The script is similar to expectations. Although it was proven yesterday that the 90-day tariff extension was a false alarm, the risk market still gave a positive response. This indicates that the market continues to believe that the final implementation of tariffs will not follow the April 2nd approach. Apart from China, the White House has revealed that discussions on tariffs have already taken place with over 70 countries and regions. Therefore, the tariffs announced on April 9th are very likely to be lighter than those announced on April 2nd. We don't know by how much, but as long as they are lighter, it is a positive for the market.

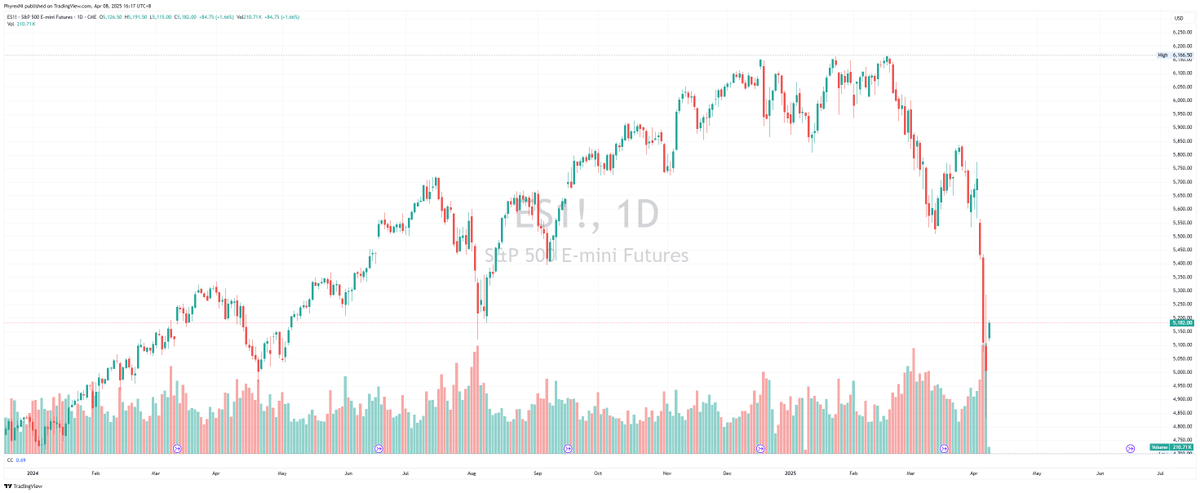

Today, U.S. stock index futures have already started to rebound before the market opens, with Nasdaq futures rising 1.62%, S&P futures rising 1.64%, and Dow futures rising 1.91%. The VIX has dropped to 43.23%. Although U.S. stocks are still fluctuating on the edge of a "bear market," market sentiment has begun to recover. The consequences of the tariffs are just the first shot; the CPI and PCE data in May should be the second shot, and the GDP data in July will be the third shot. Enjoy the current tranquility, as the challenges ahead may be greater.

The 20-year and 30-year U.S. Treasury yields have both surpassed 4.6 and 4.58, respectively, and are now starting to decline slightly. It seems there isn't much time left for bottom-fishing, as the overall risk market is merely rebounding and not reversing. There is also a GDP report waiting at the end of the month.

The trading difficulty in April will be high, so be extra cautious.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。