Today is April 7th, and let's talk about the impact of tariffs on the cryptocurrency market. This can be said to be one of the biggest topics of this quarter. In simple terms, tariffs are the "tolls" that the government collects when foreign goods enter the United States, and this cost is likely to be passed on to consumers. For example, a pair of shoes that costs $100 will become $120 with a 20% tariff, making it more expensive for the average person to buy things.

The market has plummeted so badly this time mainly because the Trump administration has imposed tariffs too harshly! The U.S. has now imposed a 10% baseline tariff on all trading partners, resulting in:

Soaring prices: Phones, cars, and clothes are all getting more expensive, and inflation is rising rapidly.

Escalation of the trade war: Countries like China, the European Union, and Canada are retaliating, causing global supply chains to become chaotic.

Ethereum has already dropped significantly, so we won't dwell on that. Why has Bitcoin also fallen so drastically? There are two main reasons:

First, the global market is scared. The tariff war has made everyone worry about an economic collapse, causing funds to flee from risk assets. Just look at the plummeting U.S. stock market and the circuit breaker in Japan; how can Bitcoin not follow suit? The last time it was this bad was during Japan's interest rate hike last year.

Second, U.S. inflation might explode. The expectation of interest rate cuts has already been delayed, and now with the tariffs, prices are rising, which could push inflation directly to 4%-5%. When inflation is high, the Federal Reserve may raise interest rates, leading to a stronger dollar, which would certainly cause both the U.S. stock market and Bitcoin to drop further.

Here comes the key point! On April 9th (Wednesday), the U.S. equivalent tariffs will officially take effect, imposing a 34% tariff on Chinese goods and a 24% tariff on Japanese goods. Chinese concept stocks, A-shares, and Japanese stocks may also drop, and Bitcoin is likely to be dragged down as well. Additionally, the CPI data will be released on Thursday; if it exceeds expectations, the expectation for interest rate cuts will be delayed again, which is bearish for Bitcoin. If it is below expectations, there may be a short-term rebound, but it won't be significant.

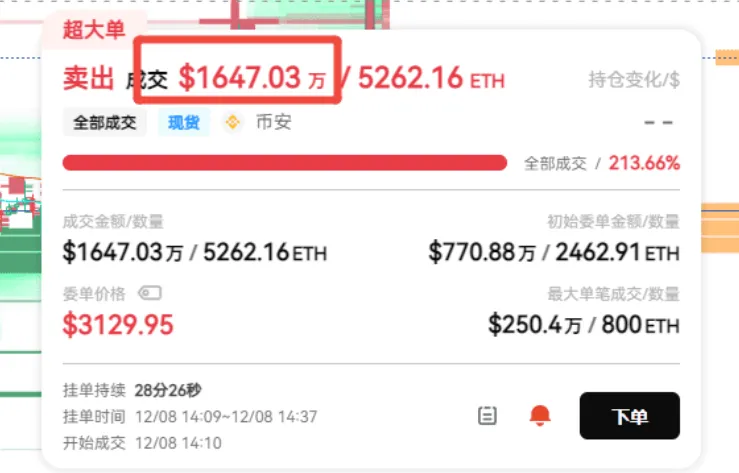

Now, let's talk about where the bottom for Bitcoin and Ethereum might be. There have already been outrageous sell orders at the $60,000 level, which are clearly bait orders.

The key level to watch is $73,000, where a massive order of $70 million appeared today. Although it was canceled, it indicates that large players are watching this price level.

The key level to watch is $73,000, where a massive order of $70 million appeared today. Although it was canceled, it indicates that large players are watching this price level.

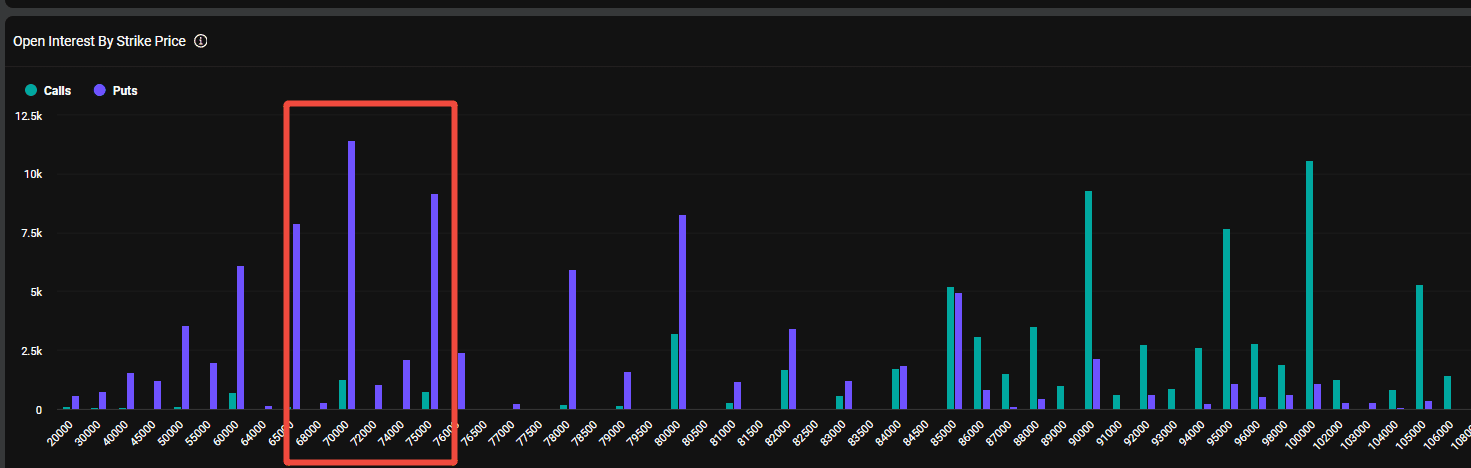

Additionally, I remind everyone to pay attention to the Bitcoin options market, where over $160,000 in put options have accumulated in the $70,000 to $75,000 range, all expiring in April, indicating that many people are betting on further declines. The short-term resistance level is between $78,800 and $79,000, and it may be worth considering shorting at higher levels. Of course, these levels are based on our PRO data, and everyone should make their own judgments regarding specific operations.

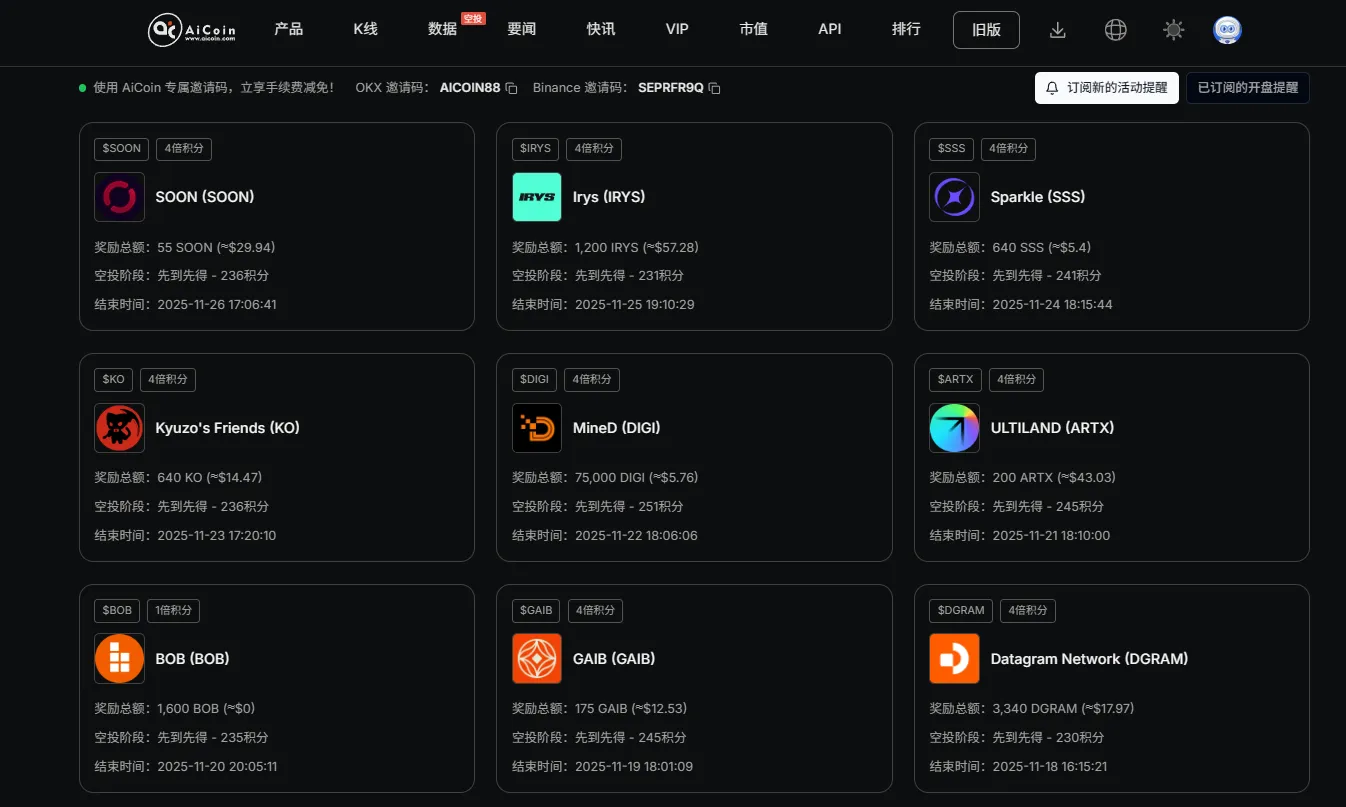

Finally, a reminder that we have a live broadcast this Thursday, so remember to tune in on time! Download the AiCoin app to get the latest market analysis as soon as possible!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。