President Donald Trump’s aggressive tariff policies continued to wreak havoc on markets, sending bitcoin to its lowest levels since early November 2024, although altcoins tumbled lower, giving BTC an edge in market capitalization dominance.

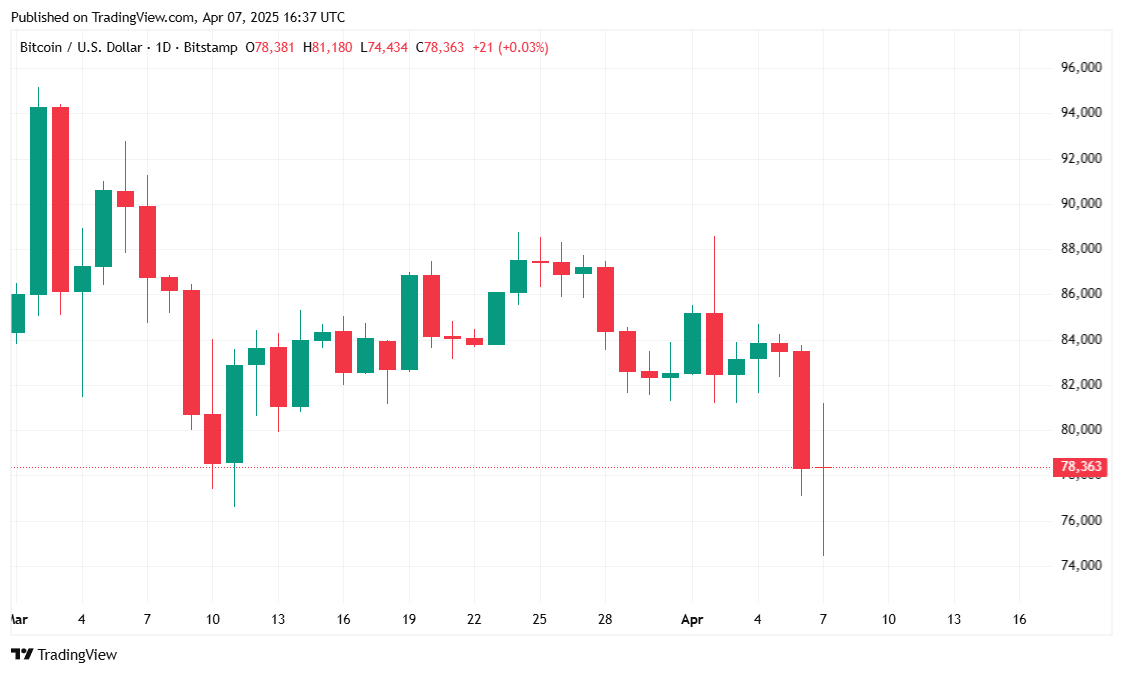

Bitcoin nosedived to $74K before climbing back above $78K on Monday. The asset is still down 4% over the past 24 hours at $78,385.02, at the time of reporting, according to data from Coinmarketcap. The leading cryptocurrency has now fallen 6% over the past seven days, trading within a volatile range of $74,436.68 to $81,119.06.

( BTC price / Trading View)

The market drop comes amid a sharp rise in trading volume, which climbed to $100.29 billion, a staggering 582.44% increase compared to the previous day. The spike was likely driven by a combination of the usual post-weekend surge and the trading frenzy sparked by Trump’s tariff announcement last week.

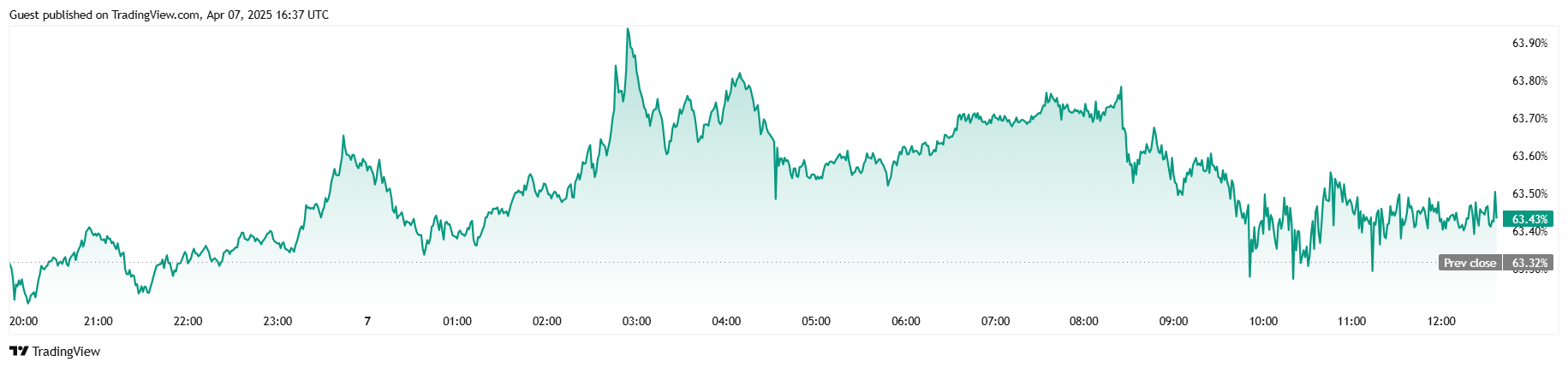

Bitcoin’s total market capitalization fell by 4.20% to $1.55 trillion, while its dominance in the overall crypto market rose slightly to 63.41%, reflecting that altcoins have taken even heavier losses than BTC in the latest downturn.

( BTC dominance / Trading View)

Coinglass data showed that total bitcoin futures open interest dropped by 4.84% to $50.72 billion, indicating a significant reduction in leveraged bets. Liquidation data revealed $9.22 million was wiped out in the past day, with $7.07 million in long positions and $2.15 million in shorts, as some bulls were clearly caught offside by the market’s move lower.

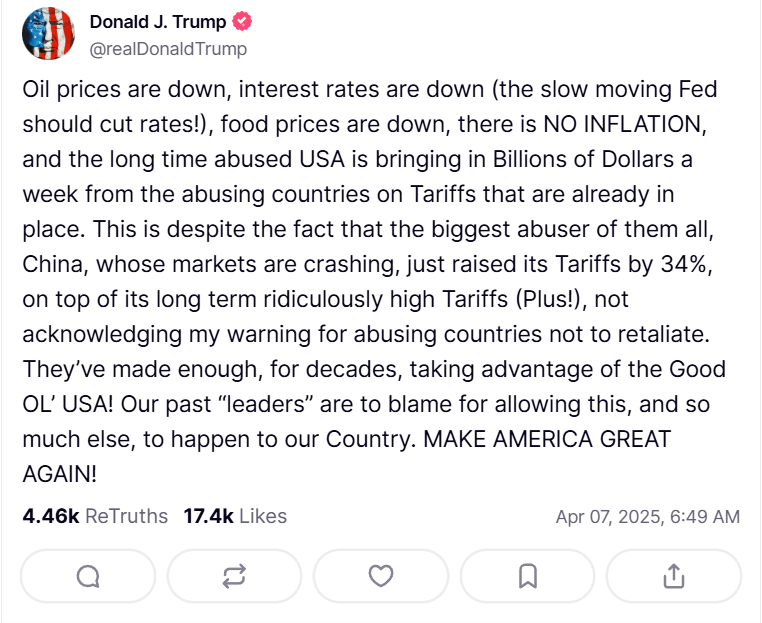

Early Monday, Trump called for an interest rate cut in a post on Truth Social. He lambasted the U.S. Federal Reserve, calling it “slow-moving” and justified the lowering of rates by claiming the economy wasn’t experiencing inflation.

“The slow-moving Fed should cut rates,” Trump wrote. “There is no inflation.”

(President Donald Trump calls for the Fed to cut rates / Donald Trump on Truth Social)

All this came after the Fed previously announced a closed board meeting scheduled on Monday at 11:30am EST to “discuss discount rates.”

Experts predict an emergency rate cut or a lowering of rates later this year, as Trump called for. Subdued rates will likely mean a price boost for risk assets such as bitcoin, although the current tariff situation could interfere with typical market dynamics.

Geoffrey Kendrick, head of digital asset research at Standard Chartered, continues to be bullish on BTC, maintaining his prior position that investors will still flock to the cryptocurrency as a safe-haven from the negative effects that tariffs will have on traditional assets such as the U.S. dollar.

“There is a lot of noise at the moment, but … I think bitcoin will become a hedge against tariff risks this time around,” Kendrick explained. “U.S. isolationism is akin to increased risks of holding fiat, which will ultimately benefit bitcoin.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。