Original|Odaily Planet Daily (@OdailyChina)

As the Trump administration officially launched the "tariff trade war," both the U.S. stock market and the cryptocurrency market faced a catastrophic blow.

In the past week, the U.S. stock market has seen over $6 trillion in market value evaporate, with the "Big Seven" of U.S. stocks, including Apple and Google, losing over $1.5 trillion in value. The cryptocurrency market also performed poorly, and after nearly a month of volatile trading, the crash finally arrived—BTC fell below the $80,000 mark again today, hitting a low of $77,000; ETH dropped to a low of $1,540, marking a new low since October 2023; the total cryptocurrency market cap fell to $2.6 trillion, with a decline of over 9% in the past 24 hours.

Odaily Planet Daily will summarize the market situation and key viewpoints in this article for readers' reference.

Macroeconomic Triggers: Trump Administration Launches "Tariff Trade War," BTC's Safe-Haven Attribute Fails in the Short Term

In the early hours of April 3, Beijing time, after several days of buildup, the Trump administration officially launched the "global tariff trade war," announcing "reciprocal tariff" measures, stating that a 10% "baseline tariff" will be imposed on all countries (effective April 5), and additional higher reciprocal tariffs will be imposed on countries with significant trade deficits with the U.S., with rates based on the extent of the trade deficit (effective April 9).

Among the new measures, tariffs on Chinese goods increased by 34%, and combined with the existing 20% tariff, the U.S. tariff level on China will reach at least 54%. China also retaliated strongly; on April 4, the State Council Tariff Commission announced that starting April 10, 2025, all imported goods originating from the U.S. will incur an additional 34% tariff on top of the current applicable tariff rates.

EU countries are also seeking to form a united front, countering Trump's tariff policy:

The EU may approve a first set of targeted countermeasures against U.S. imports worth up to $28 billion, including dental floss and diamonds;

The European Commission will present a list of additional U.S. products for tariff retaliation to member states later on Monday, in response to Trump's steel and aluminum tariffs, rather than broader reciprocal tariffs.

Luxembourg will host the first EU-wide political meeting since Trump announced comprehensive tariffs, where trade ministers from the 27 EU member states will discuss the impact of tariffs and how best to respond;

EU diplomats stated that the main purpose of this meeting is to convey a unified message, expressing a desire to negotiate with the U.S. on tariff removal, but if negotiations fail, they are prepared to take countermeasures.

Kevin Hassett, Director of the U.S. National Economic Council, previously stated that over 50 countries have contacted the White House to begin trade "negotiations."

White House: Emphasizes No Room for Negotiation on Tariffs, Effective April 9

On April 4, three informed sources revealed that White House officials distributed internal talking points and told agents that Trump's new global tariff plan should not be seen as a starting point for negotiations. The sources said that as the world tries to understand Trump's massive new import taxes, the government's internal instructions state that advisors should describe the tariffs as a response to a national emergency, rather than a basis for potential new trade negotiations. Two sources said that besides the talking points, Trump himself also told advisors that the tariffs are not meant to establish negotiations. U.S. Secretary of Commerce Wilbur Ross stated yesterday that the tariff implementation timeline will not be delayed. Tariffs will continue to be enforced in the coming days and weeks, with the April 9 tariffs going into effect.

Anthony Pompliano, founder and CEO of Professional Capital Management, stated that Trump is deliberately causing a collapse in the capital markets to force a rate cut and reduce the cost of repaying U.S. debt. Although the current U.S. government policies will bring short-term pain, the effect of low interest rates will encourage borrowing and drive up the prices of risk assets in the long term.

Considering that Trump has previously publicly urged Federal Reserve Chairman Powell to "cut rates and stop playing politics,"** reminding him that now is the best time to cut rates and criticizing Powell for always acting too late, this viewpoint indeed has a significant possibility.**

Trump's Policies Trigger Stock Market Decline, Black Monday May Recur

As the U.S. stock market significantly corrected due to trade tariffs and recession fears, Bitcoin has cumulatively fallen over 3% this week, having lost the $80,000 mark. The S&P 500 and Nasdaq closed down nearly 6% on April 4, with warnings that the market may repeat the "Black Monday" crash of 1987. CNBC host Jim Cramer stated, "The 1987 crash scenario is not ruled out," and noted that it is "quite difficult" to attempt to build a weaker new order.

Peter Navarro, a senior trade advisor to the Trump administration, previously called on U.S. investors to remain calm and not panic during an interview with Fox News on April 6, predicting that the stock market will eventually see a "full recovery." He stated, "The most important rule is, especially for retail investors, is that—unless you sell your stocks, you won't lose money. The wise strategy now is to not panic and hold on."

ETH, SOL Hit One-Year Low, Bottom-Fishing or Liquidation?

OKX market data shows that SOL fell 13% in 24 hours, dropping to $103.4, marking a near one-year low; ETH also fell 13% in 24 hours, hitting $1,540, a 19-month price low since October 2023. Additionally, the ETH/BTC exchange rate fell below 0.02, reaching a new low since early 2020, hitting a low of 0.0198, currently reported at 0.02015, with a 24-hour decline of 7.02%. Notably, this indicator has dropped to the same level as during the "312" incident in 2020 (intraday range: 0.02099-0.02458).

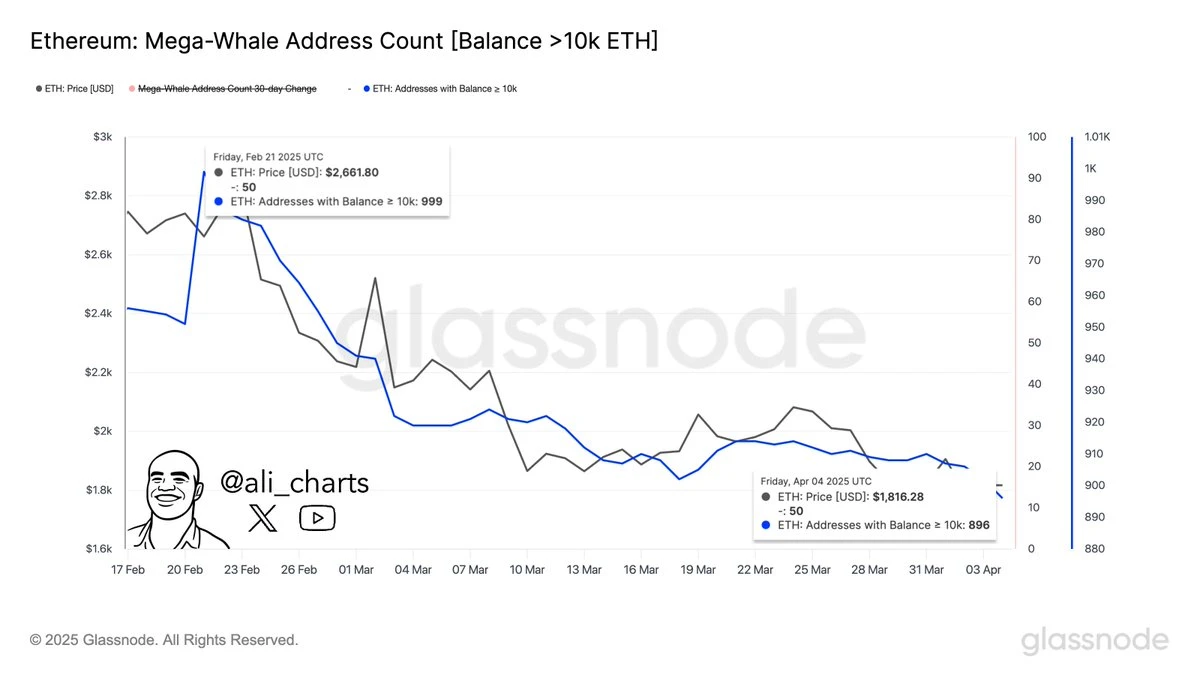

On-chain data indicates that since February, the number of Ethereum holding whales (holding more than 10,000 ETH) has decreased by about 10%, from 999 to 896 addresses.

"E-Guardian" expresses deep hurt

Regarding the future market direction, opinions vary.

Optimistic Bottom-Fishers

Last Friday, when BTC was still around $83,000, David Hernandez, a crypto investment expert at digital asset management firm 21Shares, stated that Bitcoin has shown impressive resilience, quickly rebounding after briefly falling below $82,000, solidifying its position as a hedge tool during macroeconomic pressures. If this decoupling continues, it may indicate that BTC will increasingly attract institutional investors seeking to avoid turbulent stock markets.

On-chain analyst Yu Jin monitored that the Web3 development team 7Siblings purchased 25,102 ETH in the past 10 hours, spending $42.66 million (approximately $1,700 per coin). Currently, they hold over 660,000 ETH, with a total value of $1.037 billion. Additionally, 7Siblings borrowed $412 million through ETH collateral on multiple lending protocols, with healthy borrowing positions and liquidation prices all below $1,100.

Jamie Coutts, Chief Crypto Analyst at Real Vision, stated that the growing money supply could push Bitcoin's price above $132,000 by the end of 2025.

Pessimistic Short-Sellers

Greek.live macro researcher Adam published an English community briefing, which pointed out that the community generally holds a bearish sentiment, with most traders expecting price declines in the coming weeks, primarily influenced by macro concerns centered around Trump's tariffs. Key price monitoring levels for Bitcoin include $80,000 as immediate support, with bearish targets extending to $40,000, and only a few isolated bullish voices suggesting a possibility of reaching $100,000 within months.

Traders believe that tariffs have destroyed market trust, and even if tariffs are reduced before the April 9 deadline, the damage to trade relations has already been done.

Ki Young Ju, founder and CEO of CryptoQuant, stated that the Bitcoin bull market cycle may have ended. He explained that when small capital drives prices up, it is a bull market; when even large capital cannot push prices up, it is a bear market. Current data clearly points to the latter, as capital is entering the market, but prices are not responding, which is a typical characteristic of a bear market. Selling pressure may ease at any time, but historically, a true reversal takes at least six months—thus, a short-term rebound seems unlikely.

Mechanism Capital partner Andrew Kang stated that he hasn't closely followed cryptocurrencies in recent months, but the possibility of ETH returning to the $1,000-$1,500 range this year seems quite high. Given that the speculative frenzy has clearly passed, a market cap of $215 billion for an asset with negative growth/profitability is simply absurd, supporting the bear market argument.

Turning Point: Quantitative Easing vs. Trump's Change of Heart in a Choose-One Scenario

For potential turning points in the market, we can only hope for macro-level quantitative easing policies and whether Trump will adjust his policies in light of the midterm election campaign.

BitMEX co-founder Arthur Hayes previously stated: “Trump's tariff plan further proves his commitment to reversing these imbalances. The issue for U.S. Treasury bonds is that without dollar exports, foreign investors cannot purchase bonds. The Federal Reserve and the banking system must accelerate their pace to ensure the normal operation of the Treasury market, which means restarting monetary easing (Brrrr).”

Moreover, he also mentioned that BTC holders need to learn to love tariffs; perhaps we have finally broken the correlation with Nasdaq and can become the purest fiat liquidity 'smoke detector.'

Ark Invest founder and CEO Cathie Wood warned that Trump's new tariffs could push the U.S. economy into recession. Discussing the uncertainty brought by these measures, Cathie Wood said, “The market is in quite a bit of turmoil.”

She warned that these policies could lead the U.S. into recession. She stated, “We know how he calculates reciprocal tariffs, but it doesn't seem to make much sense. We are in the eye of the storm. However, if Trump cares about his political legacy—we know he does—or is concerned about the midterm election campaign season starting this fall, then the final stretch of this rolling recession will give him and the Federal Reserve more freedom to adjust policies.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。