Author: Jordan, PANews

On July 30, 1863, "automobile king" Henry Ford was born. 127 years later, on July 30, 1990, Sun Yuchen was born in Xining, Qinghai Province. Just as Ford promoted the popularization of the automobile industry, Sun Yuchen has also achieved remarkable accomplishments in promoting the global adoption of cryptocurrency and Web3.

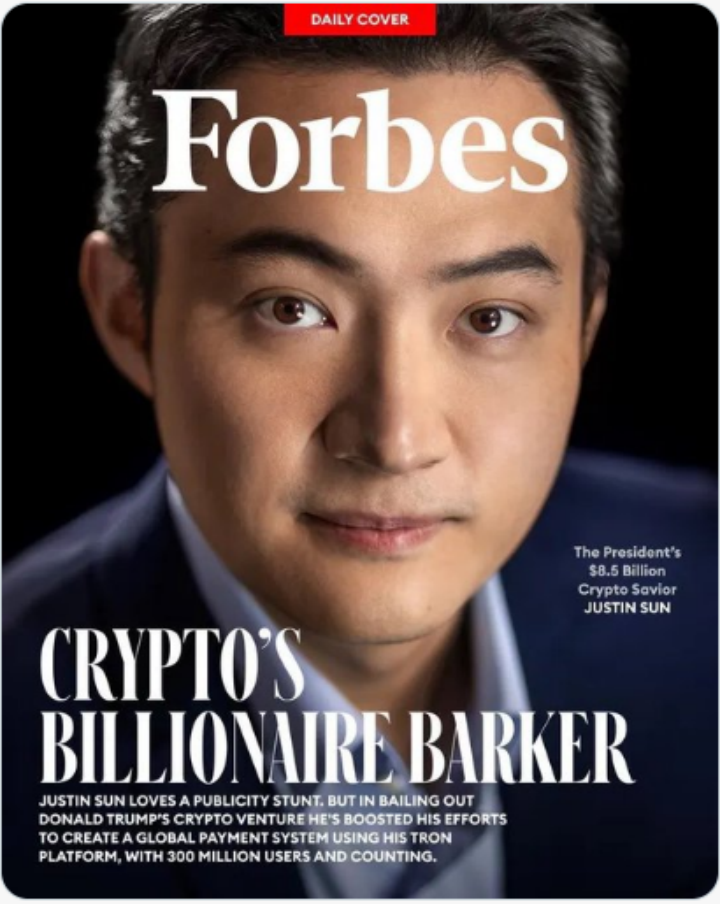

On March 28, 2025, 35-year-old Sun Yuchen, the founder of TRON, graced the cover of Forbes magazine, becoming the fourth person in the crypto field to do so after CZ, SBF, and Brian Armstrong. This event undoubtedly affirms his contributions and global influence in the blockchain field, drawing collective attention from both the crypto industry and traditional business.

From "Controversy" to "Authoritative Certification" Symbolism

Since entering the public eye, Sun Yuchen has been surrounded by controversy.

From winning first prize in a new concept essay competition to successfully enrolling in the history department at Peking University, Sun Yuchen's youth was smooth sailing. In 2011, while pursuing a master's degree at the University of Pennsylvania—Trump's alma mater—Sun Yuchen encountered something that would influence his life: Bitcoin. In the same year, he and Jiang Fangzhou, who was studying at Tsinghua University, appeared on the cover of Asia Weekly.

After making his first pot of gold through Bitcoin, Sun Yuchen returned to China in 2015 to start a business, coinciding with the rise of the domestic blockchain industry. He immersed himself in it and naturally gained favor from IDG's "Post-90s Fund." That year, Sun Yuchen also received a significant gift: he became a member of the first cohort of "Hupan University," founded by Alibaba's founder Jack Ma, and was the only "post-90s" student among them. His selection was not unrelated to the strong recommendation from IDG founder Xiong Xiaoguo, who personally wrote a recommendation letter for Sun Yuchen, adding another title to him—"Jack Ma's disciple."

It was also in 2015 that Jack Ma graced the cover of Forbes. As Sun Yuchen himself stated on social media: "Ten years later, the world has changed, but the only constant is inheritance, perseverance, and construction. It has been ten years, and everything is just beginning."

What truly brought Sun Yuchen into the spotlight was the sensational "Buffett Lunch Incident" in 2019—on June 4, 2019, at 3:48 AM, Sun Yuchen announced on various social media platforms that he successfully bid a record-breaking $4.568 million (approximately 31.54 million RMB) for Buffett's 20th-anniversary charity lunch. However, on July 23, 2019, Sun Yuchen suddenly announced that he had to cancel the lunch with Buffett due to a sudden kidney stone attack. Ultimately, on January 23, 2020, Sun Yuchen posted a photo on Twitter of himself dining with Buffett at a private country club in Omaha, USA, where the dinner lasted over three hours, discussing topics such as Bitcoin and Tesla.

Frankly speaking, Sun Yuchen's early actions did indeed spark considerable controversy. The crypto community believed he crafted an image of a "post-90s entrepreneurial pioneer" for himself and used media promotion and successful business cases to rapidly enhance his personal visibility. During this period, Sun Yuchen was often seen as a master of hype, with mixed opinions about him in the cryptocurrency industry. Some recognized his marketing capabilities, while many felt he frequently used high-profile statements and even "hitching on trends."

However, as the crypto market matured, the industry's perspective and attitude towards Sun Yuchen quietly changed.

By the end of 2024, Sun Yuchen spent $6.24 million (approximately 45 million RMB) at Sotheby's to bid for the "most expensive banana," paying with cryptocurrency. At the subsequent press conference, he even ate the banana on the spot, making his action part of the art itself, reflecting the charm of art—provoking deep thought by challenging traditional perceptions.

If Sun Yuchen's "rise" primarily relied on celebrity effects and the bull market cycle of the crypto market, as the industry began to enter a mature phase, the crypto community gradually understood and accepted viewpoints or behaviors that were once hard to accept. His appearance on the cover of Forbes magazine not only signifies recognition from international mainstream media but can also be seen as an important signal of the reevaluation of values within the crypto industry.

Behind Forbes' Report, the Market Winds Have Changed

Since the birth of Bitcoin, the cryptocurrency industry has gradually grown from a niche technological experiment to an important component of the global financial system. In this process, the attitude of traditional media has also undergone significant changes: from initial indifference to vigilance and criticism, and now to cooperation and acceptance. The shift in media stance not only reflects the development trajectory of the industry but also profoundly influences public perception of cryptocurrency.

In the early stages of cryptocurrency, mainstream media paid very little attention to this emerging technology, often remaining in a state of "indifference" and "vigilance." Even when there were reports, they often carried a condescending, skeptical, and dismissive attitude, such as:

● In 2011, Time magazine first mentioned Bitcoin but did not analyze its potential value in depth, describing it instead as "an experimental currency used by geeks to challenge the existing financial system," without giving it a positive evaluation of financial innovation.

● In 2013, a column in Forbes openly described Bitcoin as "the Ponzi scheme of the 21st century," claiming it "lacks fundamental value support and may ultimately collapse."

● In 2015, The Economist published an article stating: "Bitcoin may never become a true currency due to the lack of government support, and its price volatility makes it impossible to serve as a stable means of payment." The article argued that while Bitcoin may be innovative technically, its economic foundation is flawed.

In fact, it wasn't just the media; the mainstream venture capital circle at that time also held a skeptical attitude towards cryptocurrency individuals.

However, as BTC broke the $100,000 mark and the cryptocurrency industry entered a new development stage, traditional media no longer maintained a condescending stance, and their attitude further changed. Just recently, the Financial Times published an article apologizing to readers for its negative coverage of cryptocurrency over the past fourteen years. The media stated in its announcement:

"With Bitcoin's price recently surpassing $100,000, a considerable number of commentators believe we should apologize for our long-standing cynical attitude towards readers. Therefore, we deeply regret that you may have decided not to purchase those items that later appreciated in value based on our reporting over the past fourteen years. The price increase is certainly delightful. At the same time, if you misunderstood our cynical attitude towards cryptocurrency as support for traditional finance, we sincerely apologize, as we also dislike such behavior."

Mainstream media issuing such an "apology" to the crypto industry indirectly indicates that the winds have changed.

On the other hand, Forbes' choice of cover figures is not arbitrary but is based on a series of strict evaluation criteria, involving industry and international influence, business achievements, innovation, and topicality. Sun Yuchen, as the founder of TRON, has promoted the application development of blockchain, making TRON one of the core public chains globally outside of Ethereum. Through collaborations with multiple DeFi and NFT platforms, TRX's market value once ranked among the top ten globally. Based on Sun Yuchen's influence in the crypto industry, business operation capabilities, international market expansion, and high topicality, despite mixed opinions from the outside world, it is undeniable that Sun Yuchen's role in the blockchain industry qualifies him to be featured on the cover of Forbes.

Upgrading and Transforming into a "Global Business Leader"

In November last year, Sun Yuchen joined the Trump family's crypto project World Liberty Financial (WLFI) as an advisor. WLFI openly stated that Sun Yuchen's insights and experience would help it continue to innovate and develop. The day before this announcement, Sun Yuchen had already invested $30 million in WLFI, becoming the largest investor in the token.

In fact, for both Sun Yuchen and the WLFI project, their collaboration is a "win-win" attempt, as TRON's native token TRX has also been accepted by mainstream crypto projects endorsed by the U.S. president. According to monitoring data from Arkham, TRX has now become the fourth largest token by market value in the Trump family's WLFI holdings, following ETH, WBTC, and USDC:

- ETH: 7,933 tokens, approximately $14.63 million;

- WBTC: 162.69 tokens, approximately $13.50 million;

- USDC: 11.199 million tokens, approximately $11.20 million;

- TRX: 40.718 million tokens, approximately $9.62 million.

As described in Forbes magazine, the $75 million investment ignited a buying frenzy for WLFI in the crypto market. These operations only brought Sun Yuchen a slight paper return, and his WLFI holdings were indefinitely locked, while the Trump family profited around $400 million. However, this seemingly "loss-making" investment has given Sun Yuchen significant cross-border influence.

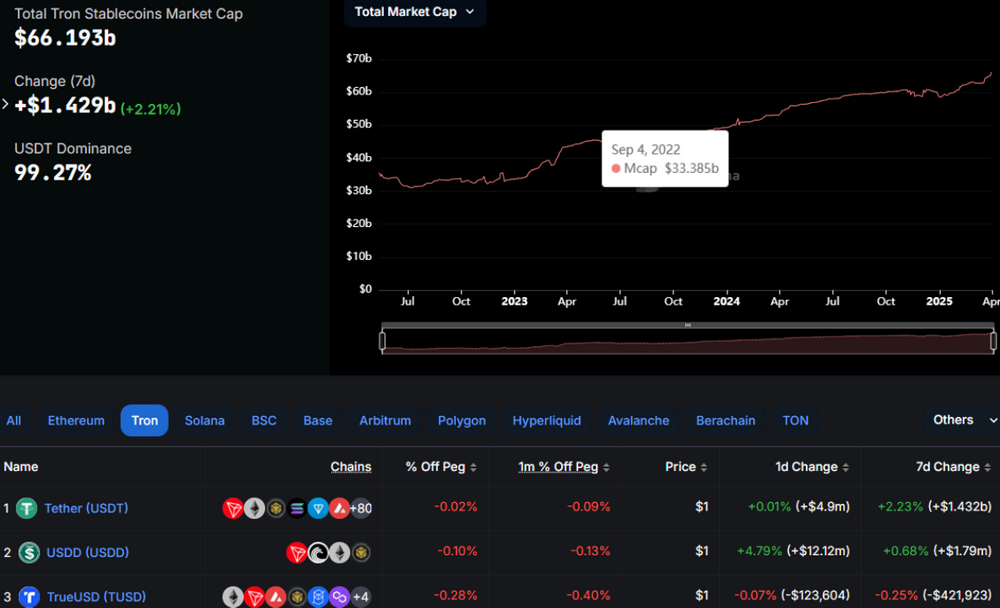

With the U.S. government strongly supporting stablecoins, the TRON public chain has maintained a leading position in the stablecoin market. Taking the largest dollar stablecoin USDT as an example, according to DeFiLlama data, TRON has become one of the top blockchains by total circulation of USDT, second only to Ethereum.

DeFiLlama data also shows that the market value of stablecoins in the TRON ecosystem has exceeded $66 billion, currently reaching a historical high of $66.193 billion, and has been showing a steady upward trend.

Thus, it can be seen that Sun Yuchen is working hard to break the public's traditional perception of "crypto = speculation" and reshape the image of the crypto industry. In this process, Sun Yuchen's personal IP has also undergone gradual transformation, achieving an upgrade from early "high-end hype" to a technical or industry leader, and now to a "global business leader."

Sun Yuchen's "Political Economy": Crypto Financial Layout, Promoting TRON's "Tentacles" to Extend into the U.S. Market

Today, cryptocurrency is no longer limited to the role of a financial tool but is gradually becoming a new type of leverage for capital operations, political influence, cross-border trade, and wealth management.

The cryptocurrency industry is playing an increasingly important role in the global political and business system. Trump's successful election as the 47th President of the United States was significantly influenced by the crypto community, and Sun Yuchen's collaboration with the Trump family's crypto project WLFI is a perfect extension of this trend. It demonstrates how crypto assets can build bridges between traditional finance and political systems, redefining the way global capital operates. Sun Yuchen's appearance on the cover of Forbes magazine serves as a milestone summary of a series of recent significant events, but his "political economy" will not be limited to this; his deep layout in crypto finance has already quietly begun.

In the early stages, TRON's strategy was to compete with Ethereum on public chain technology. However, the public chain market is highly competitive, with Ethereum's EVM ecosystem and Layer 2 scaling technology dominating. Faced with the ceiling of public chain competition, Sun Yuchen timely adjusted his strategy: shifting from technical competition to financial infrastructure, creating a global capital flow network centered on stablecoins and the TRON public chain. He also shifted focus from C-end users to institutional users to promote the entry of stablecoins into cross-border payments, asset management, and compliant financial systems. Additionally, he transitioned from a decentralized narrative to compliance and policy penetration, enhancing cooperation with governments and financial institutions worldwide. At least at this stage, these "combination punches" have indeed achieved remarkable results. Meanwhile, the crypto community's expectations for TRON have also grown increasingly high.

Will TRON be used to improve the efficiency of the U.S. government? Earlier this year, sources revealed that Musk would attempt "blockchain governance" and had initiated discussions on using blockchain technology in the newly established U.S. Department of Government Efficiency. This is the latest sign of the Trump administration's desire to boost the digital asset industry. An anonymous insider stated that Musk, who is leading the effort to improve government efficiency, has proposed using digital ledgers to reduce government costs and is discussing exploring the use of blockchain to track federal spending, protect data, make payments, and even manage buildings.

It is reported that personnel from the Department of Government Efficiency have already met with representatives from several public blockchains to assess their technologies, and the TRON blockchain is undoubtedly among those being considered.

As a blockchain network capable of processing thousands of transactions per second, TRON can be used for real-time transaction confirmations in government tax systems or for high-speed storage and querying of public data registrations (such as land ownership and company registrations). The transaction fees on the TRON chain are almost zero, especially in TRC-20 token transactions, where costs are lower than Ethereum's gas fees. This makes it suitable for low-cost cross-border payments, such as the U.S. government's funding disbursement for international aid projects and reducing operational costs for internal government payments (like pension disbursements and government contract payments). Social Security and Medicare in the U.S. are primarily paid through banks and financial institutions, which involve high fees and manual approvals. Using government-issued stablecoins on TRON for automated payments can reduce bank intermediary fees, improve fund arrival speed, and ensure that the ledger is fully traceable to prevent fraud.

Additionally, TRON smart contracts can automatically execute government procurement, social welfare disbursements, and other affairs without manual approval, reducing corruption and inefficient management. This is applicable for automatically executing social insurance (such as Medicaid and elderly protection) and automatically distributing government contract funds (to prevent fund misuse). Currently, U.S. government procurement involves numerous intermediaries, which can lead to corruption, waste of funds, and contract delays. By using the TRON blockchain, procurement processes can be tracked, contract execution ensured, and payment flows monitored in real-time, improving supply chain efficiency. The transparency and immutability of on-chain data can also be applied to tax systems, enabling automated tax collection and auditing, with smart contracts automatically calculating tax amounts and deducting taxes immediately after transactions, thus improving tax efficiency.

Of course, despite TRON's many technical advantages, promoting it within the U.S. government system still faces numerous challenges. For instance, stablecoins (TRC20-USDT) may face regulation from the U.S. Securities and Exchange Commission, and there remains uncertainty about whether the U.S. government is willing to adopt TRON for official payments. They are likely to prefer private permissioned chains over public chains like TRON. Therefore, Sun Yuchen may need to consider providing customized enterprise-level solutions and privacy computing solutions (such as zero-knowledge proofs or layered storage strategies) on TRON.

The stablecoin USD1 launched by Trump's crypto project WLFI may also collaborate with TRON in the future. In March of this year, WLFI officially announced the launch of a stablecoin USD1, pegged 1:1 to the U.S. dollar. This stablecoin will be 100% backed by short-term U.S. Treasury bonds, dollar deposits, and other cash equivalents, with each USD1 aimed at maintaining a value of 1 dollar. The reserves will be audited regularly by a third-party accounting firm, and it will initially be issued on Ethereum and Binance Smart Chain.

Although USD1 initially did not choose TRON, WLFI has clearly stated plans to expand to other blockchains in the future. From a technical perspective, TRON, which has processed countless USDT transactions, has advantages in cost and transaction efficiency over Ethereum, making it one of the most suitable blockchains for issuing USD1.

It is worth mentioning that WLFI's token distribution plan has reserved 15% as a "strategic partner incentive pool," and the leading DEX on the TRON chain, SunSwap, added a liquidity mining section for WLFI tokens in March 2025, proactively building user scenarios. More importantly, TRON's stablecoin solutions have already found application scenarios in developing countries. For example, TRC20-USDT has now become the preferred digital dollar solution for Argentine citizens to recharge their SUBE transportation cards.

If TRON is ultimately chosen as the issuing chain for USD1, it will undoubtedly further strengthen its dominant position in the global stablecoin ecosystem and may have a profound impact on the compliance process of the crypto industry. It could even propel TRON to become one of the main financial infrastructures for political capital operations in the U.S., and gaining more recognition from governments and institutions may push TRON into the "mainstream fintech" arena.

Undeniably, Sun Yuchen's layout in crypto finance has transcended mere capital linkage and has entered a stage of ecological co-construction, forming a closed loop with WLFI's stablecoin strategy. The policy resources of the Trump family will further reinforce TRON's compliance narrative.

The "Atypical Growth" of a Post-90s Entrepreneur

Perhaps influenced by his "alumnus" Trump, Sun Yuchen was deeply involved in the early ecosystem construction of Ripple Labs during his time at the University of Pennsylvania. This experience may have implanted in him the original technological ideal of "blockchain changing financial hegemony."

When industry observers criticize him for lacking originality, Sun Yuchen demonstrates an astonishing business acumen. He realizes that, in the context where blockchain technology has not yet broken through performance bottlenecks, ecosystem construction can capture user value more effectively than technological innovation. This mindset runs through his strategic layout.

In the traditional business world, "entrepreneurial spirit" is often framed within narratives of stability, low profile, and long-termism. However, Sun Yuchen has forged a sharp blade that cleaves through industry perceptions by merging traffic operations, capital games, and technological innovation. His growth trajectory reflects the underlying logic of the blockchain industry's rapid advancement and hints at the entrepreneurial attempts to reconstruct business ethics in the Web3 era. This continuous capture of user attention is precisely the survival strategy of crypto startups against cyclical fluctuations.

Sun Yuchen's traffic strategy reveals the survival rules of the crypto industry: when technology has not formed absolute barriers, the ability to operate traffic determines the life and death of a project. Through a three-stage approach of "creating momentum through controversial events—binding capital to expand the circle—upgrading technology to retain users," Sun Yuchen has led TRON out of the public chain red sea, becoming one of the few Web3 infrastructures with both high market value (TRX consistently ranks in the top 10) and a strong ecosystem (nearly 300 million on-chain accounts). This path of "marketing as infrastructure" is reshaping the underlying logic of blockchain entrepreneurship.

The controversy surrounding Sun Yuchen stems precisely from his subversion of traditional business rules. Marketing methods that were seen as "bubbles" in the classical internet era have become essential tools for building consensus in the crypto world. What was once criticized as "opportunism" is, in fact, a precise prediction of the industry's non-continuous transformation. As the Web3 revolution redefines value creation methods, it may require a new coordinate system to examine this atypical post-90s entrepreneur—he is neither a pure idealist nor a vulgar profit-seeker, but a "contradictory complex" that inevitably emerges in the evolution of blockchain civilization.

When Sun Yuchen spoke at the United Nations Blockchain Forum as an "industry ambassador," doubts always followed him: "Does excessive marketing dilute technological value?" In response, he answered in an interview with Bloomberg: "In a market where 99% of people don't know what a wallet is, the cost of education must be factored into the business model." This logic equating traffic acquisition with user education reveals the uniqueness of crypto entrepreneurship—technology without a consensus foundation is like a castle in the air. Especially in the early, wild growth phase of crypto, where regulation is ambiguous and user awareness is uneven, competition is exceptionally fierce. Many times, project parties can only accept this reality: traffic equals consensus, and consensus equals market value.

For Sun Yuchen, who masters the alchemy of traffic, the early stages indeed sparked considerable value disputes. However, like a coin with two sides, the conflict between commercial success and moral judgment always exists. Supporters believe he breaks the traditional VC monopoly, allowing retail investors to share in the growth dividends through token economics; critics accuse him of using regulatory arbitrage to harvest retail investors. This controversy essentially reflects the projection of the crypto industry's "decentralized ideal" versus "centralized operation" contradiction. When Sun Yuchen has to act as the "decentralized banner bearer" of the TRON ecosystem while also having to use the foundation's power to adjust rules at critical moments, commercial reality once again triumphs over technological utopia.

Of course, while pursuing traffic and profits, Sun Yuchen also upholds "industry justice." In the latest major industry event, when the reserve funds of the stablecoin TUSD, amounting to $456 million, were misappropriated and faced a crisis, Sun Yuchen stepped in to provide nearly $500 million, offering ample liquidity support for TUSD. He has never wavered in his commitment to industry justice. Sun Yuchen stated that he did this to instill confidence in users, protect them from losses, and ensure the industry can develop healthily and stably in the long term. It is this kind of person, often questioned, who chooses to stand up in the face of industry darkness. This may be the inherent contradiction and charm he possesses.

The "Mainstreaming" Code of the Crypto World Behind the Forbes Magazine Cover May Accelerate Huobi HTX's Overseas Expansion

As one of the oldest business media in American history, Forbes magazine deeply engages in the public discourse system through its authoritative lists and business reviews. Its published wealth rankings and influence lists not only reflect the real power structure but also influence public perception of business leaders through selection criteria. Forbes points out that Sun Yuchen has been featured multiple times in the Forbes "30 Under 30 Asia" list and is a passionate enthusiast of art collection, video games, investment, charity, and space exploration. At the end of 2024, Sun Yuchen was appointed as the Prime Minister of the Republic of Liberland, aiming to reshape the totem of the crypto world with a spirit of freedom and innovation.

On the other hand, the Forbes family holds a unique position within the elite circles of the United States. Their family-operated model allows them to continuously participate in "revolving door" politics. The president, Steve Forbes, is not only a media tycoon but has also run for president twice, transforming business discourse into political capital. The Jewish billionaire group, which Forbes magazine has long tracked (with 16 out of the top 40 billionaires being Jewish), constitutes the core circle of political and economic power in the U.S. The "entrepreneurial spirit" they advocate is essentially a media expression of ideology, shaping figures like Bill Gates and Elon Musk into business icons, binding technological innovation with wealth accumulation as a new interpretation of the "American Dream."

From this perspective, Sun Yuchen, a symbolic figure in the crypto industry, appearing on the cover of Forbes magazine may signal that mainstream traditional power institutions have fully embraced crypto assets. Trump, who previously criticized Bitcoin during his first term, vigorously promoted new crypto policies during his second term, marking a fundamental shift in the U.S. power structure's perception of crypto assets. He not only announced the establishment of a national Bitcoin reserve, incorporating crypto assets into the national strategic resource system, but also issued the meme coin TRUMP, creating a channel to monetize political influence.

Since Sun Yuchen appeared on the cover of Forbes magazine, the crypto community has begun to focus on another key question: Will Sun Yuchen help Huobi HTX accelerate its overseas expansion? Many people know Sun Yuchen's other identity: Global Advisor for Huobi HTX. The WLFI project is a key vehicle for the Trump family's layout in the crypto field, and Sun Yuchen's advisory role in this project may deeply embed him within the U.S. political elite circle. This network of relationships effectively enhances Huobi HTX's regulatory dialogue rights for conducting business in the U.S., especially against the backdrop of the Trump administration's promotion of new crypto policies. Huobi HTX could leverage WLFI's compliance experience to quickly adapt to the U.S. Securities and Exchange Commission's classification and regulatory framework, potentially creating a policy window for Huobi HTX to access the mainstream U.S. financial system.

In February of this year, Forbes magazine selected the 25 most trustworthy cryptocurrency exchanges globally for 2025, and Huobi HTX successfully made the list, further solidifying the long-established exchange's leading position in the crypto industry after over 11 years of operation. Forbes evaluated global cryptocurrency exchanges across multiple dimensions, including trading volume, compliance, and trading costs. Huobi HTX has strong competitiveness in terms of BTC and ETH holdings, spot trading volume, and product lines. Data shows that among all listed crypto exchanges, Huobi HTX ranks 6th in spot market share.

From a regional perspective, last year, Huobi HTX further expanded into the European market, with its affiliated companies maintaining compliant operations, embracing regulation, and expanding international business. By opening the door to the U.S. market and expanding globally, HTX will refresh its value in the international market. As Sun Yuchen himself stated, "Not long ago, Forbes rated Huobi HTX as one of the most trustworthy crypto exchanges in the world. Coupled with this cover appearance, it is very helpful for our expansion overseas. After we upgraded our international brand to HTX, the brand is also easier for overseas users to understand. I am very optimistic about the future development of Huobi HTX." From Sun Yuchen's words, it is clear that this will mark a stepping stone for the Huobi HTX brand to go international and open a new chapter.

Looking back at every significant layout by Huobi HTX, each has been accompanied by a tremendous wealth effect. From Asia to North America, Huobi HTX's globalization strategy is becoming increasingly clear, and the strategic layout in the U.S. market may become the next explosion point for HTX.

Conclusion: What Kind of Leader Does the Crypto Industry Need Beyond the Cover?

In December 2024, Bitcoin historically broke through $100,000, igniting global investor enthusiasm and providing strong momentum for a new bull market. This further promotes the mature development of the crypto industry, gradually moving it toward the mainstream. From the approval of Bitcoin and Ethereum ETFs to the booming bull market and the impetus from the U.S. elections, cryptocurrencies like Bitcoin have reached record valuations. Cryptocurrencies have truly taken the global financial market stage and are beginning to influence social and political landscapes step by step. The year 2025 is bound to be a critical period for the accelerated development of the crypto industry, continuous technological iteration, and widespread innovation, presenting unprecedented development opportunities for all practitioners.

Against this backdrop, Sun Yuchen's appearance on the cover of Forbes magazine seems to carry more "historical significance."

From being labeled a "marketing genius in the crypto circle" to becoming a "crypto business leader" recognized by mainstream media, this reflects not only a breakthrough in Sun Yuchen's personal achievements but also the phased evolution of the cryptocurrency industry. It can be said that Sun Yuchen has witnessed the development trajectory of the crypto industry, and his growth story is precisely a microcosm of the industry's wild growth—yearning for recognition from traditional systems while fearing being tamed by mainstream rules. If we set aside biases to analyze Sun Yuchen's success, his influence is not coincidental.

With early layouts in public chains and capturing the NFT and DeFi trends, every step Sun Yuchen has taken has been at critical nodes in the crypto industry. For example, the growth of the TRON ecosystem relies on his positioning of high-speed transactions and low costs, allowing it to successfully become an important carrier for stablecoins like USDT. Efficient capital operations and global acquisitions make Sun Yuchen more like a capital player, becoming an indispensable figure in the industry through mergers, collaborations, and strategic layouts. Traditional entrepreneurs often operate behind the scenes, while Sun Yuchen chooses to stand in the spotlight. He understands the communication rules of the social media era, daring to create traffic through controversy and binding his personal brand with projects, which has garnered broader market attention for cryptocurrencies.

Appearing on the cover of Forbes is akin to a rite of passage for Sun Yuchen and even the entire crypto industry: when the industry learns to pursue idealistic goals through Sun Yuchen-style realism, it can truly shed the "troubles of youth" and move toward a new era of mature civilization. From Sun Yuchen, we also see some typical qualities of a crypto business leader, such as the need for a vision of technological idealism and ecological coordination, the ability to break through compliance and engage in regulatory dialogue, and the capacity to shape global resource integration and brand momentum.

Questioning Sun Yuchen, understanding Sun Yuchen, becoming Sun Yuchen—let us conclude with a question: Who can surpass Sun Yuchen?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。