Source: Cointelegraph Original: "{title}"

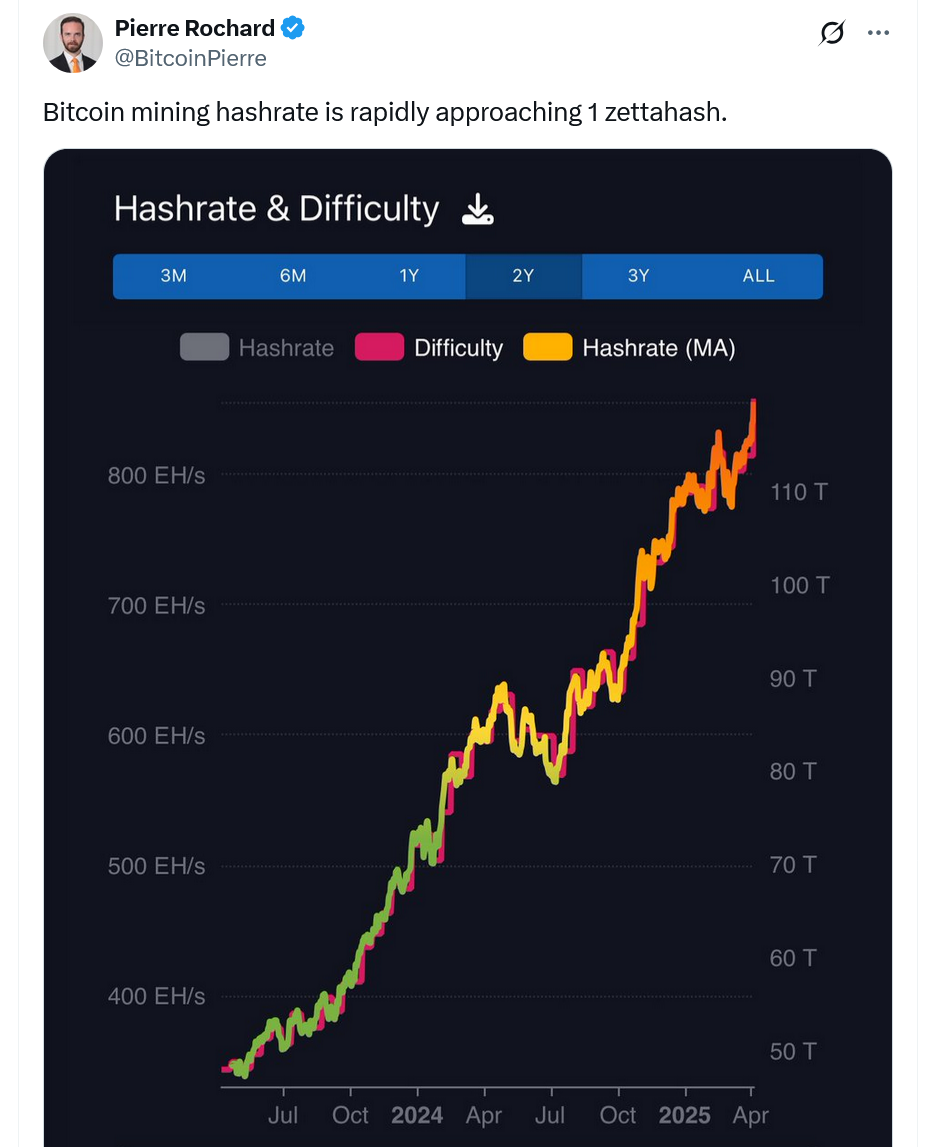

According to multiple blockchain data sources, the Bitcoin network's hash rate has surpassed 1 Zetahash (ZH/s) for the first time in its 16-year history.

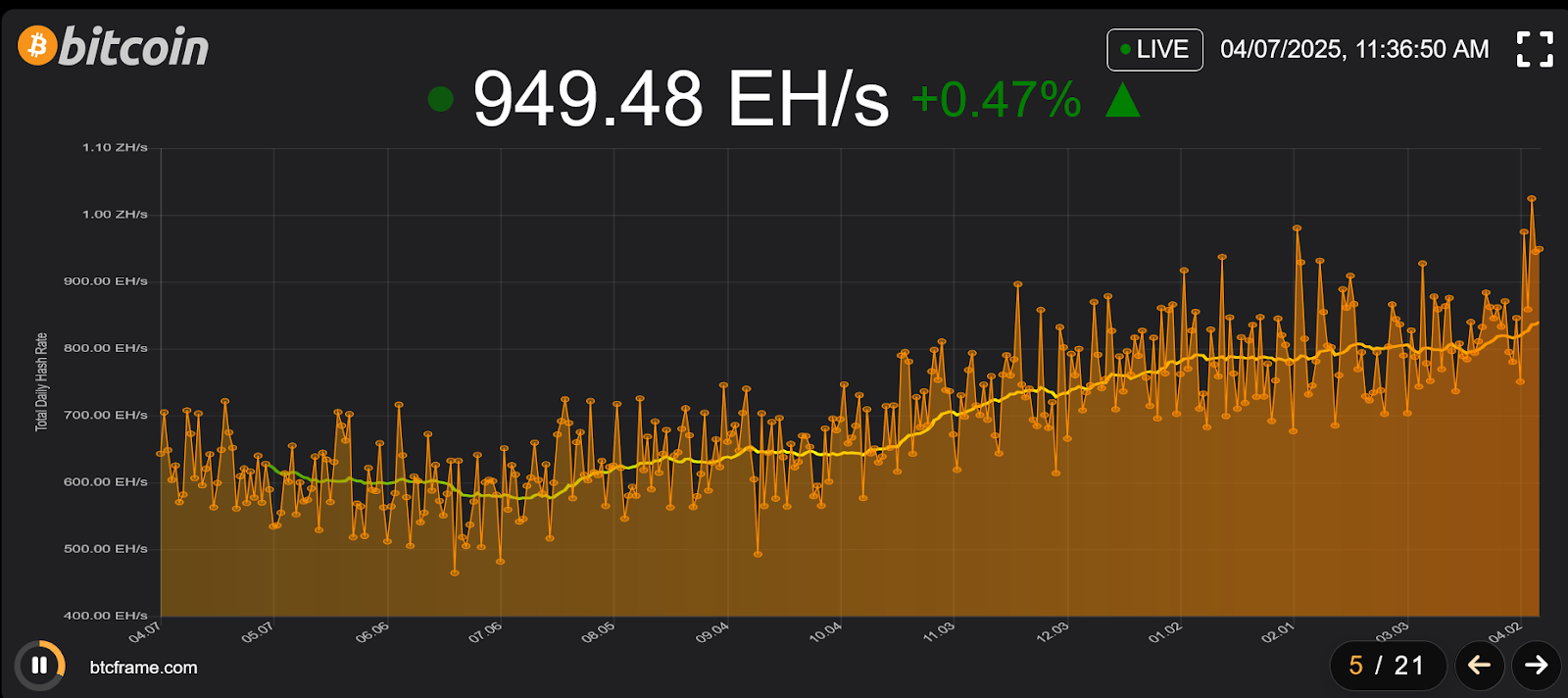

Data from mempool.space shows that the Bitcoin hash rate peaked at 1.025 ZH/s on April 5, while BTC Frame data indicates it reached 1.02 ZH/s the day before.

Coinwarz data shows that the Bitcoin hash rate soared to a high of 1.1 ZH/s on April 4 at block height 890915—however, the same data indicates that Bitcoin first broke 1 ZH/s on March 24.

Since reaching 1 ZH/s, the Bitcoin hash rate has fallen below 0.95 ZH/s as of April 7. Source: BTC Frame

These discrepancies arise from different methods of calculating hash rate—such as the measurement time for block time and difficulty adjustments, and the selection of Bitcoin nodes and mining pools used to extract data.

Bitcoin cypherpunk Jameson Lopp previously pointed out that using a "trailing block" instead of five to estimate Bitcoin's hash rate could lead to a difference of over 0.04 ZH/s.

Mitchell Askew, chief analyst at Blockware Solutions, noted in a statement to Cointelegraph: "Due to the random variations in block time, looking at raw hash rate metrics can be misleading," adding that Bitcoin's 30-day moving average hash rate is still around 0.845 ZH/s.

Despite the differences, this achievement highlights the immense computational power of the Bitcoin network and its increasing level of decentralization, making it more secure than ever and significantly reducing the likelihood of a 51% attack.

The Bitcoin network reportedly reached 1 ZH/s (equivalent to 1,000 Exahash per second)—marking a 1,000-fold increase since Bitcoin first reached 1 EH/s at the end of January 2016.

According to Coinwarz data, the second-largest proof-of-work crypto network, Litecoin, currently has a hash rate of 2.49 Petahash per second—its computational power is about one-fortieth that of Bitcoin.

Source: Pierre Rochard

Askew noted that in recent years, as more commercial Bitcoin mining companies compete to solve Bitcoin blocks, the hash rate has surged.

"Miners are doubling down—expanding their farms and bringing in more efficient machines," Askew said, adding that unless Bitcoin prices rise again in the coming months, less efficient miners may soon be eliminated.

MARA Holdings is the largest Bitcoin miner, with a hash rate exceeding 50 EH/s, while according to Hashrate Index, the largest share of hash rate flows to Foundry USA Pool and AntPool Bitcoin mining pools.

According to CompaniesMarketCap.com, at least 24 publicly listed Bitcoin companies have machines for Bitcoin mining.

Other large miners contributing to the hash rate include Riot Platforms, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf.

As Bitcoin's hash rate reaches a new historical high, the market has seen a sharp decline—Bitcoin has dropped nearly 10% to $78,750 over the past four days, while U.S. stocks faced a loss of about $6.6 trillion on April 3 and 4—marking the largest two-day drop in history.

This decline is primarily attributed to President Trump's tariff plans, with many industry analysts stating that it has triggered recession fears.

Related: Analysts: No country can win in a global trade war, Bitcoin (BTC) will soar as a result.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。