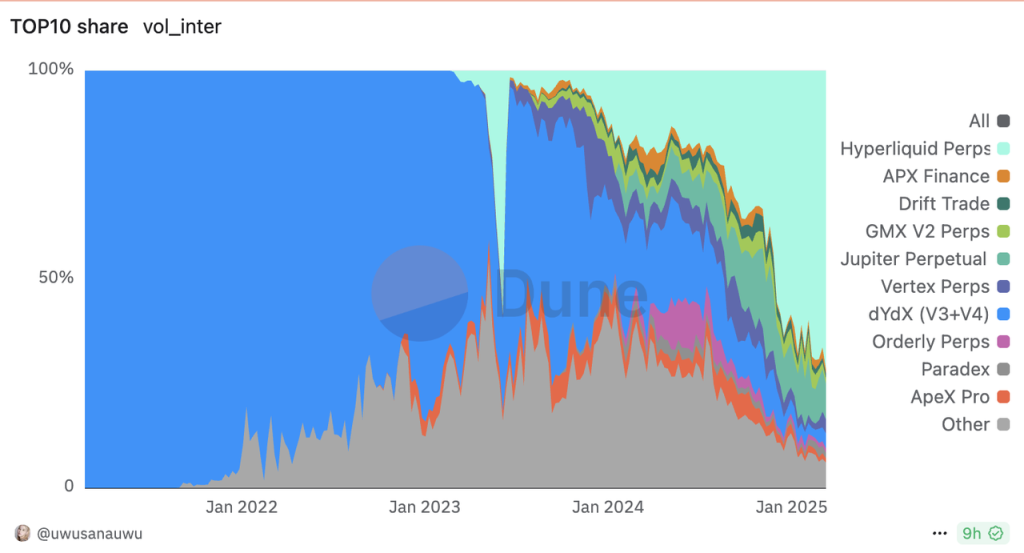

Market Share of Decentralized Derivatives Exchanges Source: Dune

Hyperliquid currently holds an absolute leading position among decentralized derivatives exchanges.

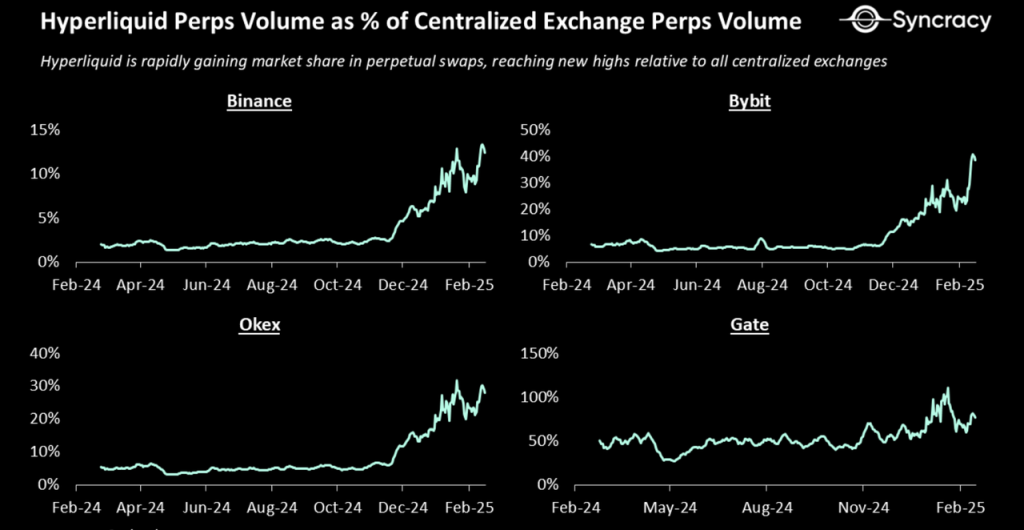

Compared to several leading centralized exchanges, Hyperliquid's trading volume is also rapidly increasing. The following chart shows the ratio of Hyperliquid's trading volume to that of Binance, Bybit, Okx, and Gate:

Ratio of Hyperliquid's Contract Trading Volume to Centralized Exchanges' Contract Trading Volume Source: Syncracy report

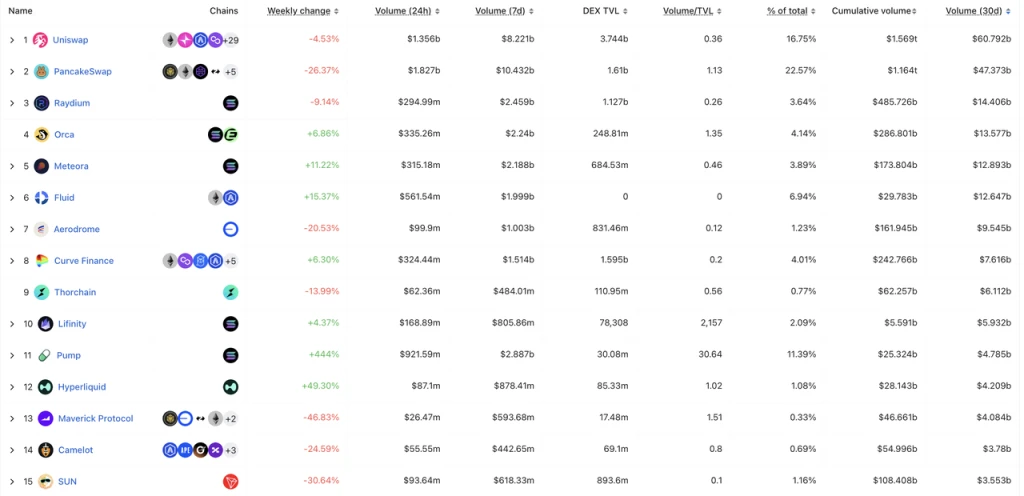

In the spot trading sector, Hyperliquid's average daily trading volume in the last month was around $180 million, ranking 12th among all DEXs.

Top 15 DEX Spot Trading Volume Rankings Source: DeFillama

- Hyperliquid's Competitive Advantages

Hyperliquid's derivatives business has rapidly developed, primarily relying on the following points:

Adoption of an order book model widely validated in the trading field, providing a smooth transition from centralized exchange experiences while facilitating the introduction of market makers;

More aggressive token listing strategy for contracts. Hyperliquid was the first to launch Pre-launch token contracts and also introduced pure DEX token contracts, quickly following up on popular tokens, making Hyperliquid one of the best exchanges for liquidity on many new tokens.

Lower fees. Compared to GMX's comprehensive fee of around 0.1% (including trading fees of 0.06% to 0.08%, slippage fees, borrowing costs, etc.), Hyperliquid only charges 0.0225% (source: Mint Ventures) comprehensive fees, giving Hyperliquid a more significant advantage in rates.

These factors have allowed Hyperliquid to establish a foothold in the decentralized derivatives exchange space. Additionally, the points program that started in November 2023 and the generous airdrop plan have further accumulated user loyalty, making Hyperliquid currently without competitors in the decentralized derivatives exchange market.

However, the above points are not sufficient to constitute a long-term competitive advantage for Hyperliquid, as competitors can fully follow Hyperliquid's mechanism design, listing strategies, and fee structures. Currently, Hyperliquid's competitive advantages mainly lie in:

A lean and proactive team with continuous delivery capabilities. Hyperliquid's team currently consists of about 10-20 people, but within less than two years, they have successively delivered three major products: a derivatives exchange, a spot exchange, and L1. Although some products still have flaws, the team's innovation and delivery capabilities stand out among similar products.

A good brand effect. Despite recent incidents involving ETH contracts and JELLY contracts, Hyperliquid still possesses a better brand effect compared to other competitors, remaining the preferred choice for on-chain users for contract trading.

Scale effects. The market-leading position since the second half of 2024 has allowed Hyperliquid to accumulate deeper liquidity compared to its competitors, and the resulting scale effect is also an important competitive advantage for Hyperliquid.

It is worth mentioning that complete data transparency is not inherently a competitive advantage for Hyperliquid. Although this feature generally facilitates users, its impact on Hyperliquid's business may be more detrimental than beneficial in both the short and long term, which we will elaborate on in the JELLY contract incident below.

Major Challenges and Risks

Derivatives trading mechanism risk: Hyperliquid has recently experienced two incidents:

One was a 50x whale leverage long position liquidation event for ETH, resulting in a loss of $4 million for HLP. The main reason was the unreasonable setting of Hyperliquid's retained margin rules, which has now been fixed.

The other was the JELLY contract incident, primarily caused by Hyperliquid's problematic position limit settings for low market cap tokens. When JELLY was launched, its market cap was close to $200 million, and Hyperliquid adopted a general position limit of $30 million. However, at the time of the incident, JELLY's market cap had fallen below $10 million, while Hyperliquid's position limit remained at $30 million, providing an opportunity for external funds to attack. This incident caused HLP to incur a maximum loss of nearly $15 million (24% of HLP's historical total profit). Ultimately, Hyperliquid chose to settle at the price before the price fluctuation of JELLY, leading to market discussions about its decentralization issues.

Both incidents highlighted vulnerabilities in Hyperliquid's core trading rules. Although Hyperliquid took relatively effective remedial measures afterward, fundamentally, the characteristic of "completely transparent position status for all addresses (including position size and liquidation amount)" in decentralized derivatives exchanges, combined with the feature that "HLP fully bears the liquidation counterparty," theoretically leaves potential attackers with unlimited attack vectors. Under artificially set rules, various vulnerabilities may exist, which can be exploited by malicious actors in the blockchain's dark forest. As long as these two core mechanisms remain unchanged, Hyperliquid will continue to face the possibility of future attacks. This is currently the main concern of the market regarding Hyperliquid.

Security risk: Currently, Hyperliquid's funds are mainly stored in its bridge on the Arbitrum network. The security of this smart contract and the multi-signature security of the team managing all funds are crucial. Previously, in December, there was an incident where North Korean hackers tested Hyperliquid's contracts, causing Hyperliquid's funds to drop sharply from $2.2 billion to $1.9 billion.

EVM progress not meeting expectations: HYPE's current valuation still has significant expectations for its EVM. The progress since the launch of HyperEVM has not been very smooth. If this continues, the L1 portion of HYPE's valuation will continue to decrease, while the overall valuation of L1 is much higher than that of derivatives exchanges. If only considering the valuation of derivatives exchanges, HYPE's current valuation is already not low (see below for details).

Valuation Reference

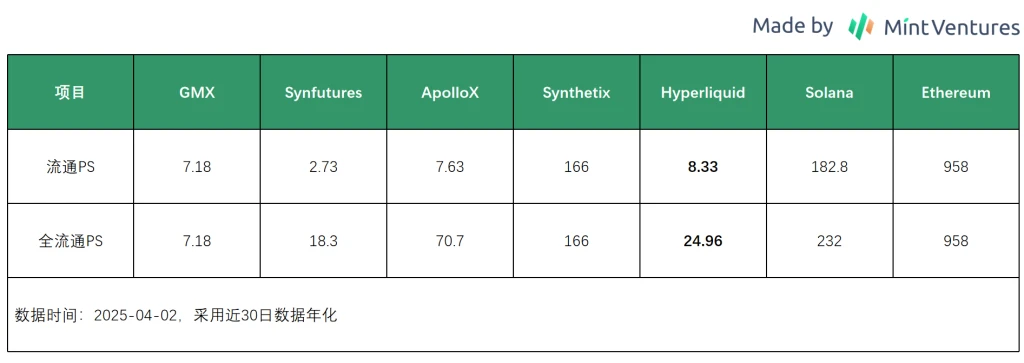

Hyperliquid's revenue currently mainly comes from fees for derivatives and spot exchanges, as well as listing fees for the spot exchange. Hyperliquid uniformly allocates this revenue, and after subsidizing HLP's earnings, it repurchases HYPE in full through the AF (Assistance Fund). Therefore, for HYPE's valuation, we apply the P/S model and even the P/E model (the portion used to repurchase HYPE is both revenue and can be approximated as the net profit of token holders).

Hyperliquid's revenue in the last 30 days was $42.05 million, with an annualized revenue of $502 million. Based on the current circulating market value of $4.2 billion, its circulating PS is 8.33, and its fully diluted PS is 24.96. Based on circulating PS, Hyperliquid's valuation is close to that of GMX and ApolloX within the derivatives exchange category. However, compared to L1, Hyperliquid's valuation remains relatively low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。