🩸 It is said that Pendle is a wealth accelerator | But how does Pendle actually make money? 99% of people don't even understand the principle!

This might be the most straightforward Pendle yield guide on the internet (you'll understand it after reading).

After this was published yesterday, many people asked me where Pendle @pendle_fi's yield actually comes from—

This question is very insightful!

In fact, yield trading, as a mature strategy in traditional financial markets, has long been widely used by professional institutions in the fields of bonds, foreign exchange, and commodities. Pendle is an innovative practice that brings this classic financial logic into the DeFi world.

I decided to take on the responsibility and continue to help popularize Pendle: Where does Pendle's yield come from?

First, let’s clarify: Pendle itself does not generate yield; it simply makes existing yield tradable.

In simple terms—

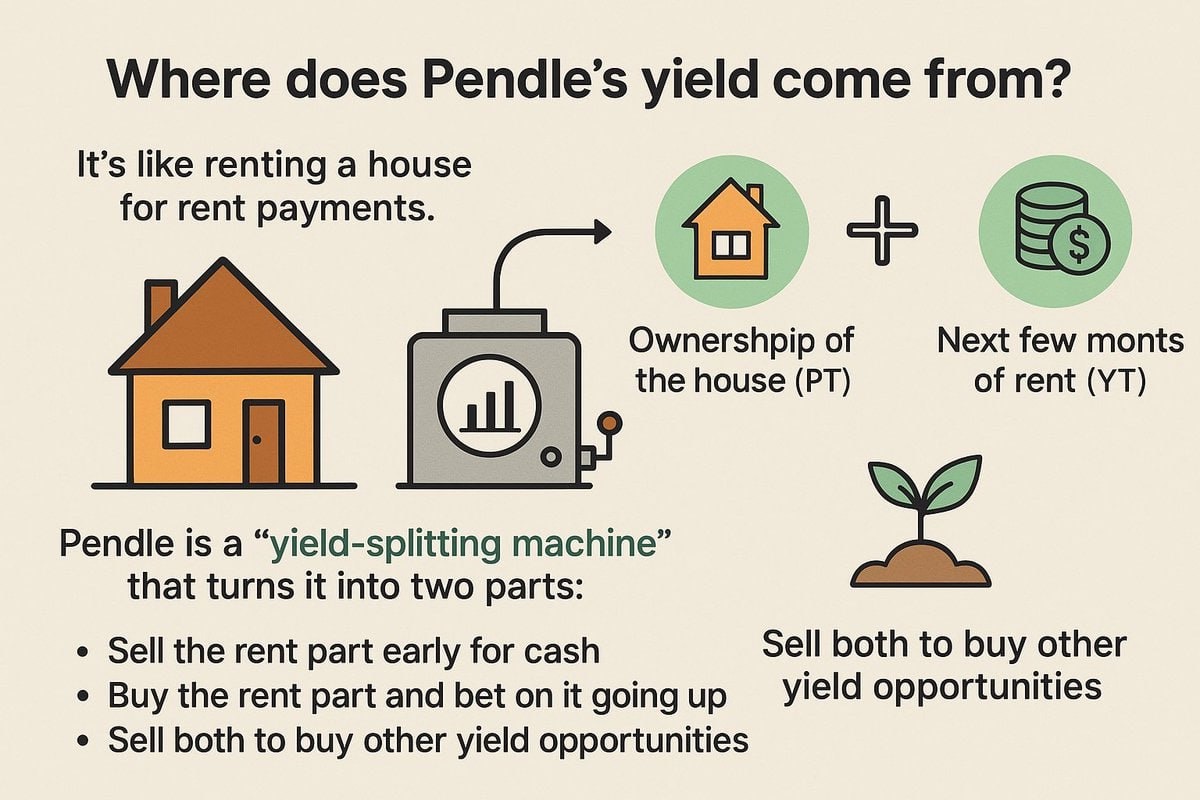

1️⃣ Pendle's yield source is like "earning rent from renting a house":

Imagine you have a house, and instead of living in it, you rent it out to someone else, receiving 100 bucks in rent every month.

Pendle is a "rent separation machine" that can help you split this house into two parts:

Ownership of the house (called PT, Principal Token)

Rent for the upcoming months (called YT, Yield Token)

You can choose to:

• Keep the house and sell the future rent for cash upfront;

• Or sell the house and only buy the rent part, betting that the rent will increase;

• Or sell both to exchange for other better houses or rental opportunities.

So, Pendle's yield source is:

✅ Turning "slowly earned yield" into "something that can be traded now"

✅ Providing people with a market to "design, transfer, and speculate" on yield

It's like splitting a fruit-bearing tree into "trunk" and "fruits",

You can sell the fruits, bet that the future fruits will increase in price, or engage in "fruit arbitrage."

2️⃣ Now back to Pendle itself:

Assets that can generate yield will produce interest or rewards, and Pendle will split them into two parts:

• PT (Principal Token): Represents your "principal," which can be redeemed for the full principal after the lock-up period, but no longer earns interest.

• YT (Yield Token): Represents your "right to future yield" for a certain period, which can be freely bought and sold, with the price determined by market dynamics.

This is like splitting an interest-bearing bond into "principal" and "interest part" for separate sale.

Since the yield is separated out, you can:

• Buy only the yield (YT) to bet on rising interest rates;

• Sell the yield (YT) to preserve the principal (PT), hedging against market fluctuations;

• You can even use interest rate changes to arbitrage between different pools, for example:

• Buy YT when the price is low, sell it after interest rates rise;

• Use PT as collateral for borrowing to buy YT at a low price, implementing a similar options hedging strategy.

So, Pendle's yield can be understood as:

A way to "cash out future cash flows early," and also a financial engineering tool for building trading strategies.

💡 In summary:

Pendle's yield essentially comes from the interest on staked assets, but its greatest value lies in turning these yields into "freely tradable commodities."

You can trade "interest" just like trading spot or futures, making yield designable, predictable, and arbitrageable.

3️⃣ How to make money on Pendle ——

So you can understand why making money on Pendle, and the significance of buying PT and YT—

Conservative: Buy PT to lock in "certain yield": You get "certain yield" upfront, unaffected by market fluctuations, suitable for those who don't want to take risks.

Aggressive: Buy YT at a low price to bet on "future interest rate increases": Buy YT at a low price when the market is pessimistic and interest rate expectations are low, then sell YT after the market regains confidence and interest rates rise, profiting from the price difference. This is like speculating on future "interest rate increases," which is the most interesting game in Pendle.

Arbitrage: Utilize interest rate discrepancies to build "arbitrage combinations": Suitable for those who understand on-chain arbitrage and enjoy quantitative strategies.

Pendle has some high-yield pools, such as:

• Certain YTs being severely undervalued (but with actual high yields)

• Different funding rates across exchanges, allowing for bilateral positions (for example, going long on SOL funding rate + shorting ETH funding rate in the Boros module)

Some have achieved 47% arbitrage in 3 days without watching the market, relying on asymmetric opportunities in the interest rate market.

This kind of play is like a "on-chain interest rate hedge fund," more advanced but super interesting.

Additionally, several pools I previously followed have been yielding quite well recently—

📌 Berachain × Pendle: The PT iBGT yield pool's APY skyrocketed to 256%

https://x.com/BTW0205/status/1905234095275401258

📌 Sonic × Pendle: LP aUSDC not only yields a comprehensive 16% APY but also earns 24 times Sonic points simultaneously

https://x.com/BTW0205/status/1902327707729588468

Once you understand the yield principles of Pendle, you'll find that this project is not difficult to comprehend, and you'll also open up a new way of thinking about "interest rate trading."

You can check out Pendle's official educational website, where the Chinese guide is quite detailed:

https://app.pendle.finance/trade/education?utmsource=landing&utmmedium=landing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。