Source: Cointelegraph Original: "{title}"

LayerZero Labs CEO and founder Bryan Pellegrino stated that stablecoins are the best tool for the U.S. government to maintain the dollar's hegemonic position in global financial markets.

In an interview with Cointelegraph, the CEO of LayerZero Labs (the company that created the LayerZero interoperability protocol, recently selected by Wyoming as a stablecoin distribution partner) mentioned that tokens pegged to the dollar have cross-border accessibility, making them an obvious choice to drive demand for the dollar. Pellegrino added:

“Dollar stablecoins are the best tool — the last Trojan horse or vampire attack on all other currencies in the world — whether it's Argentina, Venezuela, or all those countries with severe inflation.”

The CEO indicated that due to the significant enhancement of the dollar's position in the foreign exchange market by stablecoins, and the demand driven by stablecoins creating a financial moat for the dollar's status as a global reserve currency, he expects support for stablecoins at both federal and state levels to increase.

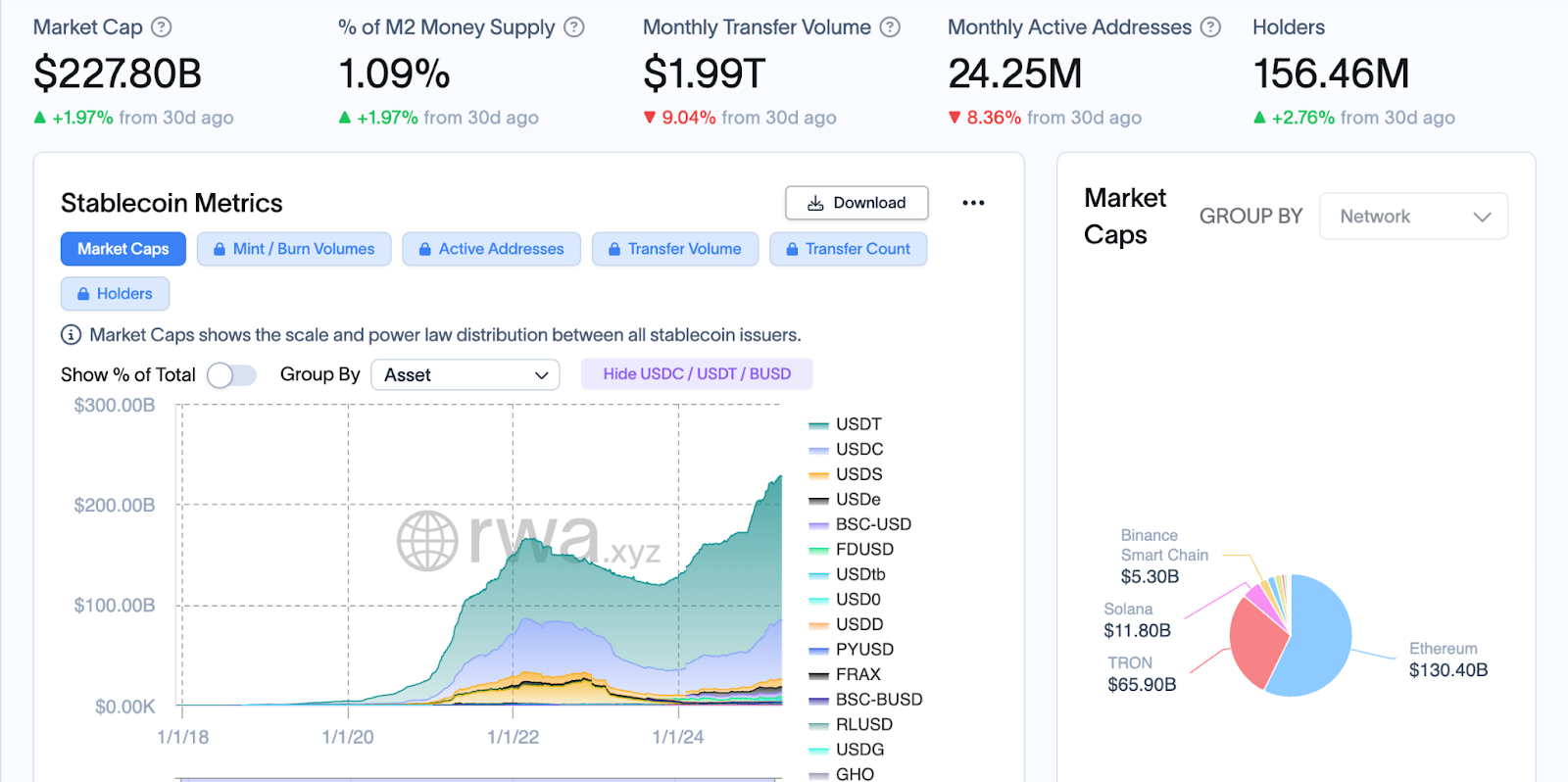

Overview of the stablecoin market. Source: RWA.XYZ

Pellegrino cited Tether (USDT) as evidence of the emerging role of stablecoin issuers as one of the largest buyers of U.S. Treasury bonds.

Tether has recently become the seventh-largest holder of U.S. Treasury bonds, surpassing Canada, Germany, Norway, Hong Kong, and Saudi Arabia.

At the White House cryptocurrency summit on March 7, U.S. Treasury Secretary Scott Bansen stated that the Trump administration would leverage stablecoins to expand dollar hegemony, indicating that this would be a top priority for officials in 2025.

According to a Chainalysis report in 2023, over 50% of the value of all digital assets transferred to countries in the Latin American region (including Argentina, Brazil, Colombia, Mexico, and Venezuela) is denominated in stablecoins.

The low transaction fees, relative stability, and near-instant settlement times of dollar-pegged stablecoins make these real-world tokenized assets ideal remittance and value storage tools for residents of developing countries facing high inflation and capital controls.

Related: FDUSD Decoupling Controversy: Sun Yuchen Accuses of Trust Crisis in the Stablecoin Market

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。